Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 May, 2020

By S&P Global

The coronavirus pandemic is sure to keep the global community in limbo over how to navigate the changing economy—with human safety indeterminate, markets remaining volatile, and no precedent to guide the way forward. In the immediate term, as developed economies in particular loosen their virus-containment measures, companies are planning the future for their workforces against a backdrop of uncertainty.

Whether the crisis revolutionizes social attitudes toward working from home, prompting people to do so permanently even as workplaces reopen, or reinvigorates the importance of the office, sending employees scrambling back for in-person interactions, is yet to be seen.

A survey released yesterday by Upwork, a global platform for freelancers, of 1,500 company executives, vice presidents, and managers, found that 56% of hiring managers feel that the shift to working from home went better than anticipated, and 40% or more of respondents see the lack of a commute, fewer unnecessary meetings, and less distractions than while at the office as beneficial outcomes from this new way of working. One-third of respondents said that productivity had increased due to remote working arrangements. The survey signals that remote working may become the standard, as 61.9% of hiring managers said they plan to change their workforces to include more remote work than they did prior to the pandemic.

Technology firms, renowned for their lavish in-office perks, are climbing on board. Twitter CEO Jack Dorsey announced on May 12 that its employees could work from home “forever.” Shopify’s CEO Tobi Lutke declared in a May 21 tweet that the company will close its offices until 2021 to “rework them for this new reality” but even then, “most [employees] will permanently work remotely” because “office centricity is over.” Facebook CEO Mark Zuckerberg said in a May 21 livestream with the company’s workforce that he anticipates half of the tech giant’s workforce will be remote by 2030. Box CEO Aaron Levie wrote on Twitter on May 21 that “the push happening around remote work is as game-changing for the future of tech as the launch of the iPhone was in 2007” and “will change how products will be designed, how teams collaborate, and how companies will be run.”

In the U.K., demand for office space will be determined by the increasing trend toward working from home counterbalanced by a decline in both the density of employees in offices and the amount of desks rotationally shared as a result of concerns related to coronavirus, British Land Co. CEO Chris Grigg said during an earnings call, according to S&P Global Market Intelligence. Comparatively, S&P Global Ratings foresees European office landlords’ rent concessions to the weakest tenants and case-by-case rent renegotiations with the stronger ones impairing revenue growth this year, with the possibility of their rent falling as much as 5% by year-end.

Permanent work-from-home policies may not be beneficial for everyone. Blurring the divisions between personal and professional time, remote working also places a disproportionate burden on working women in particular, who already shoulder the majority of households’ unpaid care work on top of their job responsibilities.

“Before the COVID-19 crisis, 16.4 billion hours were spent in unpaid care work every day across the world, with over two-thirds performed by women,” according to the International Labor Organization, which explained in a May 22 report that the pandemic has seen “the hours they devote to unpaid care work increase as a consequence of school and daycare closures, reductions in public services for people with disabilities and the elderly, the non-availability of domestic workers, and the need to look after family members with COVID-19.”

Additionally, not all workers have the privilege of working from home, especially those deemed essential during this crisis—the majority of whom in the U.S. are women, according to government data. Of the 136 million people working in health and social work worldwide, 96 million are women, according to the ILO.

Regardless, many companies will bring their employees back into the workplace eventually—and some have already started. The New York Stock Exchange reopened its trading floor at 25% capacity on Tuesday, allowing around 80 floor brokers to return to work upon signing a release waiver, having their temperature checked, and not taking public transportation.

“For the NYSE and the nation as a whole, it’s important to approach reopening with realistic expectations. While our plan is designed to reduce risk, it cannot eliminate it,” NYSE President Stacey Cunningham wrote in a May 14 Wall Street Journal editorial. “Bringing our physical trading floor back online will begin the process of returning the NYSE to the highest level of service for investors and listed companies. This is important because stocks trade better when the floor is open, with reduced volatility and fairer prices.”

Other industry leaders believe the pandemic will prompt a renewed appreciation for the office experience, rather than keep the population working from home. Paco Ybarra, CEO of Citigroup’s Institutional Clients Group, told the Financial Times on May 24 that the benefits of remote working will “erode over time” as people yearn for face-to-face relationships. However, many large banks in the U.S. don’t yet have firm timelines for when their employees can return to the office, according to S&P Global Market Intelligence.

Notably, the widespread move to remote working has broadened many companies' exposure to hacking.

"What we expect likely will happen is, as soon as people do start coming back and things are a little more business as usual, we're going to see a huge uptick in the number of reported incidents," Elissa Doroff, a cyber executive at the French insurer AXA SA, told S&P Global Market Intelligence, adding that some businesses or institutions are likely unaware that they are being attacked. This may present the cyber insurance industry with a new potential sales opportunity.

Today is Thursday, May 28, 2020, and here is today’s essential intelligence.

How Are Lockdown Measures And Remote Working Affecting European Office Landlords?

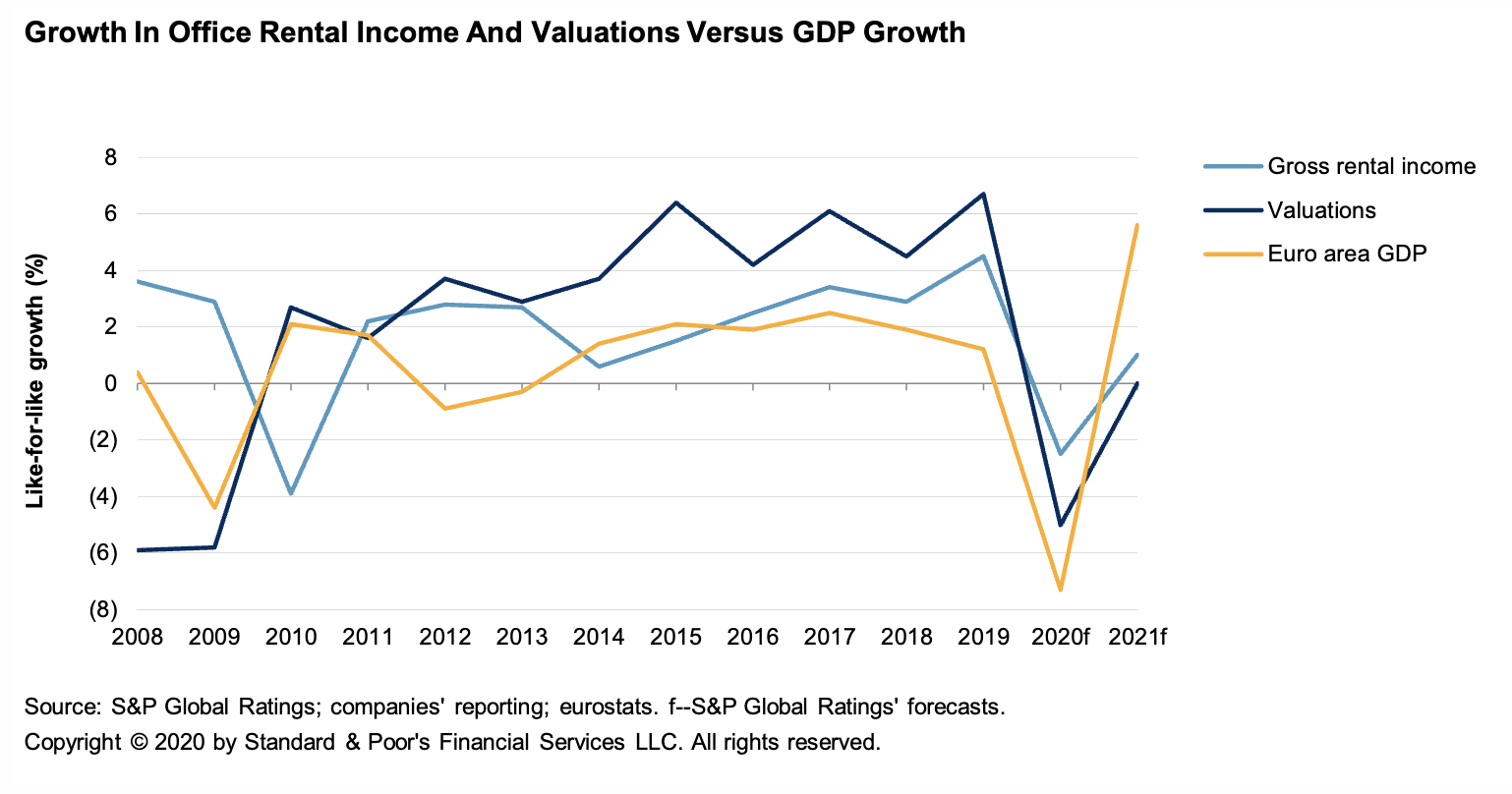

Lockdown measures to contain the spread of COVID-19 are eating into eurozone GDP and many European companies' capacity to pay rent. We believe office landlords might share some of their corporate tenants' pain, despite the protection from their long-term leases. In the short term, rent concessions to the weakest tenants and case-by-case rent renegotiations with the stronger ones will inevitably impair office landlords' 2020 revenue growth, albeit significantly less than in the retail property segment. Lease maturities in the coming quarters could also result in vacancies or lower rents if the market uncertainty persists. S&P Global Ratings therefore estimates potential rent declines between 0% and 5% for office landlords in 2020, but this should not affect the ratings on the 17 office landlords we rate in Europe, thanks to their long lease maturity profiles, creditworthy tenants, and comfortable ratio headroom. Over the longer term, the prospects of a weaker economy and the increased prevalence of remote working could erode companies' need for traditional office space in most office leasing markets. The most high-grade, service-oriented, and centrally located offices should fare better.

—Read the full report from S&P Global Ratings

'Fundamental, long-term changes' to hit property post-COVID: British Land CEO

U.K. property giant British Land Co. PLC expects the coronavirus pandemic to fundamentally and permanently alter the real estate sector in the years ahead. It's unclear how deep or prolonged the impact on economic activity or people's lives will be, but fundamental long-term changes will emerge and, based on past experience, the crisis is likely to accelerate trends such as more flexible ways of working, and a further shift to online retail, CEO Chris Grigg said during a full-year 2020 earnings call. The sudden financial shock experienced by many retailers, who were forced to close due to lockdown measures introduced to slow the spread of the virus, is expected to cause lasting damage to demand for retail property, while many commentators speculate that the success of remote working for many companies could lead to a plunge in demand for office space.

—Read the full article from S&P Global Market Intelligence

Economic Research: The Paycheck Protection Program Impact On Jobs: (More) Help Wanted

The U.S. government moved quickly to address liquidity needs of small businesses. However, the first round of the Paycheck Protection Program (PPP) funds may have missed the mark, in terms of geography, industries served, and size to meet significant small business demand. S&P Global Ratings found that 59% of first-round PPP loan approvals (average size $206,000) went to industries with jobs less affected by social distancing, such as good-producing industries. Loans approved were concentrated in states with relatively less job destruction. On second-round PPP data (through May 8), it already appears that a higher number of smaller loans have been approved (average size $73,000), reaching a greater range of businesses across the U.S., instead of being concentrated in a few states. Still, at this point in time the bulk of the programs seem to lean toward benefitting states with fewer jobless claims. And based on small business surveys, it's apparent that more help is wanted (and needed).

—Read the full report from S&P Global Ratings

Mexican Toll Roads Remain Vulnerable Amid COVID-19; Recovery Could Come Quickly As Restrictions Ease

Traffic for Mexican toll roads has steeply dropped because of restrictions related to the pandemic, but volumes should recover quickly once these restrictions are lifted. S&P Global Ratings believes the impact from the pandemic will most affect subordinated series, while senior debt will be more resilient. In S&P Global Ratings’ view, notable downside risks for toll roads remain, depending on the length and severity of the pandemic.

—Read the full report from S&P Global Ratings

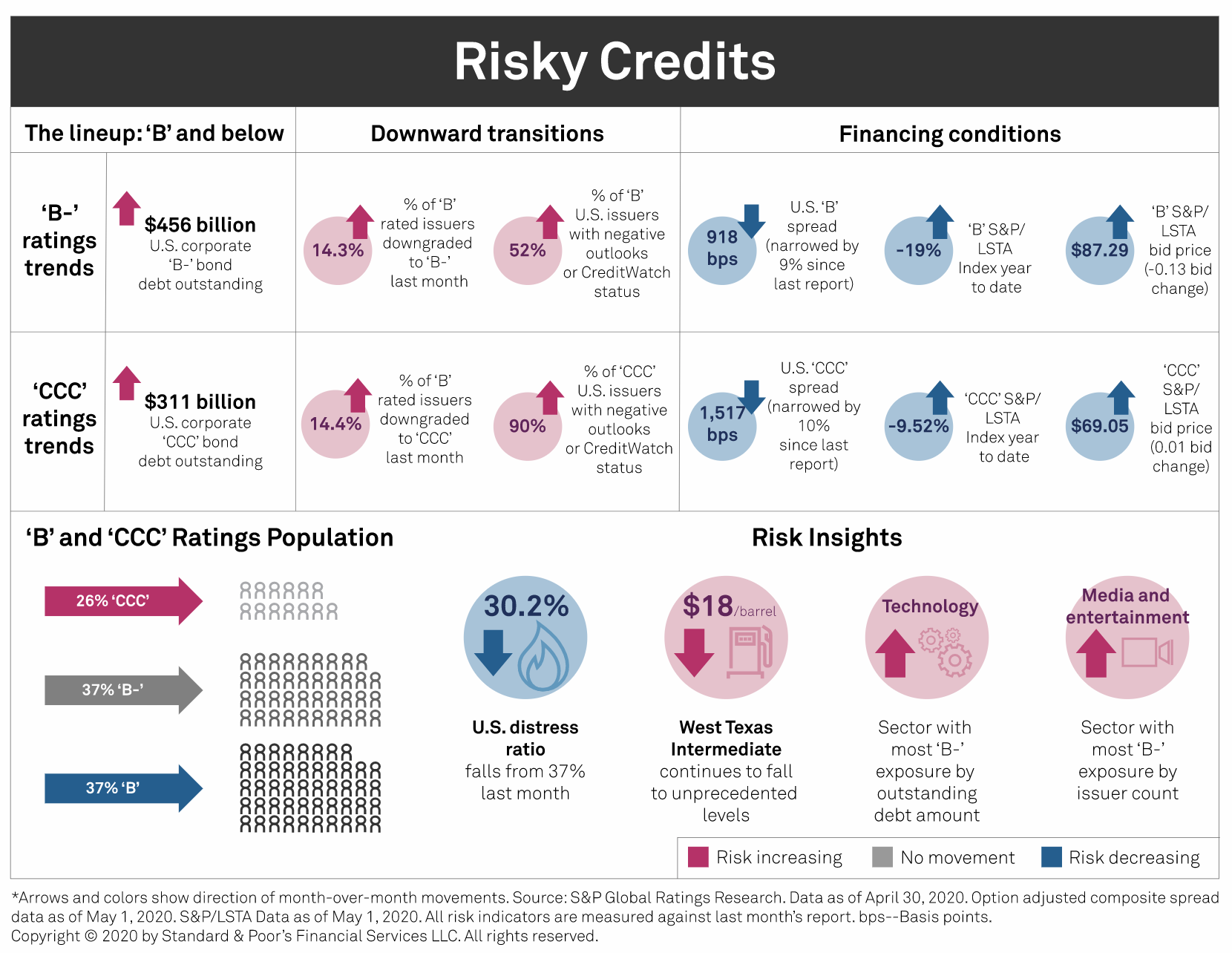

Risky Credits: Hanging On The Edge

U.S. speculative-grade composite spread narrowed by over 13% in April. Spreads remain elevated in 2020 amid investors' risk aversion, and some think they could return to March highs. Default risk is high, up to 3.5% as of March 31, 2020, and more so among the lowest rated companies. There were 21 defaults in April among companies previously rated in the 'CCC' category, but we expect far more. Although companies do not immediately resort to bankruptcy, some already faced challenges before the COVID-19 shock. Of the U.S. corporate defaults in April, 52% were due to missed interest payments and only 14% filed for bankruptcy. S&P Global Ratings downgraded or placed on CreditWatch with negative implications more than 28% of collateral for U.S. broadly syndicated loan collateralized loan obligations since March 1, 2020.

—Read the full report from S&P Global Ratings

Credit Trends: Downgrade Potential Rises To All-Time High On Sharp, Deep Economic Slowdown

Potential downgrades reached their all-time high of 1,287, above their previous record of 1087 during the 2009 subprime crisis and nearly double February's 649 issuers. Out of 550 new potential downgrades since April, 90% of the ratings were affected by economic and financial consequences of the COVID-19 pandemic—led by financial institutions, consumer products, and utilities sectors by issuer count--and join sectors with highest downgrade prospects like automotive, transportation, and media, entertainment, and lodging sectors. CreditWatch with negative implications placements are also elevated, indicative of a 50% chance of a downgrade in the near future, conditional on continued deleterious credit conditions.

—Read the full report from S&P Global Ratings

Canadian Credit Card Quality Index: COVID-19 Has Slammed The Brakes On First-Quarter Issuance

Canadian credit card ABS new issuance volume declined 71% year over year to C$1.33 billion in first-quarter 2020, as asset-backed securities markets shuttered on expectations of negative impact on consumers due to COVID-19. The pandemic's impact on credit card receivables performance will depend on the level of consumer indebtedness, the length of the economic lockdown, the nature of forbearance offerings and fiscal stimulus programs, and the credit quality strength of Canadian credit card accounts. As of March 2020, our Canadian Credit Card Quality Index does not point to early performance pressure, though it is still too early to draw any conclusions from this.

—Read the full report from S&P Global Ratings

Hertz drives US leveraged loan default amount to 6-year high

The volume of defaults in the U.S. leveraged loan market has exceeded $10 billion in May, the busiest month for such activity since 2014, according to LCD. Car rental concern Hertz Global Holdings Inc. on May 22 became the eighth issuer in the S&P/LSTA Loan Index to default on term debt this month, bringing the MTD total to $10.54 billion. That marks the highest monthly default total since Energy Future Holdings Corp filed for Chapter 11 in April 2014, with $19.5 billion of outstanding term debt.

—Read the full article from S&P Global Market Intelligence

Rapid rental car defleeting a looming risk for used vehicle values

The Chapter 11 petition of Hertz Global Holdings Inc. signals the potential addition of meaningful used vehicle supply to what the company described as a "manifestly non-functioning" market. With industry forecasts calling for declines in used vehicle values of 7% or more in large part due to fallout from COVID-19, some auto finance companies such as captives General Motors Financial Co. Inc. and Ford Motor Credit Co. LLC have lowered their expectations for recovery rates on repossessions and increased the depreciation rates over the remaining terms of leases. Lender forbearance policies and operational disruptions at auction houses have already created prospects for a backlog in supply at a time in which a dramatic macroeconomic downturn and reduction in the number of miles driven could continue to depress demand. That a key creditor group is urging Hertz to rapidly right-size a rental fleet that peaked in 2019 at more than 770,000 vehicles and averaged 518,580 in the U.S. during the first quarter of 2020 could exacerbate the supply/demand imbalance.

—Read the full article from S&P Global Market Intelligence

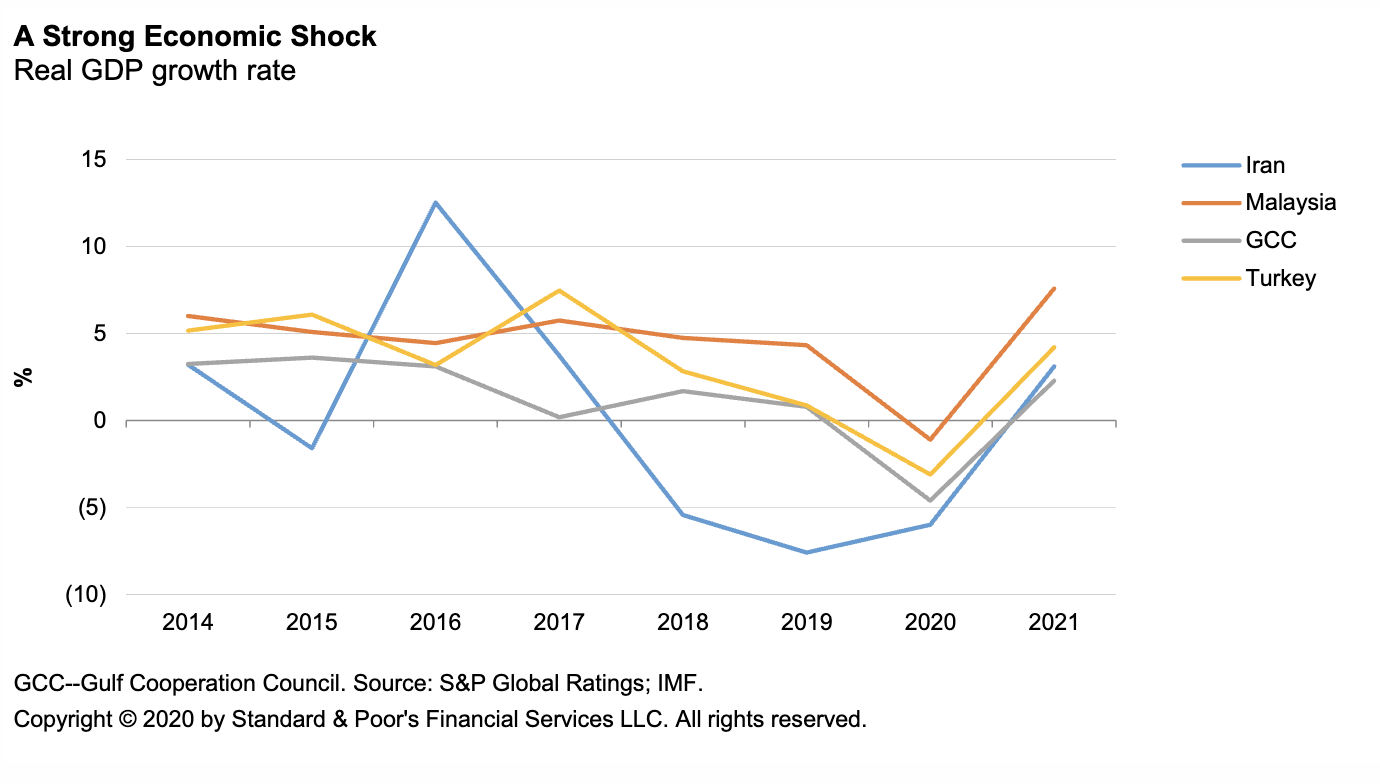

Environmental, Social, And Governance: Islamic Finance And ESG: Sharia-Compliant Instruments Can Put The S In ESG

COVID-19 has significantly slowed core Islamic finance economies because of their governments' measures to combat the spread of the virus. Unemployment rates will rise as some companies see significant revenue reduction. Islamic finance provides socially responsible products, and the current environment could offer the possibility to leverage them.

—Read the full report from S&P Global Ratings

Collapse in global energy investment risks slowing transition, create supply shortage: IEA

Global energy investment is expected to plunge by 20%, or almost $400 billion, in 2020 as the COVID-19 crisis risks slowing the world's transition to cleaner and sustainable energy systems, said the International Energy Agency on May 27. Through a combination of falling demand, lower prices and a rise in non-payment of bills, world energy revenues flowing to governments and industry are set to shrink by well over $1 trillion this year, according to IEA's World Energy Investment 2020 report.

—Read the full article from S&P Global Platts

Southern targets net-zero emissions by 2050, stops short on more actions

Southern Company formally revamped its carbon-reduction strategy to target net-zero emissions by 2050, but the utility's management held back from promising more aggressive actions on renewables and fossil fuels. During the company's annual meeting held virtually on Wednesday, Southern Chairman, President and CEO Tom Fanning announced the new zero-emissions goal, which will apply to its electric subsidiaries Georgia Power, Alabama Power and Mississippi Power and to its natural gas operations, such as Southern Company Gas. The utility still aims to reduce emissions by 50% by 2030, though Fanning said the company could meet that goal by 2025.

—Read the full article from S&P Global Platts

Oil prices fall as focus turns to OPEC+ consensus

Crude futures fell Wednesday as the focus turned to a lack of consensus among OPEC+ members ahead of the group's next meeting on June 8-10. NYMEX July crude settled at $32.81/b, down $1.54, while ICE July Brent settled at $34.74/b, down $1.43. "Oil's rally stalled out after Russia signaled they want to unwind productions in July, a sign that the battle for market share will resume as crude demand improves," said OANDA analyst Edward Moya. "Russia's comments on easing cuts in July served as a reminder that higher prices and improved crude demand will likely see OPEC+ compliance go out the window."

—Read the full article from S&P Global Platts

Oil is down but not out: signs of recovery as lockdowns ease

Giant pillars holding up oil markets have suffered cracks since the COVID-19 pandemic sent shockwaves through the global economy. Demand has collapsed and prices have tumbled, but there are reasons to believe the worst of these tremors have passed. Crude has survived the seismic shock waves and can fuel the recovery. Dated Brent – the physical benchmark used to price two-thirds of the world’s oil – has more than doubled in value since hitting a 21-year low in April. The measure of high-quality North Sea crudes is now trading at around $34/b, enough to keep the industry functioning. Prices have recovered as major consuming nations begin to ease lockdowns and producers reduce supplies to rebalance wobbly markets. The feared exhaustion of global storage capacity, which briefly contributed to some niche headline US inland oil prices turning negative last month, has abated. VLCC freight rates have fallen back to around $50,000 per day, from a peak of $200,000 per day this year at the height of the crisis as storage demand as eased.

—Read the full article from S&P Global Platts

Listen: A slow recovery for global petrochemical markets

S&P Global Platts market specialists Kevin Allen, Lara Berton, and Eric Su, give a global view on petrochemical markets dealing with the consequences of the recent oil price crash and the coronavirus pandemic, with particular focus on olefins, polymers and aromatics.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language