Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 May, 2020

By S&P Global

As lifted lockdowns aim to soften some short-term economic pain caused by the coronavirus pandemic, the outlook for the global economy continues to deteriorate. The global death toll has surpassed 300,000, according to Johns Hopkins University, but many experts agree the toll is almost certainly higher. Governments and central banks are advancing their stimulus as unemployment continues to rise, and both demand and consumption across sectors declines.

The U.N. now forecasts global GDP to contract 3.2% this year. Developed economies will shrink 5%, and their output will drop 0.7%, according to a report released Wednesday.

“Governments across the world are rolling out fiscal stimulus measures—equivalent overall to roughly 10% of the world GDP—to fight the pandemic and minimize the impact of a catastrophic economic downturn,” the U.N. said. But “the projected cumulative output losses during 2020 and 2021—nearly $8.5 trillion—will wipe out nearly all output gains of the previous four years.”

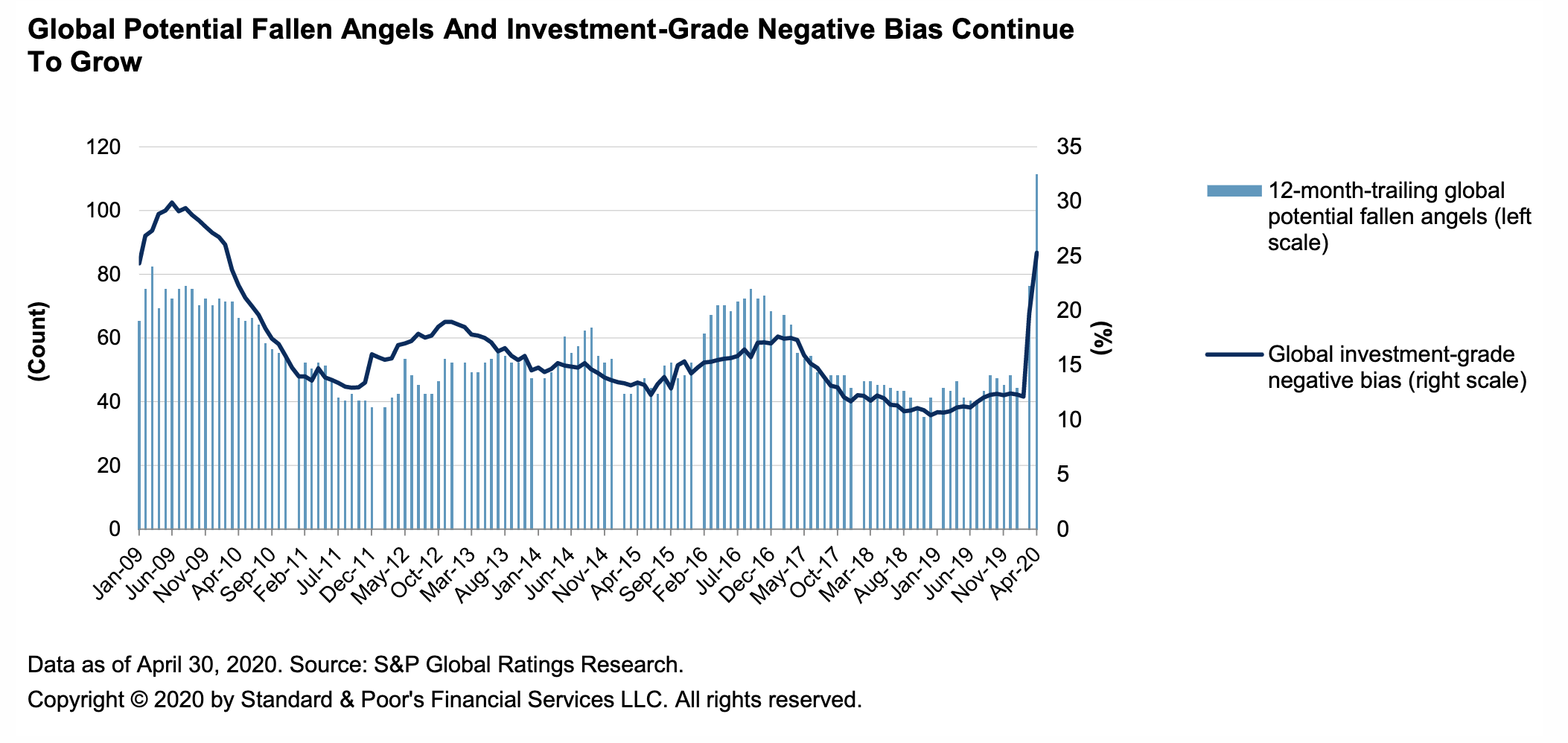

The most “fallen angels” in five years—24 borrowers around the world, accounting for $300 billion in debt—have fallen into speculative-grade from investment-grade this year, according to S&P Global Ratings. The number of potential fallen angels has climbed to 111 issuers globally as the pandemic impacts credit conditions and heightens economic and financial pressures.

Global oil demand in May will decline 21.5 million barrels a day and, marking a nine-year low, production will decrease 12 million barrels a day, according to the International Energy Agency. This year, overall demand will likely decrease 8.6 million barrels a day, slightly higher than the Paris-based agency’s forecast last month of a yearly decline of 9.3 million barrels a day. By year-end, the U.S. will be “the biggest contributor to global supply reductions compared with a year ago” despite the global “supply side [being] where market forces have demonstrated their power and shown that the pain of lower prices affects all producers.”

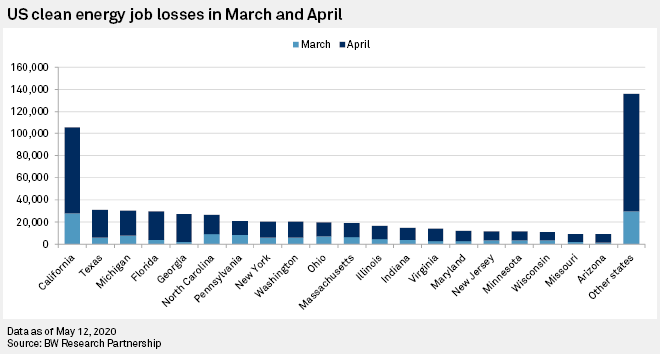

In the U.S., total unemployment claims have reached 36.6 million after approximately 3 million more Americans applied for joblessness benefits in the week ended May 9, according to the U.S. Labor Department. Nearly 600,000 jobs in clean energy were lost in March and April, according to the research firm BW Research Partnership, which forecasts that the total could reach 850,000 by the end of June.

“This reversal of economic fortune has caused a level of pain that is hard to capture in words, as lives are upended amid great uncertainty about the future,” Federal Reserve Chairman Jerome Powell said during a Peterson Institute for International Economics webcast on Wednesday. “While the economic response has been both timely and appropriately large, it may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks.”

According to a Fed survey released yesterday, 39% of Americans working in February who have a household income below $40,000 reported a job loss in March, compared with 13% of households earning more than $100,000. This exemplifies the crisis’ disproportionate disruption to the lives of individuals with low socioeconomic standing. One-fifth of employed adults reported that they can’t take any time off without a reduction in income. The survey showed that “on average, those with more education had more leave available.”

Across the globe, emerging markets are experiencing differing impacts from the COVID-19 crisis and are responding with varying approaches.

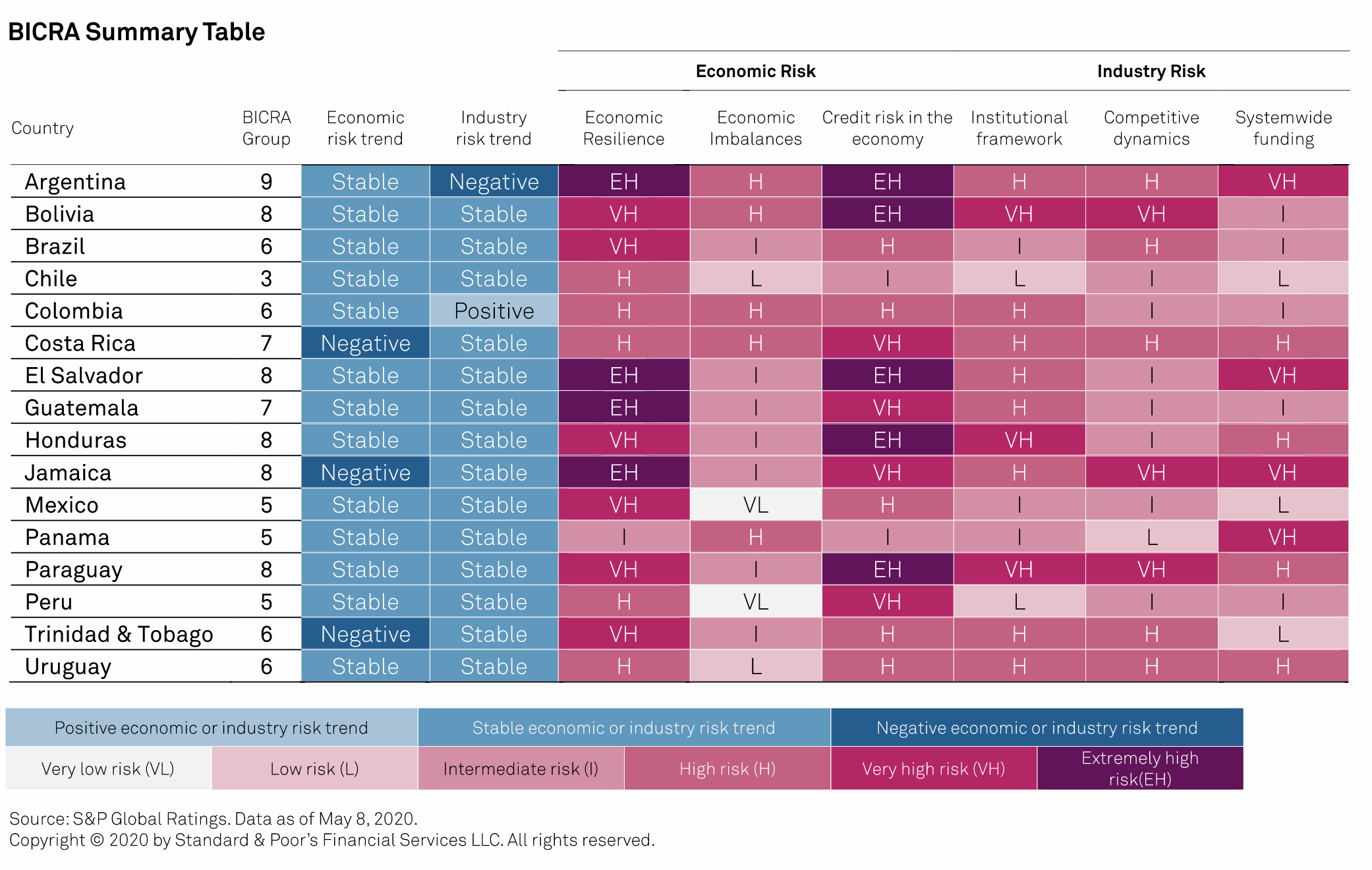

Banks in Latin America are facing negative rating momentum due to the pandemic, oil price shock, and market volatility, but S&P Global Ratings believes mitigating factors, including the support received from public authorities to encourage continued lending to households and corporates, will help banks in the region navigate the turbulence. Notably, S&P Global Market Intelligence reported that analysts believe Mexico and Brazil will play key roles in insulating Banco Santander and Banco Bilbao Vizcaya Argentaria’s Spanish parent companies from the crisis’ implications. While uncertainty prevails for the strong growth that both banks had been betting on in their Latin American markets to offset poor economic conditions and low interest rates in Europe, Pablo Manzano, vice president of global financial institutions at DBRS Morningstar, told S&P Global Market Intelligence that “it is still too early to know how LatAm is going to be affected by the COVID-19 crisis, but it seems that currently the impact might be less severe than in Europe or North America."

Banxico, Mexico’s central bank, lowered its interest rates yesterday by 0.5 percentage point, to 5.5%. In Brazil, according to S&P Global Platts, independent oil and natural gas producers urged the country’s government and industry regulators to continue their reform efforts in order to boost output once the global economy starts to rebound post-crisis.

Today is Friday, May 15, 2020, and here is today’s essential intelligence.

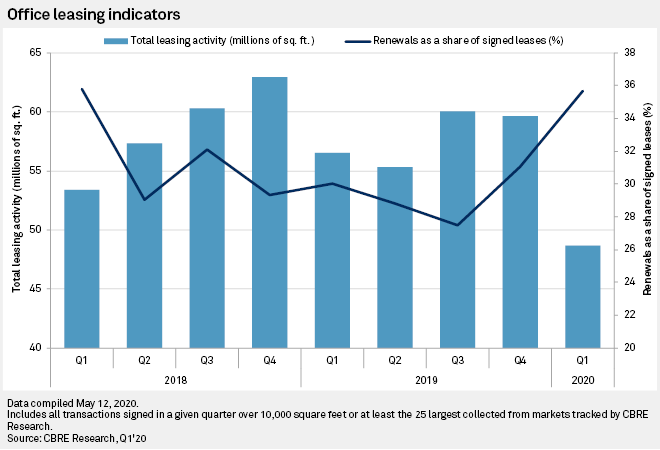

Office landlords brace for new normal in workspace demand

When white-collar employees finally return to the work spaces they left behind in March, the buildings they enter may have altogether different layouts and new safety features that suggest a possible paradigm shift in the corporate office market. With states determining criteria for returning to work post-COVID-19, each market's reawakening will play out differently, but there will be fewer workers across the board as the first waves are limited to employees whose presence on-site is deemed essential. Those reentering office buildings in many cases will be working with greater distances between them — an affront to the densification trend that has defined the office market for years. Open floor plans may be divided up where more personal space is required.

—Read the full article from S&P Global Market Intelligence

Weaker tourism outlook to deal further blow to luxury companies' earnings

Luxury goods companies could face an additional hit to their 2020 earnings as global tourism struggles to revive after weeks of canceled overseas trips and travel restrictions triggered by the COVID-19 pandemic. Tourism has long been a driving force in the luxury market. Making up about 40% of total luxury spending, it is vital to the fortunes of companies such as Kering SA, owner of Gucci, LVMH Moët Hennessy - Louis Vuitton Société Européenne, owner of Christian Dior, and Compagnie Financière Richemont SA, owner of Cartier. Analysts had expected some rebound in Chinese tourist spending in the third quarter and in global tourism in the fourth quarter. But indications are that neither will bounce back quickly, posing an additional downside risk to luxury companies' earnings and stock market valuations.

—Read the full article from S&P Global Market Intelligence

Credit Trends: Potential Fallen Angels Hit A Record High 111

One more issuer has become a fallen angel since S&P Global Ratings’ last report, bringing this year's total to 24 by the end of April. Credit pressure continues to build, and the number of potential fallen angels has reached 111--nearly one-quarter has ratings on CreditWatch with negative implications. Both are record highs. The financials sector led the additions to the potential fallen angels list, highlighting the challenges the sector is facing. However, S&P Global Ratings sees the highest downgrade potential in the lodging and leisure and auto sectors, which have the greatest number of potential fallen angels that have ratings on CreditWatch negative.

—Read the full report from S&P Global Ratings

COVID-19 Activity In Global Structured Finance For The Week Ending May 8, 2020

S&P Global Ratings took 214 rating actions across the various structured finance sectors globally during the week ended May 8, 2020 as a result of the COVID-19 pandemic. The regional breakdown is as follows: North America: 193 rating actions (189 ratings placed on CreditWatch negative and four downgrades); Europe, the Middle East, and Africa (EMEA): 19 rating actions (17 ratings placed on CreditWatch negative and two rating outlooks revised to negative); and Latin America: two rating actions (one downgrade and one rating lowered and placed on CreditWatch negative).

—Read the full report from S&P Global Ratings

Earnings at US leveraged loan issuers plunge, while overall leverage spikes

U.S. leveraged loan issuers in the first quarter confronted the leading edge of an already dire rise in broad-sector leverage measures, even as the COVID-19 pandemic chokes off access to the new-issue marketplace in the asset class. Lockdown dynamics bludgeoned earnings over the back half of the first quarter, and a nearly 10% year-over-year slide in EBITDA prodded the average debt-to-EBITDA figure for U.S. public filers in the S&P/LSTA Leveraged Loan Index to 5.9x, up a full turn year over year, and marking the highest leverage reading for this public sample since LCD started running this analysis in 2001.

—Read the full article from S&P Global Market Intelligence

COVID 19 Pandemic Monitoring the impact on Corporate Credit Risk

Proactive monitoring of quantitative and qualitative risk factors can help to understand and assess the rising credit risks associated with this pandemic. S&P Global Market Intelligence’s Corporate Scorecard provides an effective framework to navigate today’s climate, especially for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

—Read the full report from S&P Global Market Intelligence

More government credit insurance support on the way, but consistency is key

More governments are expected to join those already offering support to their trade credit insurance markets amid the coronavirus pandemic. Trade credit insurers are grateful for the support, but with a range of different approaches, consistency across countries could be a challenge for multinational companies that rely on trade credit cover. Trade credit insurance protects companies who sell goods and services on credit against the risk of not being paid by buyers if these customers hit financial difficulty. Insolvencies are on the rise because of the coronavirus crisis, and there is a risk of more.

—Read the full article from S&P Global Market Intelligence

LatAm Financial Institutions Monitor 2Q2020: COVID-19 Hits Banks' Bottom Lines

Banks in Latin America are facing negative rating momentum because of significant effects from the coronavirus pandemic, oil price shock, and market volatility. However, S&P Global Ratings believes mitigating factors will help banks in the region to navigate this turbulent scenario: The generally high liquidity levels and low dependence on external and wholesale funding, because retail deposits provide the bulk of Latin American financial institutions' funding sources; the healthy margins and provisioning coverage that provide cushion during times of economic stress; the substantial support and flexibility that banking systems will receive from public authorities to entice them to continue lending to households and corporates, whether in the form of liquidity or credit guarantees, and relief on minimum regulatory capital and liquidity requirements; and the likelihood in S&P Global Ratings’ base-case scenario of a 3% rebound in Latin America's GDP in 2021 after a sharp contraction of 5% this year (GDP weighted forecast includes the five largest economies), even if this contraction and ensuing recovery varies considerably between countries.

—Read the full report from S&P Global Ratings

Mexico, Brazil key to how Santander, BBVA weather coronavirus storm

In the 2008 financial crisis, Santander and BBVA's exposure to Latin America and the rest of the world was an important mitigating factor in their exposure to the badly hit Spanish domestic sector, Daniel Lacalle, chief investment officer at fund manager Tressis Gestión, said in an interview. And ahead of the current crisis, both banks had been counting on strong growth in their largest markets — Brazil in the case of Santander and Mexico for BBVA — to offset anemic economic conditions and historically low interest rates in Europe. That growth path is now more uncertain as, for the first time, all the banks' geographies are in crisis, Lacalle said. Both Brazil and Mexico recorded their highest daily number of coronavirus-related deaths May 11. But other experts point out that the impact from the crisis could be less pronounced in these emerging economies.

—Read the full article from S&P Global Market Intelligence

Listen: Rising hygiene products demand and falling naphtha prices present opportunities for petchems

Falling values for naphtha are stimulating margins for some petrochemical manufacturers, as COVID-19 sends people rushing to buy hand sanitizer and disposable plastics. Naphtha reporter Evridiki Dimitriadou and petrochemicals reporter Ora Lazic discuss the winners and losers at the top of the barrel and beyond with Joel Hanley.

—Listen to this episode of Global Oil Markets, a podcast from S&P Global Platts

Oil price recovery hopes lifted by faster than expected market rebalancing

The prospects of a modest but sustained oil price recovery in the coming months are growing as output curbs and a demand rebound from coronavirus lockdowns easing drains the world's oil surplus faster than expected, according to oil analysts. On the demand side, signs that the global oil market is rebalancing ahead of expectations are being led by data showing fuel demand is recovering steadily after bottoming out in April when some lockdowns began to be lifted.

—Read the full article from S&P Global Platts

Oil on floating storage soars to record highs, but peak still some way off

Oil on floating storage is now at its highest level in the history of the oil market and despite modest signs of a demand recovery, industry sources and analysts say the peak for these volumes is still some way off. There are some signs that oil is starting to improve based on global road traffic and congestion data as travel restrictions start to ease. But looking at the amount of oil on water on a real time ship tracking platform, there are many signs that the imbalance of supply and demand remains very skewed. There are currently more than 200 million barrels of oil and products on floating storage, representing around 5% of global carrying capacity, according to data from S&P Global Platts trade flow software cFlow.

—Read the full article from S&P Global Platts

US oil, gas rig count falls 29 to 369 in 9th straight week of double-digit drops: Enverus

The total US oil and gas rig count fell 29 to 369 on the week, rig data provider Enverus said Thursday, marking the ninth straight week of double-digit declines as the industry downturn continued deepening from the coronavirus pandemic. The weekly drop came entirely from a decline in oil-focused rigs, which fell by 30 to 256. Natural gas-weighted rigs rose by one to 113, Enverus said, with the gain coming from outside the eight named large basins. Since mid-March, the rig count has slipped 55% from 835. Oil prices during that span toppled from about $46/b early that month to the low $30s/b within a week and then into the low $20/s in two weeks. Over 450 US rigs have gone offline since early March, Enverus data shows.

—Read the full article from S&P Global Platts

Crude bolstered by easing lockdowns in Europe, but product margin fears remain

The European crude oil complex has seen a slight pick-up in buying interest this week, with the easing of lockdown measures encouraging refiners to take some prompt crude oil barrels straight into their systems, while opting to leave large quantities in both land and floating storage. Yet oil product margins remain under stress amid a global oversupply of refined products and continuing fears about the frail state of end-user demand due to the coronavirus pandemic.

—Read the full article from S&P Global Platts

Brazil's independent oil, gas producers push ANP reforms to survive pandemic

Brazilian independent oil and natural gas producers this week urged the government and industry regulators to continue reform efforts during the ongoing coronavirus pandemic as a way to boost output from mature and marginal fields once the global economy starts to rebound. "We understand that it's a difficult time, but I think that it's time we faced some of the historic distortions in the Brazilian market," Marcelo Magalhaes, chief executive of onshore producer PetroReconcavo, said during a webinar featuring the independent producer and larger offshore rivals Enauta and Petro Rio.

—Read the full article from S&P Global Platts

COVID-19 pushes US clean energy layoffs to nearly 600,000 through April

U.S. clean energy job losses accelerated in April to an estimated 447,200, more than tripling from March, as the coronavirus pandemic slammed companies focused on energy efficiency, renewable energy, electric vehicles and other low- to zero-carbon energy solutions, according to BW Research Partnership. The nearly 600,000 job losses in March and April, detailed in a May 12 memorandum to the American Council on Renewable Energy and other advocacy groups, surpassed the independent research firm's prior estimate that the U.S. clean energy economy could shed half a million jobs by the end of the second quarter. BW Research now conservatively anticipates that number could hit 850,000 by the end of June, reducing America's clean energy workforce by 25% and adding urgency to industry calls for congressional aid in the form of extended tax credits, cash grants and other incentives.

—Read the full article from S&P Global Market Intelligence

Oil & gas sector belief, investment in hydrogen future grows: report

Half of senior oil and gas professionals expect hydrogen to be a significant part of the energy mix by 2030, with a fifth of surveyed oil and gas companies already active in the hydrogen market, according to a report published Thursday by consultancy DNV GL. More than half of respondents in Asia-Pacific (56%), the Middle East & North Africa (54%) and Europe (53%) agreed hydrogen would be a significant part of the energy mix within 10 years. North America (40%) and Latin America (37%) were less convinced. Meanwhile, the proportion of oil and gas companies intending to invest in the hydrogen economy doubled from 20% to 42% in the year leading up to the coronavirus-induced oil price crash, DNV GL said.

—Read the full article from S&P Global Platts

Germany cautious on agreeing tougher 2030 EU CO2 cuts by end-2020

Germany is cautious about its prospects for agreeing a 2030 EU CO2 cut target of more than 40% below 1990 levels during its EU Council presidency, which runs from July 1 to December 31, a German diplomat said Thursday. The European Commission plans to propose in September raising this target to 50%-55%, which would mean further reforms to the EU Emissions Trading System, a boost to EU carbon prices, and stronger investment signals for low-carbon energies such as renewables and hydrogen.

—Read the full article from S&P Global Platts

China's green energy plan set to block retail fuel price cut proposals

China is unlikely to remove the current retail fuel price floor mechanism when the country's top decision makers meet at two political events next week, as such a move could jeopardize Beijing's push for green energy consumption. The status quo will also keep domestic refining margins healthy for the time being.

—Read the full article from S&P Global Platts

Mexican watchdog halts regulations hamstringing renewables at last minute: documents

A policy watchdog in Mexico this week halted the introduction of a set of regulations aimed at further restricting the participation of private clean energy generators in the country, according to documents seen by S&P Global Platts. The regulations were presented by the Energy Secretariat (Sener), the equivalent of the US Department of Energy, as an agreement for "reliability, security, continuity and quality" for the electricity system and tried to make them effective without the proper procedure, the documents show.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language