Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Apr, 2023

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Looking Forward at Private Markets

Private markets have moved off the sidelines and into the spotlight for multiple industries. While public markets remain essential to the global economy, many companies today have grown to dominant market positions without ever engaging with public financing. The record growth in global private equity dry powder — approaching $2 trillion by the end of 2022 — has created a need for more data, tools and insights.

The Research Council at S&P Global produced a new report that looks at private markets, covering everything from private debt to private equity, to identify how these little-understood markets will develop.

Private debt has been a huge growth story in the past decade. Pursuit of higher yields, lower volatility and uncorrelated returns has led investors deeper into direct lending over the past decade. The boom in private markets, especially in private lending, was fueled by low interest rates and strong economic growth. The switch to higher-for-longer rates with elevated inflation and the continued risk of recession raises the specter of defaults for all borrowers — especially private markets. The opacity of private markets and the lack of a secondary market and short-term liquidity may be an issue.

Private equity has been integral to the growth of institutional money over the past 15 years. Firms have raised a monumental amount of capital, especially since the 2010 Dodd-Frank Act, which accelerated the shift of funding to nonbanks. Private equity growth nourished private markets of all types: private lending, real estate, infrastructure and, now, a growing investment in energy and natural resources.

In 2022, private equity crossed a threshold, exiting an era of exuberance and entering a new period of uncertainty. Record inflation, surging interest rates and a foggy economic forecast put the brakes on private equity dealmaking, which had accelerated to its fastest pace by the end of 2021. Now, lengthening investment cycles pose new challenges to buyout fund managers.

Since the signing of the Inflation Reduction Act by President Joe Biden, private equity has been actively investing in clean energy infrastructure. The emerging cycle of energy transition and climate investing is being “born in the dark.” While impact funds operating in public markets have attracted more than $1 trillion in capital commitments from investors, it is the $260 billion raised for targeted private equity funds that may have the bigger impact on the speed and shape of the energy transition and climate infrastructure rollout over the coming decade.

Private markets have become increasingly integral to financial markets and the real economy, as evidenced by the breadth of private equity-sponsored companies and their prevalence among speculative-grade-rated companies. There will be losses, but the participants are seasoned, experienced parties, and private markets are now an embedded part of the capital-raising process.

Today is Wednesday, April 19, 2023, and here is today’s essential intelligence.

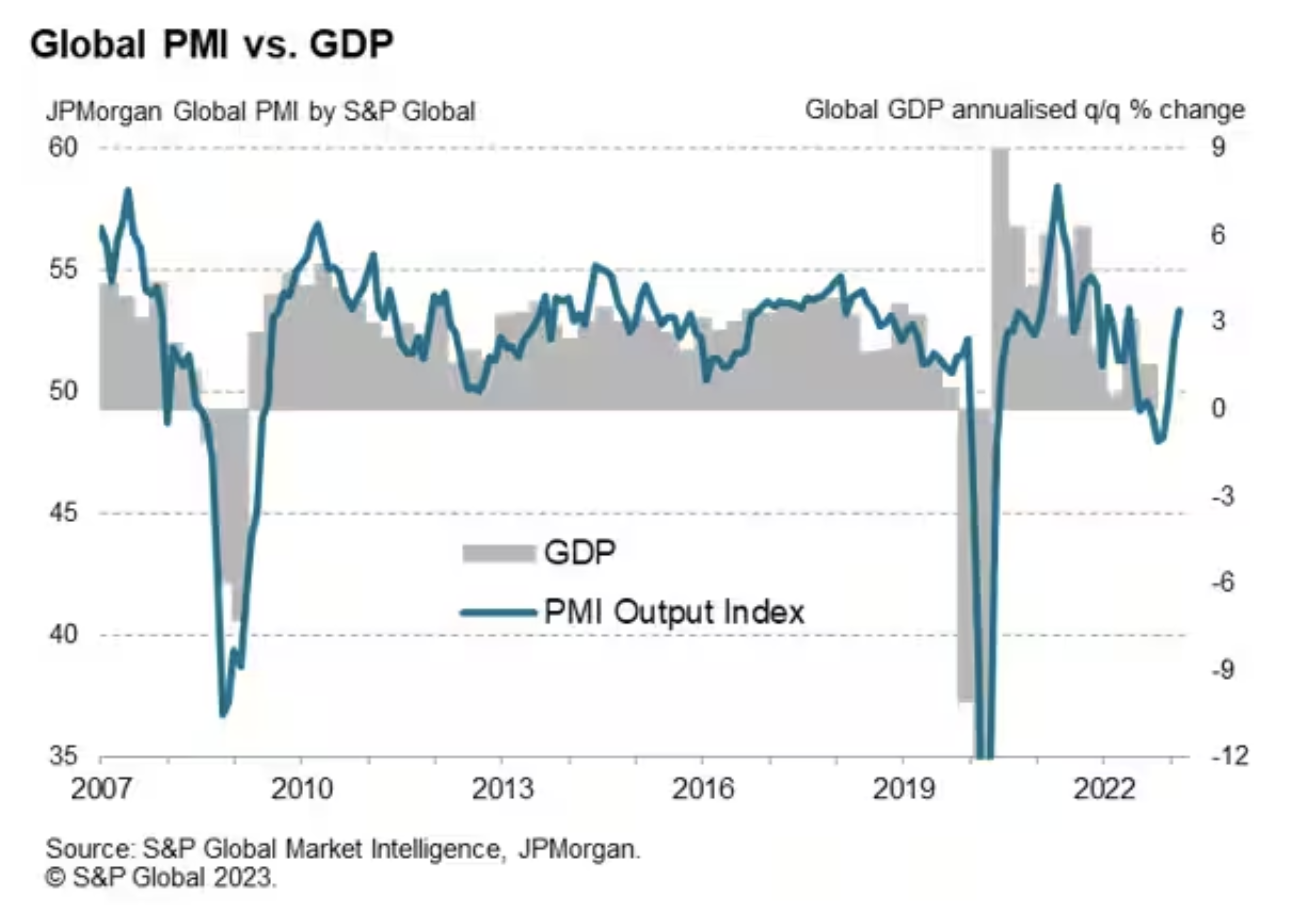

Previewing The April PMI Surveys After Global Growth Accelerated In March

Ahead of the flash PMI releases for the U.S., Eurozone, U.K., Japan and Australia, released on April 21, S&P Global Market Intelligence recaps on the latest survey findings from the March S&P Global's PMI surveys and look ahead to market expectations for April. Although the surveys surprised to the upside in March, allaying worries of imminent recessions in the world's major economies, nagging doubts about the resilience of the upturn persist. In particular, a deeper dive into the PMI survey data underscores how the current growth revival could prove short-lived and therefore highlights which data to watch in the upcoming releases.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Cost Of Living Crisis: Payment Shock In Swedish Covered Bond Pools

Swedish consumer prices are rising rapidly, pushing policy and mortgage rates to multi-year highs. For a sample of over a million mortgage loans backing Swedish covered bond programs, the average monthly payment has risen to Swedish krona (SEK) 2,256 from SEK1,503 (+50%) at the start of 2022, assuming rates have risen by 300 basis points.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

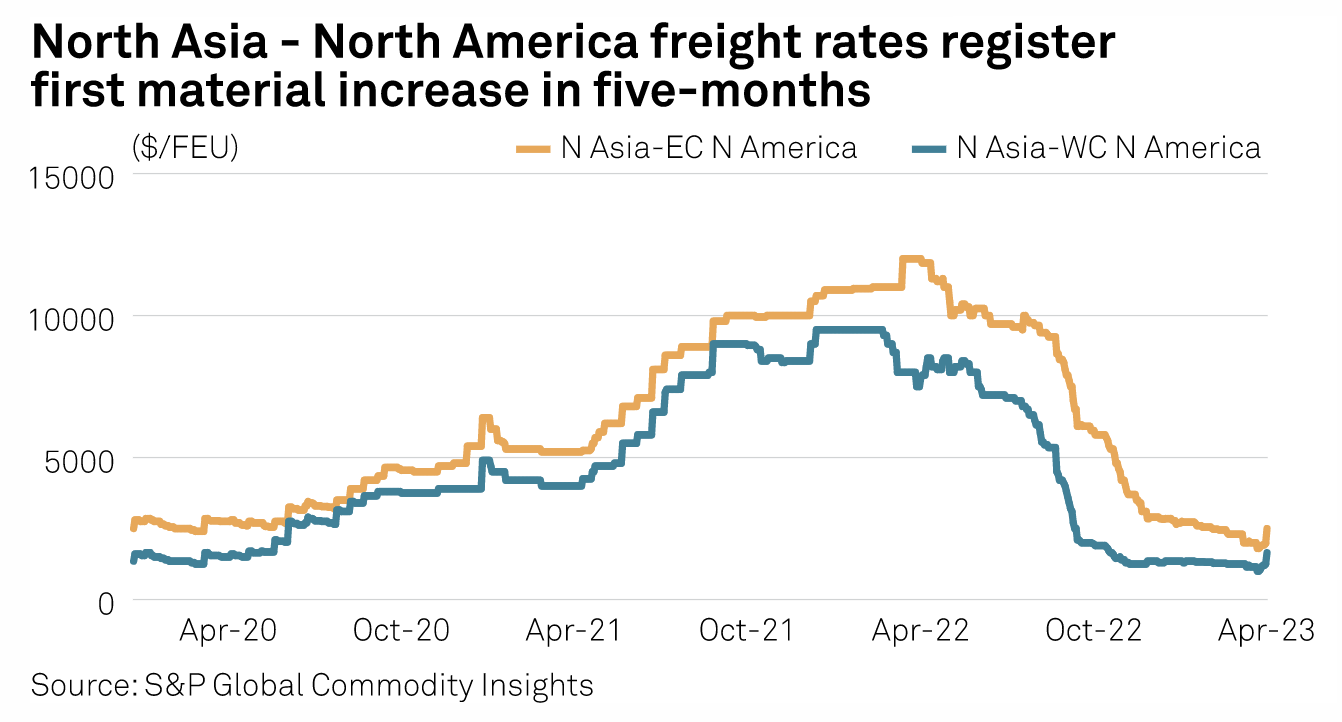

Mid-April Rate Hikes Lift Trans-Pacific Container Freight To 5-Month High

The eastbound trans-Pacific container trade saw large increases April 17, bringing rates to five-month highs after ocean carrier general rate increases supported spot pricing. This was largely expected by the market in the weeks leading up to April 15, when increases were set to come into force. While carrier nominations called for increases ranging between $600/FEU and $3,000/FEU, with the bulk of mainline carriers at the $1,000/FEU level, few if any expected full-measure increases to come into effect.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

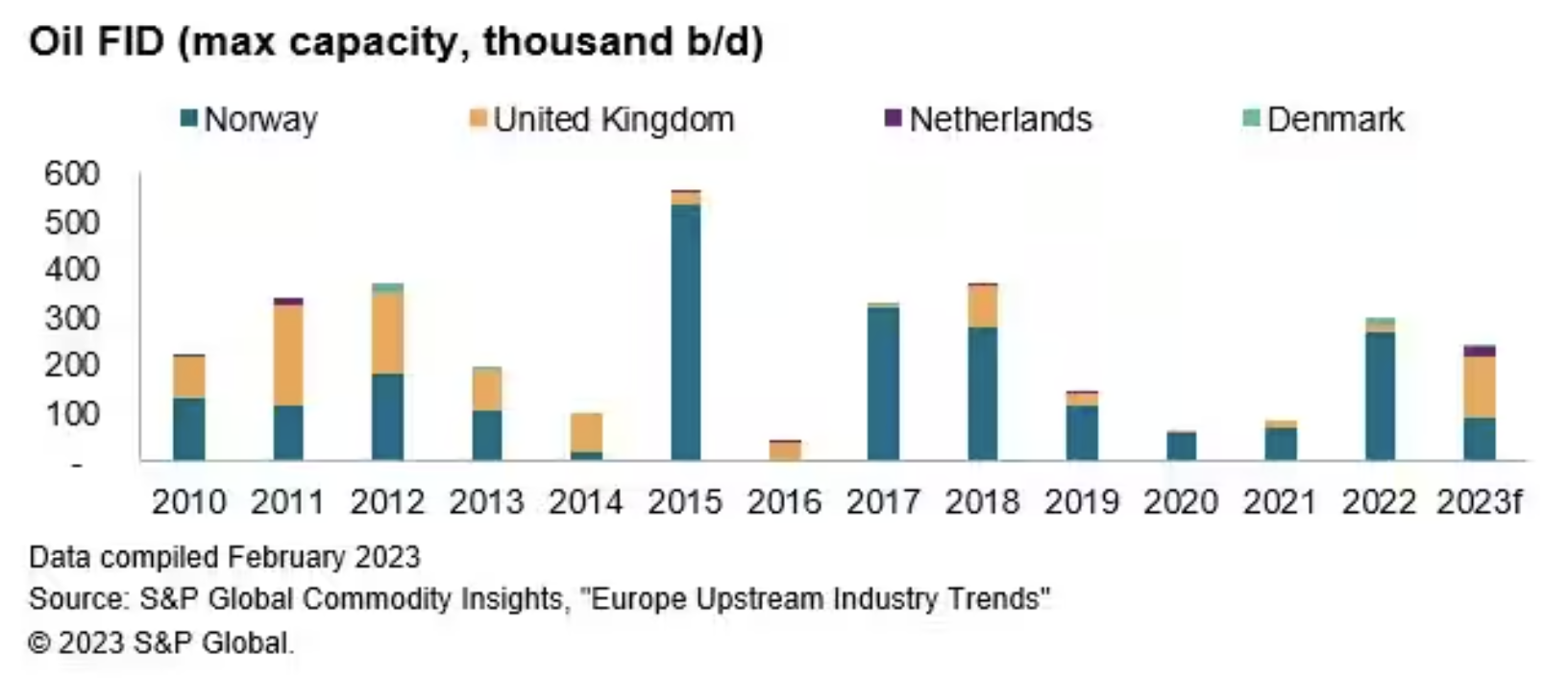

The European Offshore Vessels Market As Facing A Make-Or-Break Time Due To Rising Demand Until 2023

Several European countries have increased their offshore wind targets, surging from 31 GW today to about 125 GW by 2030. Denmark, France, Germany, Netherlands, Norway and the United Kingdom hold 80% of these targets. At present, over half of the operating capacity comes from the United Kingdom. According to Petrodata by S&P Global Commodity Insights, 61 GW of capacity is expected to be realized if they can reach final investment decision in the next five years. The United Kingdom is taking the lead, accounting for 37% of these new projects.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

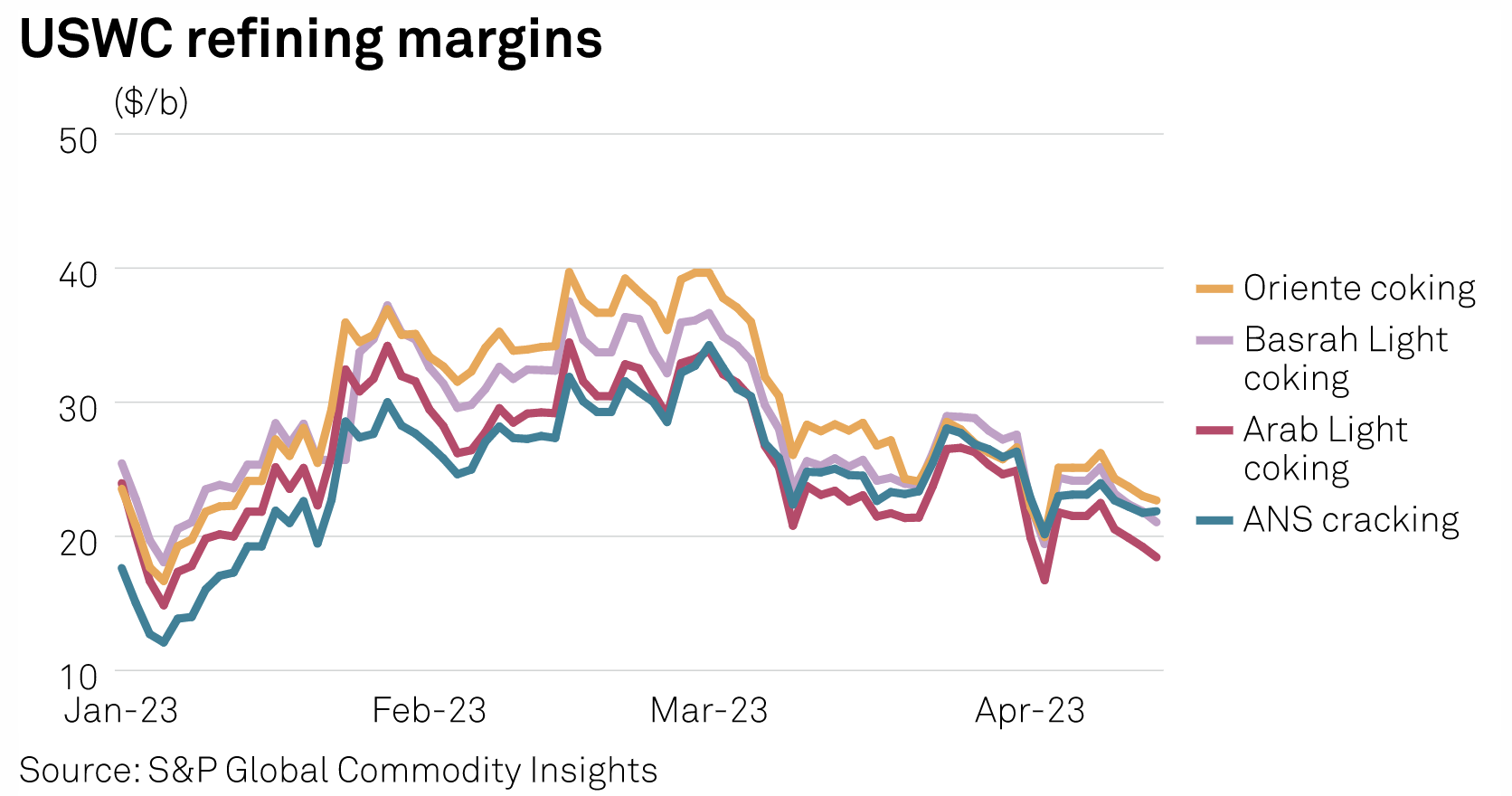

USWC Refining Margins Supported By Growing Southwest Gasoline Demand

Growing gasoline demand in the Southwest is supporting margins for U.S. West Coast refiners as refined product pipeline operators look to increase product flow into Arizona, according to an April 17 analysis from S&P Global Commodity Insights. U.S. West Coast cracking margins for regional benchmark Alaska North Slope crude inched slightly higher, averaging $22.50/b without renewable fuel obligations for the week ended April 14, up from the $22.44/b the week earlier, according to S&P Global.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Credit FAQ: Calculating Leverage For Selected U.S. Telecommunications And Cable Companies

Many investors ask how S&P Global Ratings calculates leverage for certain U.S. telecommunications and cable companies. To address their questions, we are providing our analytical adjustments for EBITDA and debt for the following companies we rate: AT&T Inc., Charter Communications Inc., Comcast Corp., Cox Enterprises Inc., Equinix Inc. and Verizon Communications Inc.

—Read the report from S&P Global Ratings