Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Apr, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Struggles in Shanghai

Shanghai’s COVID lockdown is putting China’s economic growth, and the country’s energy and commodities markets, to the test—and threatens to prolong global supply-chain disruptions.

Coronavirus cases in China’s largest city surged beyond 26,000 today, marking another record high and making it unlikely that Shanghai’s strict mobility limits on its 25 million residents will be lifted anytime soon. Keeping civilians in isolation, disrupting transportation and logistics, and limiting access to essential supplies in the city itself, the stringent restrictions in Shanghai pose serious threats to output in China and worldwide.

China’s low-tolerance for the pandemic has continued to weigh on consumer confidence, spending, and growth, and the spread of COVID cases threatens to depress growth this year as the country is already challenged in achieving its aspirational growth target of “around 5.5%,” according to S&P Global Ratings, which expects China’s economy to expand 4.9% in 2022. China’s GDP growth decelerated to 4% year-over-year in the fourth quarter of 2021 due to subdued consumption and the downturn in real estate and prompted policymakers to emphasize growth.

Now, major Chinese banks will likely report slower net profit growth this year as the uncertain economic outlook weighs on loan growth and net interest margins, according to S&P Global Market Intelligence.

The detrimental implications of Shanghai’s lockdown on domestic demand have curtailed China's output of fossil fuels like gasoline, gasoil, jet fuel, and liquified natural gas alongside the production of other commodities like soybeans, and demand for steel, according to S&P Global Commodity Insights.

Shanghai accounts for 3.8% of China’s overall GDP, features the world’s busiest port for container traffic, and is a major global manufacturing hub for the world’s supplies of autos, semiconductors, and beyond. Global trade disruptions corresponding to this situation are already evident. As of April 12, trade analytics data from S&P Global Commodity Insights showed 315 vessels waiting in the Shanghai/Ningbo region queue and 141 in the Hong Kong region.

The ripple effects of coronavirus-containment measures come as global markets reel from Russia’s invasion of Ukraine, which has sent oil prices on a volatile rollercoaster and disrupted the global energy supply. The country’s electric vehicle market is facing compounding pressures from both the lockdown and high raw material prices spurred by the geopolitical conflict. Tensions between the U.S. and China may be further inflamed by the latter’s zero-COVID approach, as this week China accused the U.S. of “weaponizing” its policies after the U.S. Department "ordered" non-emergency employees and their families to leave Shanghai "due to a surge in COVID-19 cases and the impact of restrictions related to [China's] response.”

Today is Wednesday, April 13, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

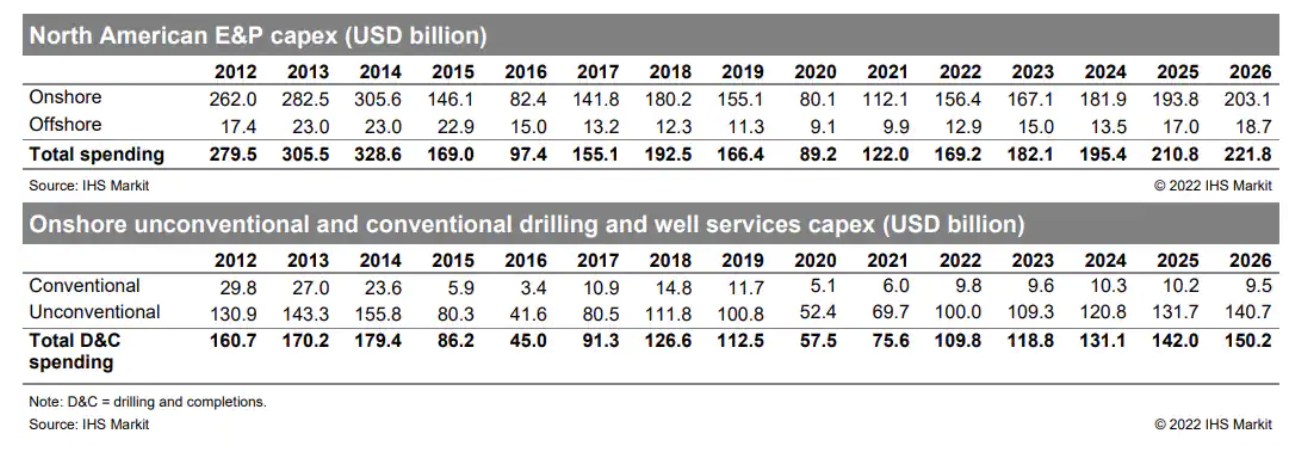

North American Service Cost Increases Expected Against An Uncertain Global Backdrop

COVID-19 counts are down and restrictions in North America are being lifted. From a public health perspective this is excellent news, but this improvement is exacerbating pain points from an economic perspective. Supply chains that were already stressed will continue to be so; rising oil prices that could be further impacted by the recent geopolitical events will contribute to inflationary pressures in the broader economy, which will then be felt at the wellhead. These acute, momentous events are occurring at the same time that operators and service companies are attempting to navigate the energy transition. This momentum has the potential to alter supply chains further as well service companies adapt to new client demands by adding new services and perhaps dropping existing ones.

—Read the full article from S&P Global Commodity Insights

Access more insights on the global economy >

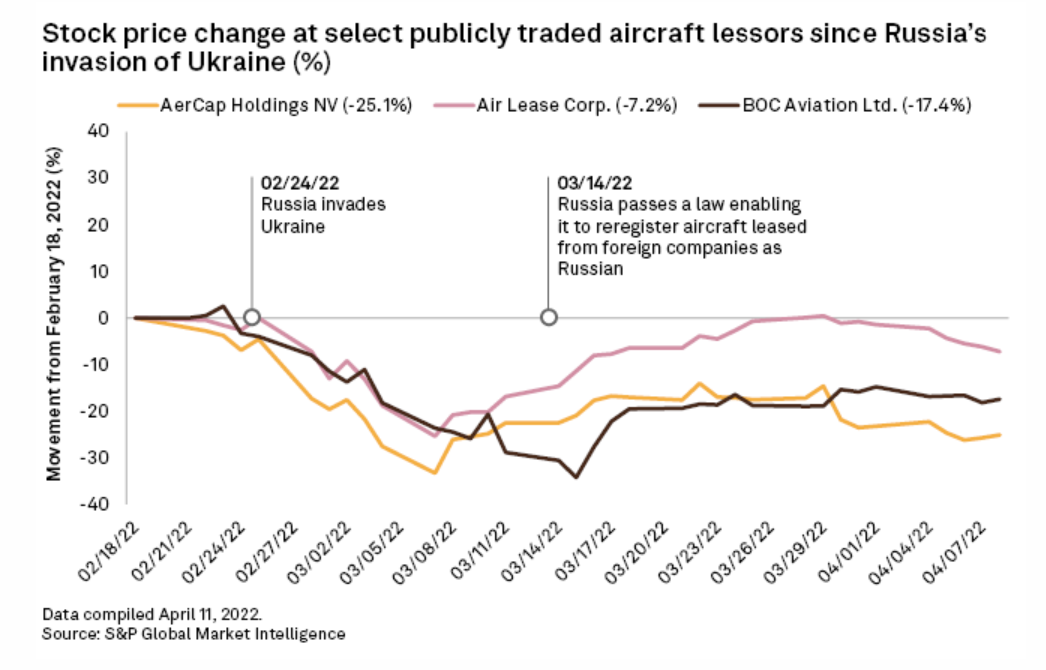

Insurers' $15B Russia Aviation Puzzle Will Take Years To Solve

Insurers are facing a yearslong legal battle with aircraft leasing firms over a potential $15 billion claims bill from jets stranded in Russia because of the Ukraine war. AerCap Holdings NV, the world's biggest aircraft leasing firm, filed a $3.5 billion claim in late March after the Russian government passed a law enabling leased jets in the country to be registered locally, widely seen as a first step toward seizing the planes. S&P Global Ratings said in a March 31 report that aviation losses from the Russia-Ukraine war could range from $6 billion to $15 billion across three different scenarios.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

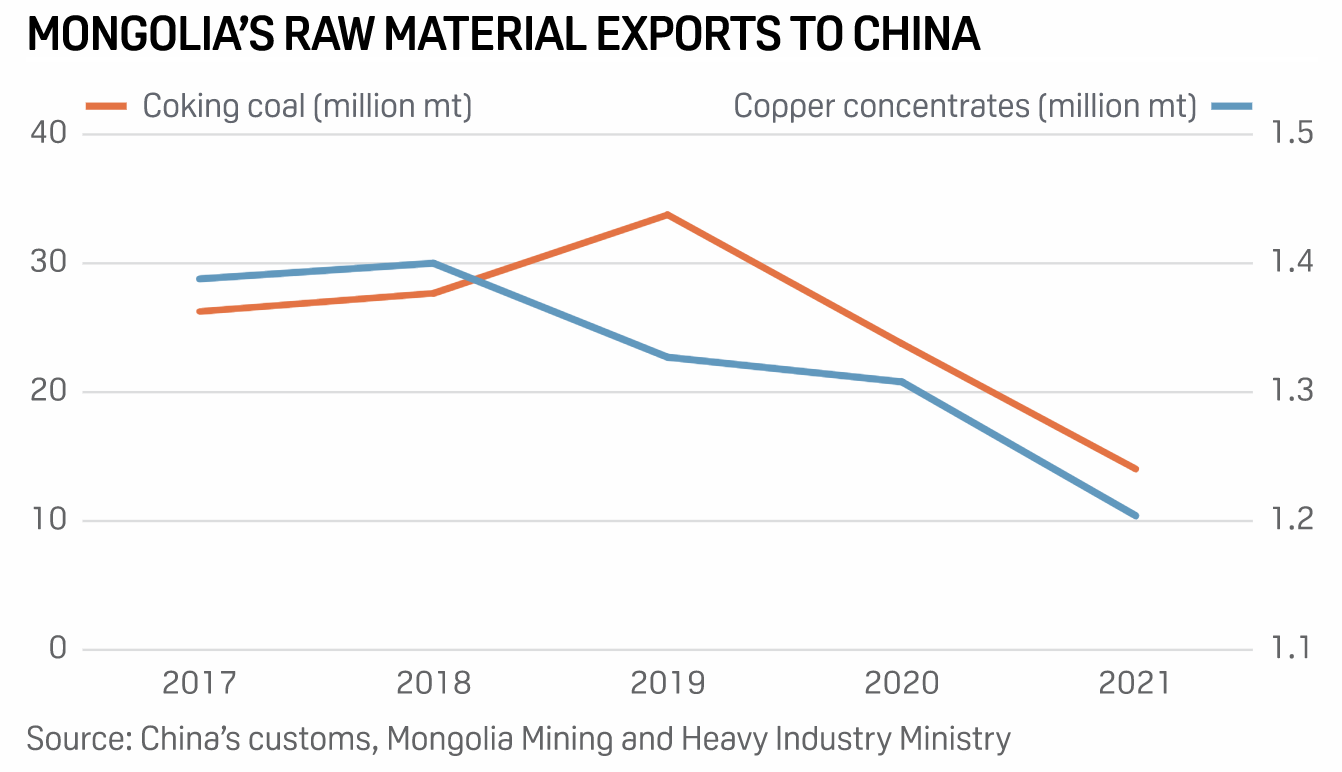

Interview: Mongolia Eyes Ramp-Up Of Coking Coal, Copper Exports To China In 2022: Minister

Mongolia is ramping up its efforts to supply raw material such as coking coal and copper to China in 2022 after a lackluster trade in 2021, as it expands its mining sector and boosts its transport network, said Batnairamdal Otgonshar, Vice-Minister at Mongolia's Mining and Heavy Industry Ministry. Mongolia is a key metallurgical coal and copper concentrates suppliers to China, with most of the trade happening through trucks. Mongolian truck suppliers in 2021 faced severe logistics issues in hauling shipments from land ports to China due to the pandemic-led restrictions at border crossings.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Beyond The Buzz - Navigating The Strengths And Challenges Of The Sustainable Finance Market

Sustainable bond issuance topped the $1 trillion mark last year, up from $600 million in 2020. In the latest episode of Beyond the Buzz, Corinne Bendersky is joined by S&P analysts Lori Shapiro and Ana Maria Romero Ramirez delve into this fast-growing market. They discuss questions around the various sustainable finance instruments that have emerged in the market, including how green, social, and sustainable they really are. Do they really do what’s said on the tin? And how will this exciting market grow this year and beyond?

—Listen and subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

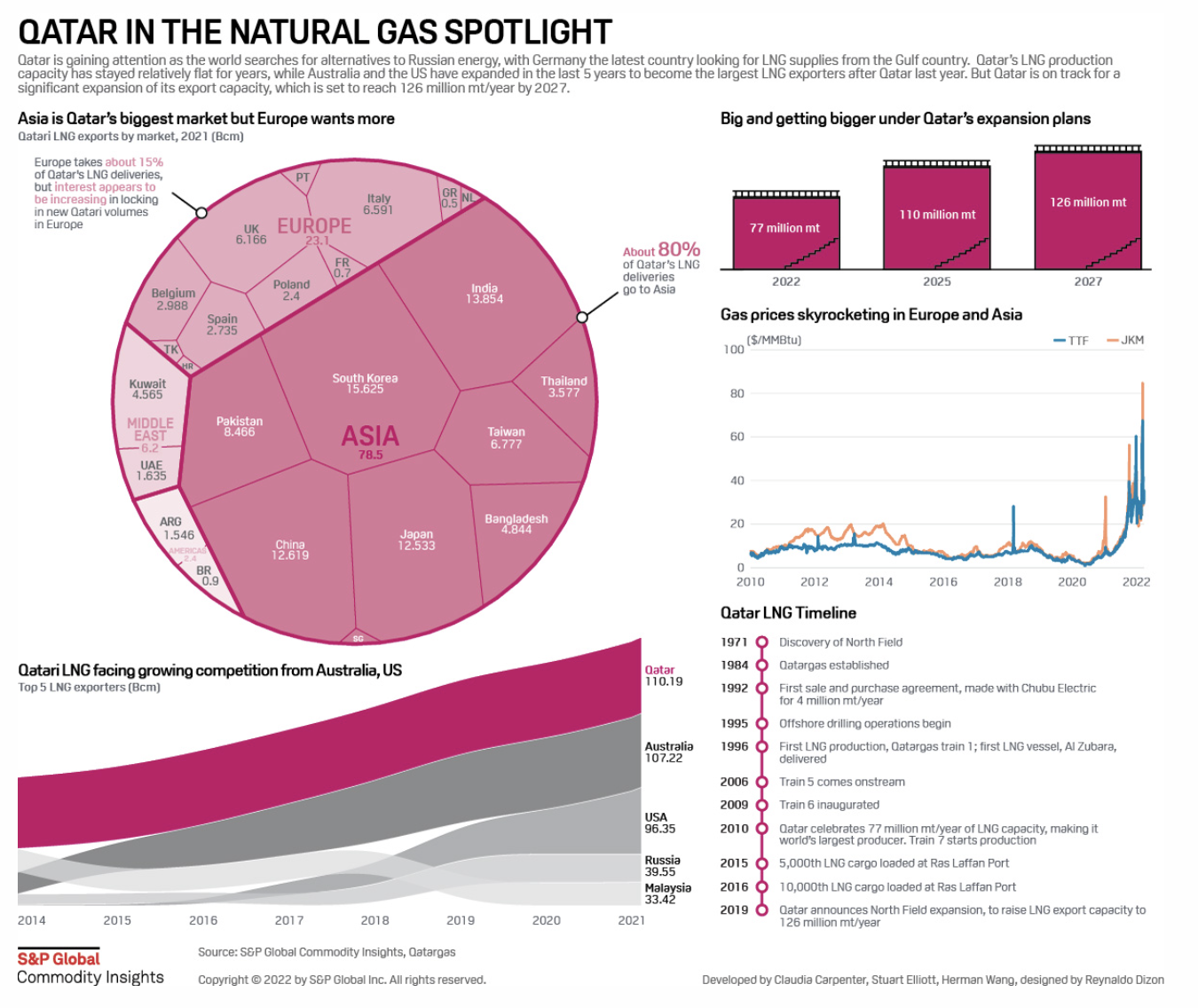

Feature: Qatar Leverages Its LNG Goals With Gas Diplomacy Amid War

With the West's relations with OPEC stalwarts Saudi Arabia and the UAE on rocky ground, neighboring gas giant Qatar's warming ties with the U.S. and Europe are a sign of shifting energy alliances. Even before the Ukraine war had Europe scrambling for alternatives for Russia's oil and natural gas, Qatar's ambitions to grow its LNG business were coinciding with burgeoning energy demand by western countries amid the recovery from the pandemic. In January, Qatar's emir secured the first head-of-state visit to the White House in 2022. President Joe Biden designated the nation a "major non-NATO ally" and the U.S. and Qatari energy ministers discussed enhancing energy relations at the CERAWeek by S&P Global conference in early March.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

How Autonomous Trucks Will Transform Landscape Of Logistics IndustryListen: Next In Tech | Episode 60: Data And Its Distribution

Does more data give you better decisions? That’s open for debate, but the quality of the data you use can have an impact on getting to decisions faster. Justine Iverson, head of S&P’s Global Marketplace explores the different aspects of working with data sets with host Eric Hanselman. Tools with higher levels of abstraction can put data-driven decision-making in the hands of more people and power a digitized business. Will the fridge of the future be adorned with data plots from school? Maybe.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence