Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 May, 2020

By S&P Global

Even as signs of normalization from the coronavirus-caused economic downturn sprout across certain countries and sectors, the pandemic is pressuring regional banking sectors as they balance declining asset quality and creditworthiness with increasing demand for commercial and consumer lending.

Downside risks remain high for banks in emerging markets. S&P Global Ratings believes the pandemic could affect these banks through their deteriorating asset quality, heavy dependence on external funding, a lack of government capacity to extend support, and a heightened likelihood of political or social tensions. Actions taken by central banks across different regions are helpful, but generally don’t reduce credit risk on banks' balance sheets. Most emerging market banks are likely to remain profitable this year, but following several rating actions and Banking Industry Country Risk Assessment changes in recent weeks, approximately one-third of emerging market banks S&P Global Ratings rates now have a negative outlook.

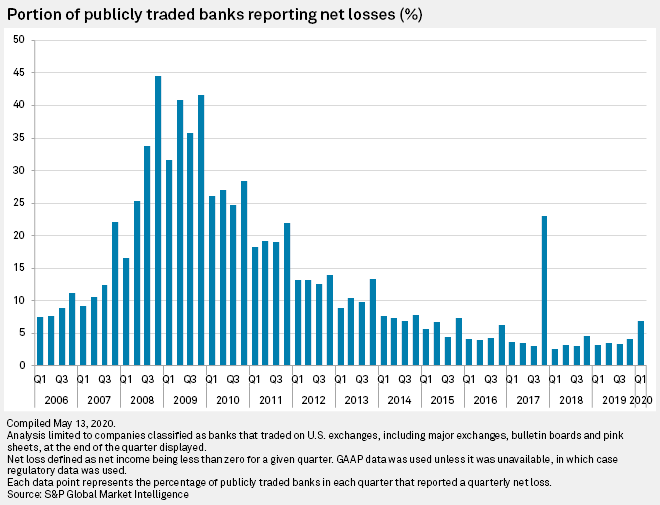

Comparatively, 41 publicly traded U.S. banks (or 7%) reported a net loss in the first quarter, the highest percentage to do so since the fourth quarter of 2017, according to S&P Global Market Intelligence. The largest bank to report a net loss during the first quarter was Texas-based Comerica Inc., which holds $76.34 billion in assets and reported $65 million in lost profits, largely driven by a $411 million provision for credit losses and up from a reserve release of $13 million a year ago.

This is largely because many U.S. banks built up their cash reserves prior to the pandemic. Analysts believe that a recovery in the second half could turn those reserves into profits, after loan-loss provisioning dents banks’ earnings in the first half.

"Banks did a good job of getting ahead of it and proactively building reserves," Brady Gailey, an analyst with Keefe Bruyette & Woods, told S&P Global Market Intelligence. "I would not expect a lot of these banks to report full-year losses."

Because the 2018 international financial reporting standard IFRS 9 requires banks to assert a forward-looking perspective and apply macroeconomic forecasts when estimating expected credit losses, Nordic banks’ first quarter results showed varying expected loan losses, which made it difficult for analysts to assess how vulnerable they are to the pandemic.

"The consequence will be deviations in the numbers. It will mean that two banks with the same portfolio may have different [expected credit loss] provisions," Anders Torgander, a financial services partner at KPMG in Sweden, told S&P Global Market Intelligence. "On top of that, the banks had so little time to deal with this when preparing this year's Q1 reports. So on the basis of published Q1 reports, it's a bit difficult to interpret how the different banks think different parts of their portfolios will be affected in the long term."

Asian banks are operating under a similar, yet stronger, uncertainty.

As the pandemic prompts business to slow or stop entirely, the severe increase in loan-loss provisions will weigh more heavily on Japanese banks. S&P Global Market Intelligence reported that the country’s three megabanks— Sumitomo Mitsui Financial Group Inc., Mizuho Financial Group, and Mitsubishi UFJ Financial Group—anticipate a combined ¥1.1 trillion ($10.2 billion) in loan-loss provisions for this fiscal year, up from last fiscal year’s ¥565.3 billion ($5.3 billion). Increasing loan defaults due to corporates’ filing for bankruptcy are straining the country’s megabanks, which have long struggled in Japan with ultra-low interest rates and modest loan growth.

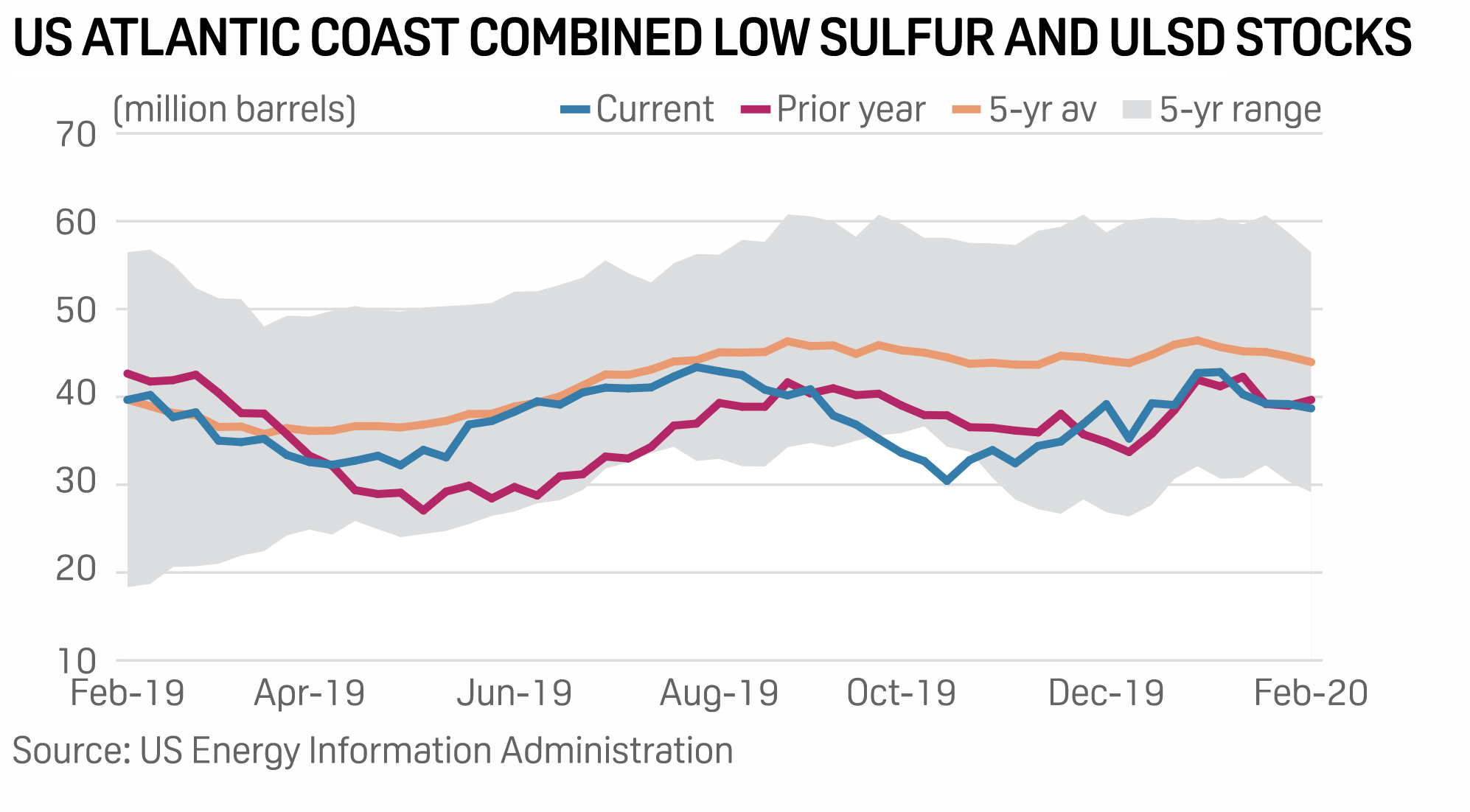

Major banks in Singapore face loan-loss risks after at least four commodities traders in the city-state were put under receivership or judicial management by their creditors earlier this year when April’s oil price crash stimulated fierce financial failures and exposed allegedly fraudulent practices, ensnaring Singapore’s commodities sector in scandal, according to S&P Global Platts. Analysts believe continued volatility in the global oil market, with or without a slow recovery for the overall global economy from the pandemic’s fallout, will unleash additional rising loan losses for the banks due to their exposure to the sector.

As part of China’s efforts to help support borrowers with weak credit profiles during the economic slowdown, the Chinese government encouraged the country’s large commercial banks to increase their lending to small businesses by more than 40% this year from last year, S&P Global Market Intelligence reported.

Today is Wednesday, May 27, 2020, and here is today’s essential intelligence.

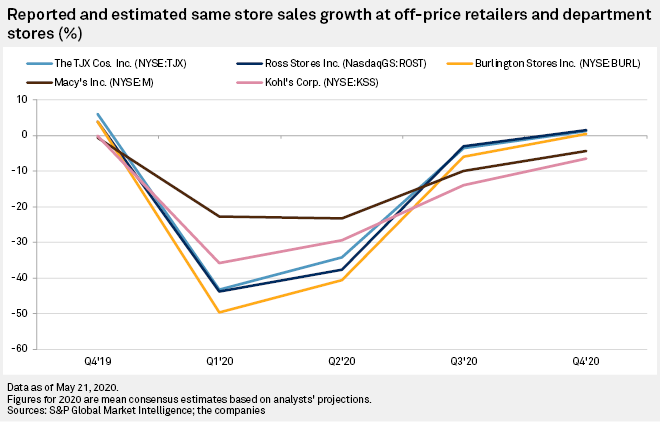

Off-price could become bright spot for retail industry as stores reopen

An economic downturn and a glut of apparel and accessories are setting the stage for off-price retailers to recover faster from coronavirus-led closures than other retail sectors. Like many retailers, The TJX Cos. Inc., Ross Stores Inc. and Burlington Stores Inc. have seen their sales suffer this spring as their stores have remained closed. But the companies, which bill themselves as offering better value than department stores and stock their racks using inventory off-loaded by full-price retailers and brands, stand to bounce back more quickly as states ease restrictions on movement and businesses. Millions of consumers are looking to spend less on clothing and other home goods in the current climate. Meanwhile, off-price retailers have their pick of apparel inventory as stores reopen; many department stores and brands missed weeks of sales key for selling spring and summer collections that are close to being out-of-season, if they are not already, and are now turning to off-price outlets as one avenue for liquidating the inventory quickly.

—Read the full article from S&P Global Market Intelligence

A Bumpy Recovery Is Ahead For Hospitals And Other Health Providers As Non-Emergent Procedures Restart

The COVID-19 crisis is disrupting the health care system like it has never been disrupted before. Hospitals and all other health service providers were hit with this disruption with lightning speed, forcing the industry to learn in real time how to handle a situation for which there was no playbook. With no precedent to look back on, and with so much uncertainty and risk, investors are struggling to assess their holdings. S&P Global Ratings is taking a measured approach to try to distinguish those credits experiencing relatively short-term stress that are expected to ultimately show recovery, from those that may experience higher levels of stress with a less favorable outcome. S&P Global Ratings expects that our view on which credits will recover and of the pace and extent of their recovery will change as we get a better picture of what the post-pandemic environment will look like.

—Read the full report from S&P Global Ratings

Credit FAQ: A Surprise Test For China Offshore Bonds With Keepwell Deeds

The bankruptcy of Peking University Founder Group (PUFG; unrated) earlier this year has thrown up a surprise test for keepwell deed structures for Chinese offshore bonds. In sorting through the claims, PUFG's state-appointed administrator has included offshore bonds directly guaranteed by the China state-owned conglomerate. The administrator has not, however, recognized the offshore bonds backed by keepwell deeds. So while guaranteed offshore bondholders can participate in the restructuring process, with the hope of getting some return on their investment, the claims from the keepwell-deed bonds are still pending. The liquidators have requested additional documentation and S&P Global Ratings believes a decision on their legality could take several months. If they decide against the keepwell claims, this could have negative implications for the outstanding keepwell bonds.

—Read the full report from S&P Global Ratings

VIX Back to Normal? Not Really

The U.S. equities market had a wild start in 2020. Following the March 2020 sell-off, the S&P 500® posted its largest monthly gain (12.8%) since 1987. Meanwhile, VIX® went from its long-term median to an all-time high within a month before it settled around 30. One thing that has been debated lately is whether VIX, often referred to as the “fear gauge,” has gone back to normal and indicates that the market has hit the bottom. To answer this question, S&P Dow Jones Indices investigates several aspects of VIX and its related trading activities.

—Read the full article from S&P Dow Jones Indices

More than 40 US banks post net losses in Q1

Dozens of banks reported net losses in the first quarter, many because they opted to build their reserves by the millions ahead of any pandemic fallout. Forty-one publicly traded banks reported a net loss in the first quarter, representing 7.0% of banks. It was the highest percentage of money-losing banks since the 2017 fourth quarter when tax cut legislation forced the write-down of significant deferred tax assets.

—Read the full article from S&P Global Market Intelligence

Japanese megabanks brace for another tough year as bankruptcies rise

A sharp increase in loan-loss provisions is set to hit the earnings of Japan's largest lenders in the fiscal year ending March 2021 as more bank loans may turn sour while the pandemic slows or shutters businesses. Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. expect double-digit net profit declines for the current fiscal year, while Mitsubishi UFJ Financial Group Inc. projects a modest single-digit increase in its bottom-line largely due to an absence of one-time valuation losses on its overseas investments. The three megabanks expect loan-loss provisions for this fiscal year to rise to ¥1.100 trillion combined, up from ¥565.25 billion in the prior fiscal year.

—Read the full article from S&P Global Market Intelligence

Banks In Emerging Markets 15 Countries, Three COVID-19 Shocks

About one-third of banks S&P Global Ratings rates in emerging markets now have a negative outlook following several rating actions and Banking Industry Country Risk Assessment changes in recent weeks reflecting the shift in their operating environment as a result of the COVID-19 pandemic. S&P Global Ratings sees three channels through which COVID-19 could affect EM banks: deteriorating asset quality; heavy dependence on external funding; or, third, a lack of government capacity to extend support, weaker governance, or heightened likelihood of political or social tensions. In S&P Global Ratings’ view, the current shock will affect profitability rather than capital. Profitability in most EM bank systems will decline in 2020 on higher cost of risk and weaker interest revenues.

—Read the full report from S&P Global Ratings

Spanish hydro power stocks edge higher despite lower rainfall

Spanish hydro power stocks rose slightly to 16.1 TWh in Week 21, or 69% of capacity, despite lower rainfall as the replenishment period draws to a close, environment ministry data showed Tuesday. Hydro stocks usually begin their seasonal decline during Week 22, with the exception of stocks in 2018 which rose until Week 24 due to heavy rainfall caused by storms.

—Read the full article from S&P Global Platts

Danish companies plan 1.3-GW green hydrogen project to fuel transport

Leading Danish companies said Tuesday they have formed a green hydrogen partnership to develop an industrial-scale electrolysis-based production facility to produce sustainable fuels for road, maritime and air transport in the Copenhagen area. The companies are: Orsted, A P Moller-Maersk, DSV Panalpina, DFDS, SAS and Copenhagen Airports. The plan comes a day before the European Commission is to unveil proposals for a green recovery program focused on renewables and sustainable production of hydrogen.

—Read the full article from S&P Global Platts

Alliant to buy six solar projects as part of 1,000-MW solar buildout

Alliant Energy said Tuesday it will buy six solar projects from four developers that will have combined capacity of 675 MW and be located in rural Wisconsin. The acquisitions, expected to cost $900 million, are the first phase of a previously announced 1,000-MW solar build-out by 2023, the Madison-based utility holding company said in a statement. It said it has filed a Certificate of Authority application with the Public Service Commission of Wisconsin to "acquire and advance" the six projects.

—Read the full article from S&P Global Platts

Oil majors promise to maintain clean energy push despite pandemic

The heads of the world's largest oil and gas producers pledged Tuesday to maintain a strategic focus on producing cleaner energy and helping to mitigate climate change despite reeling from the impact of the coronavirus pandemic on oil and gas prices. Noting "concerns" that the coronavirus crisis could push oil and gas companies and governments to delay climate action, the industry-led Oil and Gas Climate Initiative said it is dedicated to maintaining this mission to help "combating the climate challenge".

—Read the full article from S&P Global Platts

Cut methane leaks to survive in low CO2 world, IEA warns gas sector

The natural gas sector must cut emissions of potent greenhouse gas methane to stay relevant in a low-carbon world, International Energy Agency senior energy analyst Christophe McGlade said Tuesday. Energy is the second largest source of methane emissions globally, with oil and gas operations responsible for around 82 million mt in 2019, McGlade told a Eurogas webinar. It was already an "uphill battle" making an argument for using natural gas in a decarbonizing energy system, he said.

—Read the full article from S&P Global Platts

Researchers, oil industry team up to test 'next level' methane emissions sensors

Continuous methane emission sensors could help the oil and gas industry more effectively limit unintended leaks, and the University of Texas at Austin is spearheading a project to evaluate the technology's viability and durability. Project Astra will test various sensor technologies on Permian Basin oil and gas sites in West Texas and assess the amount of expected and unintended methane emissions in the area, according to David Allen, the project's lead investigator and director of the university's Cockrell School of Engineering's Center for Energy and Environmental Resources. Once researchers collect their data, they plan to create a network of sensors that could be deployed on a wide scale to constantly monitor the greenhouse gas emissions from oil and gas operations. The university is working in conjunction with the Environmental Defense Fund, ExxonMobil, Pioneer Natural Resources Co. and the Gas Technology Institute on Project Astra, according to a news release. The industry has faced increasing pressure to limit methane emissions, which have a significantly stronger climate-warming effect than carbon dioxide.

—Read the full article from S&P Global Market Intelligence

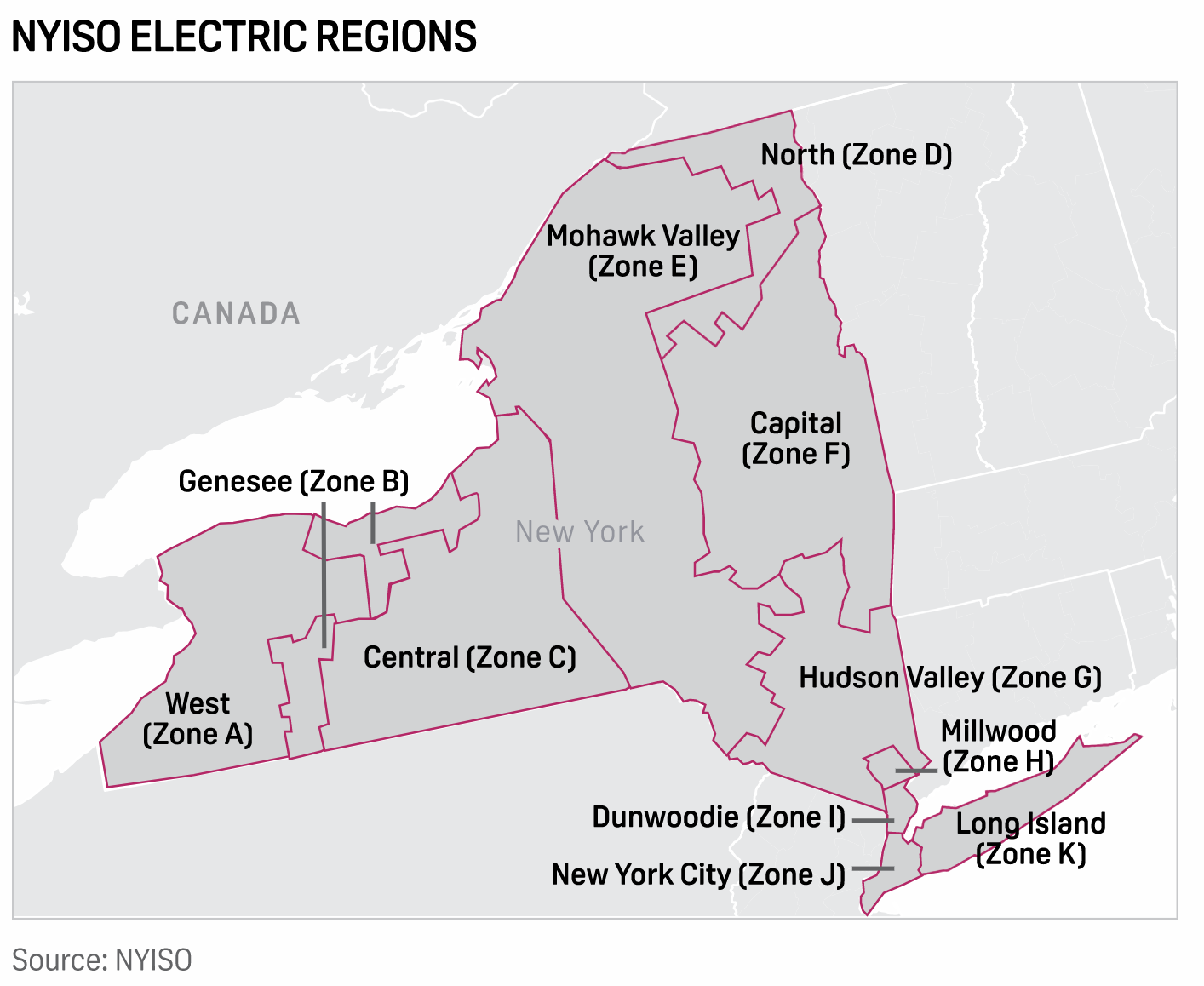

Pandemic pulls NY power prices down further from already-low 2019 levels

The New York Independent System Operator's 2019 power markets saw the lowest energy prices in the past decade as natural gas prices fell up to 41% and average load decreased to over decade-lows on mild weather, energy efficiency and behind-the-meter solar output. The coronavirus pandemic has pulled prices down 45% from the same period last year. The NYISO markets performed competitively in 2019, Potomac Economics, the market monitor, said in a presentation covering the results of its 2019 State of the Market report to be discussed at a Wednesday Management Committee meeting and posted to the grid operator's website.

—Read the full article from S&P Global Platts

Crude hits 10-week high as economic restarts prompt demand optimism

Crude futures settled higher amid signs that the continued reopening of economies in the US and Europe could bring balance to oversupplied oil markets in coming weeks. NYMEX July WTI settled $1.10 higher at $24.35/b and ICE July Brent climbed 64 cents on the day to finish at $36.17/b. Front-month WTI and Brent was last higher on March 10. Oil demand outlooks continue to improve as more state and local governments ease restrictions on non-essential travel and trade aimed at slowing the COVID-19 coronavirus pandemic.

—Read the full article from S&P Global Platts

Shut-in, even new wells may be attractive at $30s/b WTI: analysts

NYMEX crude futures have risen above the $30/b level that represents breakeven for many US upstream operators, which could result in some restoration of shut-in wells soon as the economic scourge of the global coronavirus pandemic begins to subside. Front-month crude futures have only been trading above $30/b for the past six trading days, since May 18. However, NYMEX crude contracts out along the curve have been holding there for longer. The December contract, for instance, briefly dipped below $30/b in late April, but has since risen to trade above $36/b Tuesday.

—Read the full article from S&P Global Platts

EU power CEOs see slow recovery from low prices, demand slump

European power prices and demand could take up to five years to recover to pre-coronavirus pandemic lockdown levels, according to UK power utility SSE's CEO Alistair Phillips-Davies. A mild, wet and windy winter, combined with demand drops from the pandemic lockdowns, has crashed European power prices, making utilities cautious about their future spending.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language