Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 18 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Different Pathways, Different Peaks for Oil

Discussions of peak oil demand tend to be controversial and too simplistic. While it is generally acknowledged that oil demand will peak, global oil markets are far too complex to be reduced to a simple target date. Oil demand may already have peaked in the established markets of Europe and North America. But oil demand in Africa, Latin America and parts of Asia appears to be growing rapidly. The oil industry is increasingly focused on shifting demand — shifts by region and shifts by feedstock — as it plans to repurpose refining capacity to meet changing market needs.

At the heart of the conflict over peak oil sit two industry stalwarts who have found themselves increasingly at odds: OPEC, representing a select group of oil-producing nations, and the International Energy Agency (IEA), an autonomous intergovernmental organization that provides data and analysis to the energy sector. The IEA has been reducing its projected oil demand figures, saying that demand for gas, oil and coal will peak by 2030 as electric vehicles and government commitments to decarbonize begin to bite into fossil fuel markets. OPEC, on the other hand, projects continued strong demand into the future, calling decarbonization efforts “ambitious and unrealistic net zero policy agendas.” Senior US Republican lawmakers have taken up OPEC’s condemnation of the IEA, claiming that the IEA’s peak oil projections undermine energy security by discouraging investment.

Hedi Grati of S&P Global Commodity Insights provided a dispassionate take on the debates over peak oil on a recent episode of S&P Global's "EnergyCents" podcast.

“Obviously, opinions on this topic are very divided,” Grati said. “Our own view on this is as follows: Emerging markets like Africa, Latin America, the Indian subcontinent or Southeast Asia have still got strong growth prospects to come and their peak demand is not on the horizon yet. But your typical [Organisation for Economic Co-operation and Development (OECD)] nations, United States, Canada, most Western European nations, but very crucially also China, there we start seeing that peak demand may not be that far away.”

For refiners in those OECD nations, the outlook may be less bleak than it might appear. A few areas of product growth are on the horizon — biofuels and sustainable aviation fuel are notable. But some refiners with newer facilities and advanced technology will be well placed to pivot to sustainable fuels as demand and government mandates shift the market in those countries.

Meanwhile, refiners operating in the so-called Global South are focused on traditional oil refining to meet domestic and regional demand. The Dangote refinery in Nigeria has considerable runway to meet the growing demand for oil in Africa.

“So you’ve got this globe with two speeds if you want — OECD plus China peaking relatively quickly and then starting a decline,” Grati said. “And then the rest of the world continuing to grow. And so for those who have seen our demand curve, that comes with quite a long-winded plateau, and that is exactly the consequence of those two differences in trends.”

Today is Thursday, April 18, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

Kenya's Debt Conundrum: What Is The Path Forward?

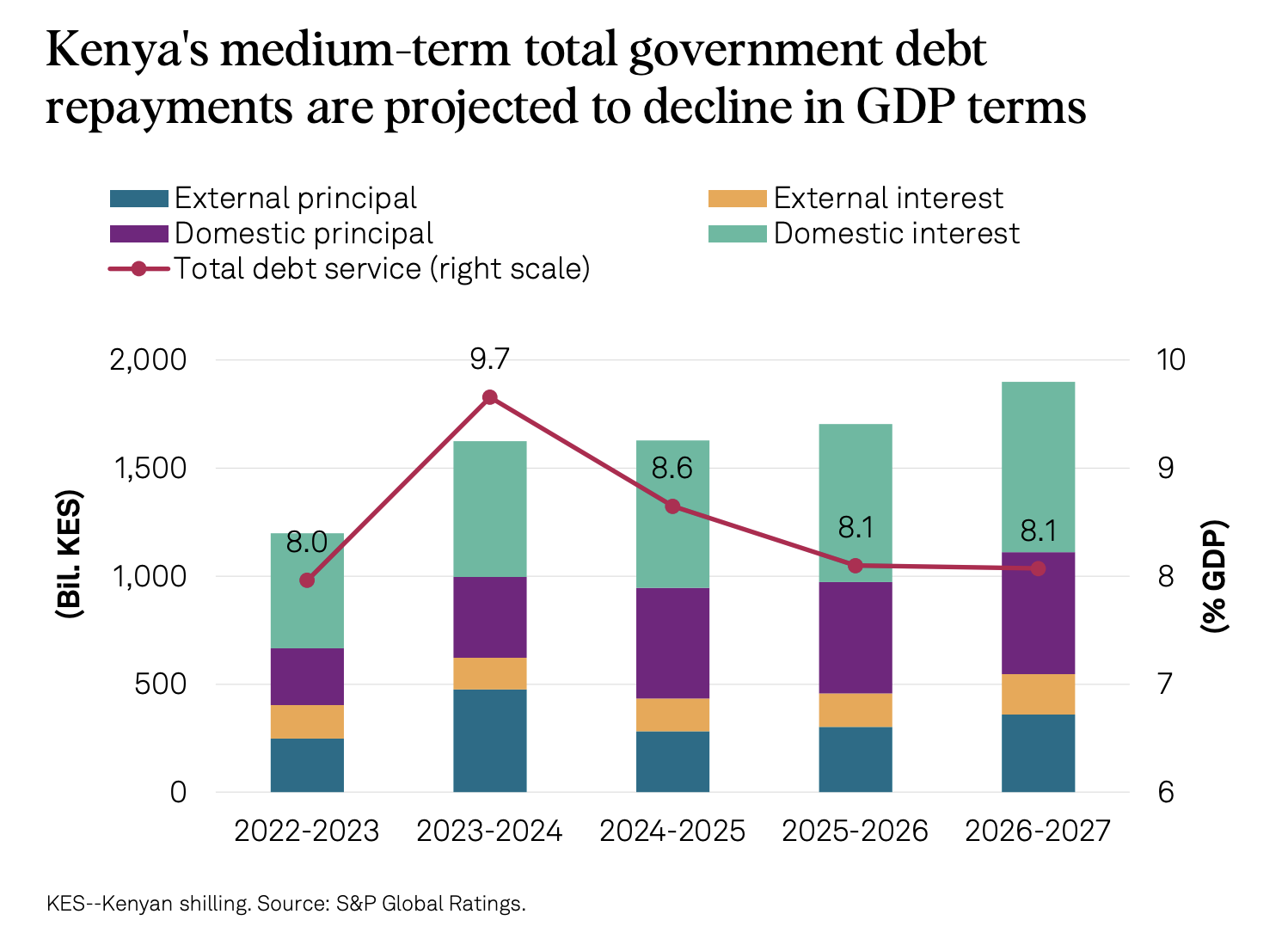

We see risks to Kenya's debt-servicing capacity amid high external refinancing requirements and tight liquidity in domestic capital markets. However, our base-case scenario assumes that Kenya will retain access to sufficient committed funding sources and foreign exchange reserves to mitigate immediate external liquidity risks.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

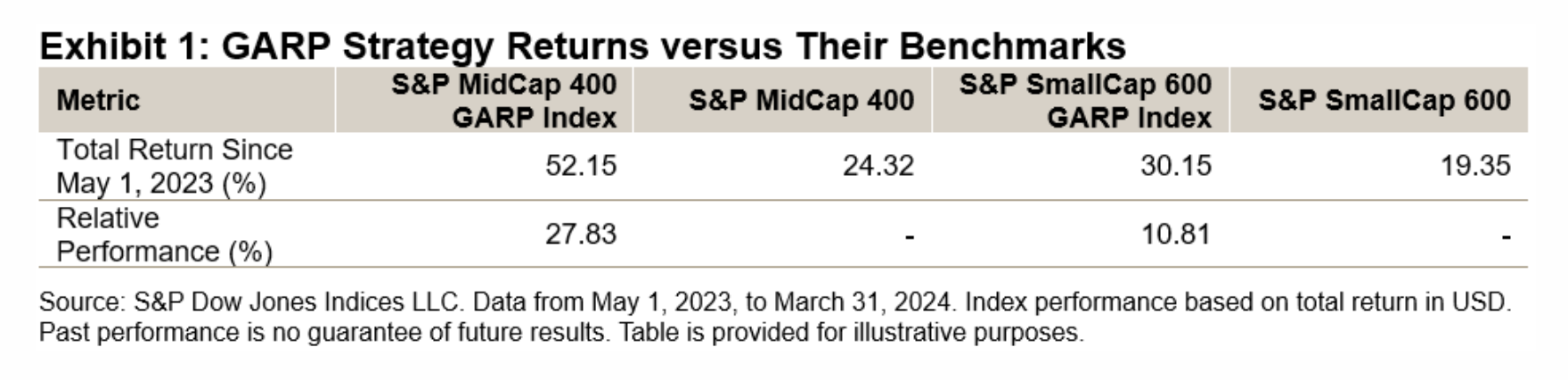

Balancing Growth and Value in the Mid-Cap and Small-Cap Spaces: The S&P MidCap 400 GARP and S&P SmallCap 600 GARP Indices

Launched in February 2019, the S&P 500® GARP Index was the first transparent benchmark tracking growth companies that are identified as being higher quality with lower valuations. Given the success of this index, we launched the S&P MidCap 400® GARP Index and S&P SmallCap 600® GARP Index to expand the available toolkit. Since their launches in 2023, these two indices have outperformed their corresponding benchmarks by a wide margin. For market participants seeking to diversify their mega-cap exposures, the S&P MidCap 400 GARP and S&P SmallCap 600 GARP Indices may provide two alternatives.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

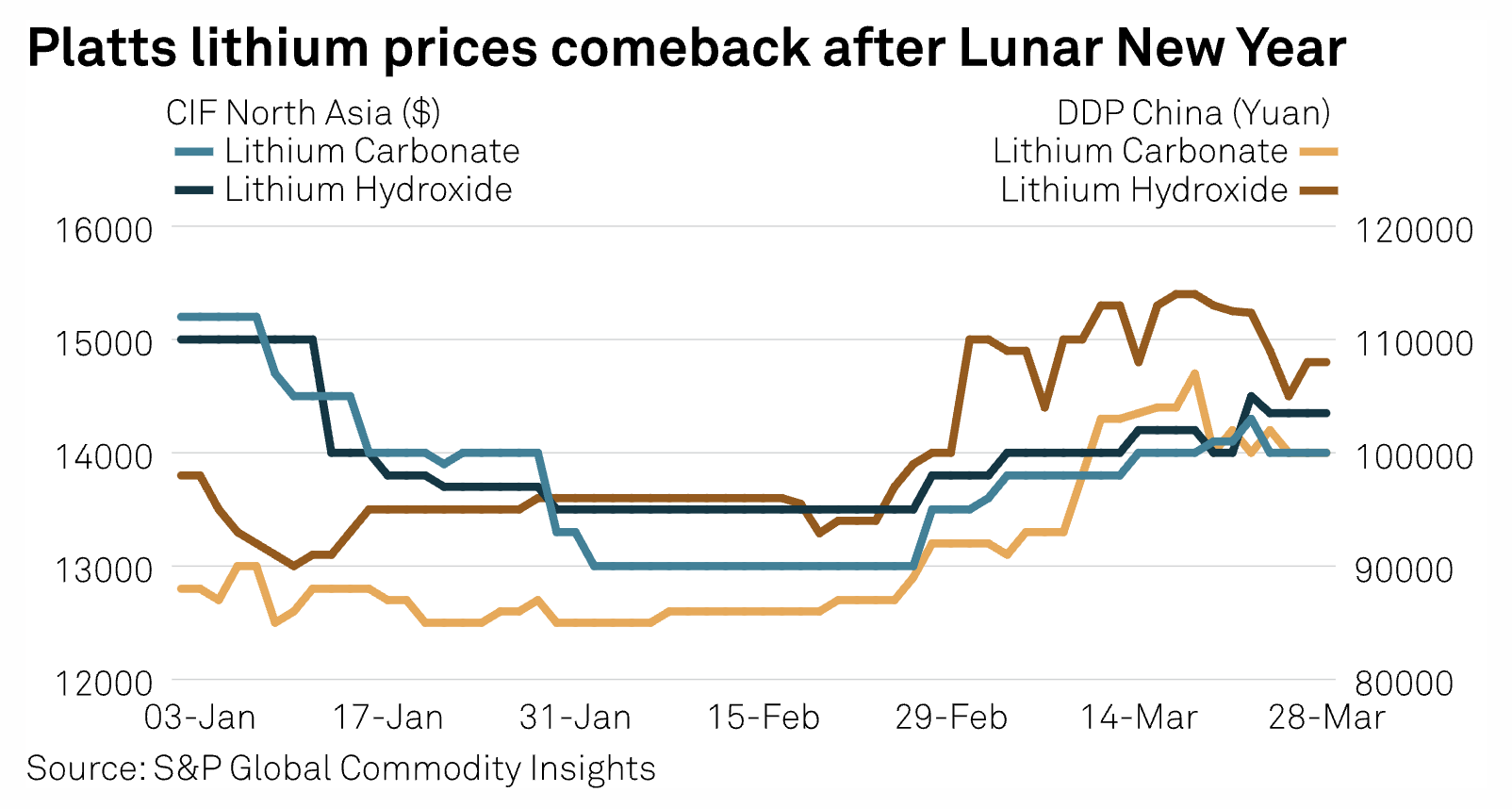

Asian Lithium Prices To Be Steady In Q2 On Measured Demand, Ample Supply

Asian lithium prices are likely to be largely steady around Yuan 100,000/mt ($13,800) in the first half of the second quarter even though participants do not discount the possibility of levels softening amid the prevailing oversupply, while demand is expected to remain rangebound well into Q2 after a modest uptick in mid-March.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Unpacking Mitigation, Adaptation Pathways Toward Sustainable Agriculture

Agriculture has a greater impact on the environment than any other human activity. It uses more land than any other human activity, resulting in deforestation and the loss of biodiversity, it uses more water -- around 70% of freshwater is used globally -- and it is responsible for around 24% of greenhouse gas emissions. Concerns about the environmental impact of agriculture have grown in recent years, and this has resulted in the rise of, among other adaptations, "regenerative agriculture". The term "natural capital" is bandied around frequently and featured prominently in the Food and Agriculture Organization's State of Food and Agriculture 2023 publication.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

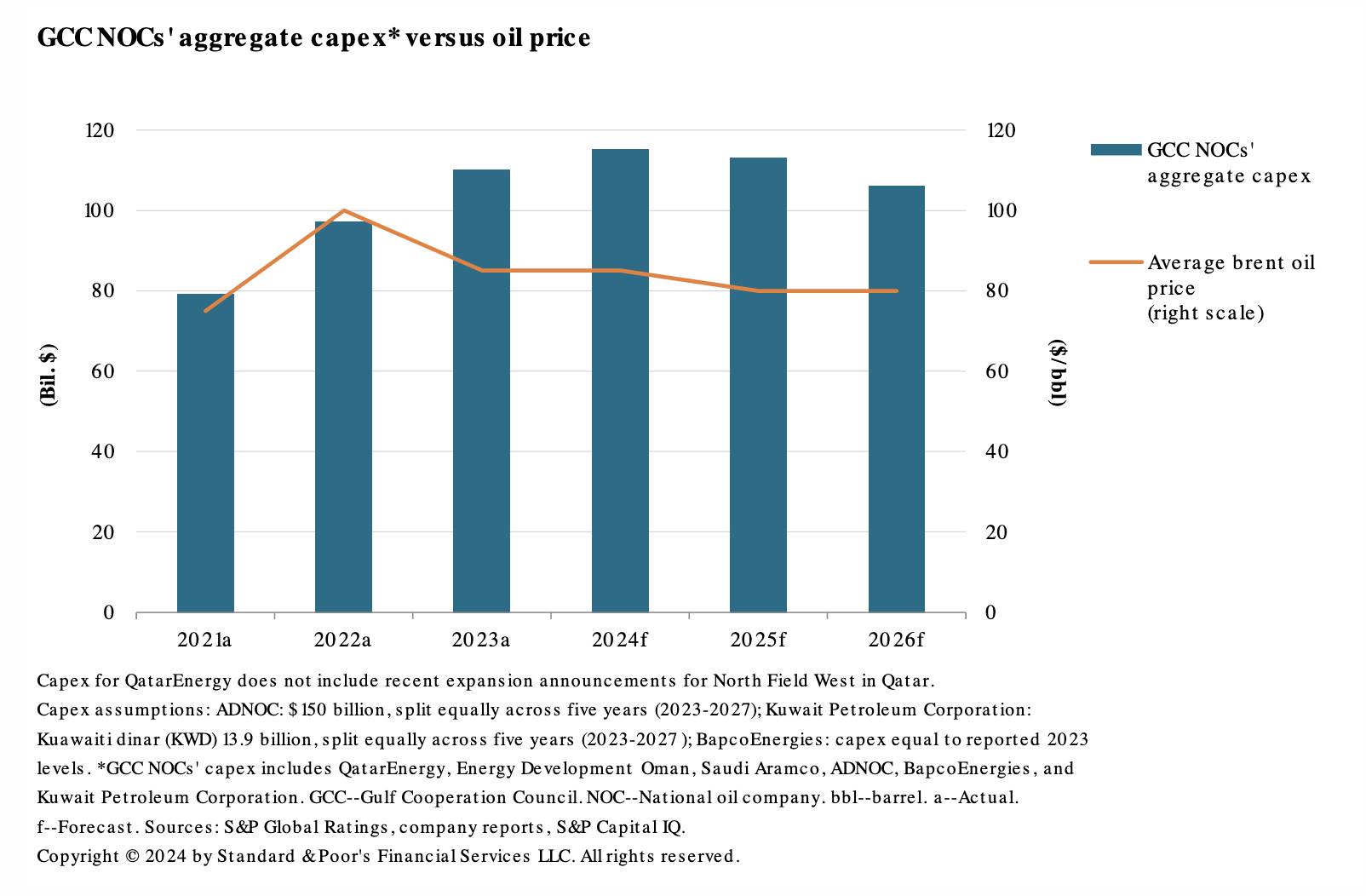

GCC Oil And Gas Producers' Capex Cooldown Won't Fire Up Drillers' Leverage

Saudi Arabian national oil company (NOC) Saudi Aramco recently paused its plan to expand its maximum sustainable oil-production capacity in the country, raising questions about the spending outlook for oil and gas producers in the broader GCC region. While we understand that GCC NOCs' capital expenditure (capex) could remain elevated owing to capacity expansion plans in Qatar and the United Arab Emirates (UAE), their spending, and the pace of it, will affect the oilfield service companies along the value chain, especially drillers. Drillers' business models and revenue generation depend on producers' capex.

—Read the article from S&P Global Ratings

Access more insights on energy and commodities >

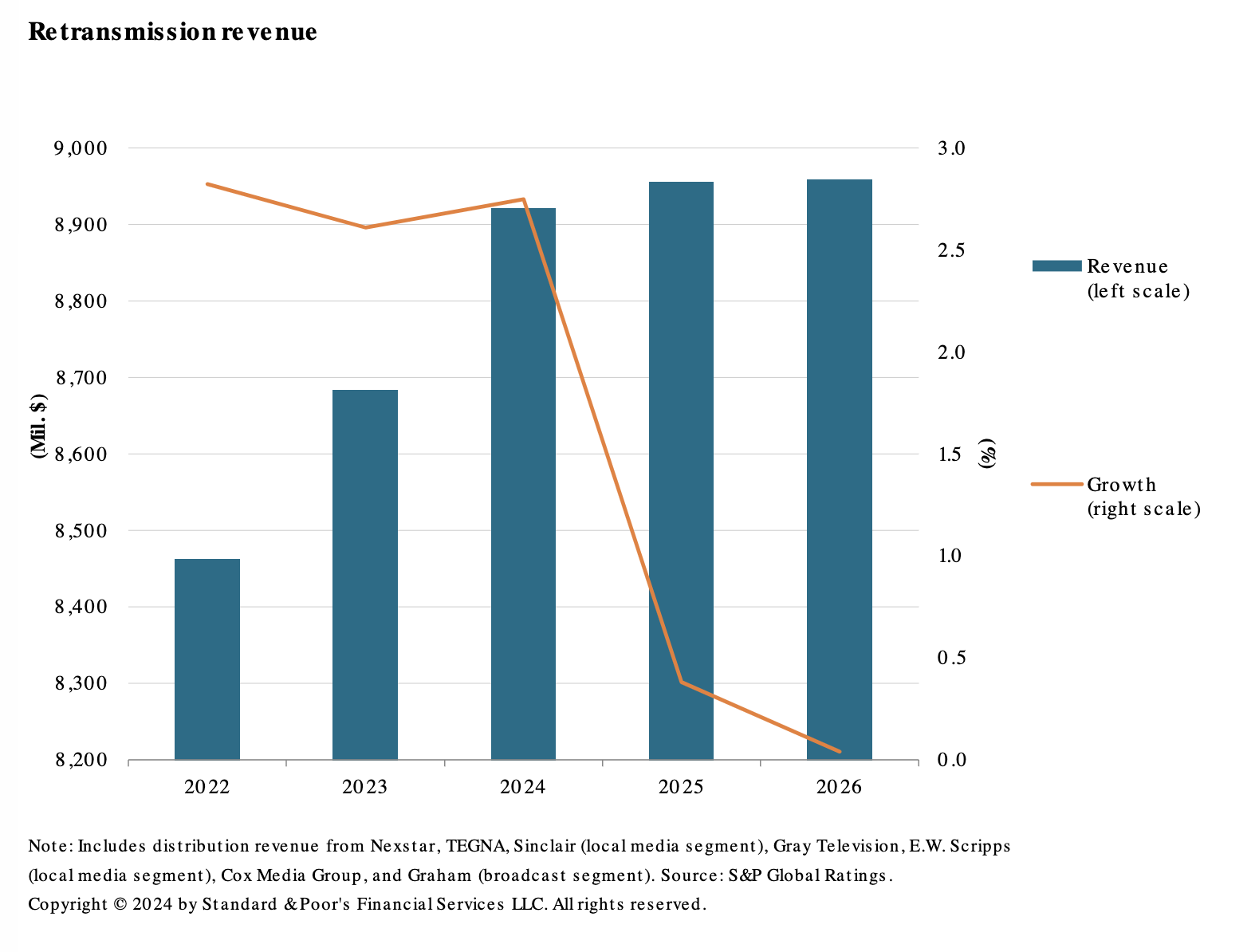

Credit FAQ: Outlooks Diverge For U.S. Local TV Broadcasters As Industry Faces Secular Challenges

We have taken several rating actions on the U.S. local TV broadcasters in 2024 (including two downgrades, a negative outlook revision, and one rating affirmation), reflecting increasing risks as both consumers and advertisers navigate away from TV. In some instances, we lowered our financial forecasts; in others, we lowered our business risk assessments and tightened our rating thresholds. Of the six local TV broadcasters we rate, three have stable outlooks and three have negative outlooks. Those with stable outlooks have stronger leverage and cash flow profiles.

—Read the article from S&P Global Ratings