Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 April, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Shipping Impacted by Baltimore Bridge Collapse

In 1977, the Francis Scott Key Bridge was constructed across the outermost crossing of the Port of Baltimore, one of the largest container ports on the East Coast. On March 26, a container ship struck one of the bridge’s piers, triggering a collapse across multiple spans of the bridge.

The Dali, a Singapore-flagged container ship, hit the bridge following a momentary loss of propulsion. The Dali is reported to have dropped its anchors in an attempt to avoid the collision. The crew issued a mayday, which is said to have prevented some motorists from crossing the bridge before its collapse. The Dali is reported to have passed foreign port inspections prior to the accident.

With the twisted metal spans of the bridge and a container ship blocking the harbor’s deepwater channel, vessel traffic into and out of the Port of Baltimore is suspended until further notice. Sixteen commercial vessels, including the Dali, were in the harbor at the time of impact. According to S&P Global Commodities at Sea data, six were carrying cargo and 10 were “in ballast,” meaning they were not carrying cargo.

Marine salvage experts told S&P Global Market Intelligence that the channel could be cleared in 10-14 days, depending on the time it takes to remove the Dali from the bridge’s wreckage. If it proves impossible to remove large sections of the bridge and a lot of underwater cutting and intricate rigging are required, that timeline could lengthen considerably. Channel clearing will likely focus on the smaller pieces of the wreckage to allow ships to start passing into and out of the harbor.

According to data from PIERS, a trade flow analytics tool within S&P Global, the Port of Baltimore handled 4% of the total trade volumes on the East Coast. However, Baltimore is a key export location for Appalachian coal and a key import hub for cobalt, aluminum, copper and zinc, and the port handles the most road vehicles of any terminal in the US.

While the long-term pricing impact on thermal coal from the bridge collapse is uncertain, thermal coal market participants told S&P Global Commodity Insights that the coal market is currently oversupplied, and a delay in exports from the port is unlikely to lead to a prolonged increase in prices. Appalachian coal is mostly used for power generation; it is also used as metallurgical coal for steel production.

Over half of all cobalt imports to the US come through the Port of Baltimore, as well as 12% of aluminum imports, according to S&P Global Commodity Insights. Shipments of other metals — nickel, tin, copper, aluminum, zinc and lead — are also affected. Container rates have remained steady since the crash.

The bridge collapse is likely to have a significant impact on reinsurers, S&P Global Market Intelligence reports. Liability lawsuits are almost certain, and the complex web of claims may take years to resolve. Lloyd's of London CEO John Neal suggested that the cost of likely claims “is not outside of the normal levels of expectations of what we should see in a given year."

Today is Tuesday, April 2, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

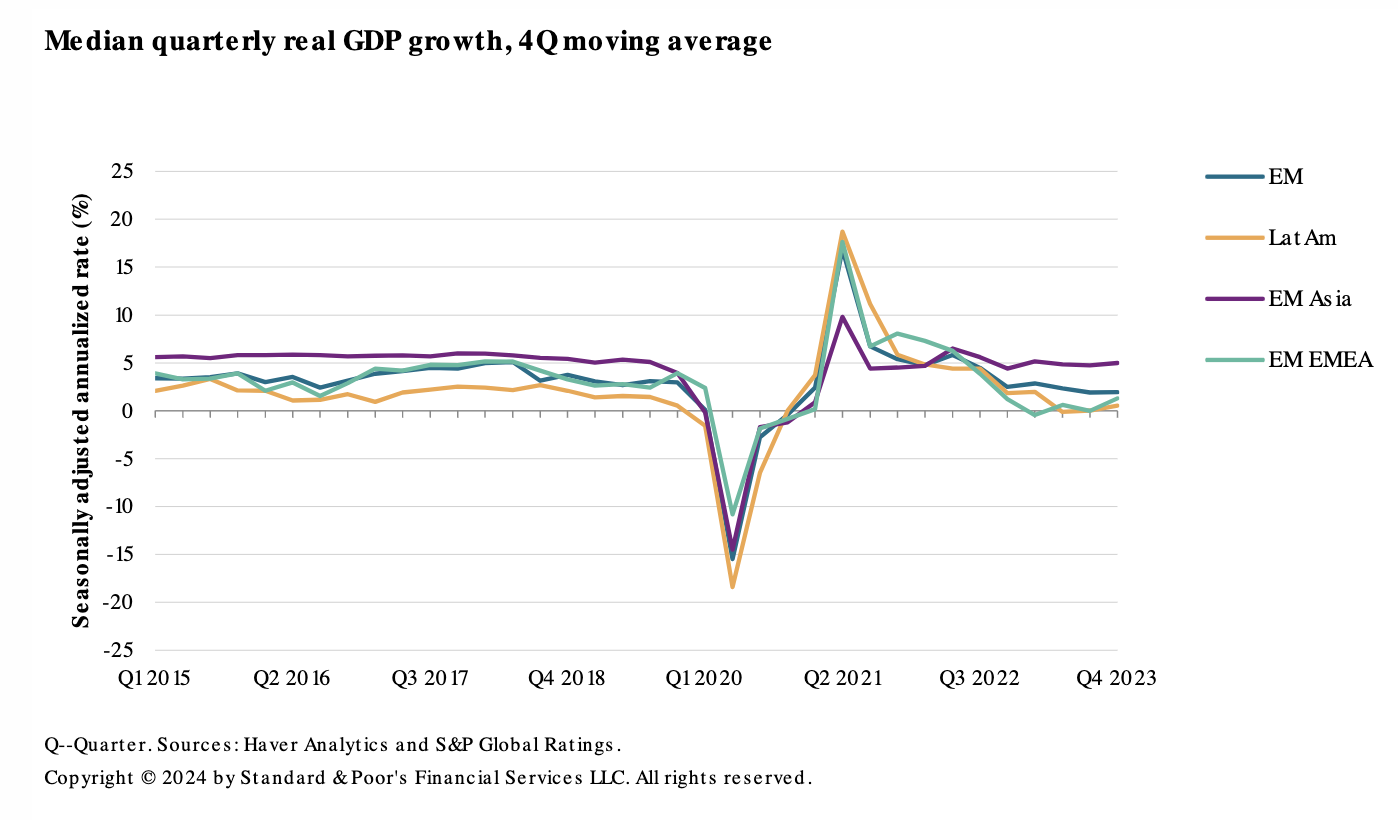

Economic Outlook Emerging Markets Q2 2024: Growth Divergence Ahead

On balance, macroeconomic conditions for emerging markets (EMs) in 2024 have improved marginally since the end of 2023. This is mainly due to continued resilience in global economic growth, especially in the US, and a modest improvement in financial conditions as S&P Global Ratings expects monetary policy to eventually loosen in the US and the eurozone this year.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

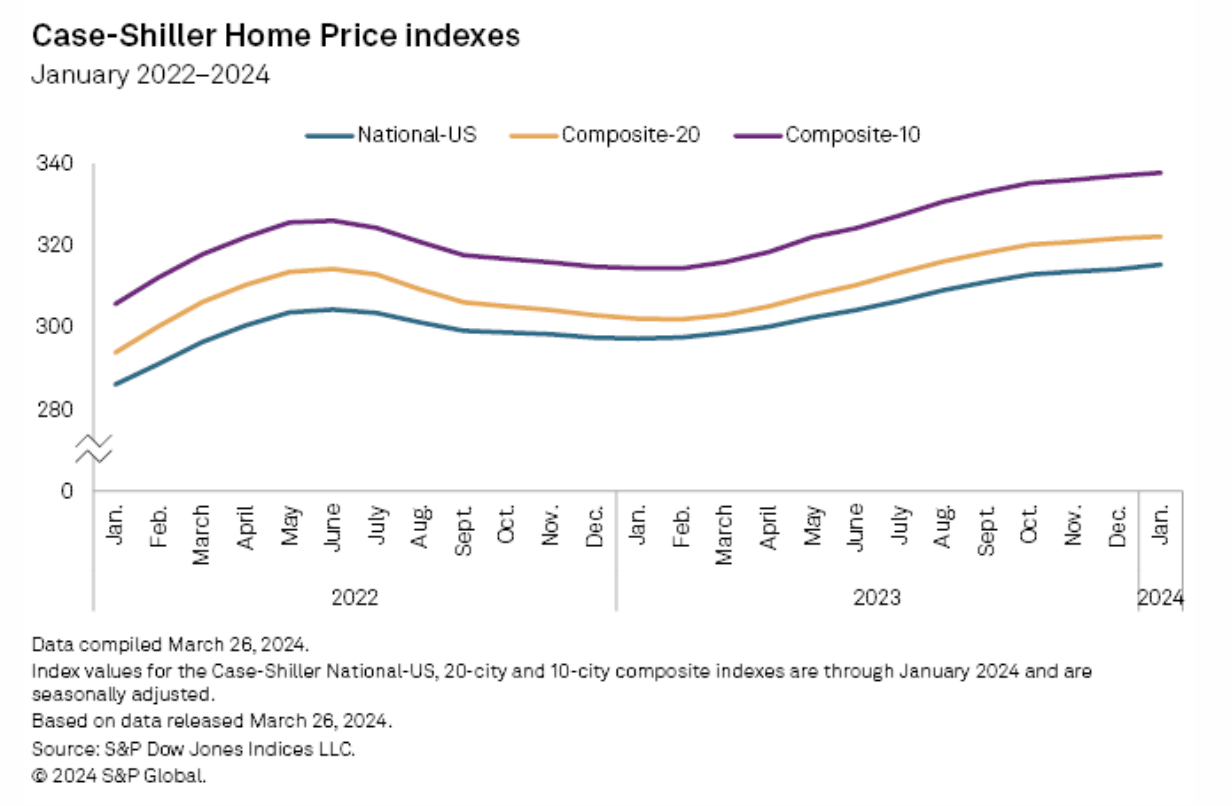

US Housing Market: US Home Prices Grew At Record Pace In January

US home prices continued to scale higher in January. The S&P CoreLogic Case-Shiller US National Home Price NSA Index, covering all nine US census divisions, was up 6.0% year over year in January, surpassing the 5.6% year-over-year increase in December 2023. On an annual basis, the 10-City Composite logged a 7.4% increase in January, up from a 7.0% rise recorded the previous month. The 20-City Composite posted a yearly increase of 6.6%, up from a 6.2% yearly gain the previous month.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

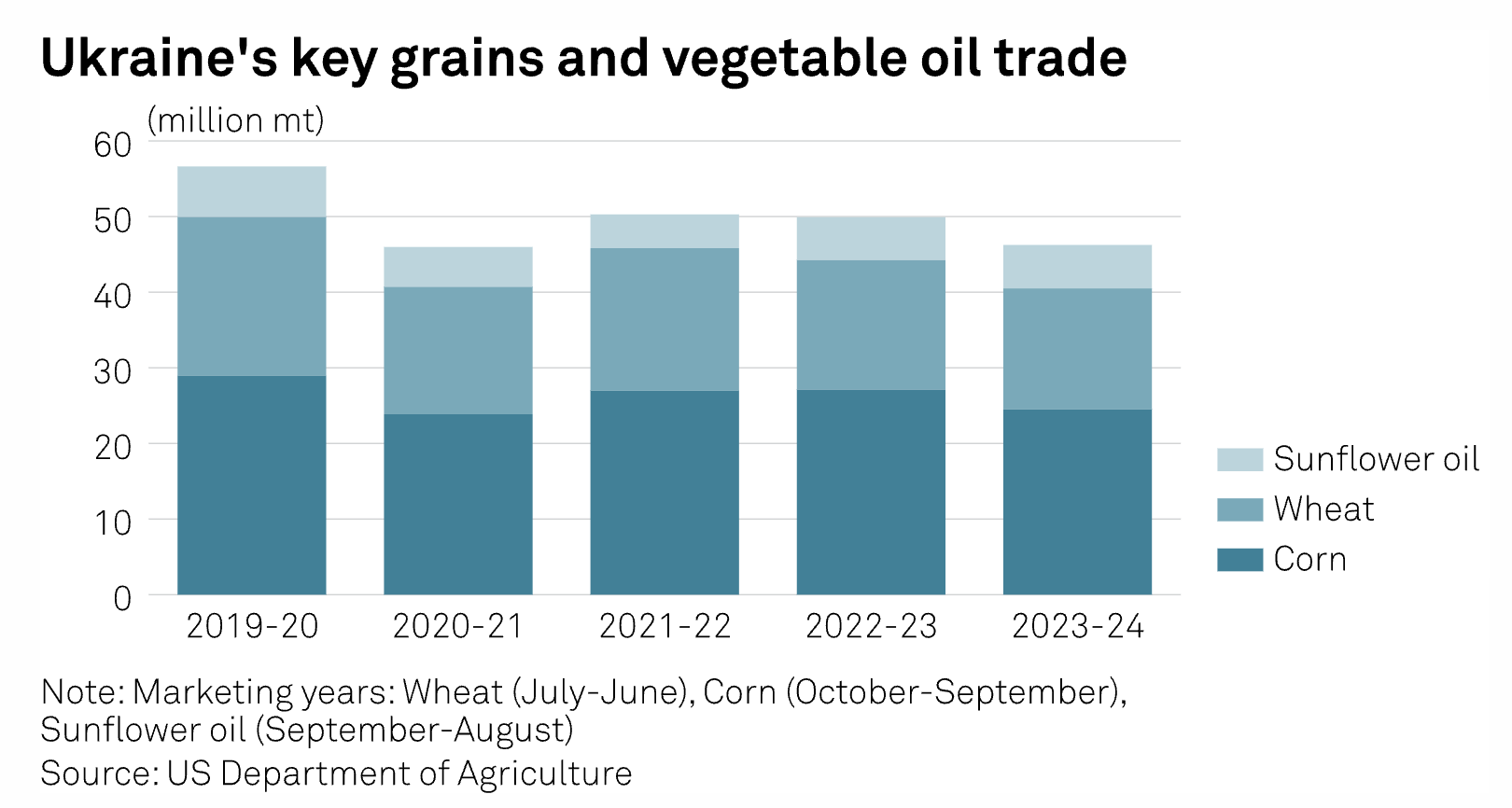

Insight Conversation: Vladyslav Vlasiuk

Ukraine is known as the breadbasket of Europe, but the Russia-Ukraine war disrupted agriculture supplies from the country, creating ripples beyond the region and raising concerns around global food security risks. Vladyslav Vlasiuk, adviser to Ukraine President Volodymyr Zelensky and a sanctions expert, talks to Rohan Somwanshi and Lalita AVD about the future of Ukraine's grain markets and how the country aims to alleviate food security risks.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Women In Leadership Why Mercer CEO Turned Down The Top Role — Twice

To celebrate Women’s History Month, ESG Insider relaunched its ‘Women in Leadership’ series of the ESG Insider podcast. Over the coming months, the podcast will speak with women CEOs and leaders from across industries and around the world. In this episode, hear from Martine Ferland, CEO of global consulting firm Mercer, which is a business of professional services firm Marsh McLennan.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

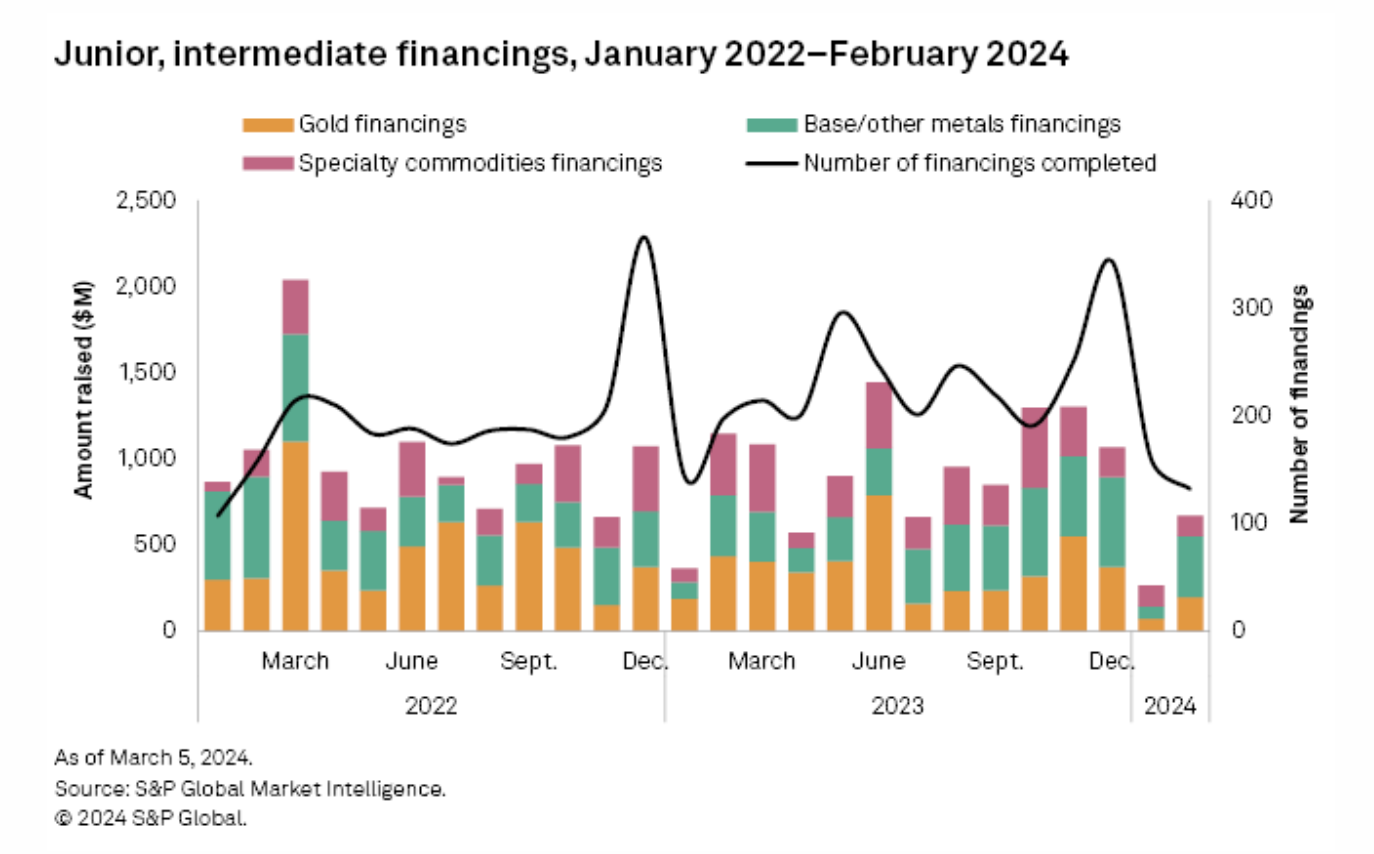

IM March 2024 – Exploration Activity Improves

The declining streak of S&P Global Market Intelligence's Pipeline Activity Index came to an end in February. The index increased 11% month over month to 88; before that, it had fallen for three straight months. The gold Pipeline Activity Index was responsible for the monthly rebound, increasing 22% month over month to 115 from 94. The base/other Pipeline Activity Index posted a slight decrease in the month to 61 from 64.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2: Ep.6 All Things Streaming

In this episode, MediaTalk host Mike Reynolds sits down with S&P Global Market Intelligence Kagan analyst Seth Shafer, who specializes in the streaming industry. Together, they talk about which streaming services — Netflix, Disney+, Peacock, Max and Paramount+ — gained or lost ground in 2023 in terms of subscribers. They also discuss changing strategies around advertising, password sharing, international rollouts and prioritizing profits over growth. Seth also gives a preview of Kagan projections around streaming ad revenue growth, and what those numbers mean for linear TV networks.

—Listen and subscribe to MediaTalk, a podcast from S&P Global Market Intelligence