Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 May, 2020

By S&P Global

As the global total of reported deaths due to coronavirus surpasses 250,000, at least 13 countries have begun lifting their coronavirus-containment restrictions. Policymakers, business leaders, and civilians are attempting a balancing act of protecting populations from infection while trying to prevent the downturn from deepening or darkening. Five months since this unprecedented crisis began, the future of credit, markets, economic stability, and public health is plagued with uncertainty.

Of the 62 corporates globally that have defaulted this year, half occurred in April, with five in the last week of the month, according to S&P Global Ratings. Media and entertainment, the oil and gas sectors, healthcare, and retailers and restaurants made up the majority of defaults. At this point last year and in 2018, there had been 42 and 32 defaults, respectively. S&P Global Ratings sees a myriad of risks across the foodservice and beverage industries due to the coronavirus crisis, as food distributors face unprecedented demand shocks, alcoholic-beverage companies see more ratings pressure than soft-drink makers, and restaurants, delis, and convenience stores suffer sales slumps. However, S&P Global Ratings expects tobacco sales to remain firm.

On May 1, another 19 U.S. corporate borrowers drew roughly $4.2 billion from their revolving credit facilities, according to LCD, part of S&P Global Market Intelligence. Companies across all sectors drew about $32.14 billion collectively in April, piling on the $219.87 billion borrowed in March and pushing total borrowing to $252.02 billion during the period.

“To be a little bit simplistic, you could say that the coronavirus is making the private sector shut down for three months. If you theoretically could inject an amount of capital equal to the turnover that the private sector has lost in those three months, then the economy can restart back to normal,” Manfredi Catella, chairman and CEO of Italian real estate investment company Coima, told S&P Global Market Intelligence. “There are some big companies who are opportunistically trying to speculate on the situation, trying to get a bargain on rents from their landlord. These companies should really be put on stage.”

“When we speak about ESG, meeting your obligations when you can afford to is ESG,” Mr. Catella said. “If every one of us can afford to lose some money, but help create a safety net in the economy, to have solidarity among businesses, this will help companies to survive, to avoid having to fire people, and to be ready for the economy to open up again as soon as possible.”

Outlooks for the energy sector are oscillating as the majority of lockdowns remain, even as governments lift some coronavirus-containment measures. Easing restrictions are improving demand for oil products, thus boosting momentum for global refining margins. However, oil major Royal Dutch Shell PLC cut its dividend on April 30 for the first time since World War II. Additionally, Asian gasoline demand last month contracted 1.24 million barrels after shrinking 1.12 million barrels in March, according to S&P Global Platts Analytics.

The NYMEX June natural gas futures contract settled today at $1.993 per one million British Thermal Units, the highest prompt-month close since Jan. 17. The past 14 weeks have been the longest uninterrupted stretch of sub-$2/MMBtu prices for the prompt-month NYMEX contract in the last 20 years, according to S&P Global Platts.

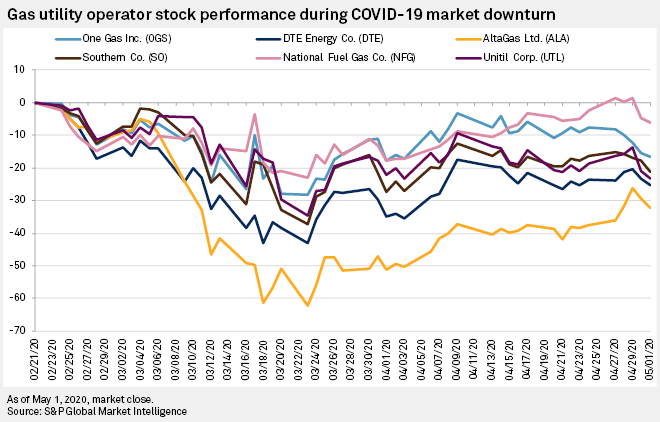

Bigger power-generation assets may be able to weather the crisis, according to S&P Global Market Intelligence. Large natural gas utilities are skirting the effects of the pandemic as their small and midsize peers are issuing revenue, profit, and capital spending warnings linked to the pandemic. Small and midsize renewable-power developers face greater risks than large utilities, independent power producers, and large corporates.

Today is Monday, May 4, 2020, and here is today’s essential intelligence.

Default, Transition, and Recovery: April Accounts For Half Of Defaults So Far In 2020

The 2020 global corporate default tally has reached 62—half of which were in April including five defaults last week. With the month coming to a close, April saw just as many defaults as the first three months of the year combined (31 in total). The sectors with the most defaults in April were the media and entertainment, and oil and gas sectors with six defaults each as extended coronavirus-containment measures have had a major effect on corporations, especially for issuers in the industries at the lower end of the rating scale most exposed to COVID-19-related risk. These sectors also experienced a large number of issuers with downgrades in April due to COVID-19 and the collapse of oil prices. Although S&P Global Ratings' economic forecasts continue to worsen, financing conditions have been gradually improving as central banks and governments around the world have enacted liquidity and helped stabilized financial markets. However, as the world entered the pandemic with a record level of issuers rated 'B' and below, the speculative-grade default rate can be expected to rise to 10% within the next 12 months.

—Read the full report from S&P Global Ratings

Update: Coronavirus-related US revolving credit drawdowns swell to $252B

LCD, part of S&P Global Market Intelligence, on May 1 added roughly $4.2 billion in revolving credit drawdowns, across 19 issuers, to its list of coronavirus-related liquidity actions by U.S. corporates. Roughly $252.2 billion of this activity via 542 borrowers has been captured since March 5. Looking at broad industry sector, Consumer Discretionary accounts for nearly half of total RC drawdowns. Within Consumer Discretionary, much of the volume is from Automobile Manufacturers. Of the data so far, better-quality BBB issuers account for 43% of the overall volume by corporate credit rating. The maturity wall for these revolving credit drawdowns for both the investment-grade and speculative-grade segments peaks in 2024. This data is sourced from available SEC filings. It is not an exhaustive list of all RC drawdown activity.

—Read the full article from S&P Global Market Intelligence

Consumer drawdowns fade in April amid broader drop in pandemic-related borrowing

Consumer companies slowed their coronavirus-related credit drawdowns in April but still accounted for more than a third of total borrowing during the month and more than half of the more than $252 billion drawn by businesses since March 5. Companies across all sectors drew about $32.14 billion collectively in April, piling on the $219.87 billion borrowed in March and pushing total borrowing to $252.02 billion during the period, according to LCD, a division of S&P Global Market Intelligence. Fewer companies tapped their revolvers in April to preserve cash during the coronavirus pandemic, which has shuttered business operations around the globe.

—Read the full article from S&P Global Market Intelligence

Food Service, Beverage, And Tobacco Prognosis Mixed From Coronavirus

Ratings in the food service distribution sector remain on CreditWatch with negative implications given substantial uncertainty around the ability to restore sales, EBITDA, and credit metrics in 2021-2022 following the dramatic erosion anticipated in 2020. Sector liquidity improved recently following capital market issuance and is generally good. Alcoholic beverage issuer ratings face more rating pressure than nonalcoholic beverage ratings and S&P Global Ratings has a negative outlook for the sector because of higher leverage and more exposure to on-premise sales. But portfolio mix and the degree to which companies manage their costs and cash flows are important factors for all beverage company ratings. Rating stability is anticipated in the U.S. tobacco sector since near-term sales are expected to remain relatively firm, albeit volatile. Accelerated volume declines over the medium term is possible if disposable incomes remain depressed or health concerns increase due to the coronavirus pandemic.

—Read the full report from S&P Global Ratings

Credit opportunities are available, but investors are taking a cautious approach

Credit managers and limited partners, are taking a cautious approach to opportunities, but new investments are not completely off the cards, panelists at a Carmo Companies' Global Private Equity Web Meeting, which ran April 27-29, said. There is limited information about the extent to which the coronavirus pandemic and the associated lockdown provisions will affect businesses, and the full impact of the crisis is not expected until second-quarter results come out in July and August.

—Read the full article from S&P Global Market Intelligence

Tenants exploiting COVID-19 crisis should be 'put on stage,' says COIMA chairman

Major companies in good health pushing for rent reductions from landlords are behaving irresponsibly and are "the worst family members of the common economy," said Manfredi Catella. He believes Italy must be very careful about how it reopens its economy and urges the government to inject the necessary liquidity to bolster its recovery. The Italian hotel sector is at risk of seeing considerable distress as it is fragmented, with many assets owned by small, independent businesses, he said.

—Read the full article from S&P Global Market Intelligence

COVID-19 Effects Might Quadruple U.K. Bank Credit Losses In 2020

S&P Global Ratings estimates that systemwide U.K. domestic credit losses will rise to £18.5 billion in 2020, or 100 basis points (bps) of domestic lending—more than four times the 2019 level. As the economy recovers into 2021, S&P Global Ratings estimates that credit losses will fall to 60 bps (close to their long-term average) and then to 35 bps in 2022. Risks are skewed to the downside, given that the effects of COVID-19 on the economy may be more severe, or the rebound slower, than S&P Global Ratings currently envisages.

—Read the full report from S&P Global Ratings

UK banks report stampede for 100% state-guaranteed Bounce Back Loans

Take-up of the latest British government 100%-guaranteed coronavirus business loans has been extraordinarily fast compared with existing schemes, with Lloyds Banking Group PLC alone receiving 5,000 applications by 10 a.m. on May 4, and HSBC Holdings PLC taking 200 applications in the first minute of the scheme going live, MPs were told. The U.K. Parliament's Treasury Select Committee quizzed all the main high street banks, along with challenger bank Starling Bank Ltd., on their response to the COVID-19 crisis. The government's latest assistance for businesses, called the Bounce Back Loans, is aimed at the smallest end of the business market, offering between £2,000 and £50,000 at a maximum of 25% of turnover, fixed at 2.5% interest over six years with no interest payable in the first year. This scheme comes in response to criticism of the government for failing to offer 100% guaranteed loans to firms affected by the pandemic at the start of the crisis.

—Read the full article from S&P Global Market Intelligence

Banks deal with heightened sanctions risks, compliance hiccups amid pandemic

Banks face longer transaction processing times and possible sanction violations as the coronavirus crisis puts pressure on their compliance control functions, experts warn. Customers' rapidly changing supply chains are a growing concerns for banks. As lockdown measures are causing logistical challenges, businesses must increasingly change third-party providers at short notice, said Sven Bates, a U.K.-based senior trade and sanctions associate at law firm Baker McKenzie.

—Read the full article from S&P Global Market Intelligence

Listen: Why US oil sector relief may require green energy dealmaking

US President Donald Trump has promised relief to the ailing oil and gas sector, and it's not yet clear if the recently expanded Federal Reserve lending program is the full extent of that aid. Democrats easily blocked the administration's first attempt to help drillers in the form of buying US crude at low prices to fill the Strategic Petroleum Reserve. The incident underscored just how hard it would be to get any kind of fossil fuel relief through Congress.

A recent survey by the Brunswick Group found little support among Americans for granting federal relief to the US oil and gas sector -- unless that aid is tied to emissions reductions or other environmental benefits. The survey also found little support for banning foreign crude imports to boost domestic prices. Brunswick's Stephen Power argues that there is a path for the oil industry to build a support among the public and in Congress for bipartisan federal aid. But it's going to require some give-and-take with Democrats and a willingness to consider their energy policy priorities such as federal aid to renewable sector.

—Listen to this episode of Capitol Crude, a podcast from S&P Global Platts

Small renewable developers face steeper climb over coronavirus curve

Small and midsize developers of power generation assets have much more to lose than large utilities, independent power producers and large corporates as the energy sector continues to grapple with coronavirus-related uncertainty. Development milestones and construction dates may be further postponed, posing a financial risk for project owners, while financing could be more difficult to obtain.

—Read the full article from S&P Global Market Intelligence

Small, midcap gas utilities raise more coronavirus concerns than larger peers

Small and midsize natural gas utilities issued revenue, profit and capital spending warnings linked to the coronavirus outbreak, while their bigger peers largely shrugged off the pandemic's potential impacts on their gas business. Utilities across the nation have suspended service shutoffs in the face of soaring unemployment and widespread financial hardship, raising concerns that unpaid bills will pile up and saddle gas distributors with bad debt. The economic downturn and stay-at-home orders also threaten to derail demand among industrial and commercial gas customers.

—Read the full article from S&P Global Market Intelligence

NYISO Tracker: Power prices plunge on pandemic-weakened loads, gas prices

Pandemic-driven weak power demand combined with plunging natural gas prices to crash New York Independent System Operator on-peak wholesale power prices by 46% to the lowest prices – around $15.50/MWh -- in April among the eight US power regions, and summer forwards followed suit. Day-ahead on-peak locational marginal prices posted an average decline of 48.5%, year on year, to $16.40/MWh in New York City Zone J, and the West Zone A prices averaged down 46.5% to $14.04/MWh. Among the eight US power market regions included in S&P Global Platts' monthly Power Tracker analysis, Southwest Power Pool had the second-lowest average prices, with SPP North Hub down almost 35.8%, year on year, to $16.41/MWh, and SPP Souh Hub down 29.6% to $16.53/MWh.

—Read the full article from S&P Global Platts

Lots of talk for little action in big Texas: Fuel for Thought

In an oversized state known for its ingenuity, pride, stubbornness and free-range capitalism, it’s a borderline miracle that Texas is even seriously considering implementing a plan for mandatory oil production reductions. During the worldwide collapse in oil triggered by the coronavirus pandemic, the contention is that Texas is producing way too much oil at no profit, potentially leaving the state’s economy much weaker and wasting valuable natural resources. The Railroad Commission, which regulates the energy sector in the state, will meet again May 5 to consider forcing producers to cut their outputs by 20% from the fourth quarter. The goal is essentially to force Texas to temporarily reduce its oil volumes by at least 1 million b/d from a previous high of more than 5 million b/d. The measure, called prorationing, hasn’t been utilized in Texas in nearly 50 years. However, the bottom line almost certainly is that Texas won’t intervene in oil. Sitton is just one of three votes, and the other two commissioners have vocally leaned against taking action, citing the free markets.

—Read the full article from S&P Global Platts

Refinery margin tracker: Global margins rise as coronavirus lockdown restrictions ease and product demand returns

Global refining margins are gaining upward momentum as governments ease lockdown restrictions thus improving product demand, an analysis from S&P Global Platts showed Monday. In the US, roughly 90% of the country is under some form of lockdown to slow and prevent the spread of the deadly coronavirus. But as the infection curve slows and the number of states easing restrictions rises from 16 to 32, it is expected quarantined residents will be anxious to get back on the road. And retail gasoline prices 40% lower than last year offer additional enticement to get them behind the wheels of their cars. Phillips 66, which has refining and retail operations in Western Europe, has seen demand destruction there rise to 50% today from 70% in mid-April when it was at its worst.

—Read the full article from S&P Global Platts

Dividend cuts should be last resort for European oil majors – Goldman Sachs

Oil major Royal Dutch Shell PLC's dividend cut could prompt other European integrated oil and gas companies to do the same, but trimming payouts to investors should be used as a last resort after employing other cost-cutting options in the face of the oil price crash, according to analysts from Goldman Sachs. "We believe that it is in the best interest of shareholders if Big Oils continue to rethink the capital intensity of their businesses, rather than reducing shareholder distributions," the investment bank said in a May 1 research note. Historically, oil companies have opted to protect the dividend in times of financial distress, focusing instead on capital discipline and operating efficiencies as a way to preserve capital. To address the recent crash in oil prices, Shell and its peers all announced spending cuts, operating expense reductions, and the suspension of stock buyback programs.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Europe, May 4-8: Refined oil products face dwindling storage as power markets look for signs of demand recovery

In this week's highlights: Oil and gas dwindling storage options pose a major challenge; Norway's Equinor is set to unveil its first-quarter results; and European electricity markets keep a sharp eye on signs of demand recovery as lockdowns begin to ease.

—Share this video from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language