Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 12 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Consumer Dilemma

The US economy’s future provides plenty to puzzle over. On the one hand, persistently high inflation has led the Federal Reserve to raise interest rates to levels not seen since before the 2008 financial crisis. On the other, key indicators such as unemployment and wage growth look strong, lifting hopes for a soft landing and gradual easing of financing conditions.

This dilemma is reflected across the consumer sector, where high costs and inflation mingle with optimism, buoyed by a continued appetite for spending.

For example, competition among US credit card lenders continues to be fierce despite a growing proportion of delinquencies. The ratio of overdue balances to total credit reached 3.33% at the end of 2023, according to S&P Global Market Intelligence. This reversed a decline as consumers paid down debt following the COVID-19 pandemic. Net charge-offs, which reflect likely losses, also jumped to 3.58% at the end of last year.

Still, credit card issuers predict continued loan growth and a battle for market share. Robust economic data, particularly from the labor market, strengthens that view.

"The landscape has always been competitive," Citigroup CFO Mark Mason said Feb. 20. "Whenever you have a business that's got good growth trajectory and good returns, it's going to be followed with competition."

Auto loan delinquencies have similarly climbed, reaching 3.32% at the end of 2023, the highest level for at least 10 years, according to S&P Global Market Intelligence. The figure comes amid an unusual year-over-year decline in the volume of auto loans outstanding.

However, as with credit cards, analysts say delinquencies should be considered alongside more encouraging factors such as employment and wage growth. The situation also reflects the aftermath of the pandemic, during which consumers faced higher prices for new and used vehicles, combined with lower interest rates and economic support. The sector is “marching to the beat of a different drummer relative to the rest of the consumer loan portfolio,” said Neale Mahoney, a professor of economics at Stanford University.

Regarding technology, US consumers are taking longer to replace gadgets such as smartphones, laptops, tablets, wearables and streaming devices, partly due to inflation. In a survey by S&P Global Market Intelligence 451 Research, the proportion of respondents who said they replaced all these products every five years or more increased significantly year over year in the fourth quarter of 2023. Meanwhile, higher costs have left manufacturers reluctant to cut prices, S&P Global Market Intelligence Kagan analyst Neil Barbour said, citing the Xbox Series X and PlayStation 5 video game consoles as examples of this trend.

Inflation is also driving up the cost of auto insurance, which saw its steepest year-over-year increase in 50 years in February, according to the US Bureau of Labor Statistics. In 2023, the 10 largest private auto underwriters increased their premium rates by 24% or more, S&P Global Market Intelligence reported. Insurance companies and trade associations point out that the cost of repairing and replacing cars has gone up. Nonetheless, the cost increases have some consumer advocates worried about drivers reducing their coverage or even going uninsured.

If this all sounds very mixed, then a final note of optimism can be found in the scale of private equity and venture capital-backed investment in the consumer sector globally. Between Jan. 1 and March 12, the announced value of deals in consumer staples and consumer discretionary businesses reached $11.96 billion, according to S&P Global Market Intelligence. These levels are significantly higher than those of the corresponding period in 2023, apparently reversing a post-pandemic decline in which private equity investment in the consumer sector fell for two consecutive years in 2022 and 2023.

While the change reflects renewed confidence in the consumer sector, particularly service-based businesses, investors such as Hamilton Lane emphasize the need for tough due diligence to ensure target companies are well-positioned for a slowdown.

Today is Friday, April 12, 2024, and here is today’s essential intelligence.

- Written by Mark Pengelly.

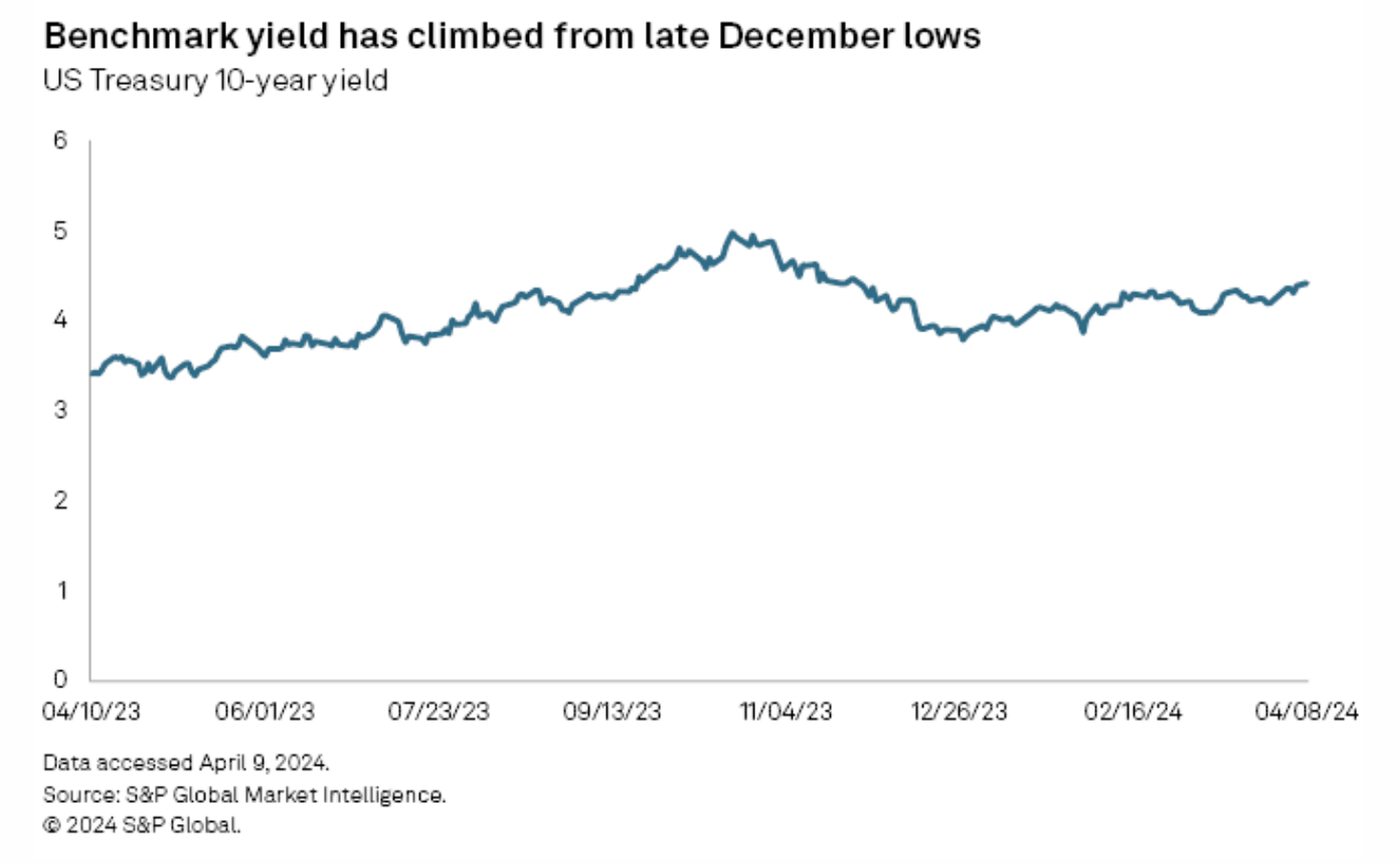

Strategists Brace For Spike In US Bond Yields As Economy Fails To Cool

US government bond yields may soon climb toward their recent peak as inflation remains stubbornly above the US Federal Reserve's target, the labor market shows little sign of cracking and expectations for cuts to benchmark interest rates are diminishing. The benchmark US Treasury 10-year yield approached 4.5% early April 10 following the release of hotter-than-expected consumer price index data, extending a climb up from a recent trough near 2023-end. The yield, which moves opposite prices, peaked most recently at 4.98% on Oct. 19, 2023, its highest level since 2007. It fell to 3.79% on Dec. 27, 2023, as expectations for interest rate cuts in 2024 ramped up amid falling inflation data and forecasts for a slowing labor market and wage growth.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

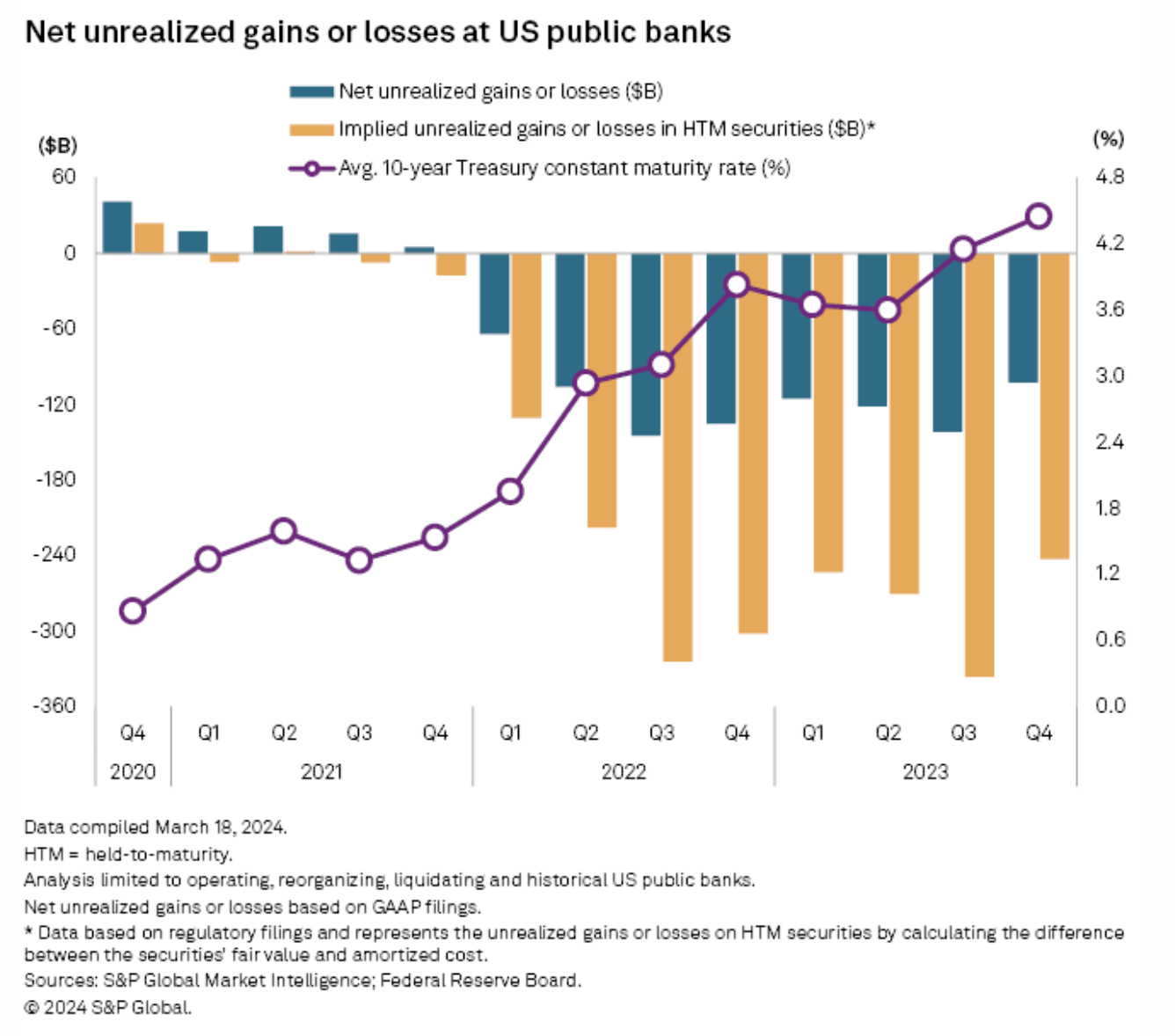

Banks Contemplating Further Bond Portfolio Restructuring With Rates In Flux

After a flurry of restructuring activity in the fourth quarter of 2023, fewer loss trades in bank bond portfolios have emerged in recent months amid increases in intermediate and long-term rates. While those moves could be temporary, with the Federal Reserve expected to cut rates in the second half of 2024, the increase in rates has pushed bank bond portfolios further underwater and made loss trades slightly more punitive in the near term.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

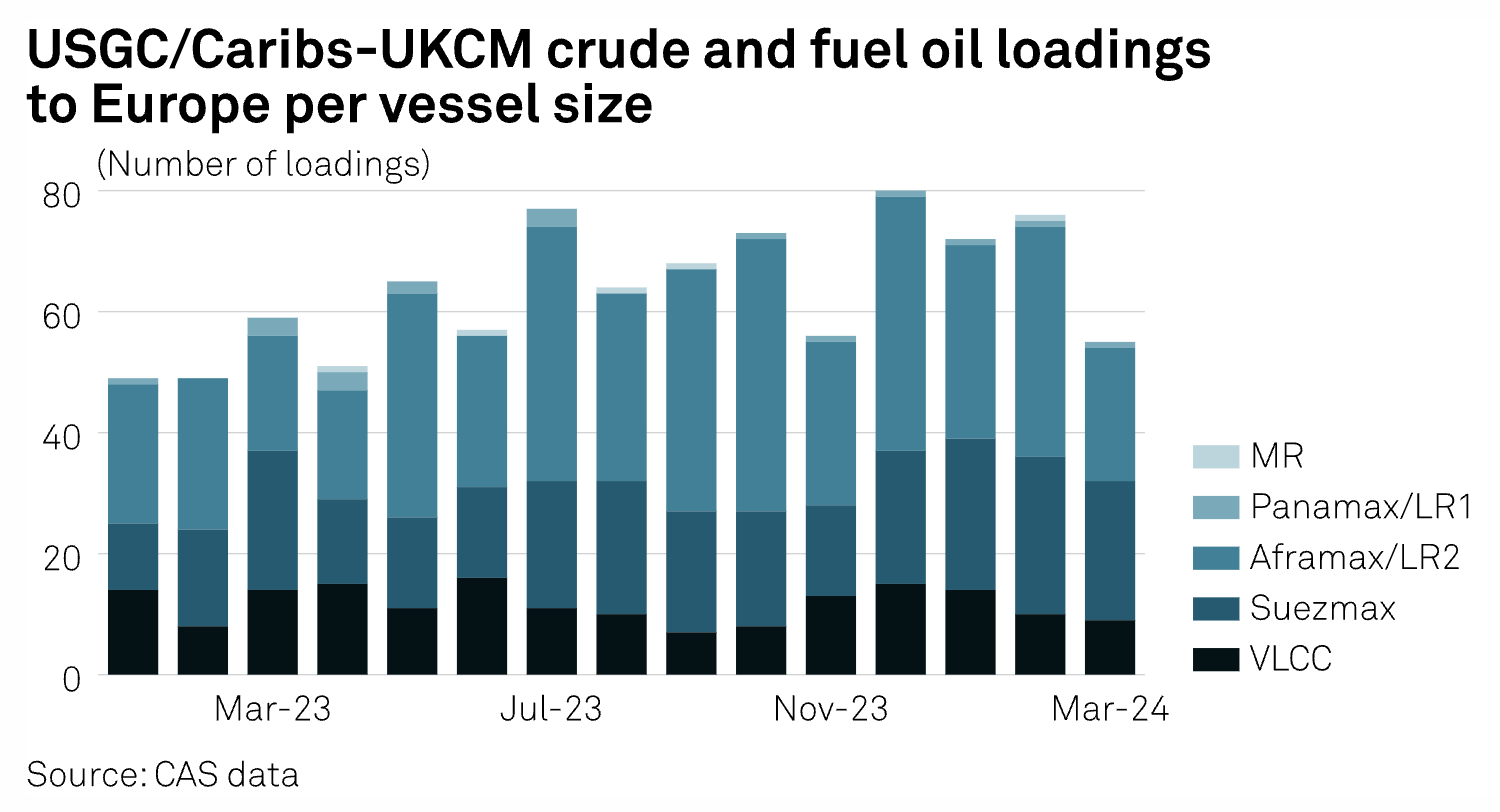

Americas Midsize Crude Tanker Intertrade To Drive Freight As TMX Expected Online At End-Q2

Freight for ships carrying crude in the Americas is expected to remain wrapped up in intertrade dynamics between the midsize tankers, facing uncertainty as US exports remain strong and as the market eyes developing trade flows out of the region heading into the second quarter of 2024. Rates for midsize tankers are expected to remain dependent on their counterparts, with Suezmaxes frequently being taken on European export runs over the smaller Aframaxes.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

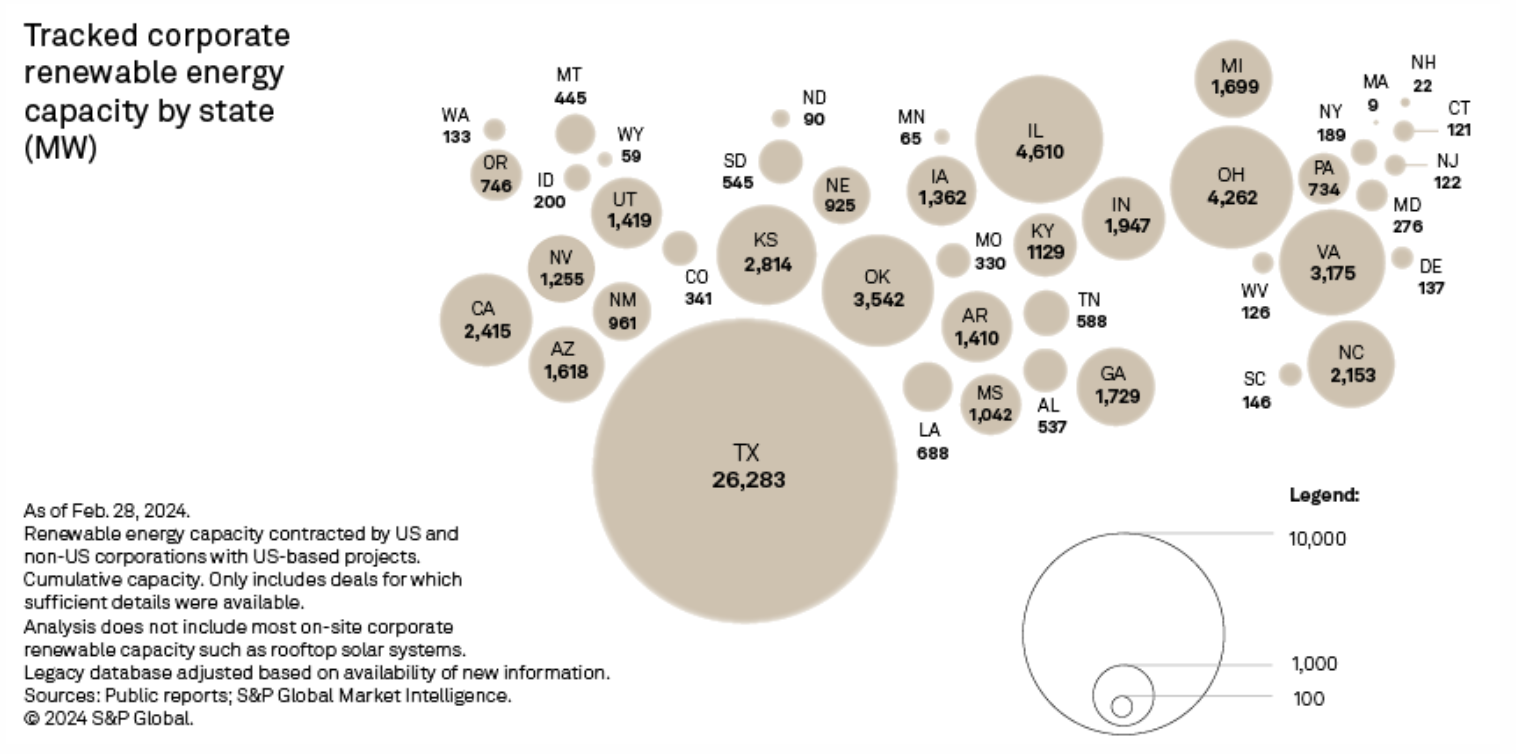

Visualizing Global Corporate Renewable Capacity By US Corporations

US corporations remained active in the corporate procurement arena, adding 17 GW of carbon-free generation since March 2023. This enabled pushing cumulative capacity above 93 GW, including deals signed as far back as 2008, three-quarters of which have been contracted domestically. This represents a slight decline from 2023 levels (~78%) however as more companies expand their geographic footprint.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: What Can WPC Tell Us About Q1?

Rob Westervelt, editor-in-chief of Chemical Week, and Antionette Smith, senior editor/chemicals at S&P Global Commodity Insights, join podcast host Vincent Valk to discuss key takeaways from this year's World Petrochemical Conference and read some tea leaves on what to look out for in first- quarter earnings.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

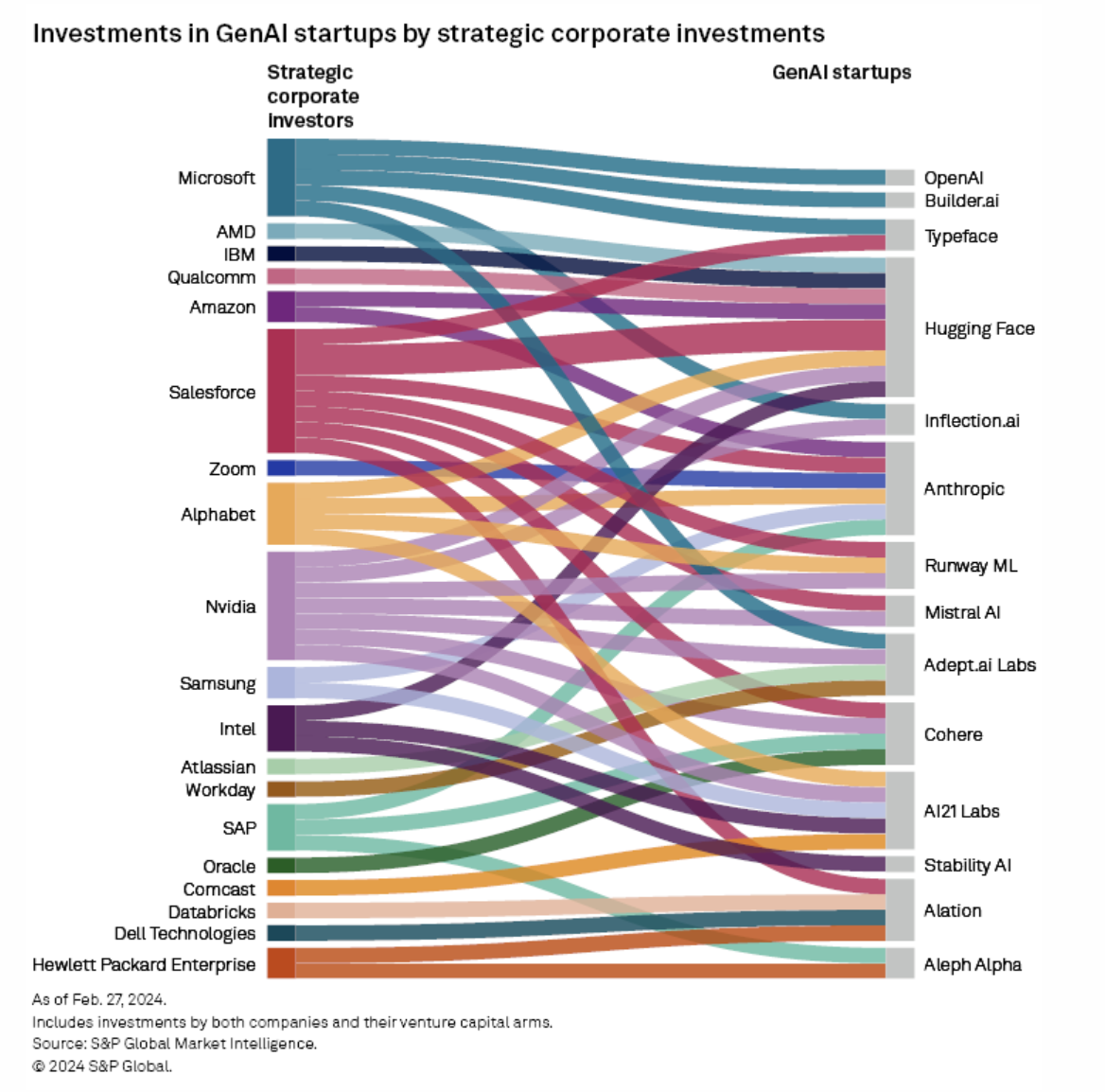

Are Generative AI Foundation Models Also Model Businesses?

The stars of the generative artificial intelligence world so far, we would argue, are the foundation model providers. They are the ones that first wowed us with what GenAI could do, got the attention of the media and politicians alike, and then — in the case of OpenAI — descended into corporate chaos worthy of its own docudrama, which we assume is already in production. While the revenue generated by many of these foundation model companies in less than two years has been incredible, it is prudent to ask whether they will be the ultimate winners in this space, or just a passing fad on the way to eventual dominance by hyperscale cloud vendors and chipmakers.

—Read the article from S&P Global Market Intelligence