Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 May, 2020

By S&P Global

Whether the current crisis has set the global energy transition from fossil fuels to renewable energy into warp speed or set it back lightyears is yet to be seen—but what is certain is the notable short-term effect lockdowns have had on emissions.

Carbon emissions fell a colossal 17% in April from a year earlier, according to an international study in the journal Nature Climate Change that analyzed daily CO2 emissions from 69 countries, all 50 U.S. states, and 30 Chinese provinces--in total representing 85% of the global population and 97% of global CO2 emissions. Some nations’ emissions during the peak of April’s confinement measures decreased as much as 26% on average.

“The changes in emissions are entirely due to a forced reduction in energy demand. Although in this case the demand disruption was neither intentional nor welcome, the effect provides a quantitative indication of the potential limits that extreme measures could deliver with the current energy mix,” the report said.

By the end of this year, global emissions could decline 4.4% to 8%, according to the Nature Climate Change study. The International Energy Agency also forecast on April 30 that carbon emissions will fall an estimated 8% this year. The International Monetary Fund projected that the coronavirus-caused emissions decline this year could total 5.7%.

These decreases in CO2, while extreme, may not be permanent.

“During previous economic crises, the decrease in emissions was short-lived with a post-crisis rebound that restored emissions to their original trajectory, except when these crises were driven by energy factors such as the oil crises of the 1970s and 1980s, which led to substantial shifts in energy efficiency and the development of alternative energy sources,” the Nature Climate Change report said. “For example, the 2008–2009 Global Financial Crisis saw global CO2 emissions decline of 1.4% in 2009, immediately followed by a growth in emissions of 5.1% in 2010, well above the long-term average.”

Navigating sustainable growth, with continued reduced emissions, represents both an opportunity and a challenge as the world emerges from sheltering in place and works to recover lost economic momentum.

Some polluting behavior is already showing signs of a rebound to the levels prior to the onset of the crisis. As easing national lockdowns ease, economic and social activity restart. Traffic in Germany, the U.K., France, Italy, and Spain climbed to 61% of pre-pandemic levels last week, according to Apple data. In Germany, the region’s biggest fuel market, which in mid-April began easing lockdown restrictions, traffic had recovered to 93% of pre-pandemic levels on Sunday.

Before the coronavirus crisis began, S&P Global Platts Analytics expected global electric vehicle sales this year to slightly decline year-on-year, due almost entirely to a broader energy transition slowdown in China. Now, S&P Global Platts Analytics forecasts that global electric vehicle sales will total 1.97 million, down more than 11% from last year. Comparatively, Bloomberg New Energy Finance estimates that electric vehicle sales will fall 18%, to 1.7 million units worldwide, this year due to diminished consumer spending during the coronavirus crisis.

A total of 155 companies—representing 34 sectors, 33 countries, and a combined market capitalization of more than $2.4 trillion—including Swedish fashion retailer H&M Group, California-based technology company Salesforce, and Swiss food and drink conglomerate Nestlé, signed a statement yesterday urging global governments to align their economic recovery efforts with emissions-reduction actions.

“As countries work on economic aid and recovery packages in response to COVID-19, and as they prepare to submit enhanced national climate plans under the Paris Agreement, we are calling on governments to reimagine a better future grounded in bold climate action,” the Science Based Targets initiative statement said. “We are now urging governments to prioritize a faster and fairer transition from a gray to a green economy by aligning policies and recovery plans with the latest climate science. We must move beyond business-as-usual and work together in solidarity to deliver the greatest impact for people, prosperity, and the planet.”

Today is Wednesday, May 20, 2020, and here is today’s essential intelligence.

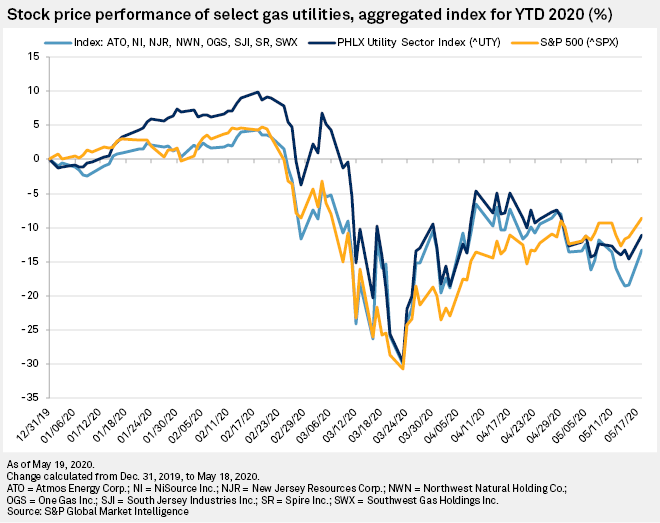

Gas utility industry looks beyond pandemic to multiyear strategic focus

Confident in their ability to weather the coronavirus pandemic, gas utilities have turned their focus to long-term strategy, executives told the financial community during a virtual gathering. That confidence stems largely from the steps the sector took to shore up its finances and processes as the pandemic was taking hold, industry representatives said during the American Gas Association's 2020 Financial Forum. AGA President and CEO Karen Harbert kicked off the event, an annual meetup that moved online following the outbreak, by outlining the trade group's three goals for navigating the outbreak and associated government restrictions and economic downturn. The first was to make sure gas utility workers were deemed essential to ensure they could move freely through their territories and access personal protective equipment from government stockpiles. Second, AGA has sought to be a conduit of information, both between the federal government and industry and among gas distributors, in order to accelerate the sector's response. Last, the organization counseled regulators and lobbied legislators during negotiations for stimulus packages, which included $900 million in new Low Income Home Energy Assistance Program funds in the Coronavirus Aid, Relief and Economic Security Act.

—Read the full article from S&P Global Market Intelligence

Feature: US ethanol producers eye uncertain future after earnings show financial damage from pandemic

Earnings for major US ethanol producers took a hit in the first quarter of 2020 as the coronavirus pandemic slashed fuel demand across the country, and the globe. Now those companies are looking ahead nervously – not unlike many other sectors – at how their post-pandemic world will be reconfigured. Valero, ADM, Pacific Ethanol, The Andersons and Green Plains Renewable Energy reported their Q1 earnings in the past two weeks. All of the company's ethanol units posted losses.

—Read the full article from S&P Global Platts

Feature: Toluene road to recovery far from clear in H2 2020

Global toluene supply and demand balances are expected to remain under pressure during the latter half of 2020 due to lower operating rates and reduced demand amid the ongoing coronavirus pandemic. Weaker pricing in benzene and derivative styrene markets, as well as soft paraxylene prices, dented chemical demand for toluene during much of the first half of the year. However, while weaker aromatics pricing is expected to persist in the second half, demand for higher-octane toluene in summer and lower product availability due to refinery run cuts may give some upside to the market.

—Read the full article from S&P Global Platts

European traffic activity continues to rebound as lockdowns ease

Traffic activity in Europe's five biggest economies rose to more than 60% of pre-pandemic levels last week, according to Apple data, as economic and social activity continues to recover in line with the easing of national lockdowns. Driving activity in Germany, the U.K., France, Italy and Spain stood at 61% of January 13 levels based on direction routing requests from May 13-17, according to Apple mobility data. European driving activity has been recovering slowly from a multiyear low in mid-March when lockdown measures were implemented across the region.

—Read the full article from S&P Global Platts

China Commodities Watch: Brave New Post-COVID World

The second quarter is likely to still be tough for China's commodities companies. S&P Global Ratings believes demand is gradually recovering but has yet to normalize, even as aggressive measures have largely contained the COVID-19 outbreak in the country. We continue to see price weakness. Oil prices have stabilized at a much lower level than was seen during the first quarter, and chemical spreads generally remain subdued. Coal and steel prices are also soft as inventories increased during the lockdown. Chinese commodities prices will likely stay soft in the second quarter amid ample inventories. S&P Global Ratings has so far revised our outlooks on about one-fifth of publicly rated Chinese commodities firms since the outbreak began. S&P Global Ratings expects a more meaningful recovery in the second half, with China's cement and steel sectors best positioned for a rebound.

—Read the full report from S&P Global Ratings

Listen: Back in black: The oil market’s way forward

After a historic collapse into negative territory, oil prices have rebounded on the backs of OPEC+ production cuts and the first glimmers of an economic recovery from the COVID-19 pandemic. Will the upward trend be sustainable? S&P Global Platts news editors examine the latest market forecasts and the dynamics influencing the OPEC+ alliance's ability to bring down the global surplus of oil.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

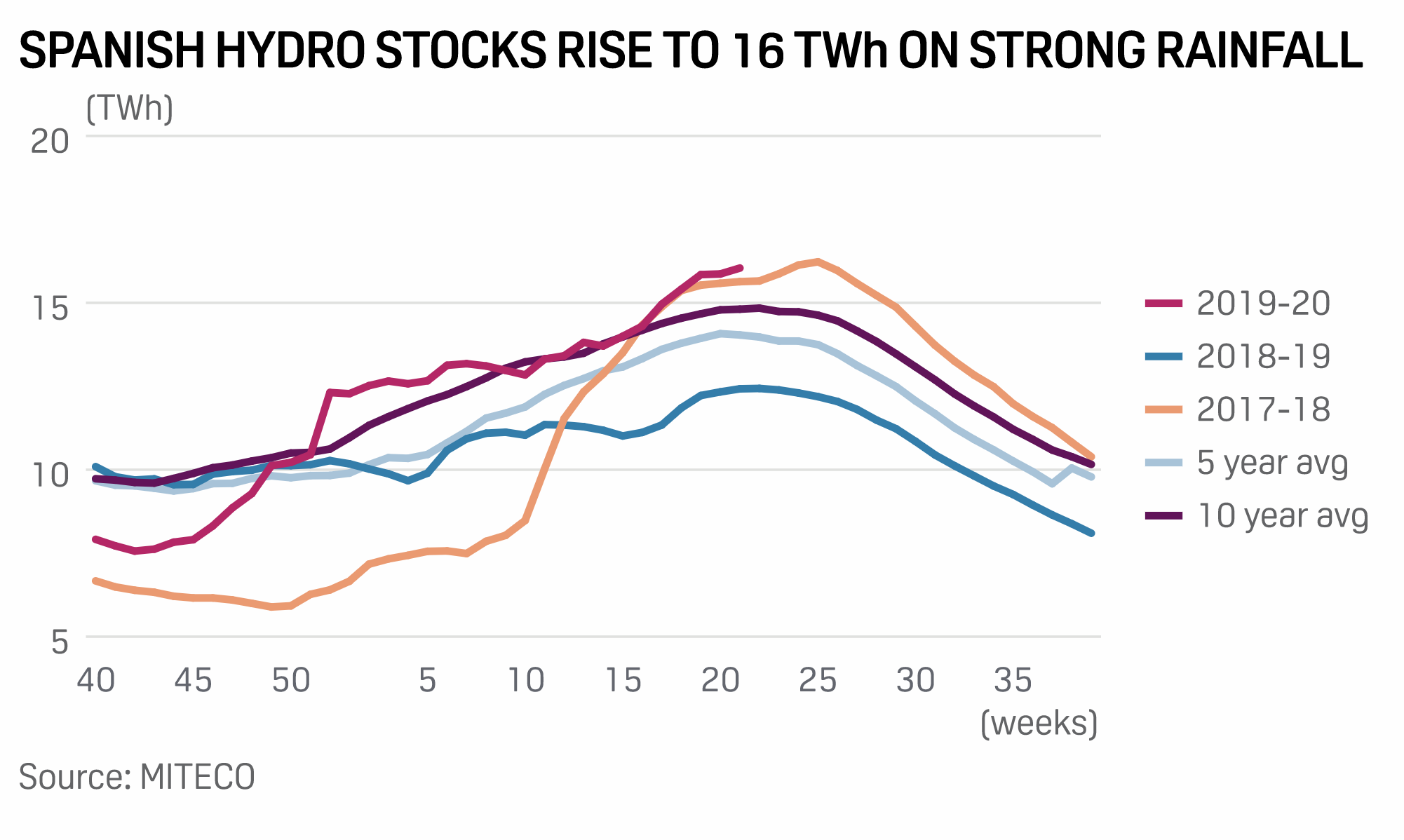

Spanish hydro power stocks rise to 16 TWh, out-compete gas-fire generation

Spanish hydro power stocks rose to 16 TWh in Week 20, or 70% of capacity, amid higher rainfall and are set to continue to out-compete gas-fired generation, environment ministry data showed Tuesday. “Stocks have risen although not too much and the forecast of rain isn't much for the next days," a Spanish power trader said. "So I guess that is supporting [the June power contract] so it's not seen much lower, since demand is recovering and the heat is coming."

—Read the full article from S&P Global Platts

Interview: IOC eyes hydrogen-based fuel to shape India's energy transition: chairman

State-run Indian Oil Corp. is working on a long-term energy transition strategy, which would involve producing hydrogen in a cost-effective way as well as developing technology to combine compressed natural gas with hydrogen, its chairman Sanjiv Singh told S&P Global Platts in an interview. In addition to refining and fertilizers, hydrogen provides a huge opportunity for the transportation sector, and in other commercial applications, but one of the biggest challenges to overcome is to make it commercially viable, he added. "I see a lot of potential and lots of opportunities for hydrogen. There are three parts to the story -- hydrogen production, hydrogen fuel cells and how we use hydrogen in the transportation sector," Singh said. "We see ourselves as a company to provide the answers for producing hydrogen in an economical way."

—Read the full article from S&P Global Platts

Battery storage market remains robust despite coronavirus delays

The coronavirus pandemic has created bumps on the road to battery storage for renewable power generation in the U.S., but the technology has gathered enough momentum that any difficulties are only expected to delay, not block, eventual widespread adoption. "I think, in the short term, there's not going to be as much of an impact," said Andy Klump, founder and CEO of Clean Energy Associates LLC, noting that while there may be some delays, many storage projects under development are slated for 2021 operation dates. "While a lot of them are being permitted and developed as we speak, it was really for next year, so some of those may also slide into 2022," he said. While the coronavirus will have a short-term impact on the financing and construction of battery storage projects, Klump believes the market will be quick to rebound from any lag. "I still think the segment's very robust, it's still going to go through a hockey stick-like growth the next two to three years," Klump said. "That hockey stick may be pushed off by three to six months because of this."

—Read the full article from S&P Global Market Intelligence

Global EV sales to drop 18% in 2020 on pandemic: BNEF

Global sales of electric passenger vehicles will fall 18% in 2020, to 1.7 million worldwide, as the coronavirus pandemic dents consumer spending, according to a Bloomberg New Energy Finance report Tuesday. However, this will be offset by an even bigger drop in sales of traditional combustion engine cars. BNEF said in its long term electric vehicle outlook that the pandemic has brought 10 successive years of growth in EV sales to a halt. Yet, on a more optimistic note, looking toward a greener future, BNEF said that internal combustion engines, or ICE, are set to drop by around 23%, while long-term electrification of transport is projected to accelerate in the years ahead.

—Read the full article from S&P Global Platts

Airlines could save $15 billion from new emissions baseline: IATA

Airlines could save an estimated $15 billion in carbon offsetting costs if the International Civil Aviation Organisation uses 2019 to calculate aviation's CO2 emissions baseline, an official with the International Air Transport Association said Tuesday. Sticking to the original plan to use an average of 2019 and 2020 emissions as the baseline could inflate airlines' bill for buying offset credits, because the coronavirus and government lockdowns have massively reduced the sector's emissions this year. "We've gone to ICAO and said 2019 emissions should be used," IATA's director of aviation and environment Michael Gill said in a webinar Tuesday.

—Read the full article from S&P Global Platts

Social bond surge appears here to stay as COVID-19 crisis shifts funding needs

The COVID-19 pandemic has led to surging demand for bonds that finance social projects. Market participants say this spike is likely to last beyond the crisis as the coronavirus has given the social bond market a sense of purpose and clear goals that it previously lacked. Social bonds are debt instruments that raise money for social projects, including affordable housing, health and education. They have long been the poor cousin of green bonds, which fund environmentally friendly projects such as wind farms or solar power. Green bond issuance has soared in recent years as investors lapped up debt focusing on climate change. But with the onset of the coronavirus, that demand flipped. Social bond issuance for 2020 totaled $11.58 billion as of May 15, compared to just $6.24 billion in the same period of 2019, according to an International Capital Market Association analysis of the Environmental Finance database. Total social bond issuance in 2019 was $16.70 billion.

—Read the full article from S&P Global Market Intelligence

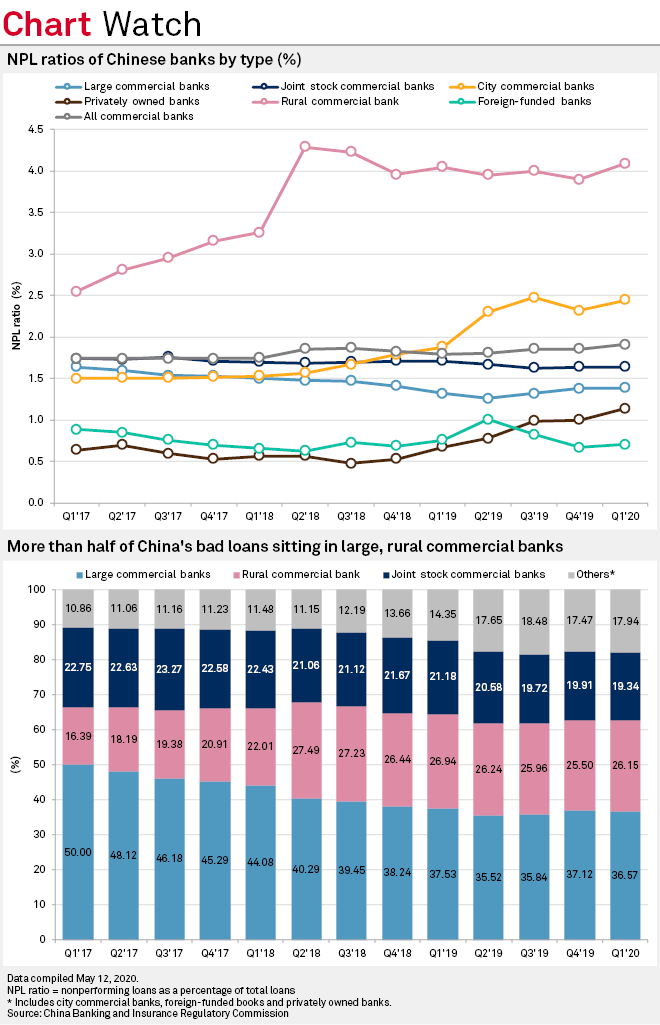

China midsize, locally focused lenders seen facing rising risk of bank failure

China's midsize and locally focused banks reported faster increases in borrowers failing to repay their loans on schedule in the first quarter as the economy contracted, suggesting a rising risk of bank failure among smaller and less capitalized lenders, experts say. Among all bank types, city commercial banks reported the highest year-over-year increase in nonperforming loan ratio to 2.45% as of end-March, from 1.88% a year earlier, according to the latest data released by the China Banking and Insurance Regulatory Commission. It was followed by privately owned banks, with their aggregate ratio rising to 1.14% from 0.68%. Rural commercial banks continued reporting the highest NPL ratio in the country at 4.09%, up from 4.05% a year earlier.

—Read the full article from S&P Global Market Intelligence

UK banks leaning too heavily on old tech to distribute COVID-19 business loans

The U.K. Treasury's emergency lending schemes for small and medium-sized businesses hit by the coronavirus pandemic rely too heavily on big banks and old technology, critics say. The Coronavirus Business Interruption Loans Scheme, or CBILS, launched March 24 to provide emergency liquidity to businesses. This was followed by the Bounce Back loans scheme in May, which offers loans of £2,000 and £50,000 to tide over the smallest businesses. The two schemes had distributed some £14 billion between them as of mid-May. CBILS has come under fire for being too slow to process loan applications, leaving desperate businesses unable to access the cash they need to stay afloat.

—Read the full article from S&P Global Market Intelligence

Largest Brazilian Banks' First-Quarter Results Point To Mounting Credit Losses

As the coronavirus pandemic escalates in Brazil amid rising credit stress, S&P Global Ratings now forecasts a recession this year with GDP contracting around 4.6%. As a result, three of the largest banks in Brazil—Banco do Brasil S.A., Banco Bradesco S.A., and Itau Unibanco S.A.—increased provisions significantly for credit losses in the first quarter of 2020, jeopardizing their bottom-line results. Banco Santander (Brasil) S.A., on the other hand, took a different approach because it registered only a modest growth in provisioning. Nevertheless, S&P Global Ratings expects pressure on banks' asset quality to continue increasing in the second quarter of the year, prompting banks to raise provisions further toward mid-year.

—Read the full report from S&P Global Ratings

Funding COVID-19 debt splurge risks the independence of major central banks

"Now is not the time to worry about debt, but use the great fiscal power of the U.S. to avoid deeper damage to the economy." The statement by Federal Reserve Chairman Jerome Powell on April 29 marked the completion of an extraordinary reversal in the relationship between the Federal Reserve and the U.S. government. In December 2018, Powell appeared a paragon of central bank independence as he clashed with President Donald Trump and pushed up the federal funds rate to 2.25%-2.5% to keep a lid on what it perceived to be an overheating economy. Now, the goals of the Federal Reserve and the U.S. government are much more closely aligned. Treasury needs to issue unprecedented amounts of debt to support $3 trillion of government spending commitments to rescue the economy from its coronavirus-induced slump, while the Fed has announced an open-ended program of government bond purchases.

—Read the full article from S&P Global Market Intelligence

Listen: Street Talk Episode 61 - Investors debate if U.S. banks have enough capital in post COVID world

In this episode, members of the investment community discuss current bank stock valuations, the Street's view of future credit losses and capital levels, and the market's positive reaction to large reserve builds in the first quarter. The episode also features commentary from stress-testing experts, who say banks would be wise to look at the Great Recession for insight into future losses as well as our analysis of bank capital levels if those loss rates occur in the future.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language