Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 May, 2020

By S&P Global

As confirmed coronavirus cases climb towards 4 million worldwide, the United Kingdom and United States are reopening their countries’ economies—fighting deepening downturns and rising death tolls. Approximately a third of the world’s cases are centralized in the U.S., while the U.K.’s death toll is the highest across Europe.

In the week ended May 2, 3.2 million Americans filed for unemployment, according to the U.S. Department of Labor. Down slightly from the previous week’s 3.8 million initial claims, this brings the total number of U.S. jobless workers to nearly 33.5 million in seven weeks. Tomorrow’s Bureau of Labor Statistics jobs report for the month of April will show the high costs of the sudden stop shutdown, likely wiping out the entirety of jobs gained over the past decade.

“The substantial flow of UI [unemployment insurance] claims between the March and April reference periods, compared to pre-COVID trends, suggests that April’s U-3 unemployment rate could rise from 4.4 percent to 19.8 percent,” the White House’s Council of Economic Advisers wrote in an article published today. “Looking ahead, with many States reopening their economies, there may be early signs of the economic comeback in the May report. However, given the 7 million UI claims since the April report’s reference period and that the May report’s household survey occurs next week, fuller measures of recovery will likely not be shown until the June report—even if they are already underway.”

Investing in infrastructure could help support the U.S. economy’s post-crisis recovery. “If we look at infrastructure as a way of not bailing people out short term, but creating jobs and jobs that pay well and generate taxes to offset the cost of the investment, I think we will be in much better shape," Steel Manufacturers Association President Philip Bell told S&P Global Platts in an interview. “When we look at what can be done to support 21st century steelmakers, I think probably one of the most important things we can do it get a comprehensive, well-funded infrastructure investment program in place as part of the COVID-19 relief efforts.”

In a report released yesterday, S&P Global Ratings’ Chief U.S Economist Beth Ann Bovino advocated that a $2.1 trillion boost of public infrastructure spending over a 10-year period could boost the U.S. economy by as much as $5.7 trillion over that time period and create 2.3 million jobs by 2024.

The Bank of England estimated that this quarter the U.K. economy could shrink by 25% and this entire year by 14%, marking the worst economic contraction since 1706. Leaving interest rates at the record low 0.1% set in March at the onset of this crisis, the central bank’s scenario forecasts GDP recovery of 15% in 2021.

“The scale of the shock and the measures necessary to protect public health mean a significant loss of economic output has been inevitable in the near term,” Bank of England Governor Andrew Bailey said, adding that the central bank would “take further action as necessary” as the coronavirus pandemic progresses.

Major British banks made provisions against loan losses in the first quarter of nearly six times the amount set aside in the same period last year, totaling more than £7.5 billion ($9.2 billion), according to S&P Global Ratings, which estimated that systemwide U.K. domestic credit losses will rise to £18.5 billion ($22.9 billion) this year.

In England and Wales, black people are approximately twice as likely as white people to die due to the coronavirus, according to the U.K. Office for National Statistics. The analysis showed that differences in wealth, education, and additional longstanding socioeconomic factors partly explains why communities of color are disproportionally impacted by the virus.

On Wednesday, the European Commission warned that the bloc’s GDP would contract by 7.4% this year, with an expected rebound of 6.1% in 2021. The eurozone will contract 7.7% this year and rebound 6.3% next year. “Unemployment is set to increase, though policy measures should limit its rise. The impact of the pandemic will be felt on the labor market, bringing to an end a decade-long period of improvement. But timely and sizeable policy measures, from governments and EU institutions, should help to limit job losses,” EU economy commissioner Paolo Gentiloni said in a statement. “Our economy is not expected to have fully made up for these losses at the end of 2021. Output at the end of next year is set to be about 3% lower than expected in our autumn forecast.” He said that “both the recession and the recovery will be uneven.”

As the eurozone eases its coronavirus containment measures, Russia has emerged as the continent’s new infection hotspot. The country has reported more than 177,000 confirmed cases, according to Johns Hopkins University data, the world’s fifth highest count behind the hard-hit U.S., Spain, Italy, and U.K. More than half of the country’s cases are in Moscow, according to Sergei Sobyanin, the city’s mayor, who also said that the actual number of cases in the capitol city is closer to 300,000. S&P Global Ratings assumes that Russia’s response to the coronavirus crisis will push the country’s regions to their highest budget deficits in the 21st century.

Today is Thursday, May 7, 2020, and here is today’s essential intelligence.

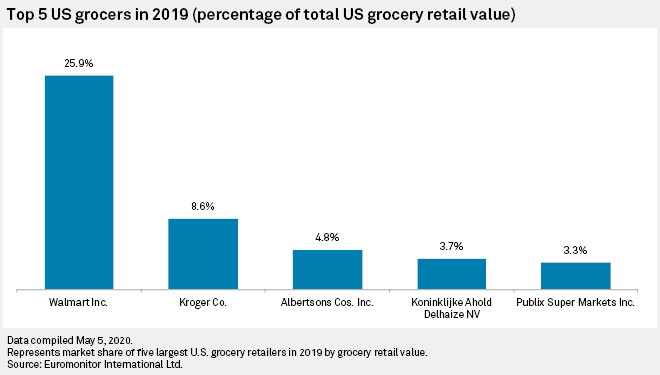

Independent grocers could lose share to Kroger, Amazon amid coronavirus crisis

The coronavirus crisis is presenting new challenges to independent grocers in the United States, which could cede market share to Amazon.com Inc. and other large national players better equipped to handle increased demand and supply-chain disruption. These independent supermarkets are smaller, localized grocers that lack the national and regional footprints of companies like The Kroger Co., Walmart Inc. and Amazon, which owns Whole Foods and is building out a new grocery store concept. The pandemic is testing smaller retailers of all stripes, from mom-and-pop operations to local chains and specialized, niche grocers. As customer demand for delivery has surged during the outbreak, grocers of all sizes are scrambling to keep shelves stocked with essentials such as eggs and meat. But those challenges tend to be even more daunting for smaller grocers, said Ricky Volpe, a professor in California Polytechnic State University's Agribusiness Department.

—Read the full article from S&P Global Market Intelligence

Pension Brief: The Future Of U.S. Public Pensions After The Sudden-Stop Recession

U.S. public pension funds in aggregate lost approximately $850 billion in the first quarter of 2020. A Q2 2020 return of nearly 30% is needed for government-sponsored pension systems to maintain the 73% average funded ratio from a year ago. Should experience mirror that of the recent Great Recession, adjustments to reduce plan costs and increase contributions are likely.

—Read the full report from S&P Global Ratings

Insurers will take more care over policy wordings post-crisis, says RSA CEO

Insurers will be more careful about their business interruption policy wordings going forward as a result of coronavirus claims disputes, according to RSA Insurance Group PLC CEO Stephen Hester. Speaking to analysts about RSA's first-quarter 2020 trading update, Hester said some parts of the commercial insurance industry were "cottage industry like," with insurers using a variety different wordings depending on the scheme or broker they are accepting business through. He said: "All insurers will think that maybe we haven't been quite as disciplined as we should have [been] in applying the same high standards of clarity on our wordings in every case." He added that this would lead to "greater concentration" of wordings and companies trying to introduce some standardization to avoid "some of the more ambiguous situations which cause heartache not just for us but for our customers."

—Read the full article from S&P Global Market Intelligence

Interview: Infrastructure spending key to US recovery: SMA CEO

A robust federal infrastructure investment package would not only help to support steel demand as the US recovers from the coronavirus pandemic, it will help to support the country more broadly as it adjusts to a "new normal" in the wake of the virus, Steel Manufacturers Association President Philip Bell said in an interview with S&P Global Platts this week. "When we look at what can be done to support 21st century steelmakers, I think probably one of the most important things we can do it get a comprehensive, well-funded infrastructure investment program in place as part of the COVID-19 relief efforts," Bell said. "The thing about infrastructure is that it's not a bail out, infrastructure creates jobs. In fact, these would be American people, doing American jobs, to help other Americans." Bell pointed to a recent report from the Boston Consulting Group which found that for each $1 trillion invested into infrastructure, it has the potential to create over 3 million jobs in the span of five years.

—Read the full article from S&P Global Platts

COVID-19 Response Will Push Russian Regions To Post Highest Deficits In 20 Years, Despite Federal Support

Russian regions' budgets are coming under great pressure from the recession provoked by lower oil prices and the social distancing measures to slow the spread of COVID-19. S&P Global Ratings is projecting steep shortfalls in revenue that will push Russian LRGs to their highest budget deficit in the 21st century, reaching 6%-9% of their total revenue. The magnitude will depend on the exact amounts of tax revenue decline, possible expenditure cuts, and potential federal support. Recession and low commodity prices will substantially reduce Russian regions' tax revenue in 2020-2021. The federal government is providing substantial liquidity support to Russian regions, but it will fall short of fully compensating lower revenue. As a result, the deleveraging trend of recent years will reverse this year and regions' debt burdens could climb to 30% of operating revenue by the end of 2022.

—Read the full report from S&P Global Ratings

Unregulated Power Update: Independent Power Producers Navigate Falling Demand And Credit Risks In Wake Of Economic Shock

This commentary is the second in a two-part series on merchant power. In the first commentary on the unregulated power markets, published April 24, S&P Global Ratings presented details on the power demand drop, the effect on regional spark spreads, and the ensuing impact on single asset/portfolio project-financed transactions. In this commentary, S&P Global Ratings responds to investor questions by identifying areas of credit risks for independent power producers (IPPs) and discuss current views on the credit quality of rated IPPs.

S&P Global Ratings thinks the impact on IPPs has been relatively muted up to this point, especially compared to other energy sectors such as oil and gas, midstream and refining. Still, the sharp economic shock represents a stress test of their retail-wholesale integrated business model. A muted impact could underscore the efficacy of the integrated model and result in upgrades as the economy recovers. The economic stress does slow the momentum, but does not change our views about the investment-grade aspirations of these companies. S&P Global Ratings believes visibility into cash flow preservation in 2021 is equally important to credit improvement as wading through this immediate crisis. S&P Global Ratings continues to maintain our positive outlooks on four companies through this period. Any rating or outlook changes—in either direction—will likely come in the third quarter or later.

—Read the full report from S&P Global Ratings

UK banks' loan loss provisions soar in face of pandemic

Major British banks made provisions against loan losses of more than £7.5 billion in the first quarter in the face of the coronavirus pandemic, nearly 6x the amount set aside in the same period last year. But even this may be just a small sign of things to come, said S&P Global Ratings, which estimated that systemwide U.K. domestic credit losses will rise to £18.5 billion in 2020. "While that is our current base-case estimate, we believe that losses may be higher still," Ratings said.

—Read the full article from S&P Global Market Intelligence

Banks disclose energy exposure, efforts to shrink portfolio

Some U.S. banks have been moving to reduce their exposure to energy, an industry experiencing significant turmoil during the fallout from the COVID-19 pandemic. Uncertainty regarding the economic impact of COVID-19 has prompted banks to disclose exposure to at-risk industries, and oil price volatility could lead to credit quality issues for lenders with significant energy exposure. During first-quarter earnings calls, many banks disclosed their exposure to the sector and offered additional commentary on their expectations for the future of their energy portfolios.

—Read the full article from S&P Global Market Intelligence

Argentina's banking business shrinks as sovereign default looms

A potential default of sovereign bonds could trigger further U.S. dollar withdrawals while jeopardizing the quality of banks' premium dollar loan book to exporting companies. With the May 8 deadline for debt talks just hours away, both Argentina's government and bondholders still appear far from a deal. Banks in Latin America's third largest economy are bracing for a no deal scenario. The resulting sovereign default would further complicate an already fragile operating environment, which has seen reduced lending and dwindling dollar deposits, aggravated by a contraction brought about by the global pandemic.

This perfect storm has resulted in a dramatic reduction of dollars in the country's financial system. Dollar deposits have been falling since the 2019 presidential primaries, which signaled a political change and a return to Peronist rule. Savers rushed to withdraw their dollar deposits from bank accounts, which dropped to $17.9 billion in April 2020 from $32.5 billion in August 2019. To meet dollar demand from customers, banks moved to roll back lending in kind. Banks have pushed to collect loans and offered discounts on peso loans for borrowers willing to cancel their dollar loans early.

—Read the full article from S&P Global Market Intelligence

Listen: Energy transition to be shaped by world response to COVID-19

The coronavirus pandemic may accelerate a shift from fossil fuel spending to investments in renewable energy, but the pace of that transition depends heavily on how governments direct economic recovery spending, and whether the consumer behavior changes induced by the outbreak become permanent. S&P Global Market Intelligence interviewed some of the leading global climate and energy experts and all agreed that the energy sector will look different on the other side of the COVID-19 crisis. A struggling oil and gas industry will lead to fewer jobs in that field, while changes in commuting, air travel and manufacturing may encourage businesses and governments to reconsider air pollution and traffic congestion problems.

—Listen to this episode of Energy Evolution, a podcast from S&P Global Market Intelligence

Harmonization, sustainable financing key to Europe's Green Deal: Enel

Europe's Green Deal must address harmonization of permitting procedures and encourage sustainable financing to accelerate growth in renewables, Italian utility group Enel said Wednesday. Company CFO Alberto de Paoli told analysts the company saw simplification and harmonization at the EU level of permitting procedures for power plants from coal to gas, investment in storage, and monetization of hydro plant as fundamental enablers of decarbonization. EU recovery funds under discussion could trigger the scale-up of sustainable investment across Europe, improving corporate access to debt and the establishment of temporary equity partnership to reduce corporate need capital, he said.

—Read the full article from S&P Global Platts

AEP moving forward with Okla. wind projects, expects sales decline from pandemic

American Electric Power Co. Inc. is cutting certain operations expenses and shifting capital spending to offset the impacts of the COVID-19 pandemic, but the company sought to reassure investors that it will move forward with the planned $2 billion North Central Wind projects in Oklahoma. "We already know we're going forward with the project," AEP Chairman, President and CEO Nicholas Akins said May 6 on the company's first-quarter 2020 earnings call. "The question is what size?" The Arkansas Public Service Commission on May 5 became the latest jurisdiction to approve its portion of the projects, Akins said. The approval includes a "flex-up option" that allows the jurisdiction to increase its megawatt allocation. This follows approvals earlier in the year by the Oklahoma Corporation Commission and the Federal Energy Regulatory Commission.

—Read the full article from S&P Global Market Intelligence

Analysis: US oil and gas rig count falls 34 to 398 as Permian collapse extends

The US oil and gas rig count fell 34 to a total of 398 in the week ended May 6, as Permian basin drilling activity continued to decline, rig data provider Enervus said Thursday. Oil rigs again led the decline, falling 29 on the week to 286, while the number of gas-focused rigs slipped 5 to 112. Total US drilling activity has declined nearly 53% from its recent peak during the week-ended March 4, and is now 63% behind year-ago levels.

—Read the full article from S&P Global Platts

Container shipping teaching OPEC lesson in market management

If OPEC looks out to sea it will find a kindred spirit. Both the oil industry and global trade have been ransacked by a collapse in global demand, with oil producers and the shipping sector employing strategies to restore balance. While an alliance of ocean carriers has been keeping freight rates stable, there is a difficult journey ahead before they are seen as flag bearers for market management. Carriers moved fast and decisively to reduce overcapacity to prevent a dramatic drop in freight rates. The sector has voided more than 400 sailings this year – or 10% of nominal TEU capacity from active service -- as lower volumes offset the drop in coronavirus-hit demand. And there are plenty more blank sailings to come.

—Read the full article from S&P Global Platts

Analysis: Saudi Aramco's coronavirus strategy in focus in Q1 earnings presentation

It may have only been six months ago, but Saudi Aramco's stock market debut took place in a different world. With the global economy under siege, attention is focused on how the world's biggest oil company will adapt to decimated demand and low prices. On Tuesday, the Saudi state-run company will provide insight into its COVID-19 coping strategies when it presents its first quarter earnings. Analysts and investors will be looking for guidance on how Aramco plans to adapt in terms of capital expenditure, investment into expanding spare capacity despite weak fundamentals and its commitment to paying a dividend. After years of uncertainty, Aramco made its much anticipated debut as a public company in December, listing a sliver of its shares on the Saudi domestic stock exchange. The overwhelming majority of the company remains in the hands of the Saudi government.

—Read the full article from S&P Global Platts

COVID-19 demand for hygiene products buoys Europe's petchem sector

Unlike European refineries, which have been cutting runs or shutting as COVID-19 destroys demand for oil products, the petrochemical industry has been kept ticking over by buying of plastics for hygiene products and single-use food containers. In April, Austria's OMV said it had converted its production in favor of petrochemicals due to weaker demand for jet fuels. While OMV had to revise down its anticipated refinery margins for 2020, it revised up its petrochemical margin forecast. Meanwhile in its Q1 results this week, French oil major Total said its refineries in Europe were running at around 60%. By contrast, demand for plastics has supported petrochemical volumes, which have not been "affected by the crisis", Total said. "Thanks to the flexibility of steam crackers" they can "benefit from low cost naphtha and ethane".

—Read the full article from S&P Global Platts

Listen: More turbulence ahead for jet fuel as forward structure gives a grim outlook

The malaise in jet fuel and air traffic is grounding airmail and the outlook seems bleak for airlines as the contango in jet fuel stretches out ever further. Jet fuel reporter Gary Clark and Middle Distillates editorial manager Eleni Pittalis tell Joel Hanley the latest.

—Listen to this episode of Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language