Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 10 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Benchmarking Large Language Models for Business and Finance

While many industries appear content to ride the generative AI hype cycle, financial professionals require an objective evaluation of the AI tools available today. Hype is insufficient; the hallucinations occasionally derived from large language models (LLMs) can prove costly when integrated into financial modeling. S&P Global developed a methodology and a benchmark for evaluating the ability of LLMs to understand and leverage text for finance and business. This benchmark required the financial expertise of S&P Global and the research and engineering expertise of Kensho, an AI company acquired by S&P Global in 2018.

The new benchmark evaluates LLMs based on their performance on 600 questions that would be useful for financial industry participants. These questions break down into the categories of quantitative reasoning, quantity extraction and domain knowledge and address some of the perceived weaknesses of many LLMs. While many of today’s LLMs excel at answering questions or generating code, they can struggle to reason with quantities, particularly where numerous calculations must be performed.

Companies such as Kensho have used AI for sentiment analysis and entity identification (for example, when a company goes by multiple names). But the new LLM benchmark is aligned with broader practical use cases for the financial market. Each LLM was asked to accurately perform complex calculations based on numbers from lengthy documents. They were given financial reports and asked to extract pertinent numerical information for a model and to demonstrate fundamental financial knowledge.

“In order to answer a complex program synthesis question, the model must be able to understand and extract relevant values within a question or context,” Kensho researchers wrote in a recent research paper describing the benchmarks. “It must also have some knowledge of the necessary formulas and other information required to then compute the answer.”

The beta version of the benchmark was launched earlier in April with an invitation for other LLM providers to submit their AI tools for evaluation. The advantage for LLM providers is that they do not have to share any part of their proprietary models; they are evaluated solely on output.

Today is Wednesday, April 10, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

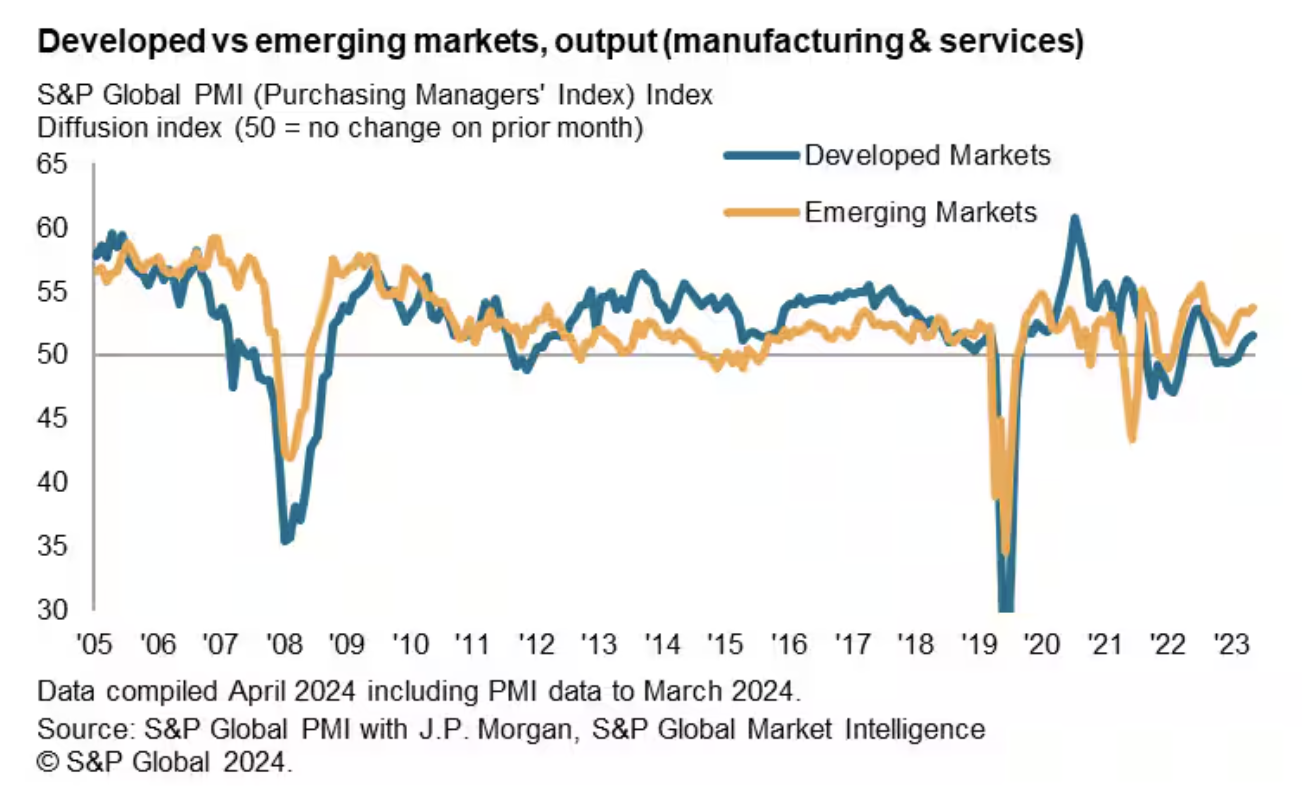

Emerging Markets Activity Expands At Fastest Pace In Ten Months

Emerging markets growth accelerated at the end of the first quarter of 2024, rising in March at the fastest pace since May of last year. Supporting the latest expansion were improvements across both the manufacturing and service sectors, with India continuing to lead growth in both sectors among the biggest emerging market economies.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

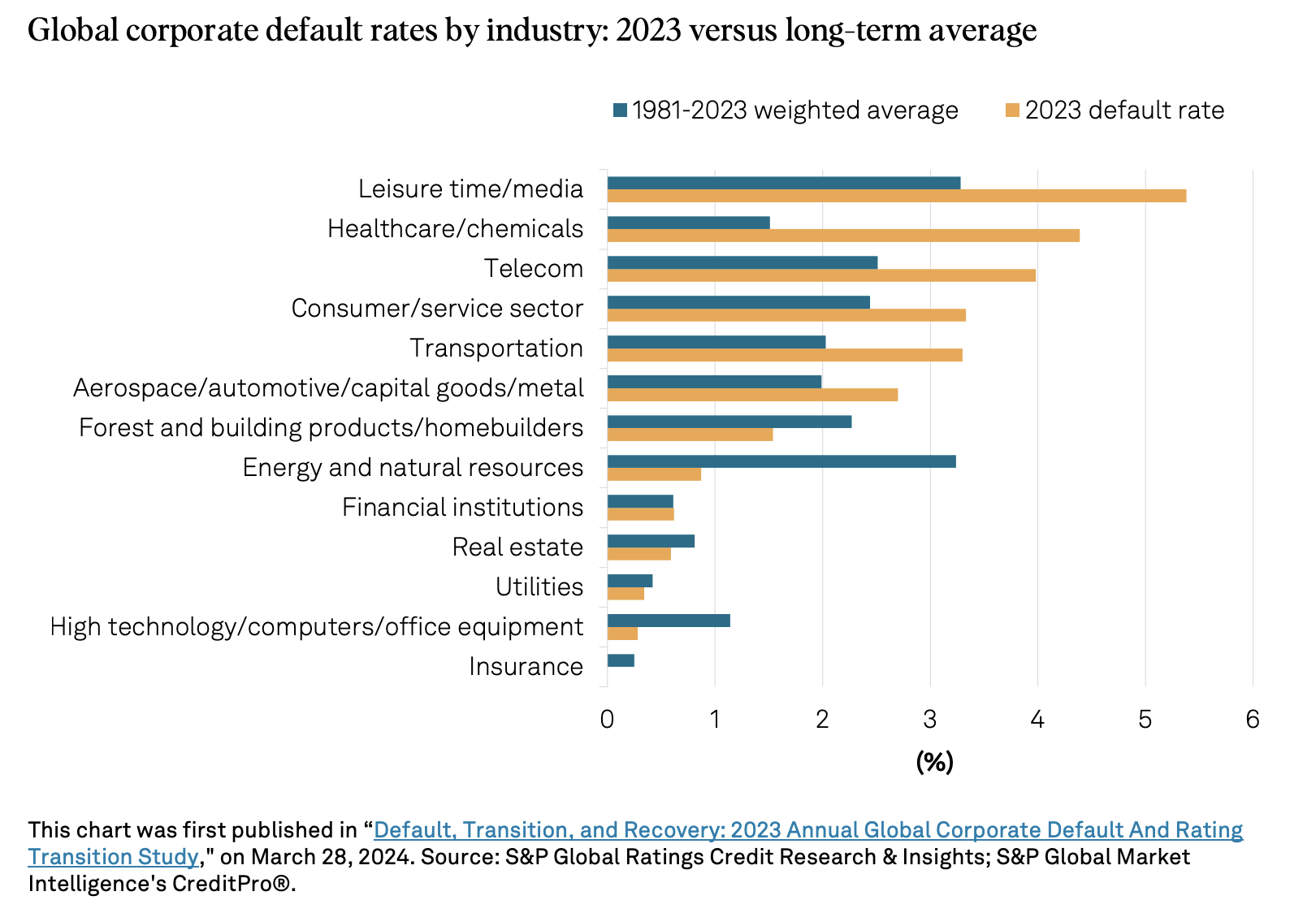

This Week In Credit: Trends Improving Despite Higher Defaults

Positive rating actions and outlook changes greatly outnumbered negative ones last week, in line with the improving trend S&P Global Ratings has noted since February. Six defaults last week represented the highest number so far this year. This extends the elevated defaults trend, but S&P Global Ratings expect it to stabilize toward year-end. The one new rising star last week was Italian capital goods company, Ali Holding S.R.L. Higher financing costs are among the persistent risks. Last week, speculative-grade bond spreads and CDS spreads for North American corporates widened.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

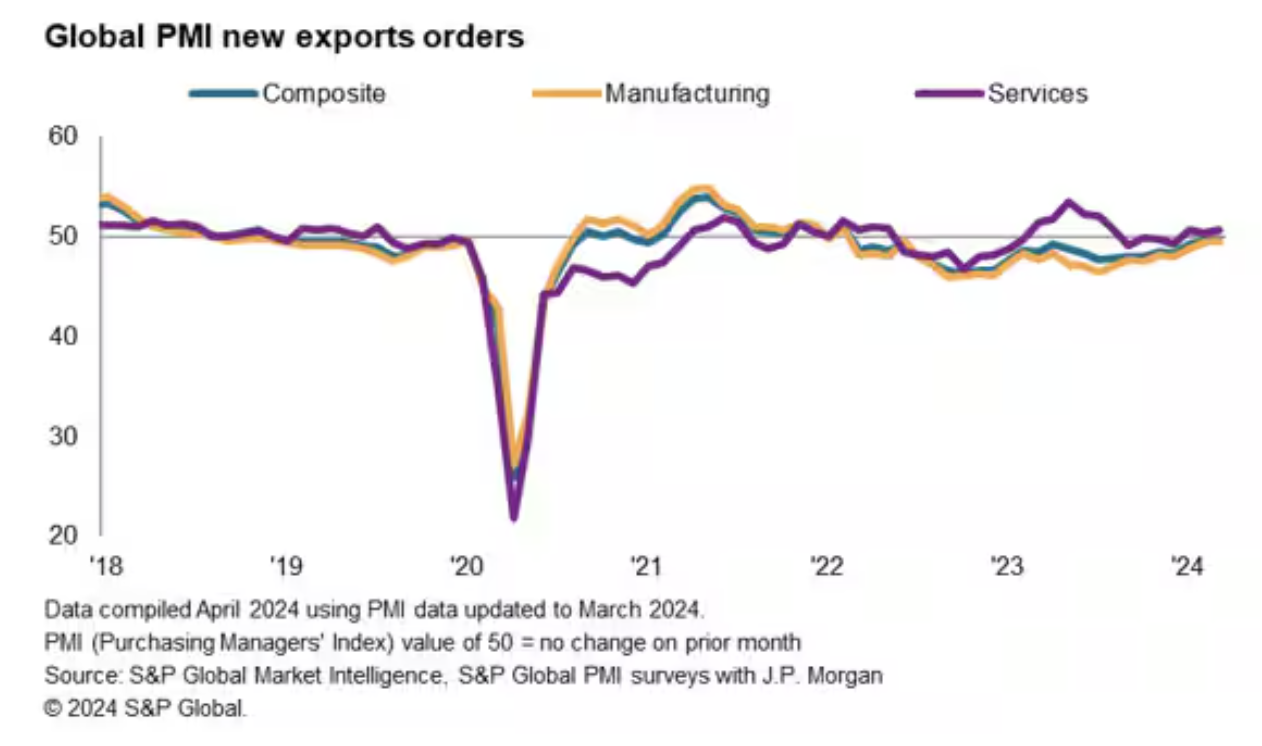

Global Trade Near-Stabilizes At The End Of First Quarter

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a near steadying of global trade in March. Although export orders for goods and services have now fallen continually for just over two years, the pace of decline eased further in March to the slowest in the current 25-month sequence to indicate a near-stabilization of conditions.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

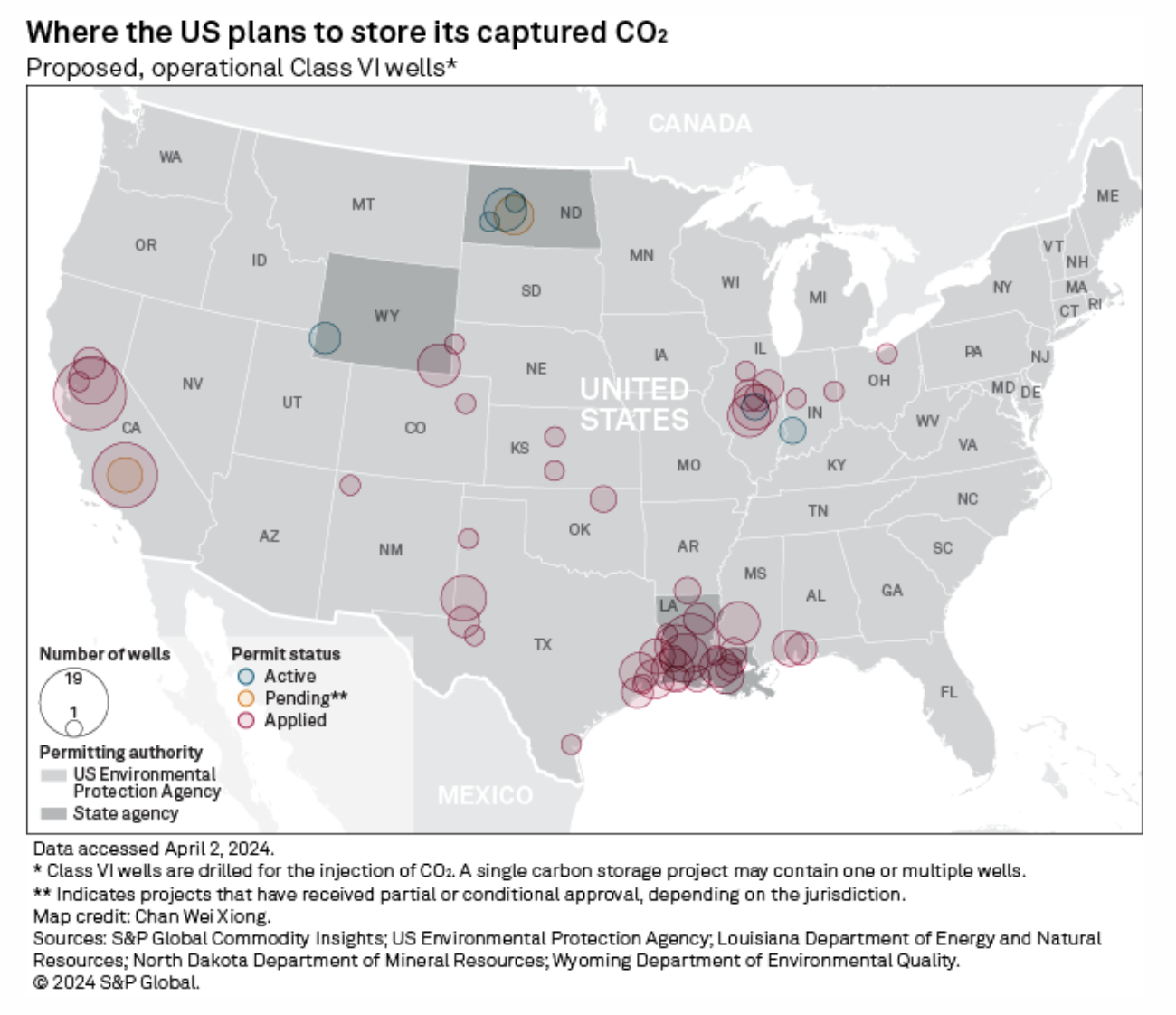

Biden's Carbon Capture Plans Inch Closer To Reality Amid Uptick In Well Permits

The Biden administration's ambition to capture carbon dioxide on a large scale and inject it back into the ground may have seemed daunting one year ago with only two CO2 storage facilities in the US. But a boost in federal spending on the technology in 2021 and 2022 may finally be bearing fruit after a sudden uptick in permits, according to industry watchers. The US government is trying to encourage emitters to reduce their carbon footprint with tax credits worth up to $85 per metric ton of CO2 captured. For the full value of the credit, the CO2 must be pressurized into a supercritical state and injected into what is known as a Class VI well, drilled about 1 mile into the earth beneath a layer of impermeable rock.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

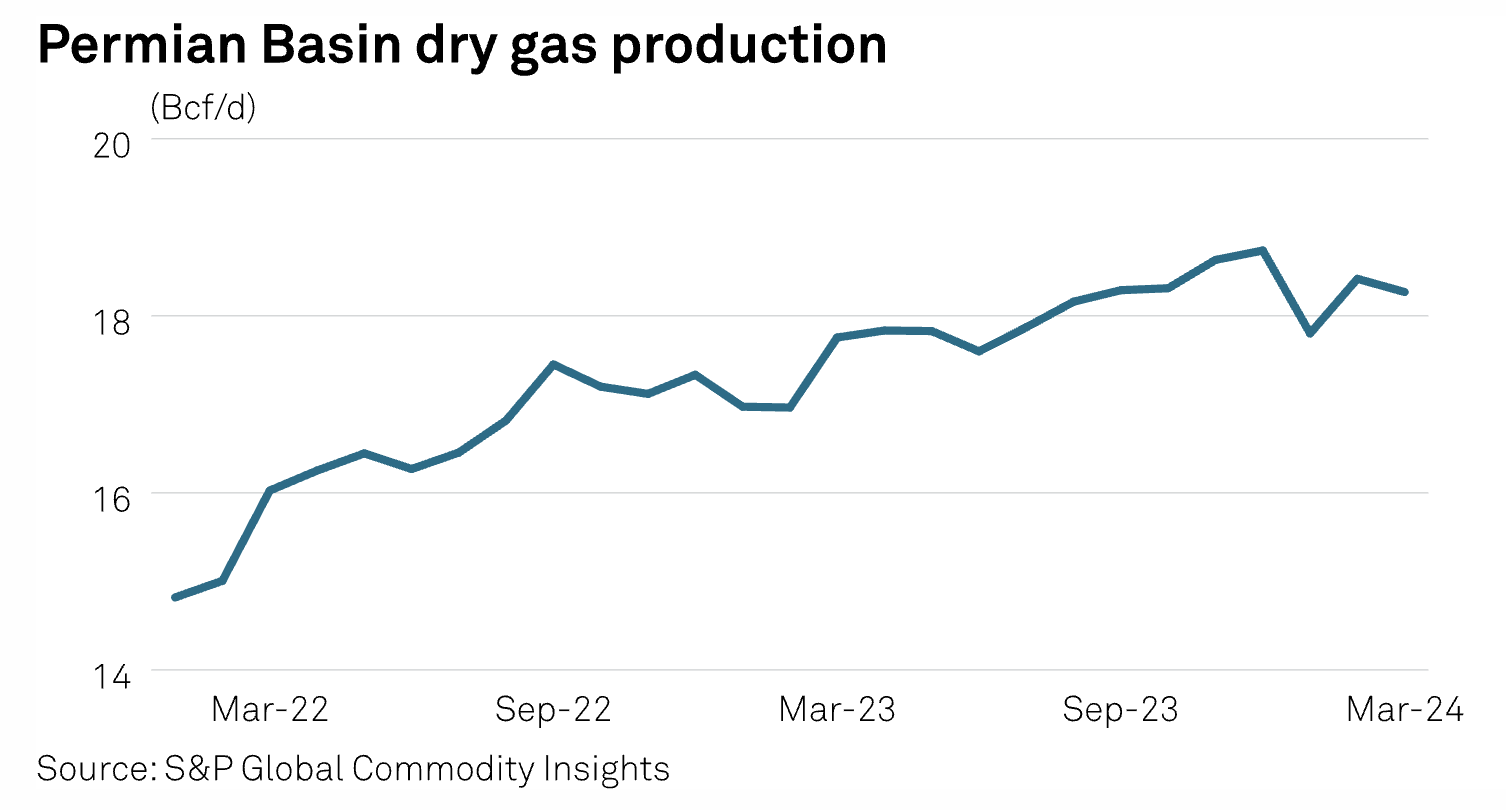

690-Mile Greenfield Permian-To-Louisiana Natural Gas Pipeline Targets 2028 Start

The developer of a 2 Bcf/d interstate pipeline project to transport "liquids-rich" Permian natural gas to the Louisiana Gulf Coast has requested to initiate the prefiling review process with the US Federal Energy Regulatory Commission and is targeting a 2028 in-service date. DeLa Express is an affiliate of private energy infrastructure firm Moss Lake Partners. The 42-inch, 690-mile pipeline would begin in the Delaware Basin at Loving County, Texas, and supply "markets on the US Gulf Coast from Port Arthur, Texas, to Cameron Parish, Louisiana, including growing demand from liquified natural gas export facilities as well as Moss Lake's affiliated natural gas liquids export project, Hackberry NGL," it said April 2 in the prefiling request (PF24-4).

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Next in Tech | Episode 161: Payment Technology In Automotive

The integration of payment technologies in the automotive realm offers interesting potential, but it has to be done with care to ensure customer experience meets expectations. FinTech’s move into the EV software ecosystem is a first step and analysts Beatriz Minamy and Sophia Furber join host Eric Hanselman to explore automotive as the latest software platform to embed payments, what’s needed, concerns about fraud and how the market is evolving. It can be more than charging, if it’s done well.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence