Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Apr, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Increasing Inflationary Pressures Intensify Risks For Emerging Markets

How will emerging market economies endure the energy, trade, and price pressures of the Russia-Ukraine conflict?

As some of the last economies to begin recovering from the downturn caused by COVID, emerging markets (EMs) now face macroeconomic and credit conditions dominated by the Russia-Ukraine conflict and inflation risks, according to S&P Global Ratings’ latest outlooks. Consumer price inflation in the median EM is likely to be 1.2 percentage points higher in 2022, compared with the previous inflation forecast from November. And such rising inflationary pressures and financing costs may impede fiscal consolidation, strain governments' credit quality, and erode credit fundamentals.

S&P Global Economics lowered its real GDP growth forecast for EMs overall to 4% for this year and 4.3% in 2023, from 4.8% and 4.4% in the previous forecast, respectively. The outlook for EMs in Europe, the Middle East, and Africa has worsened due to the Russia-Ukraine conflict’s intensifying of energy prices and weakening of trade, financing conditions, and investor and consumer confidence. The six largest Latin-American economies are set to see growth this year of 1.7%, marking a downward revision from S&P Global Ratings’ previous 2% forecast.

“The Russia-Ukraine conflict has exacerbated inflationary pressures by ratcheting up energy and food prices, which could prompt governments to extend or reimpose some of the temporary fiscal measures that were established during the pandemic, instead of originally phasing them out. This would weigh on growth and prolong fiscal rebalancing, which would hurt creditworthiness and ratings,” S&P Global Ratings Emerging Markets Regional Credit Conditions Chair Jose Perez-Gorozpe said in research published this week. “Inflation has a greater impact on households in EMs than on those in developed economies, because spending on food, gas, and transportation represents a larger portion of their disposable income. Rising energy costs, along with elevated food prices, raise concerns about potential social instability in several EMs, ultimately reducing policy predictability. So far, rated EM corporations have been absorbing higher costs, but stress could heighten if inflation lasts much longer. At the same time, higher interest rates could raise debt servicing costs.”

Downside risks for EMs are significant, according to S&P Global Ratings.

“Broadening inflationary pressure means we now expect tighter monetary policy across most EMs despite the conflict weighing on economic activity, especially with the U.S. Federal Reserve indicating a swifter policy tightening stance,” S&P Global Ratings Chief Emerging Markets Economist Satyam Panday said in research published this week. “A prolonged Russia-Ukraine conflict is a key downside risk for EMs. The concurrent risks of faster Fed tightening and negative investor sentiment due to the conflict may trigger financial market volatility, leading to weaker exchange rates and significantly higher yields.”

Today is Friday, April 1, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Listen: The Essential Podcast, Episode 56: The Myth Of Growth — A Machine For Manufacturing Courage – Venture Capital And The Power Law

Sebastian Mallaby, Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations and author of numerous books, joins the Essential Podcast to discuss his latest book—The Power Law: Venture Capital and the Making of the New Future. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets—macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more—in interviews with subject matter experts from around the world.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on the global economy >

Global Credit Conditions Q2 2022: Confluence Of Risks Halts Positive Credit Momentum

The first few months of 2022 mark a turn in positive credit momentum, with downgrades now outpacing upgrades, reversing a trend that started a year ago on the back of the solid economic rebound and remarkably favorable global financing conditions. Just as much of the world was hoping to move on from the pandemic, the Russia-Ukraine military conflict brings a new set of challenges and uncertainties. Soaring energy and food prices exacerbating already high inflationary pressures, supply chains facing new disruption risks, the lingering pandemic and mobility restrictions (particularly in China), and the prospects for sharply higher interest rates are all pushing lenders and investors to reassess their risk-reward appetites. Yields across many market segments have risen after more than a year of historically accommodative conditions.

—Read the full report from S&P Global Ratings

Access more insights on capital markets >

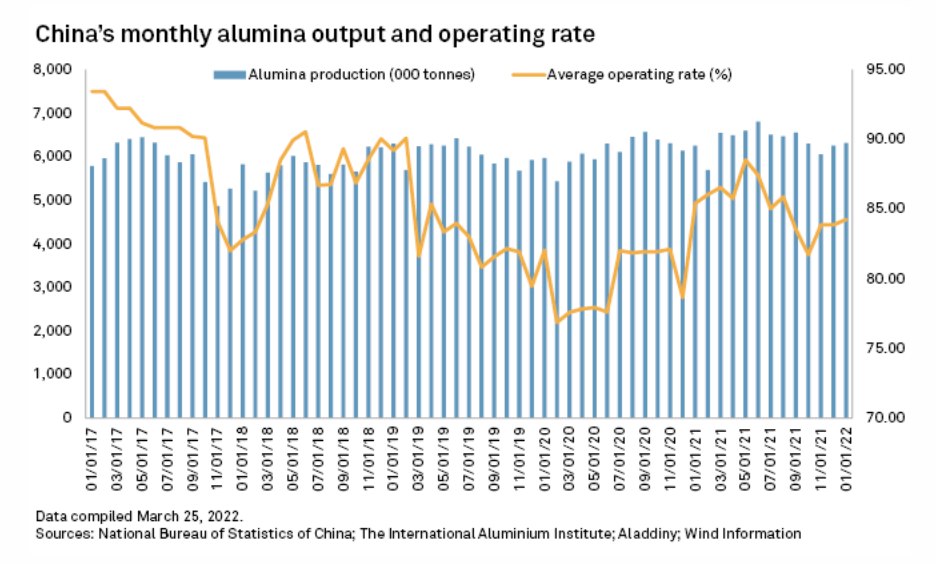

Australian Ban Of Alumina Exports To Russia To Leave Rusal Scrambling

Australia's March 20 ban on alumina exports to Russia will leave aluminum major UC Rusal IPJSC with a raw material deficit that even alumina giant China will not be able to offset, setting the stage for a worsening global aluminum shortage. Even Russia's allies, such as Kazakhstan, Guinea, and Jamaica, will need months to ramp up production to match the loss from Australia. While China is capable of producing additional alumina for export, it would be a short-term solution, as China uses much of its alumina domestically. That will leave Rusal and Russia struggling to maintain normal aluminum production levels.

—Read the full article from S&P Global Market Intelligence

Access more insights on global trade >

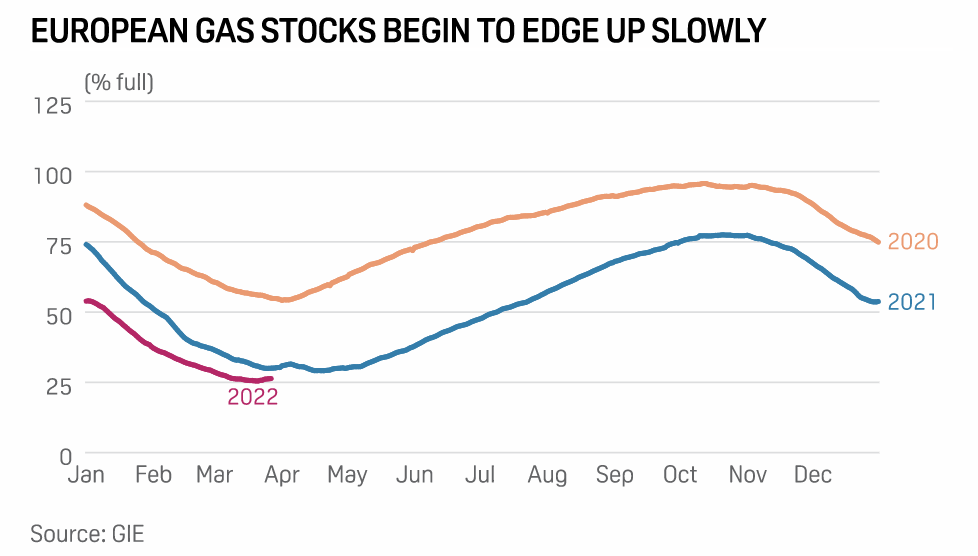

Geopolitical Risk Dominates Outlook For Europe's Energy, Carbon Markets In Q2

Already dazed from months of extreme volatility, Europe's energy markets enter the second quarter of 2022 with no sign of a let-up in the daily turmoil brought on by the conflict in Ukraine. The gas market—already bowing under the weight of record high prices—is set for further unprecedented change as the EU looks to slash demand for Russian gas and new storage obligations shift trading dynamics. The TTF day-ahead price hit a new all-time high of Eur212/MWh ($233/MWh) on March 7, according to S&P Global Commodity Insights assessments, a 1,190% increase year on year as the fall-out from Russia's invasion of Ukraine on Feb. 24 continued to roil markets.

—Read the full article from S&P Global Commodity Insights

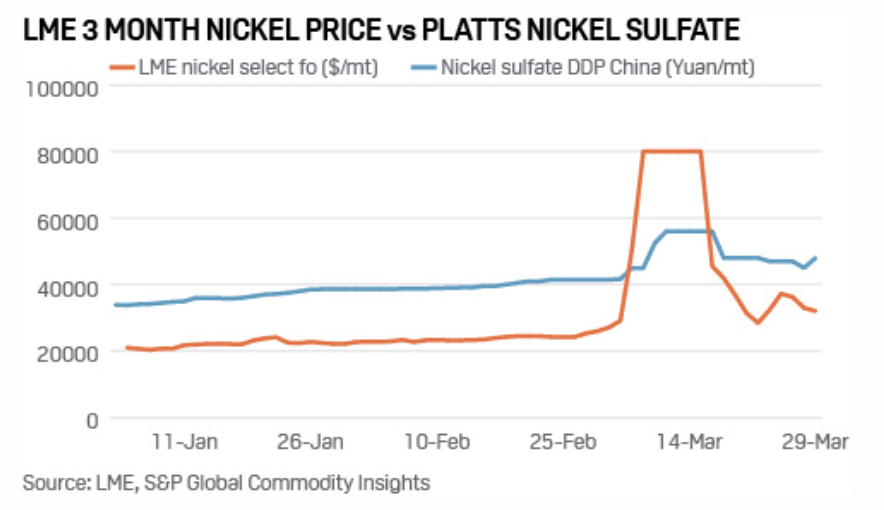

Stuttering LME Nickel Trade Throws Confusion Over Physical Market

Trade in the physical nickel market has slowed down with market participants unsure about how to price deliveries after the London Metal Exchange halted nickel trading and on resumption saw breaker limits hit for several days. The LME's nickel paper contract is the global benchmark for pricing physical deliveries of the metal required for stainless steel and increasingly for batteries of electric vehicles. The LME has experienced a multitude of issues in delivering the end of day quote—or cash settled price. The CSPs over the month of trading are aggregated and a monthly average is delivered—this is the price, known as a quotation period or QP, that buyers pay for that month's worth of deliveries.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

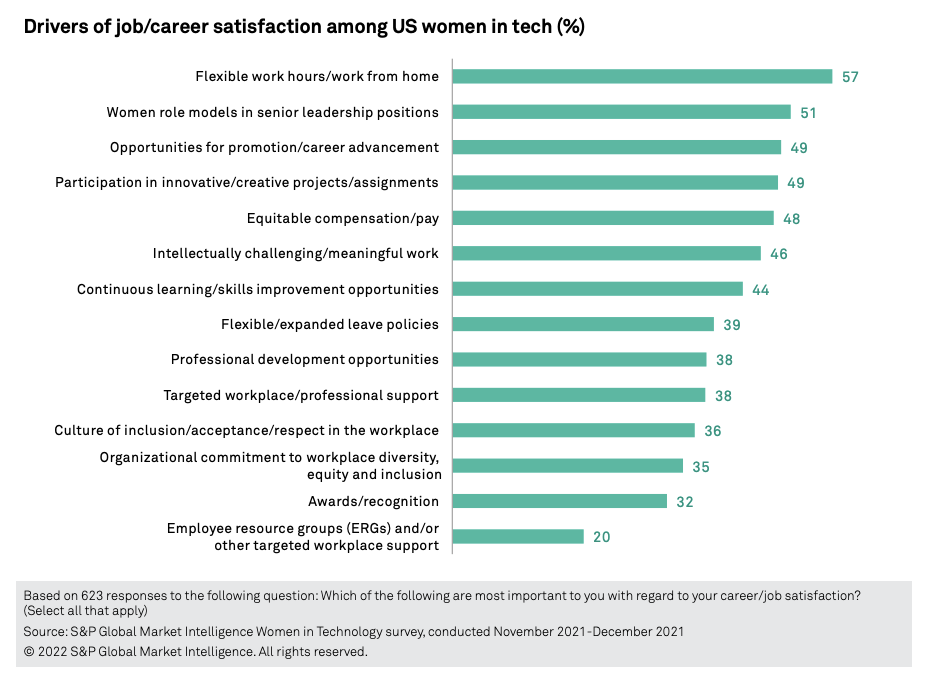

Women in Technology Study

Job satisfaction is high among U.S. women working in technology, but work remains to improve gender diversity and root out unhealthy aspects of company culture, according to results of a new study focusing on women in the technology industry from S&P Global Market Intelligence. Conducted by S&P Global Market Intelligence in collaboration with the California Technology Council and WE Global Studios, the study titled, “Women in Technology: Key strategies to retain and attract diverse talent,” investigates key drivers of career satisfaction and dissatisfaction for women working in technology and helps companies identify strategies for creating more inclusive and productive cultures. The study is based on a fourth-quarter 2021 survey of 626 U.S.-based women working in technology-focused roles across various sectors.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >