Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 19 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Who Wins the Generative AI Game?

Generative AI applications and the large language models on which they are built appear poised to reshape many industries and markets. Multibillion-dollar investments in generative AI startups have become routine, and estimates for the total market opportunity stretch into the hundreds of billions of dollars and beyond. But not every player gets to win. The history of technology is one of consolidation and extinction. So which companies are best placed to dominate this fast-growing market, and which will require art and guile to avoid becoming also-rans?

According to S&P Global Ratings, AI-related revenues are forecast to grow at a compound annual growth rate in the high 20% range. By 2028, these revenues could reach nearly $650 billion, accounting for almost 15% of global IT spending at a time when such spending is anticipated to rise significantly as a percentage of global GDP. This means the AI market is expected to grow faster and create more technology sector upheaval than the introduction of smartphones.

Most industry observers believe that the hyperscalers capable of providing large up-front investments are well poised to dominate this market. Companies such as Microsoft, Amazon, Alphabet and Meta have already invested in expanded datacenters and generative AI foundation model companies. Capital expenditures for cloud service providers will increase substantially over the next three years as they add capacity, starting with an expected 26% increase in 2024.

Semiconductor companies stand to be on the receiving end of much of these expenditures. While Nvidia grabbed headlines with enviable fourth-quarter 2023 sales numbers, driving an increase of $277 billion in its market capitalization, other bespoke manufacturers, including Broadcom and Marvell Technology, are positioned to sell picks and shovels during the AI gold rush. The orders of hardware suppliers such as Dell Technologies and Hewlett Packard Enterprise could also grow as hyperscalers and customers increase capacity.

According to S&P Global Market Intelligence, AI foundation model companies will struggle to survive as stand-alone businesses in the long term, even as they currently attract a great deal of investment. Foundation models may be thought of as the software side of AI. Training and maintaining these models requires a massive investment of time and money. While increased demand may allow prices to increase to cover some of this investment, many foundation model companies will become acquisition targets for larger technology companies.

Customers are increasingly looking for customized models and applications. While general-purpose AI has attracted the most press attention in the short term, companies committed to protecting their intellectual property and possessing complex and extensive datasets will look to develop proprietary models and applications.

“Investors' enthusiasm for AI's potential is evident in the rich equity valuations of companies generating revenue from the new technology (and of some companies that are spending in expectation of revenues),” S&P Global Ratings wrote. “Yet it remains uncertain when, and often if, investments will deliver meaningful revenues.”

Today is Friday, April 19, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

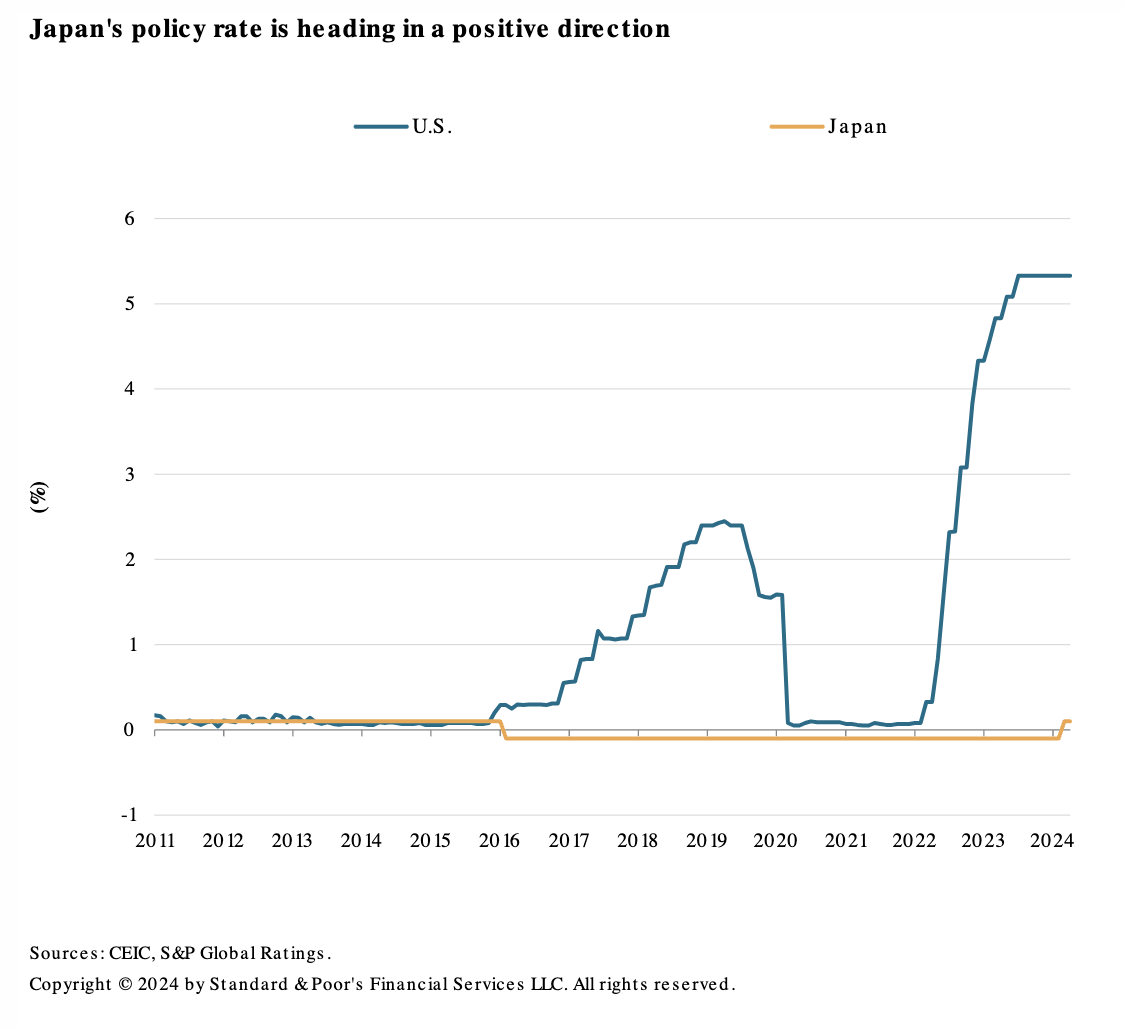

Economic Research: Japan's Long Wait For Sustained Inflation Is Likely Ending

Japan has rejoined central bank orthodoxy. The move away from negative policy interest rates indicates the Bank of Japan (BOJ) believes inflation can be sustained at or close to its 2% target. S&P Global Ratings broadly agrees with that assessment. Consequently, it believes the BOJ will likely slowly increase the policy rate to around 1% by end-2027.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

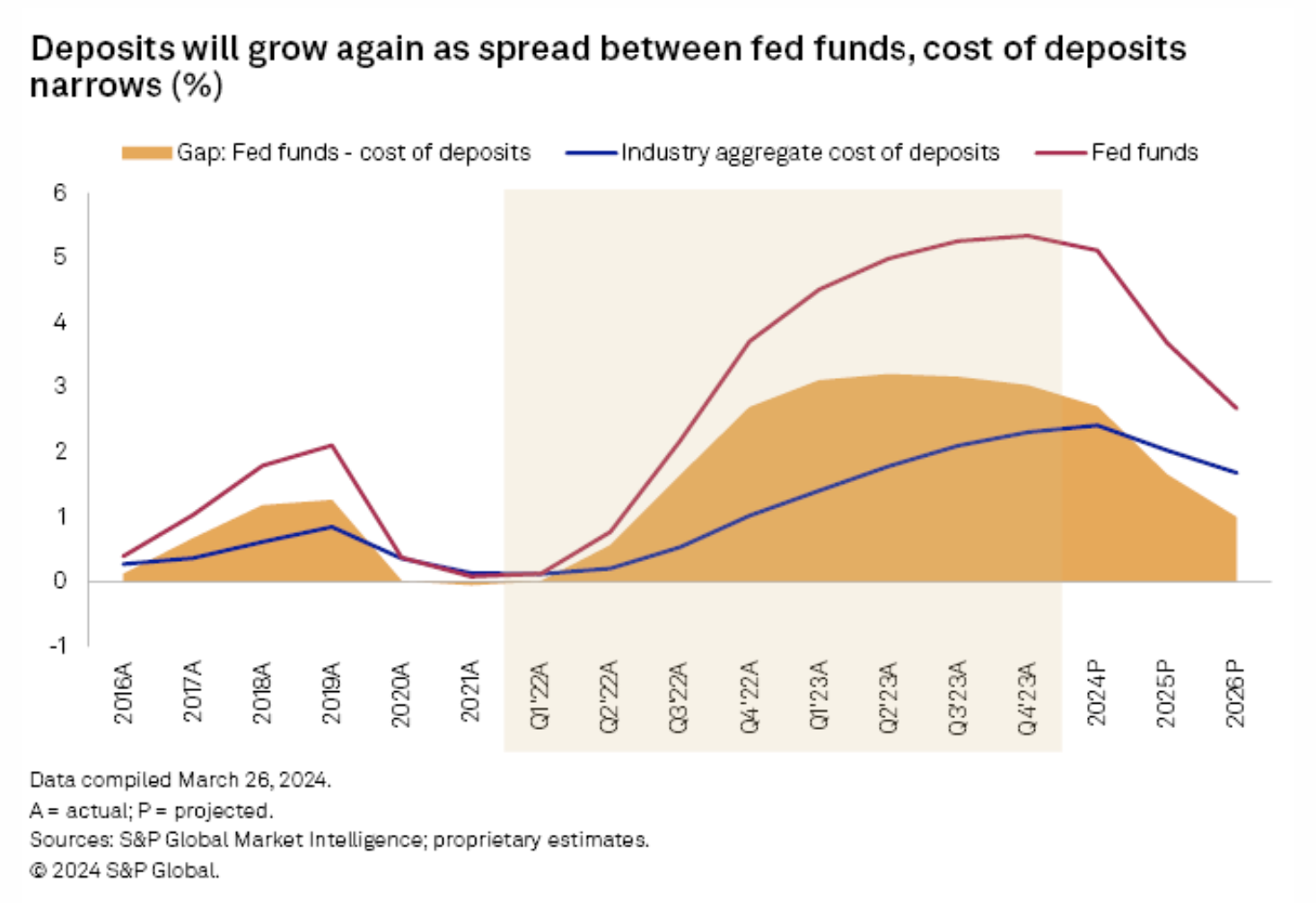

US Banks Will Trade Liquidity Pressures For Higher Credit Costs

Deposits remain firmly in focus, even with interest rates expected to fall in the second half of 2024. Customers continue to shift funds into higher-cost products and demand higher rates for their funds, while regulators are encouraging banks to hold more liquidity, leading to pressure on net interest margins. That pressure will eventually subside but will be replaced by higher credit costs, particularly as banks begin to recognize losses on their commercial real estate portfolios and reserve for future problems. Still, much of that reserve build will occur in 2024, allowing US bank earnings to rebound strongly in 2025 and 2026 as provisions for loan losses decline and become a much smaller headwind to earnings.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

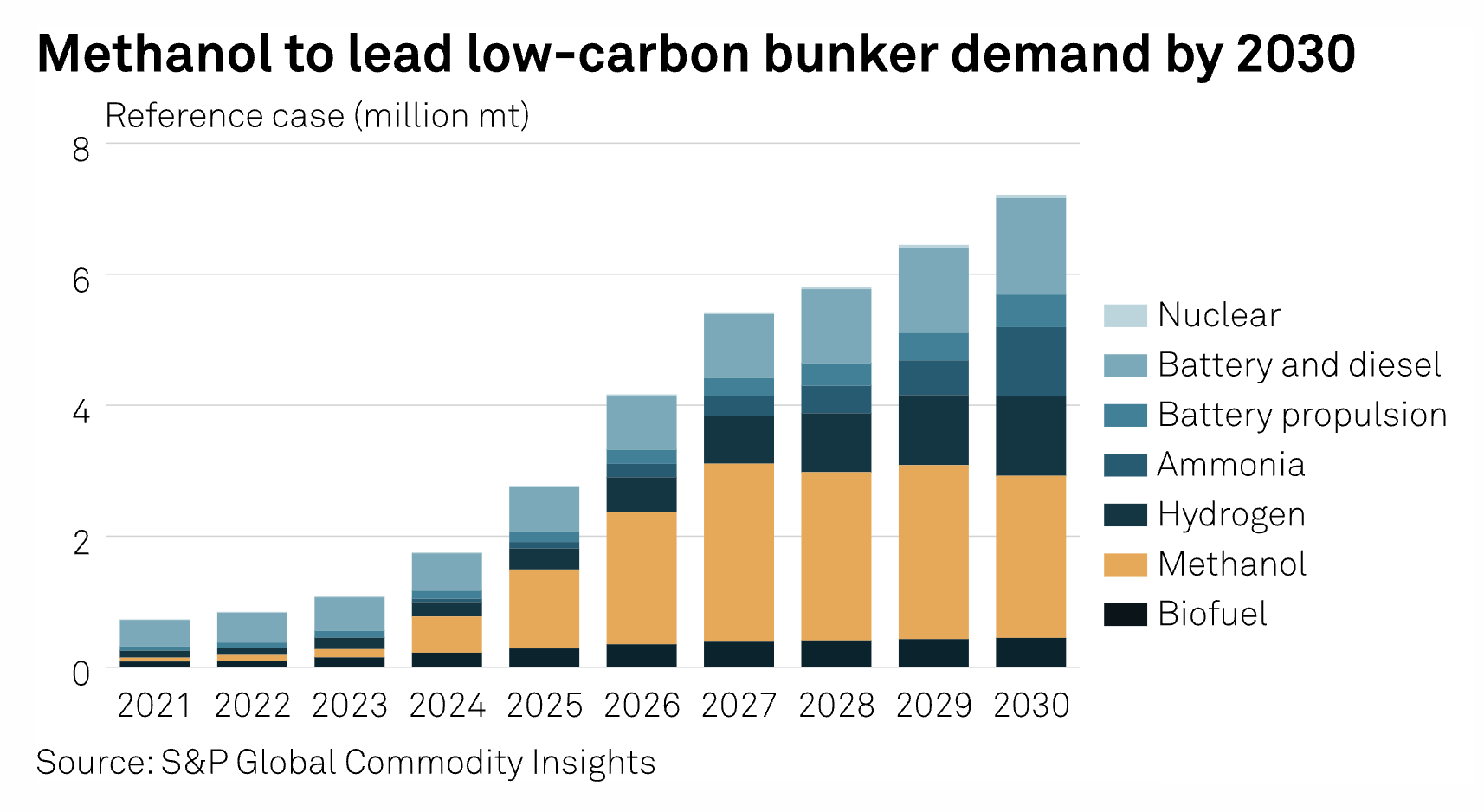

Wartsila Says Shipowners Need To Decarbonize At 'Right Speed'

Shipping companies should decarbonize their operations at "the right speed" to reduce the financial burden while meeting regulatory requirements, Wartsila's marine business head, Roger Holm, told S&P Global Commodity Insights in an interview. While some environmentalists have called for a phaseout of fossil fuels as soon as possible to address climate change, Holm, whose company is one of the largest marine technology providers, suggested shipowners would need to be prudent in making decarbonization investments for business survival.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

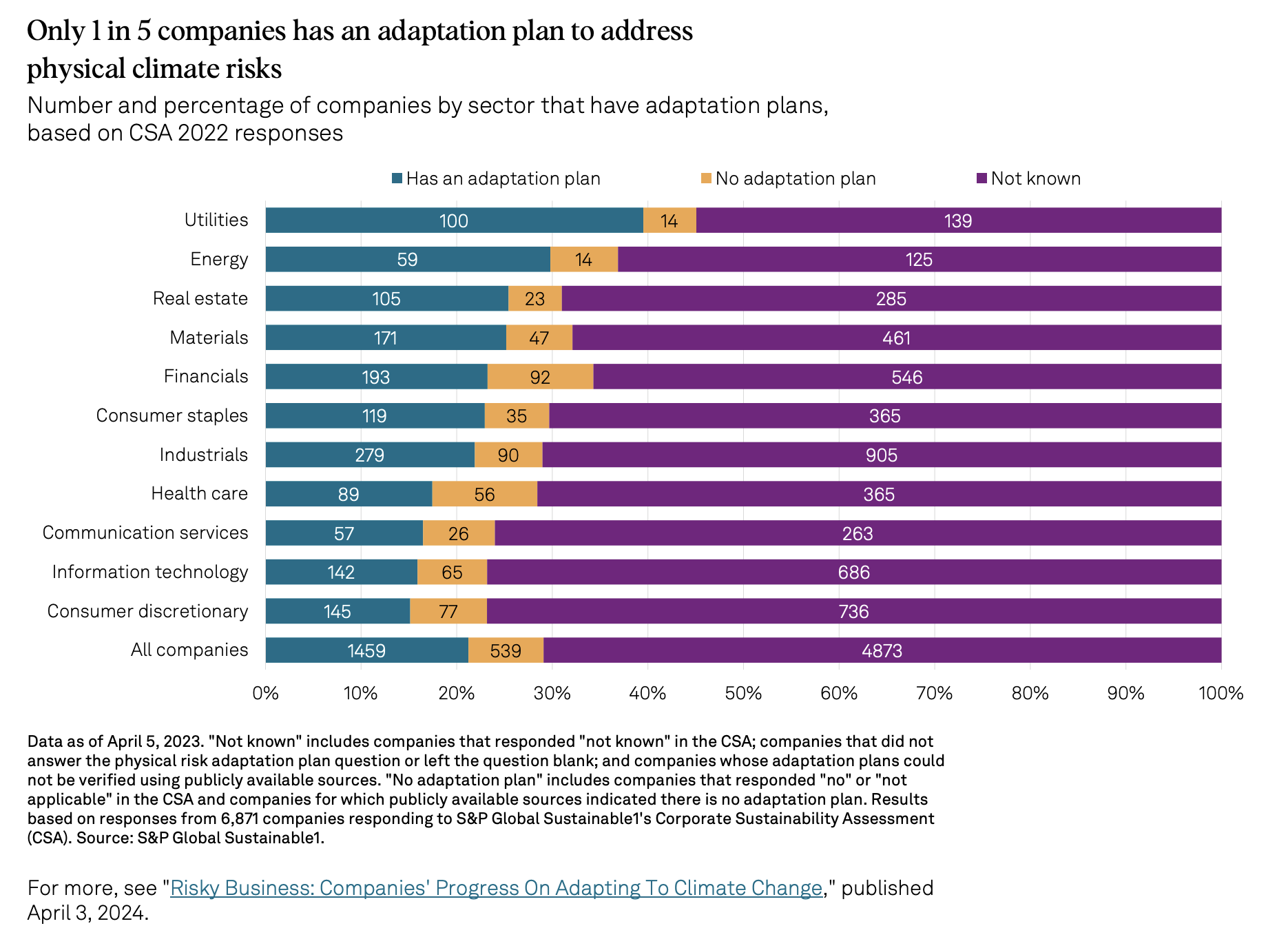

ESG In Credit Ratings April 2024: First Month Since 2020 Without Positive ESG-Related Rating Actions

All 14 of March’s ESG-related rating actions were downgrades or negative outlook and CreditWatch changes. This is the first month without positive ESG-related rating actions since May 2020. Governance factors remained the primary driver with nine related rating actions. Risk management, culture and oversight was the primary underlying ESG factor with five. Governance factors have driven 80% of ESG-related rating actions year to date. The downgrade of the Region of Brussels-Capital was the first ESG-related rating action this year on an international public finance issuer, driven by governance factors. It was also the only one on a European issuer in March — all others were on North America-based entities.

—Read the article from S&P Global Ratings

Access more insights on sustainability >

Listen: India Election: Navigating the new and old: what lies ahead on India’s energy transition map?

India's energy transition strategy encompasses greater adoption of a wide range of renewable fuels to go with baseload coal for decades to come, with new policies on CCUS, carbon markets and power reforms set to play a role in the decarbonization of the third largest greenhouse gas emitter of the world.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

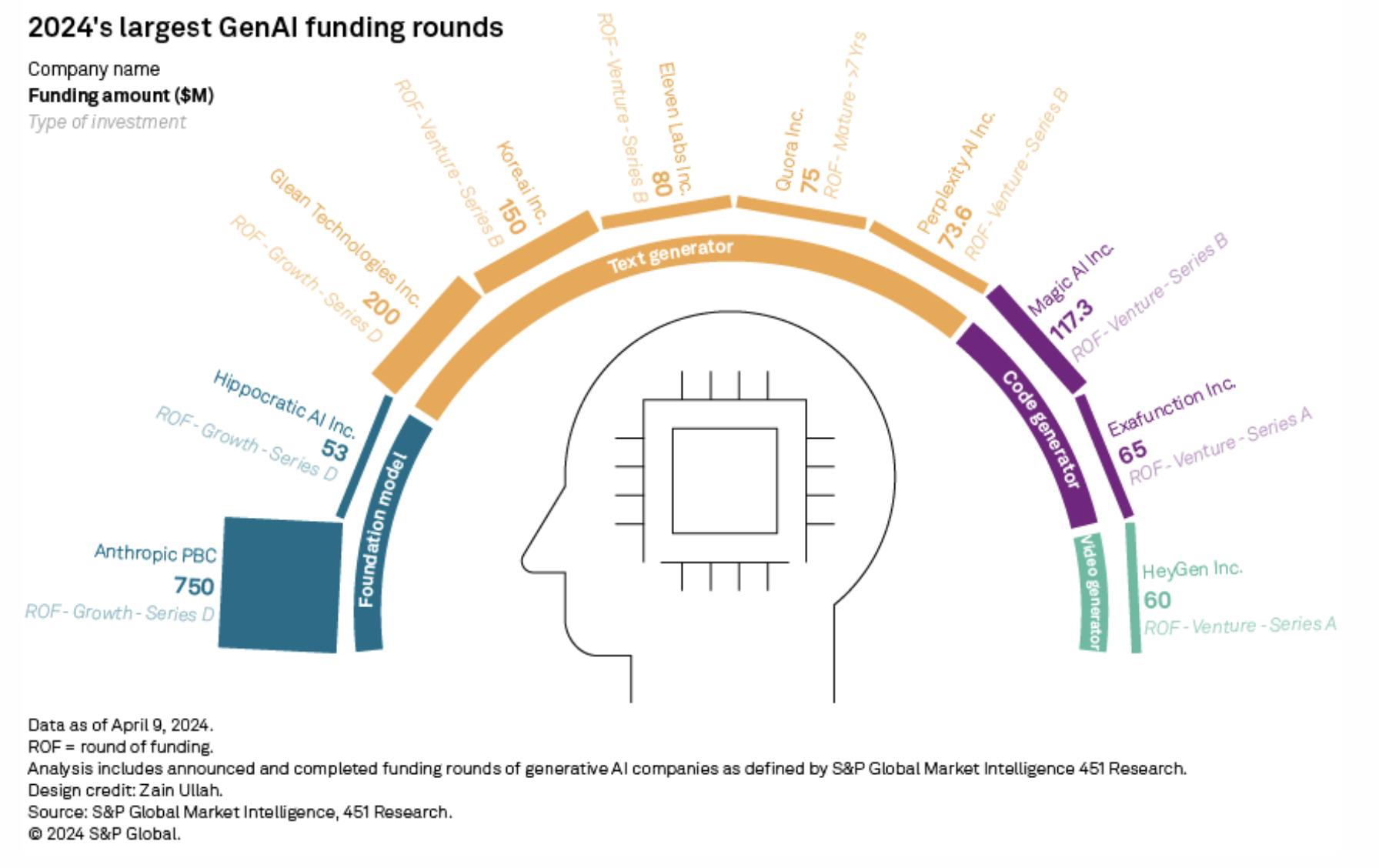

GenAI Investors Target App-Makers In 2024 As Foundation Model Focus Fades

Generative AI investors are shifting their focus from the companies building foundation models to the companies making applications built on top of those models. A foundation model is a general-purpose AI model that can be instructed to generate content, such as text, code, images and synthetic data. Generative AI (GenAI) application companies leverage third-party foundation models to build software services for specific consumer or business purposes.

—Read the article from S&P Global Market Intelligence