Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 May, 2020

By S&P Global

As millions of workers lose their jobs and livelihoods, and countries forecast their worst downturns in decades and even centuries, the pandemic now threatens the vital networks that connect the global economy.

Cross-border supply chains have been severely restricted by the COVID-19 crisis’ impacts on worldwide import and export volumes, reduced supply of parts, caused production disruptions and slumping sales, and contributed to countries’ diminishing financial performance and markets’ negative sentiment, according to S&P Global Market Intelligence research. This has heightened many companies’ default risk. Automobile manufacturers, as well as consumer electronics makers, face considerable supply chain pressures.

“Understanding where a company’s critical supplies are coming from and the creditworthiness of those suppliers can be essential to assessing the health of that company,” S&P Global Market Intelligence Risk Services Director Sidiq Dawuda wrote in the report. “Depending on how integral a supplier is to the company, a sudden reduction in supplies can transmit operational and financial stress, especially if the company cannot find an alternative supplier before current inventory is fully depleted.”

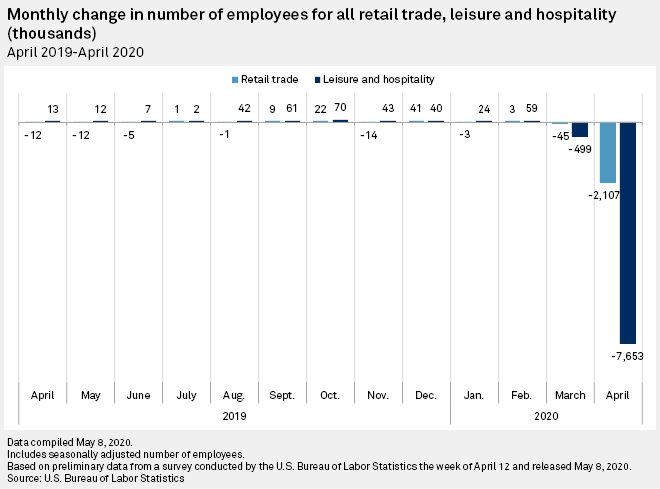

Erasing the record economic growth of the preceding decade, the crisis spurred unemployment of 20.5 million Americans in April, tripling unemployment levels to 14.7%, according to the U.S. Bureau of Labor Statistics. S&P Global Market Intelligence reported that retail trade, leisure, and hospitality industries accounted for 9.8 million (or 48%) of the unprecedented job losses. While the Labor Department said nearly 90% of job losses in April will be temporary, the likelihood that many of these jobs will be recovered is improbable. The effects of second waves of outbreaks, an inability to return to a semblance of normal life, and consumer behavior drastically altered by the crisis could weaken the world’s largest economy’s ability to stage a full recovery for years to come.

The global corporate default tally for this year has reached 66, as Australia-based transportation airline Virgin Australia, New York-based apparel retailer J. Crew, Luxembourg-based software provider Evergreen Skills, and one confidential issuer defaulted in the week ended May 8, according to S&P Global Ratings. With 32 defaults last month alone, April saw the greatest number of defaults in a single month since the 2008-2009 financial crisis. S&P Global Ratings estimates that the 12-month-trailing speculative-grade default rate for the U.S. rose to 3.9% in April, from 3.5% in March, while the default rate for Europe is estimated to have increased to 2.7% in April from 2.4% in March.

This year will be the worst year in decades for emerging-market economies, according to S&P Global Ratings, which forecasts that average emerging market GDP will contract 0.5% and that no region will be spared a severe downturn. Sovereign credit fundamentals have weakened, with countries facing fiscal rigidities and those that relied on external financing pre-pandemic faring the worst. Homebuilders, real estate, consumer products, and utilities sectors face the greatest potential for downgrades. Across emerging markets, the recovery will be uneven and fundamentally depends on policy responses to bolster strength.

Africa faces extraordinary risk compared to other regions. The World Health Organization warned last month that cases in the continent could surge from current levels of approximately 51,000 to 10 million in three to six months. In a study published last week, the WHO projected that within the first year of the pandemic, 29 million to 44 million people could be infected with the coronavirus, and up to 190,000 people could die, if virus-containment measures across Africa fail.

“While COVID-19 likely won’t spread as exponentially in Africa as it has elsewhere in the world, it likely will smolder in transmission hotspots,” WHO Regional Director for Africa Dr. Matshidiso Moeti said. “COVID-19 could become a fixture in our lives for the next several years unless a proactive approach is taken by many governments in the region… The importance of promoting effective containment measures is ever more crucial, as sustained and widespread transmission of the virus could severely overwhelm our health systems.”

Today is Monday, May 11, 2020, and here is today’s essential intelligence.

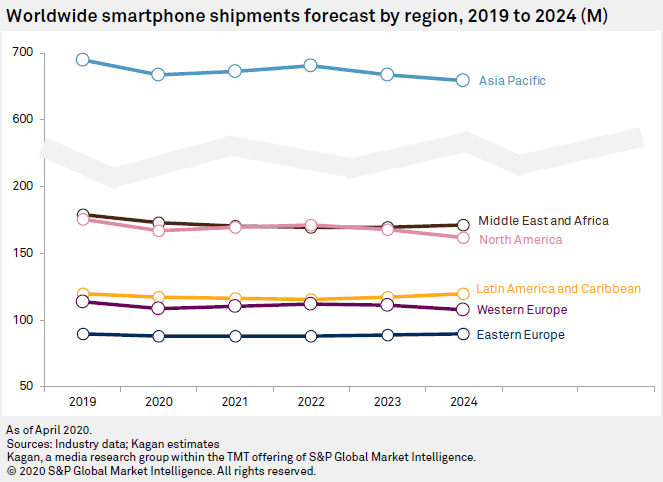

5G To Buoy Declining Smartphone Shipments Through 2024 Despite COVID-19 Effects

The impact of the COVID-19 pandemic on supply chains and the near-certainty of a global recession are expected to depress 2020 smartphone shipments by 3.7% to 1.33 billion units, according to Kagan. Meanwhile, widespread build-outs of 5G networks and the increasing availability of 5G handsets are expected to temper the negative effects of a global recession and help slow the decline of worldwide shipments to a negative 1% CAGR from 2019 through 2024. Worldwide smartphone shipments are expected to bump up in 2021 and 2022 as more 5G-capable devices become available and an increasing number of users migrate to 5G — especially in mature markets.

—Read the full article from S&P Global Market Intelligence

COVID-19’s Wake-up Call for Supply Chain Credit Risk

The impact of COVID-19 on the global economy is unique as it has not only affected demand, like crises of the past, but has also severely restricted cross-border supply chains. According to S&P Global Ratings research, the disruption to the global supply chain will be another critical factor that will weigh on the creditworthiness of some sectors. This disruption will be evidenced by reductions in worldwide import and export volumes, alongside diminishing financial performance of countries and the market’s likely negative sentiment of some private and public companies. To understand the implications of COVID-19 on supply chains, S&P Global Market Intelligence used shipping data and supply chain intelligence from Panjiva, part of S&P Global, and our Probability of Default Market Signals (PDMS) model, which incorporates stock price and asset volatility to calculate a one-year probability of default (PD). This will capture the more immediate market shocks from COVID-19 and enable us to assess the industries and companies that have experienced material changes to their default risk. In addition, our fundamentals based CreditModel™ is used to gauge if the mid- to long-term credit risk of these companies has changed significantly.

—Read the full article from S&P Global Market Intelligence

Consumer sector pummeled in wave of US job losses in April

Restaurants and retailers continue to be among the companies hit hardest by U.S. job losses triggered by the coronavirus pandemic as layoffs and furloughs sparked by business shutdowns drove unemployment to new highs in April. Retail trade, leisure and hospitality industries accounted for 9.8 million of the 20.5 million jobs shed across the broader economy during the month as stay-at-home orders and closures of nonessential businesses pushed jobless numbers from 870,000 in March, according to data from the Bureau of Labor Statistics.

—Read the full article from S&P Global Market Intelligence

Default, Transition, and Recovery: J. Crew And Virgin Australia Help Push The 2020 Corporate Default Tally To 66

The 2020 global corporate default tally has reached 66, after four issuers defaulted last week. The defaulters were Australia-based transportation airline administrator Virgin Australia Holdings Ltd., New York-based apparel retailer J. Crew Group Inc., Luxembourg-based e-learning/training content software provider Evergreen Skills Lux S.ar.l., and one confidential issuer. With 32 defaults, April had the highest single-month default tally since the great financial crisis. There have been only three defaults so far in May, but S&P Global Ratings expect that number to increase as the impact from social distancing measures to contain the spread of COVID-19 is weighing on global economies. S&P Global Ratings expects the U.S. speculative-grade corporate default rate to rise to 10% over the next 12 months from 3.1% in December 2019.

—Read the full report from S&P Global Ratings

Update: Coronavirus-related US revolving credit drawdowns surge to $275B LCD, part of S&P Global Market Intelligence, on May 7 logged $7.2 billion in revolving credit facility drawdowns via 18 debt issuers. Roughly $274.9 billion across 630 borrowers has been recorded since March 5. The activity reflects the intense corporate focus on liquidity, amid the economic shutdown due to the coronavirus pandemic. In more ordinary times these revolving credits might go largely undrawn. Looking at broad industry sectors, Consumer Discretionary accounts for 43% of total RC drawdowns. Within Consumer Discretionary, much of the volume is from borrowers in the Automobile Manufacturers segment.

—Read the full article from S&P Global Market Intelligence

Emerging Markets Monthly Highlights: Economic Rout Deepens, Policy Response Ramps Up A slump in domestic and foreign demand amid lockdowns at home and abroad has pushed EM economies into recession The magnitude of the impact of social distancing measures on activity is beginning to surface in a range of hard and soft economic indicators. The economic recovery will be uneven across EMs, and will depend crucially on the effectiveness of public health and economic responses. The revenue impact of lockdowns has been significant across many sectors. The potential for downgrades is highest in the Homebuilders, Real Estate, Consumer Products and Utilities. S&P Global Ratings expects the financial pain on corporations and households to show up in the form of rising nonperforming loans, pressuring financial institutions credit quality.

—Read the full report from S&P Global Ratings

Possible Effects Of COVID-19 Crisis On Broadcast Networks Broadcast networks are likely to have a tough road ahead due to the coronavirus and its lasting impact on the industry. Networks are bearing blows from multiple areas, including advertising, retransmission fees and programming, with the loss of sports arguably one of the biggest problems. Lack of big sporting events will likely be a great shock for revenues. Although the Olympics are now scheduled to air in 2021, over $1 billion is at stake this year for Comcast Corp.'s NBC. Looking at the Big Four networks' performance over the past two decades, the Olympics provided gains in years that may have otherwise ended in losses. In 2002, following the dotcom bust and 9/11, ad revenues grew 5.5%, but if you take out the Olympics, the figure falls to a loss of 2.1%. A similar situation arose in 2008 during the Great Recession: The ad revenue decline was 2%, compared to a 7% deficit lacking the Olympics.

—Read the full article from S&P Global Market Intelligence

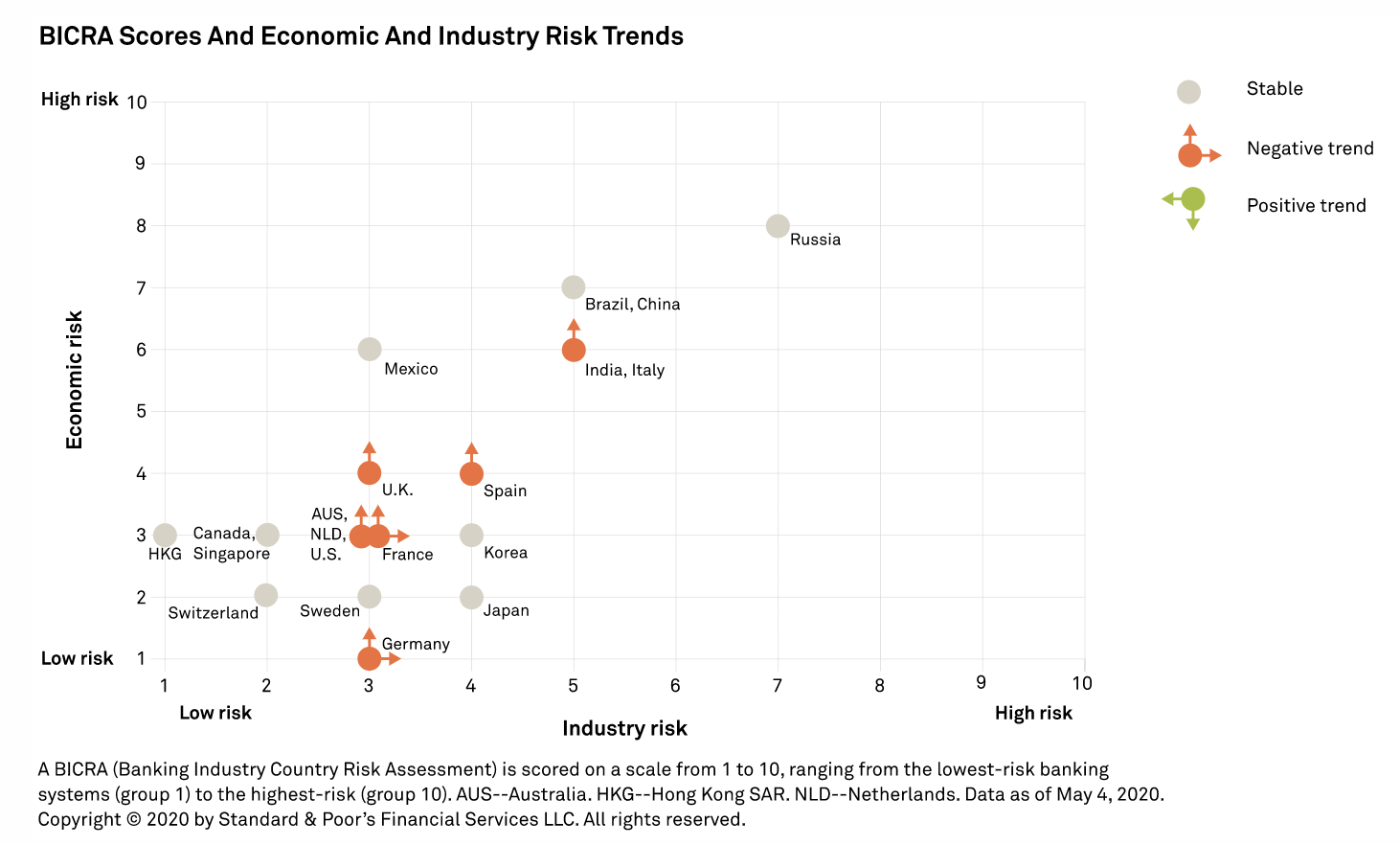

How COVID-19 Is Affecting Bank Ratings: May 2020 Update

S&P Global Ratings continues to expect that bank rating downgrades this year due to the COVID-19 pandemic will be limited by banks' strengthened balance sheets over the past 10 years, the support from public authorities to household and corporate markets, and our base case of a sustained economic recovery next year. Nevertheless, S&P Global Ratings’ outlook bias has turned markedly negative, following the recent downward revision of our central economic forecasts, continued material downside risks to these forecasts, and the potential longer-term impact on banks' profitability. S&P Global Ratings cannot rule out further rating actions, including some downgrades, in particular for banks with pre-existing financial strength issues. Although emerging market banks are often more exposed than developed market peers, S&P Global Ratings expects most will face an earnings rather than a capital shock, exacerbated by lower investor appetite and increasing funding cost for systems dependent on external financing, and the oil-price shock for some.

—Read the full report from S&P Global Ratings

China's largest banks' profits rise, margins drop in Q1 amid rate reforms

China's four largest commercial banks reported year-over-year increases in net income for the first quarter of 2020, while facing decline in net interest margins, return on average equity and nonperforming loan ratios, on the back of the country's interest rate reforms. Among the four lenders, China Construction Bank Corp. logged the highest year-over-year net income growth at 5.12% for the quarter, increasing to 80.86 billion yuan from 76.92 billion yuan, according to data compiled by S&P Global Market Intelligence. It was compared with 4.80% growth at Agricultural Bank of China Ltd., 3.16% at Bank of China Ltd. and 3.02% at Industrial & Commercial Bank of China Ltd. Net interest margins continued to narrow from a year earlier as Chinese banks were facing downward pressure on interest rates.

—Read the full article from S&P Global Market Intelligence

The banks using regulatory grace period to file call reports amid COVID-19

Regulators have taken the unusual step of delaying call report deadlines for the banking industry. Banks are using that extra time to cope with disruption from the coronavirus pandemic, get to grips with a new accounting standard and devote resources to the Paycheck Protection Program. Banks and credit unions received a 30-day coronavirus-related grace period for filing their first-quarter call reports with the Federal Financial Institutions Examination Council. The normal deadline for filing first-quarter call reports — 35 days after quarter-end for companies with foreign offices and 30 days for those only with domestic offices — just passed. About 18% of call report filers took advantage of the extra time, an S&P Global Market Intelligence analysis found.

—Read the full article from S&P Global Market Intelligence

Listen: Q1 earnings provide snapshot of pandemic's impact on oil sector, hint at what's to come

It's been a chaotic couple of months for the global commodities markets, and the oil sector has been on the firing line of the price and demand collapse resulting from the coronavirus pandemic. Within days of lockdowns, expanding from Asia into Europe and the US, capex cuts were announced by oil and gas producers as they rapidly adjusted their spending plans to shore up budgets as prices slumped. The majority of oil majors have reported their first-quarter earnings, showing a partial snapshot of the pandemic's impact on commodity markets.

—Listen to the latest episode of Commodities Focus, a podcast from S&P Global Platts

Analysis: Aramco's price hikes disappoint amid struggling demand for Middle East crude in Asia

The unexpected price hikes from top Middle East oil producer Saudi Aramco raised a few proverbial eyebrows across the Asian crude market on Friday, with the move seen as detrimental to refiners still grappling with bleak product margins and scrambling for a foothold amid the collapsing oil demand in the region. "I bet everyone is surprised," a crude trader said, adding that "no one expected them to increase" OSPs. The hikes were "unexpected, as all Asia lifters were expecting a $2-$3 drop, and it seems there isn't much spot demand except in China," a China-based end-user said on Friday.

—Read the full article from S&P Global Platts

EOG shuts in 125,000 b/d of oil this month, eyes less in June

EOG Resources will temporarily shut-in production for at least four months, including 125,000 b/d in May, owing to recent low crude prices from the global coronavirus pandemic, top company executives said Friday. But June shut-ins will total 100,000 b/d, EOG said in a late Thursday statement, adding it also shut in 24,000 b/d last month. Shut-ins for 2020 will average 40,000 b/d, as output is gradually brought back over the rest of the year if oil market conditions permit, Bill Thomas, CEO of EOG, said in a first-quarter earnings call.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language