Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Apr, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Cleaning Up In The Cloud

In the fast-paced technology world, companies are accelerating efforts to move to the cloud—but the frenzy to expand cloud computing capabilities is also ramping up concerns about its carbon emissions.

As usage of the cloud’s on-demand software and databases expand, investment in cloud infrastructure is accelerating to keep pace with demand. With increased energy usage comes increased environmental concern, especially as enterprises already face pressure from investors and regulators to align with sustainability standards and act on their net-zero commitments. But cloud migrations may prove to bring more carbon reduction opportunities, rather than challenges, to the market.

“We are entering an era in which cloud computing is no longer a separate IT category—it is IT,” 451 Research, part of S&P Global Market Intelligence, said in recent research. “As a result, there is a lot of interest in, on the one hand, just how much energy hyperscalers [like data centers, servers, storage, and data transit] consume, and, on the other hand, the carbon reduction potential of the cloud … Overall, 451 Research data finds that if they move their IT to the cloud, enterprises can save up to 85% of energy usage, resulting in a smaller carbon footprint. In some cases, even more of a reduction can be seen if the cloud facilities deploy completely renewable carbon-free energy. Here, organizations can improve just by moving to the cloud.”

Cloud datacenters, despite consuming significant amounts of energy, are more efficient than typical enterprise environments and can continually improve as power reduction in more recent generations of server technology, datacenter efficiency adaptations, and better access to green energy grids develop, according to 451 Research, part of S&P Global Market Intelligence. Enterprises can save up to 60% of their energy usage just by switching their servers to the cloud, and moving to the cloud provider's data center can deliver an additional 10%-15% increase in energy efficiency.

“Energy conservation (saving) relies on better efficiencies, so the most effective strategies will focus on squeezing out as much of these efficiencies as possible, getting the energy requirement as low as possible and then looking at how to decarbonize that,” 451 Research, part of S&P Global Market Intelligence, said in the April 5 report. “Simply moving to using green energy is not going to deliver the desired—or the best—carbon reduction. The best place to go from a carbon reduction perspective is the cloud.”

The cloud’s carbon reduction potential may be important for the market as it continues its expansion—extending into sectors like gaming, confronting regulatory scrutiny over anti-trust concerns, and dealing with geopolitical shocks and corresponding risks of cyberattacks.

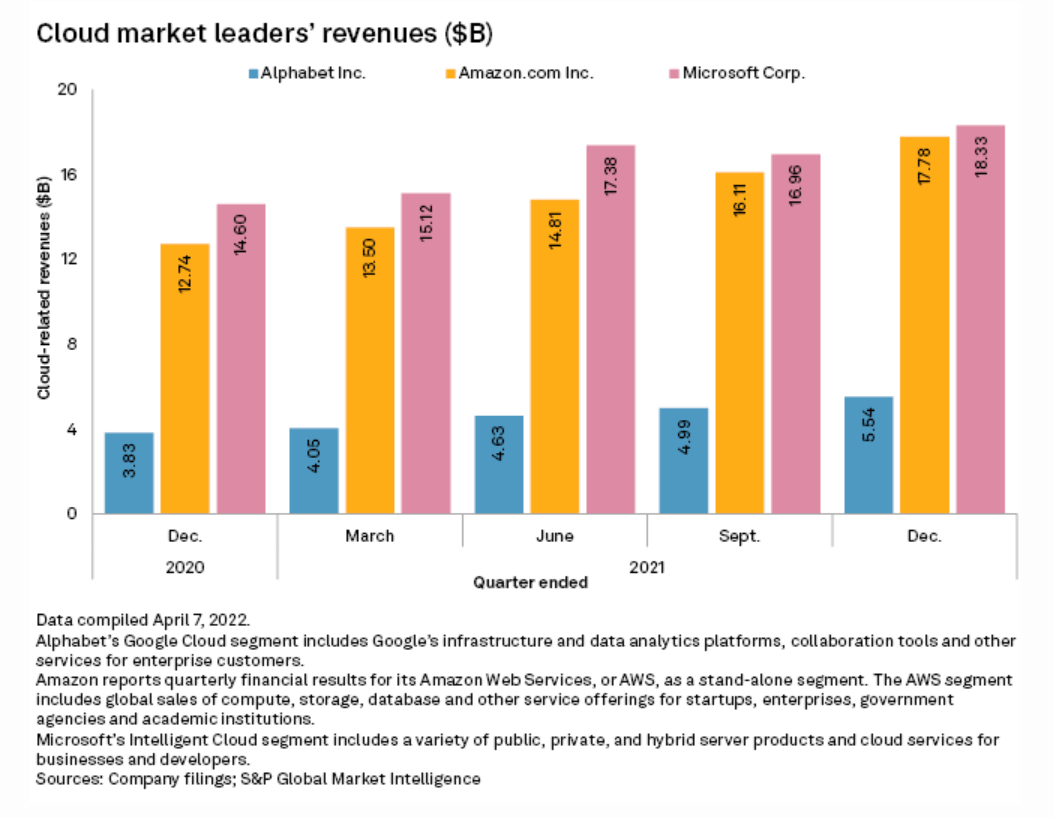

As the three largest cloud providers, Amazon, Microsoft, and Alphabet have enjoyed significant growth, according to S&P Global Market Intelligence. Amazon Web Services’ revenue grew 39.5% year-over-year in 2021, to $17.78 billion. Microsoft’s intelligent cloud segment grew 25.5%, to $18.33 billion, with cloud services alone experiencing revenue growth of 46%. Alphabet's Google Cloud saw revenue increase by 44.6%, to $5.54 billion, by the fourth quarter of 2021. Notably, enterprises are taking a multicloud approach, as three out of four enterprises are now using more than one cloud provider, according to 451 Research, part of S&P Global Market Intelligence.

"When it comes to the cloud, it can be easier in some cases to have interoperability across different platforms and solutions, so the concept of multicloud is getting very prevalent," Scott Kessler, global sector lead for technology, media, and telecom at the research firm Third Bridge, told S&P Global Market Intelligence, adding that "big tech companies have targets on them, and they are being put in positions where they need to not just provide great products and services, but also try to do so in a way that is perceived positively by everyone, from customers to other constituencies, including regulators and legislators.”

Today is Monday, April 11, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

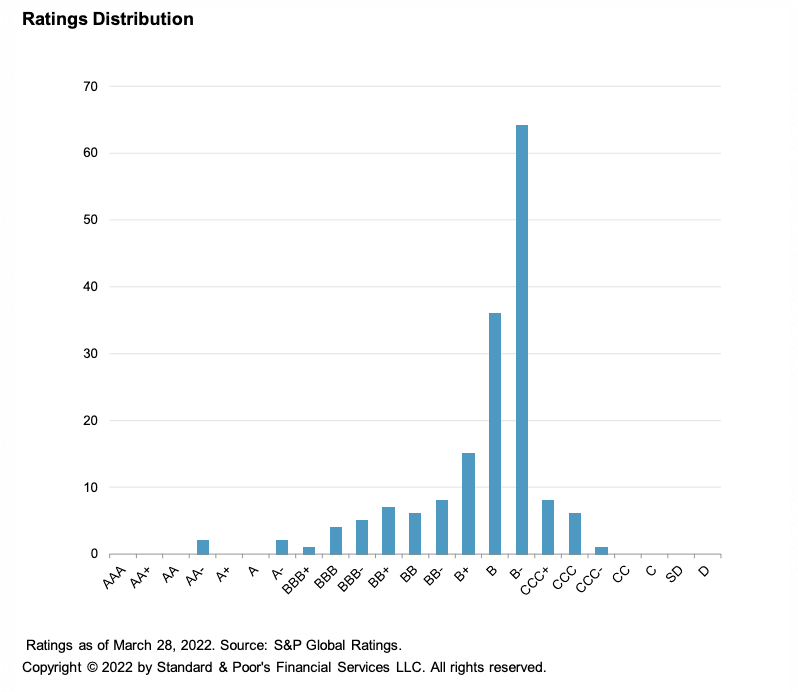

Lower Economic Activity Will Test Several U.S. Business And Technology Services Companies In 2022

Despite limited direct revenue exposure to Ukraine and Russia, ensuing inflationary challenges, rising wages for labor-intensive operations, high gas prices for distributors, and cyber risk for some information, payment, and technology service providers will remain key risks in 2022 and may slow the pace of deleveraging assumed in ratings from S&P Global Ratings. In response to market developments related to the Russia-Ukraine conflict, S&P Global Ratings recently revised its global GDP growth to 3.5% this year, a decline by 70 basis points from its previous baseline, as Europe's growth is hit hardest by the conflict.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

When Rates Rise: Saudi Banks’ Profits Follow

S&P Global Ratings expects banks in Saudi Arabia to benefit from the expected increases in interest rates by the U.S. Federal Reserve, which the Saudi central bank typically mirrors because of the Saudi riyal peg to the U.S. dollar. S&P Global Ratings economists expect the Fed to raise rates six times this year (including one that already took place in March), and five more times in total in 2023 and 2024—a steeper increase than base case assumptions of many Saudi banks. These changes will be earnings-accretive for Saudi banks because of the structure of their balance sheets. However, this is predicated on the assumption that the shift in the yield curve is parallel and that banks' balance sheets remain static.

—Read the full report from S&P Global Ratings

Access more insights on capital markets >

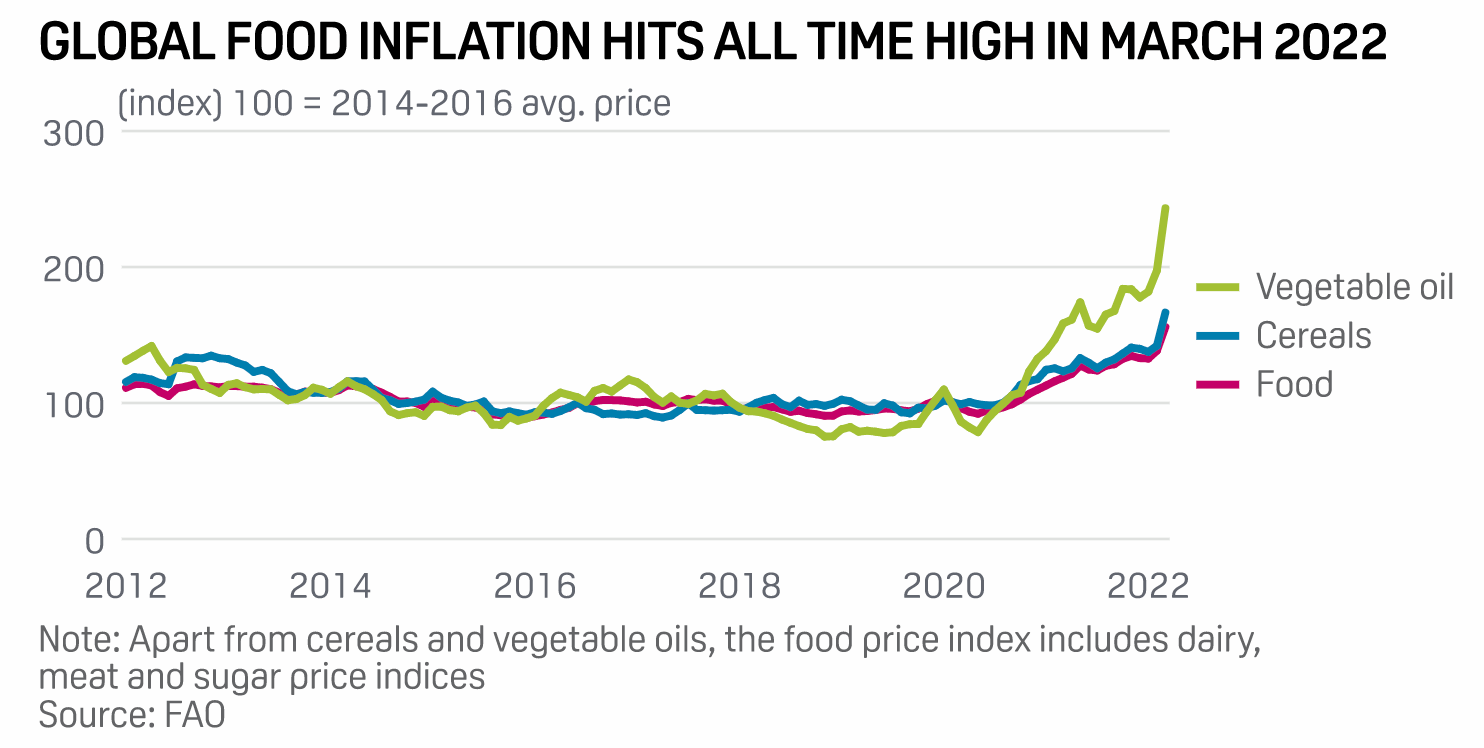

Russia-Ukraine War-Led Supply Disruptions Propel Food Prices To Record Highs: FAO

Tightening supplies and trade disruptions fueled by the Russia-Ukraine war lifted global food prices to a record high in March, the UN's Food and Agriculture Organization said in report April 8. The FAO Food Price Index averaged 159.3 points in March, up 34% from year-ago levels to reach the highest level since its inception in 1990, the FAO report showed. Multiple sub-indexes, such as vegetable oils, cereals, and meat also surged to records. In another report released recently, the FAO warned that the global demand-supply gap caused by the ongoing Russia-Ukraine war, which started Feb. 24, can further push up international food and feed prices by 8%-22% from already-elevated levels.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How The Largest U.S. Pension Fund Uses Its Financial Power To Influence Corporate ESG Performance

In 2022, the ESG Insider podcast is bringing you a series of interviews with some of the world’s largest asset managers, owners, and financial institutions. In this episode, hosts Lindsey Hall and Esther Whieldon hear from the largest pension fund in the U.S.—the California Public Employees' Retirement System, or CalPERS. We speak to Simiso Nzima, managing investment director of global equity at CalPERS. The conversation focused on five vital sustainability topics—executive pay and its link to ESG performance; board diversity; climate risk; the lack of standardization in ESG metrics; the SEC’s new proposal on climate-related disclosures; and finally, the debate about divestment versus engagement.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

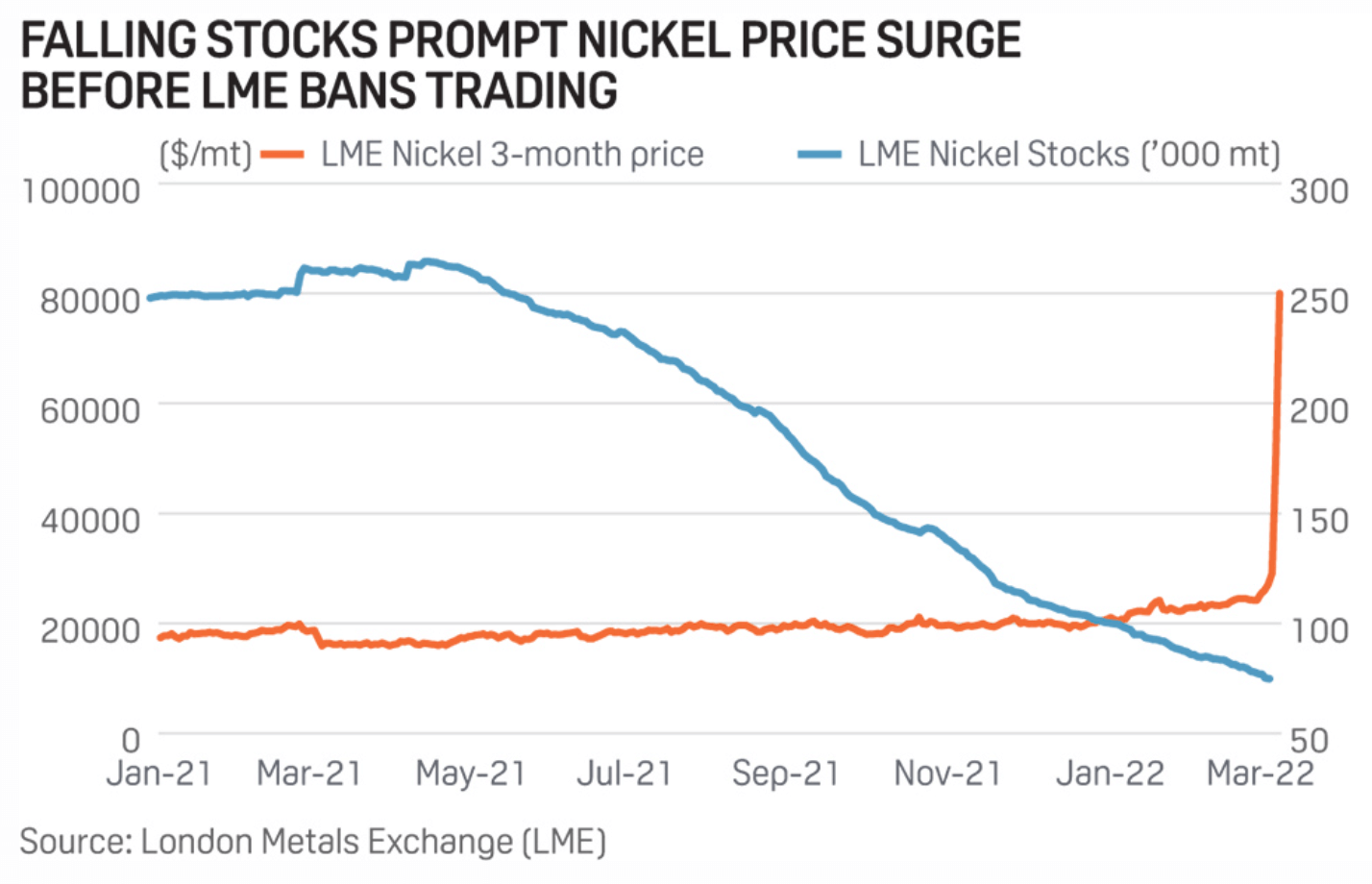

Metals Exchanges Temper Volatility With Visibility: More Reforms To Come?

The commodities price "supervolatility" sparked by the Russia-Ukraine war may be prolonged—reminiscent of that seen during the oil price shock, China's awakening as a consumer nation, and the global financial crisis. Metals may bear the brunt. Slow recovery from the GFC, and COVID-19, eroded investment in new mine production, trimming supplies even while population pressure and the decarbonization drive boost demand. The low-carbon world is high-metal. Prices have jumped: aluminum and zinc are up 21% year to date, copper 7%, and nickel 57%, while lithium prices have more than doubled amid tight supplies.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Microsoft's Burgeoning Cloud Business Draws EU Scrutiny

Microsoft Corp. is gaining ground on Amazon.com Inc. in the cloud-computing market, and the software company's rapid ascent has drawn the attention of European regulators. The European Commission is circulating a questionnaire to Microsoft customers and rivals to gauge whether the company may be using its dominant position in the market to stifle competition with its cloud business and licensing deals. Analysts say while Microsoft has grown its business by leaps and bounds in Europe, growth in multicloud strategies leaves plenty of room for competitors big and small.

—Read the full article from S&P Global Market Intelligence