Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 May, 2020

By S&P Global

As all 50 U.S. have relaxed their coronavirus-containment measures—to varying degrees—the international community is watching the world’s biggest economy as it reignites activity.

In nine weeks, a total of 38.6 million Americans filed for unemployment benefits—with 2.4 million people submitting applications in the week ended May 16, according to the U.S. Labor Department. The unemployment rate in April skyrocketed to 14.7%, up 11 percentage points, while the eurozone’s rose only 0.1 point, to 7.4%. S&P Global Ratings believes that Europe’s unemployment level during the pandemic has been contained by the deployment of extensive short-time work programs in the region's largest economies as an alternative to massive layoffs. Comparatively, the U.S. government’s Coronavirus Aid, Relief, and Economic Security (CARES) Act aims to provide additional support to unemployed Americans through insurance and one-time payments.

The U.S. Congressional Budget Office projects that the widespread shutdowns and closures to fight the coronavirus pandemic will push the U.S. economy to contract an annualized 37.7% in the second quarter. The agency expects economic activity to rebound in the second half of this year.

"In the second quarter, the number of people employed will be almost 26 million lower than the number in the fourth quarter of 2019," the CBO wrote in its May 19 report, forecasting that unemployment will increase to 15% in the second and third quarters, then fall to 11.5% in the fourth quarter. The CBO stated that the continuation of social-distancing measures will keep economic activity and labor market conditions "suppressed for some time."

Pharmaceutical sales are dropping as elective procedures and physician office visits decline alongside delays in testing and diagnosis. S&P Global Market Intelligence reported that AmerisourceBergen Corp., Cardinal Health Inc., and McKesson Corp.—the U.S.’s top healthcare distributors—all reported below-average revenue in April after an uptick of pharmaceutical sales in the previous month. The distributors are preparing for the eventual introduction of a coronavirus vaccine.

While unemployment remains high and there have been only modest improvements for retail, leisure, travel, restaurants, and hospitality providers, some economic data signal that the economy may be on the mend. Driving, walking, the visiting of parks, and other mobility is increasing as states lift restrictions, new business applications and mortgage applications are appearing, and consumer confidence seems to have stabilized, according to S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino.

Still, the pandemic is disproportionately affecting communities of color in the U.S. and shining a stronger spotlight on the intersections of race, health, and socioeconomic inequality. Research by the non-partisan organization APM Research Lab shows that “the latest overall COVID-19 mortality rate [through May 19] for black Americans is 2.4 times as high as the rate for whites and 2.2 times as high as the rate for Asians and Latinos,” noting that if Americans of color died of COVID-19 at the same rate as white Americans, “about 12,000 black Americans, 1,300 Latino-Americans, and 300 Asian-Americans would still be alive.” The research, which analyzed race and ethnicity of individuals that died due to coronavirus in Washington, D.C. and 40 states with such aggregated information available, found that black Americans are dying more than any other race, at a rate of 50.3 per 100,000.

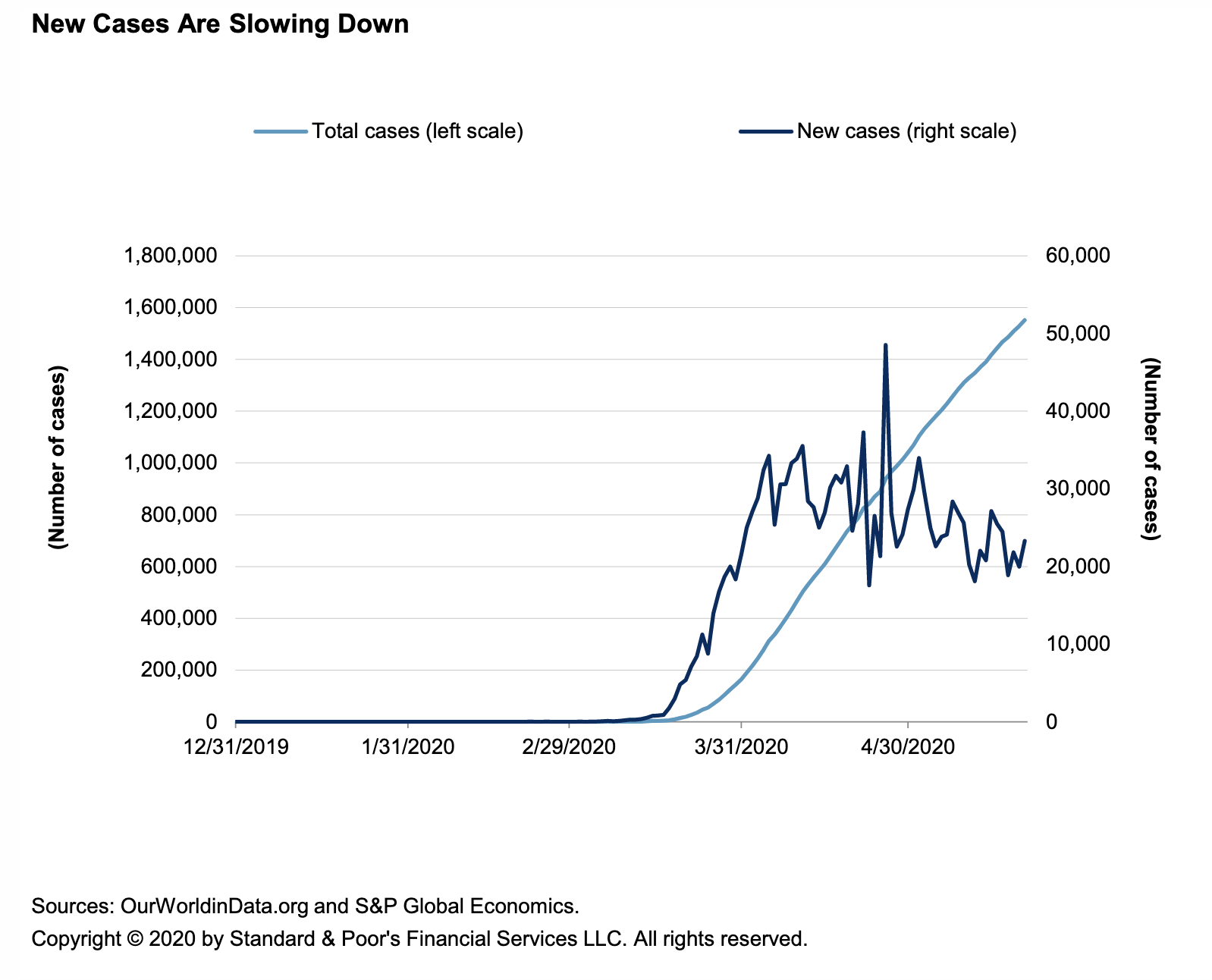

Of the more than 5 million confirmed cases of coronavirus worldwide, more than 1.5 million are in the U.S., where nearly 95,000 people have died, according to Johns Hopkins University data. Experts believe the real numbers are much higher. Although the latest daily death totals are lower than at the beginning of this month, yesterday marked the country’s highest death toll in a week.

The U.S. Centers for Disease Control released long-awaited guidelines on reopening schools, businesses, and other entities on May 19. S&P Global Market Intelligence reported that a recent Associated Press and University of Chicago NORC Center for Public Affairs Research poll found that 83% of Americans feel at least somewhat concerned that lifting social-distancing restrictions would lead to additional COVID-19 infections, with 54% of responders saying they were very or extremely concerned.

Today is Friday, May 22, 2020, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Economic Data Hints At Signs Of Improvement From Recent Lows

Real-time high-frequency economic data for the U.S. is hinting that the lockdown-led plunge may now be behind us and that normalization has begun. As restrictions on economic and social activities are gradually lifted, mobility is on the rise, new business applications and mortgage applications have bounced, and consumer confidence appears to have found a bottom. Still, unemployment claims remain uncomfortably high, but are ebbing. Activities directly affected by social distancing--retail, recreation, leisure, traveling, restaurants, and hospitality--are off their lows, but have improved only modestly.

—Read the full report from S&P Global Ratings

U.S. Dollar Liquidity Returns, Selectively, To Asia

The tide of U.S. dollar liquidity is flowing slowly back to Asia. That flow seems to benefit mainly the larger, financially stronger companies or those with government ownership, but S&P Global Ratings is now seeing early signs of a reopening to select speculative-grade Chinese developers. However, swathes of issuers remain locked out of fresh dollar funding, and S&P Global Ratings expects this market will be split between haves and have nots until there is greater visibility on post-COVID conditions.

—Read the full report from S&P Global Ratings

Decamping Factories Unlikely To Unplug China's Growth Advantage

Once the economic shock of COVID-19 passes, a broader question about China's growth trajectory will remain. Geopolitical tensions and supply disruptions threaten to accelerate the migration of manufacturing out of China. Departing producers could make it harder for the country to continue on a structural strong growth trajectory. Short of a major change of heart among economic policymakers, S&P Global Ratings believes the Chinese economy will continue to grow faster than most for many years. The country's future economic expansion remains pegged to its huge and growing domestic market, as well as many opportunities to make efficiency gains through reforms. While absolute growth rates will moderate, S&P Global Ratings believes China's economic performance will continue to be a key sovereign credit support.

—Read the full report from S&P Global Ratings

Low-debt Asia-Pacific economies well-placed to weather coronavirus

Many economies in Asia-Pacific have built strong buffers of reserves and their central banks still have room to ease further, giving them a better chance to weather the coronavirus pandemic, economists said. The starting point for public debt and fiscal deficit in Asia is "favorable" as the debt-to-GDP ratio is generally more manageable, ranging between 30% and 55% for most economies except India and Japan, said Govinda Finn, Japan and developed Asia economist at Aberdeen Standard Investments. That "implies the public sector still has room to lever up. The starting point of fiscal deficit is also manageable, with most Asian economies except China and India running deficits no more than 3.5% of GDP in 2019," Finn said in emailed comments.

—Read the full article from S&P Global Market Intelligence

TikTok user growth and US strategy spur ByteDance IPO amid regulatory scrutiny

Despite ongoing regulatory scrutiny in the U.S., TikTok Inc.-owner Beijing Byte Dance Telecommunications Co. Ltd. is well placed for an initial public offering following a boost in popularity and organizational changes, experts told S&P Global Market Intelligence. The Chinese internet technology company was planning to list in Hong Kong this year, according to media reports. ByteDance declined to comment when contacted by this news service. While the TikTok parent is working to resolve regulatory concerns in the U.S., its video-sharing social network has seen huge growth in the country and elsewhere, meaning a later, 2021 IPO is possible, analysts said. The Chinese company, which was valued at about US$75 billion during a funding round in August 2018, is now reportedly valued between US$105 billion and US$110 billion, based on recent secondary market trades.

—Read the full article from S&P Global Market Intelligence

COVID-19 could prolong Google, Fitbit's 'complex' EC review

The already complex European Commission review of Google LLC's proposed acquisition of Fitbit Inc. could be delayed by logistical challenges posed by the coronavirus, lawyers said. The $2.1 billion deal, announced Nov. 1, is conditional on merger control approval from authorities in the U.S., Europe and Australia. It has been notified in the U.S. — where it has reportedly been subject to a second request from the Department of Justice — but is yet to be filed with the EC.

—Read the full article from S&P Global Market Intelligence

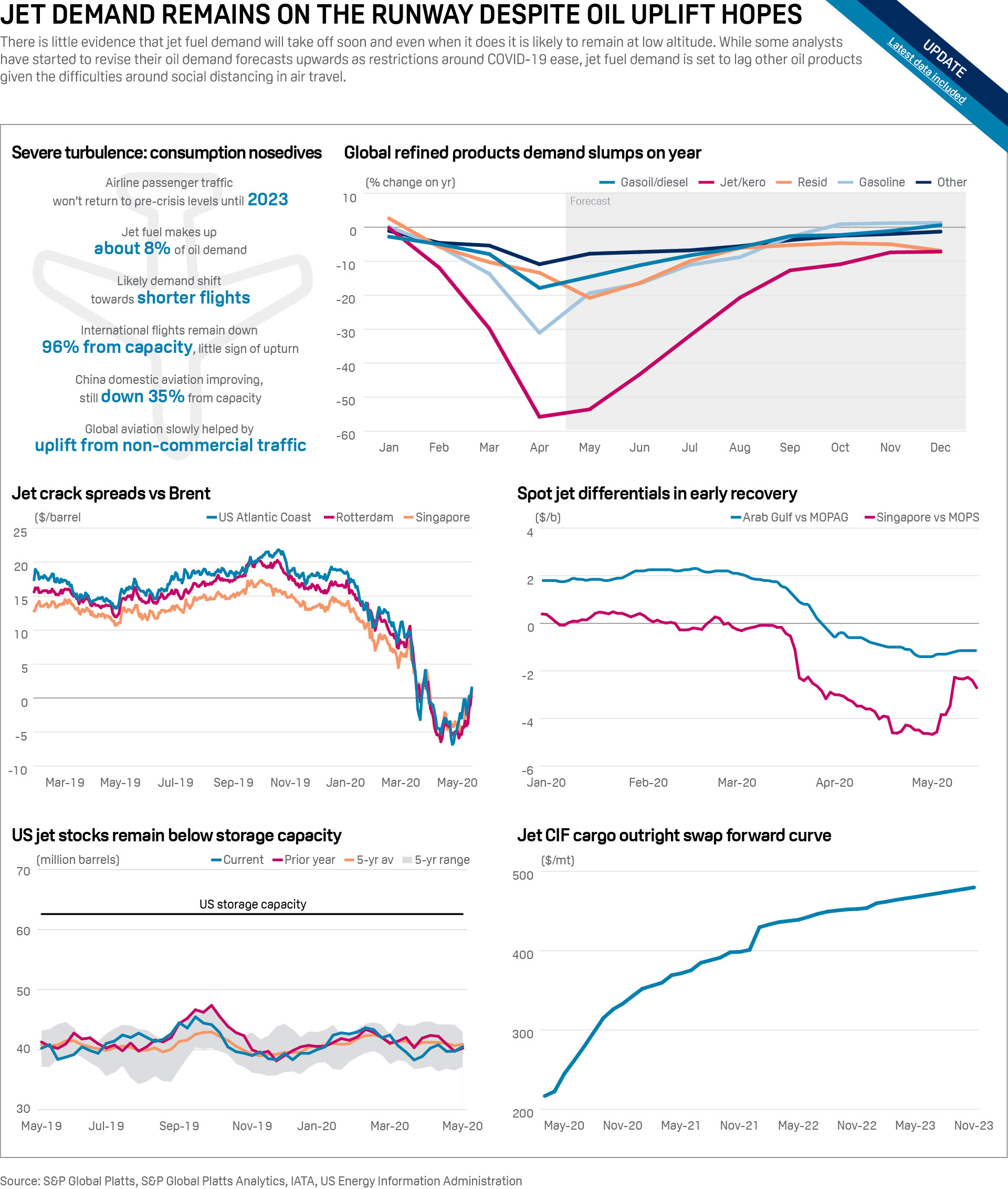

Jet demand remains on the runway despite oil-uplift hopes

There is little evidence that jet fuel demand will take off soon and even when it does it is likely to remain at low altitude. While some analysts have started to revise their oil demand forecasts upwards as restrictions around COVID-19 ease, jet fuel demand is set to lag other oil products given the difficulties around social distancing in air travel.

—Read the full article from S&P Global Platts

Global oil demand recovery constrained more by economy than fuel switching: BP's Dale

Global oil demand may struggle to fully bounce back from the COVID-19 pandemic any time soon but will likely be constrained more by the pace of economic recovery than a sudden slide in the world's dependence on fossil fuels, according to BP's chief economist Spencer Dale. Even when global lockdowns to contain the pandemic are lifted, some market watchers have speculated that a shift to more home-based working, a sharp drop in business travel and other permanent changes in energy use will result in a major hit to near-term oil demand.

—Read the full article from S&P Global Platts

Gasoline is driving US oil demand as Memorial Day holiday looms, just how much is unclear

As the Memorial Day holiday weekend draws near, the allure of beaches, boardwalks and lakes is likely to be greater than ever for many Americans quarantined by the coronavirus pandemic. But exactly how many Americans will take to the road for a holiday that typically sees an increase in drivers' mileage is unclear. As is exactly how far they will travel. Predicting traffic volumes is so difficult that travel club AAA will not – for the first time in 20 years – issue its usual Memorial Day forecast on to how many people will be traveling over the holiday weekend because it believes the accuracy of the data has been undermined by the pandemic.

—Read the full article from S&P Global Platts

FEATURE: Argentina oil production may take years to recover despite $45/b reference price

Argentina's move to set a $45/b domestic crude oil reference price this week has brought cheer to some oil producers, but analysts say it may take a couple of years to rebuild production, following its plunge in April, as companies keep to the sidelines because of the country's financial crisis and erratic energy policies. The reference price will remain in effect until the end of the year, unless Brent, the international benchmark price followed in Argentina, surpasses $45/b for more than 10 days. That may not happen this year; Brent is expected to average $35/b, according to Moody's Investors Service.

—Read the full article from S&P Global Platts

Analysis: China's May key oil product exports set to fall to multi-year low

China's total exports of three key oil products – gasoline, gasoil and jet fuel – are expected to fall to a multi-year low, possibly below 2 million mt in May amid negative export margins, refining sources and analysts said this week. China's export of these three oil products had stood at over 2 million mt/month since August 2015 and rose rapidly to an average of 4.61 million mt/month in 2019, data from the General Administration of Customs showed.

—Read the full article from S&P Global Platts

INTERVIEW: Jefferies' LaFemina says 'new normal' in metals markets will take time

Significant volatility in metals markets will continue until we get to a "new normal" following the COVID-19 markets crisis and this will take time worldwide, despite encouraging progress in China, Christopher LaFemina, managing director for global metals and mining equity research at investment bank Jefferies LLC, said in an interview with S&P Global Platts. Some markets in China are now seeing "something more like a V-shape recovery rather than the dreaded L or U shape recovery," LaFemina told Platts reporters in an interview this week, noting that China's April industrial production was actually up on the year, and its fixed asset investment growth and property markets are beginning to reaccelerate.

—Read the full article from S&P Global Platts

The Essential Podcast, Episode 10: Resilience in the Face of Risk – Coronavirus and Climate Change

Steven Bullock, Head of Research at Trucost, joins The Essential Podcast to discuss the benefits of resilience in the face of risk and reasons for hope and caution on issues of climate change and carbon in a restarting global economy. Listen and subscribe to The Essential Podcast on Spotify, Apple Podcasts, Google Podcasts, Deezer, and our podcast page.

—Listen to this episode of The Essential Podcast, from S&P Global

Clean energy groups sidestep brunt of coronavirus impact

Green has proven to be gold in the coronavirus pandemic, at least when it comes to power generation. Europe's largest renewable utilities escaped the early stages of the crisis largely unscathed during the first quarter, reporting solid profits and little business impact while some of their dirtier and more diversified competitors suffered. Although the period included only the first glimpse of nationwide lockdowns, which continued throughout April and into May, Denmark's Ørsted A/S, Spain's Iberdrola SA and other renewable-focused utilities showed greater resilience in their financial performance, although some companies with retail arms and other operations still registered a hit. "Renewable developers remain more resilient than conventional power generators, especially nuclear and coal, and energy suppliers," Elchin Mammadov, an analyst at Bloomberg Intelligence, said in an email.

—Read the full article from S&P Global Market Intelligence

EC's draft green recovery plan sets out RES, hydrogen stimulus

Massive new funding for renewables, sustainable hydrogen, networks and electric cars are at the heart of energy actions in the European Commission's draft green recovery plan, according to a leaked draft document made available by the Euractiv news agency. The European Commission is working on a package of measures to help EU economies recover from the coronavirus pandemic. The stimulus package, reportedly providing around Eur1 trillion ($1.1 trillion) of support across all sectors, is due to be presented on May 27. On a public holiday in Brussels Thursday, no EC spokesperson was immediately available to confirm the authenticity of the document. The draft document details plans for an EU tender scheme for 15 GW of renewables over the next two years, with Eur10 billion ($11 billion) of EIB co-financing to support member state projects.

—Read the full article from S&P Global Platts

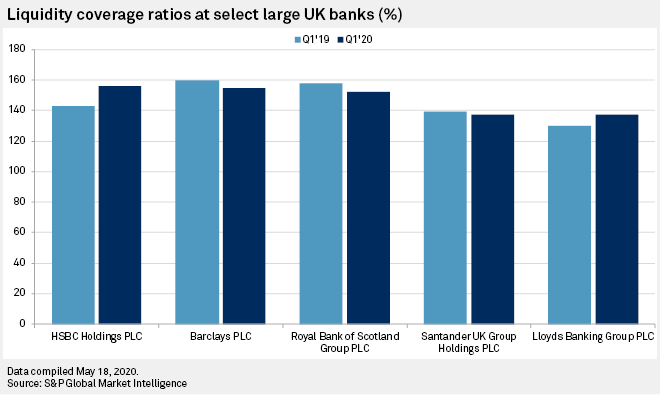

Britain's banks under pressure as mortgage payment holidays start to bite

British banks may end up extending existing mortgage payment holiday schemes to a year, even as one in seven mortgages in the U.K. are now subject to such an exemption, potentially affecting bank liquidity. The government said in March that banks were required to grant temporary reprieves on mortgage repayments to help families struggling financially during the coronavirus crisis. Existing payment holidays are due to expire in June or July, and the U.K. Financial Conduct Authority is considering extending them for a year or more, according to The Times. Sources talking to the Financial Times said Chancellor Rishi Sunak is in advanced talks with the regulator to extend the scheme.

—Read the full article from S&P Global Market Intelligence

Credit Suisse, UBS will have edge over European peers in Q2 after strong Q1

UBS Group AG and Credit Suisse Group AG reported strong first-quarter results despite the coronavirus crisis, and analysts predict the Swiss pair will continue to outperform European peers in the second quarter due to their wealth management businesses and their room for maneuver on costs. With 75% and 40% year-over-year jumps in first-quarter net income, Credit Suisse and UBS pulled in €1.23 billion and €1.45 billion, respectively. HSBC Holdings PLC's net income dropped 51%, while Barclays PLC and BNP Paribas SA posted declines of 32% and 33%, respectively. Strong securities trading revenues and lower loan loss provisions than peers were the main drivers, but even if capital market volatility abates and provisions increase, the Swiss banks are generally seen as more resilient than others in Europe.

—Read the full article from S&P Global Market Intelligence

Unfortunate timing: Some PE fund vintages will be hit much harder by COVID-19

Of all live private equity funds, 2016 to 2018 vintages and those that began investing seven to 10 years ago could be the greatest casualties of the coronavirus crisis in performance terms, according to market sources. The first group may incur deep net asset value reductions this year, assuming the worst of the economic crisis occurs in 2020, according to recent analysis of European leveraged buyout funds conducted by alternative assets software provider eFront SA.

—Read the full article from S&P Global Market Intelligence

Tidal wave of investment-grade bond issuance, prompted by Fed, rolls on

U.S. policy responses to the COVID-19 pandemic remain a lightning rod for debate, but there is little ambiguity regarding the effectiveness, implicit or otherwise, of the liquidity backstops the Federal Reserve erected two months ago to stabilize the corporate bond markets. The tidal wave of investment-grade, or IG, bond issuance — deals rated BBB–/Baa3 or higher — since the Fed announced those facilities has swept away prior records and continues apace in May.

—Read the full article from S&P Global Market Intelligence

Argentine fintech Ualá sees 300% growth in payments

The coronavirus pandemic has led to a 300% increase in the payment of bills and services via Ualá, and a 40% growth in the money invested in the mutual fund available on the financial services app. Ualá claims to have the highest number of contactless credit cards in circulation in Argentina, and has issued 2 million prepaid MasterCard-branded cards. In an interview with S&P Market Intelligence, Pierpaolo Barbieri, Ualá's founder and CEO, said the company is now "fully funded" to cover growth for the next two years. That growth, he confirmed, includes new business units and a significant staff build up. The move comes as the company expects greater demand as the cornonavirus pandemic has forced Argentina into lockdown.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz. Note: The COVID-19 Daily Update will not publish on Monday, May 25 due to the U.S. Memorial Day weekend. The Update will resume on Tuesday, May 26.

Content Type

Location

Language