Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 30 Apr, 2020

By S&P Global

Global energy demand could suffer an “unprecedented decline” of 6% this year due to the coronavirus pandemic, the International Energy Agency stated today, with advanced economies, including the U.S., seeing the sharpest drops.

The projected decline would be “more than seven times the impact of the 2008 financial crisis on global energy demand, reversing the growth of global energy demand over the last five years. The absolute decline in global energy demand in 2020 is without precedent, and relative declines of this order are without precedent for the last 70 years,” the IEA wrote in its 2020 Global Energy Report. The agency also forecasts that global CO2 emissions will decline 8% compared to last year. “Such a reduction would be the largest ever, six times larger than the previous record reduction of 0.4 gigatonnes in 2009 due to the financial crisis and twice as large as the combined total of all previous reductions since the end of World War II,” the agency said.

Tomorrow, the historic OPEC+ agreement goes into effect, reducing oil production for the group’s 23 member and non-member nations by 9.7 million barrels a day in May and June, 7.7 million barrels a day from July to December, and 5.8 million barrels a day from January 2021 to April 2022.

Following the weeks-long oil price war with Saudi Arabia that, on top of diminished demand due to the coronavirus crisis, further obliterated the stability of the global oil market and instigated the OPEC+ production cut, Russia could emerge as a key make-or-break player in the deal’s success. The country faces serious skepticism over its willingness to cooperate with the unprecedented production cut, having consistently flouted cuts in the past, according to S&P Global Platts. Both Saudi Arabia and Russia’s quota is 8.5 million barrels a day—meaning Russia will need to cut about one-fifth of its recent crude production to meet the requirement. Russian energy minister Alexander Novak said yesterday that the country will lower its output by 19% in May compared to February's level.

"It is still too early to determine the longer-term impacts, but the energy industry that emerges from this crisis will be significantly different from the one that came before," Fatih Birol, the IEA's executive director, said today, according to S&P Global Market Intelligence. Mr. Birol also said that involuntary production cuts from non-OPEC countries shouldn’t be underestimated because reduction from countries unassociated with the organization “could well be similar” to the OPEC+ cuts.

Norway announced yesterday that it would cut crude production by 250,000 barrels a day in June and 134,000 barrels a day through the second half of this year in alignment with the OPEC+ agreement, according to S&P Global Platts. While Norway is the largest North Sea oil producer, it isn’t part of the 23-country OPEC+ alliance.

The coronavirus pandemic has all but decimated the American energy industry. U.S. Energy Information Administration data shows that commercial crude inventories climbed 8.99 million barrels, to 527.63 million, in the week ended April 24. The number of active oil and gas rigs in the U.S. decreased by 59, to 432, in the week ended April 29, according to data provider Enverus, as low crude prices push operators to idle their rigs. A survey by the investment bank Cowen showed that the rig count could continue its descent, falling by another 22%-44%. Texas-based energy multinational ConocoPhillips reported a first-quarter loss of $1.7 billion and said it will curtail its oil production by 265,000 barrels a day starting in May and 460,000 barrels a day by June.

Inclusive of the nation’s oil industry, the U.S. economy has crumbled under the coronavirus crisis. More than 3.8 million Americans filed joblessness claims last week, bringing the total to approximately 30 million in just six weeks, according to the U.S. Labor Department. Yesterday, the Bureau of Labor Statistics reported that U.S. GDP contracted an annualized 4.8% in the first quarter of this year.

Coal production in the U.S. declined for the fourth consecutive week, down 0.5% from last week and 39.4% lower than production rates during this time last year, according to the EIA.

"It has been a challenging start to 2020 and among the most complex global backdrops in my more than three decades in the global resource industry," Glenn Kellow, president and CEO of coal company Peabody Energy, said on the company's earnings call, according to S&P Global Market Intelligence. "In just the first quarter, Australia was still facing the impacts of persistent and tragic bushfires, immediately followed by some of the heaviest rainfall to hit New South Wales since the 1990s. In the US, we saw natural gas prices hit 21-year lows, and now we and the rest of the world are managing through the devastating and complex COVID-19 pandemic. "

Renewables may be the sole energy source to emerge unscathed from the COVID-19 crisis. The IEA expects this year total global renewable energy usage will increase 1%, and renewable electricity generation from wind, solar, and hydro power to grow 5%.

Yesterday, S&P Global Platts Analytics forecast that the expected drop in CO2 emissions this year will be so significant that it puts the world on track to where it would have been in 2027 in pursuit of a 2 degrees Celsius global warming emissions trajectory.

However, the pathway to a greener world post-crisis may be paved with more roadblocks than expected.

"Governments, companies, and consumers will be in far more tenuous fiscal positions because of the pandemic, which can make ambitious commitments to clean energy more challenging, particularly given lower fossil fuel prices," S&P Global Platts Analytics stated. "At the same time, with governments playing a central role in stimulus and recovery efforts, policy priorities will have the potential to advance climate agendas in ways that were not previously in play.”

The IEA wrote in its report that “a sustainable energy pathway calls for continuous efforts and commitment. The unprecedented decline in emissions in 2020 may only be temporary without structural changes. Recoveries from past crises have caused immediate rebounds in CO2 emissions, including the highest year-on-year increase on record in 2010” after emissions declined during the 2008-2009 financial crisis.

As such, even when much of the world is at an almost complete standstill, the reductions in fossil fuel usage and water and air pollution aren’t enough to achieve the goals of the Paris Agreement on climate change across a long-term basis, according to S&P Global Market Intelligence. Increasingly, the pandemic is materializing as a call to action to address climate change—the other black swan in the world—which has been studied and understood for dramatically longer than the coronavirus has.

Today is Thursday, April 30, 2020, and here’s an overview of today’s essential intelligence.

Electric vehicle subsidy extensions offer little relief to Chinese automakers

China's decision to extend subsidies and exemptions for electric and plug-in hybrid vehicles until 2022 is unlikely to significantly boost sales in this category, given the stronger effects the government's wider initiatives to stimulate consumption will have on traditional gasoline-powered models. The Chinese finance ministry earlier in April said it would reduce the subsidies by stages, rather than scrapping the subsidies and tax exemptions altogether by the end of 2020 as planned. It will start from a 10% cut in 2020 to a 30% reduction in 2022. The subsidies will apply only to cars worth less than 300,000 yuan, meaning that many EVs produced by foreign manufacturers will not qualify. The announcement came after sales of new energy vehicles, or NEVs, plunged 56.4% in the first quarter amid a 42.4% overall decline in the auto sector, according to figures released by the China Association of Automobile Manufacturers.

—Read the full article from S&P Global Market Intelligence

Energy demand to drop 6% in 2020 amid biggest shock since WWII – IEA

The coronavirus pandemic is expected to decimate energy demand across the world by 6% this year, an "unprecedented decline" that will hit hardest in advanced economies including the U.S. and Europe, the International Energy Agency said April 30. The forecast would mean energy demand — most significantly for coal, oil and gas — is set to decline at seven times the rate seen after the global financial crisis of 2008, a drop on par with losing the entire energy demand of India. With fossil fuels hardest hit by the demand destruction, energy-related carbon emissions could fall back to 2010 levels this year, the organization, or IEA, said. Demand for energy is set to fall by 11% in the EU and 9% in the U.S., the IEA projects, although it said the final impact is heavily dependent on the length and severity of measures to curb the spread of the virus. The group's analysis is based on assumptions that lockdowns will ease in the coming months, meaning the shock could be greater if restrictions stay in place or in the case of another outbreak later in the year.

—Read the full article from S&P Global Market Intelligence

COVID-19 highlights scale of action needed to tackle climate change

The steps the world has taken to contain the coronavirus pandemic sheds light on the potential global impacts of climate change and just how far the world still must go to slow the pace of global warming, climate scientists have suggested. Under normal circumstances, people have a hard time understanding the implications of longer-term risks when they have not yet directly experienced those implications, Peter Mennie, global head of ESG integration and research at Manulife Investment Management, said in an April 28 webinar hosted by sustainability-focused shareholder group Ceres. Significant differences exist between COVID-19 and climate change when it comes to the root cause and ability to predict and plan for such scenarios.

The rapid onset of the coronavirus prompted unplanned for social distancing mandates and economic collapse while the impacts of climate change have ramped up over decades and will continue to grow unless greenhouse gas emissions levels are not curbed. he coronavirus is a so-called black swan event in which the risk of another pandemic had been forecast by scientists but very little was known about the form it would take or how it would play out in real-time. Even now, very little is known about how and when the world can exit the pandemic, scientists said. In comparison, scientists, companies and other entities have conducted vasts amounts of studies, modeling and scenario analysis over the past several decades regarding climate change, which makes crafting a response and mitigation easier than for a pandemic, panelists at the Ceres webinar said. And although the pandemic has forced many more people to work from home and is taking up much of the attention of companies and nations, investors say they are still pushing ahead on ensuring the recovery and future actions account for climate change.

—Read the full article from S&P Global Market Intelligence

Biden energy agenda greener than Obama climate policies, observer says

Given more bipartisan recognition of climate change threats and the technological advancements in clean energy, energy industry observers expect former Vice President and presumptive Democratic presidential nominee Joe Biden to pursue more progressive climate and energy policies if elected in November than those of the Obama administration. Biden has even asked his transition team to explore the possibility of creating a new climate cabinet position, according to a pool report from a virtual fundraiser held earlier in April.

"I think the politics around climate have fundamentally changed from when President Obama was in office to now, and I think also the economic environment has fundamentally changed," said Sasha Mackler, director of the Energy Project at the Bipartisan Policy Center. "Those two factors are going to drive a much different political and policy agenda from a Biden presidency than we saw under President Obama, and I think it would be more ambitious."

—Read the full article from S&P Global Market Intelligence

Analysis: US crude stocks climb to 3-year high as refinery demand bottoms

US crude inventories again moved higher last week, but the build was blunted by an unexpected uptick in refinery demand, sliding production levels and strong export flows, an S&P Global Platts analysis showed Wednesday. US commercial crude inventories climbed 8.99 million barrels to 527.63 million barrels during the week ended April 24, US Energy Information Administration data showed. The build was around 1 million barrels smaller than analysts had forecast in S&P Global Platts' Monday survey. The build was realized entirely at Cushing, Oklahoma, the delivery point of the NYMEX crude contract, and on the US Gulf Coast.

—Read the full article from S&P Global Platts

Analysis: US oil, gas rig count falls 59 to 432 as oil collapse extends

The US oil and gas rig count fell 59 to 432 during the week ended April 29, rig data provider Enverus said Thursday, as upstream players continued to idle oil rigs in response to sustained lower crude prices. The decline was concentrated almost solely in the number of rigs chasing oil, which fell 56 to 315, while the gas-focused rig count dipped only three to 117. The total US rig counts has almost been halved since March 11, with rig totals falling 48%, or 403, from 835, in response to a steep decline in crude prices. Front-month WTI is down nearly 65% from its most recent peak in mid-February, and Platts Midland crude has lost nearly 68% of its value over the same period. The number of rigs active in the Permian Basin was down 33 at 229 last week, fully 47% lower than during the same period last year. The Permian has seen rig totals drop by 47% since the first week of March, plummeting 200 rigs from a total 429 rigs.

—Read the full article from S&P Global Platts

ConocoPhillips raises May oil output curtailments, still more due for June

ConocoPhillips will increase its near-term oil production cuts beyond the 225,000 b/d gross originally signaled two weeks ago, owing to persistent low crude demand and prices due to the coronavirus pandemic, the company said Thursday. The company now intends to curtail 265,000 b/d of gross oil, starting in May, representing an additional 40,000 b/d of cuts from the Lower 48 states. The other 100,000 b/d, from the Surmont oil sands project in Canada, is unchanged from earlier this month, ConocoPhillips said in its first quarter earnings release. But June's cuts will be even steeper, totaling 460,000 b/d and including 260,000 b/d in the Lower 48 states, 100,000 b/d from Surmont, still unchanged, and 100,000 b/d in Alaska, ConocoPhillips said. "The next few months will be very bumpy for industry and for us," company CEO Ryan Lance said in a statement, referring to recent crude price volatility that is expected to continue plaguing oil producers.

—Read the full article from S&P Global Platts

Listen: When it comes to crude, Chinese buyers are spoilt for choice

There has been unprecedented demand destruction in Asia as a result of the coronavirus pandemic, causing many refiners to cut run rates. While COVID-19 initially wreaked havoc in Chinese markets, commodity trends in the country seem to be showing signs that it is getting back in business. Other countries in the region, meanwhile, are still on lockdown and even extending quarantine periods. Is China the only respite for crude sellers under the current circumstances? S&P Global Platts editor Avantika Ramesh and analysts Oceana Zhou and Daisy Xu discuss.

—Listen to this episode of Global Oil Markets, a podcast from S&P Global Platts

Norway oil producers seeking clarity on production cut announcement

Norwegian oil producers were seeking clarity Thursday on a landmark production cut announced by the government in support of wider OPEC-plus output cuts intended to overcome the crisis in oil markets, as the country unveiled a tax break for the industry. In a statement late Wednesday, Norway's petroleum and energy ministry said crude production would be cut by 250,000 b/d in June and 134,000 b/d through the second half of the year, in accordance with a clause in the country's petroleum act allowing curbs based on "important interests of society." It added the launch of production from a number of new projects would be delayed into 2021 due to the coronavirus pandemic, resulting in production in December 2020 being 300,000 b/d below original expectations. It said fields that had been due to start producing but been delayed by the pandemic would have contributed 166,000 b/d of oil production in December. Industry sources said the cuts did not come as a surprise, but much remained to be worked out in terms of the details.

—Read the full article from S&P Global Platts

Involuntary non-OPEC output cuts should not be underestimated: IEA's Birol

Involuntary production cuts from non-OPEC countries should not be underestimated, the executive director of the International Energy Agency said Thursday, adding that the massive demand destruction caused by the coronavirus pandemic was forcing companies to shut in more output. "These reductions may well be similar to reductions that will be coming from OPEC+ throughout the year," said Faith Birol on a press webinar at the launch of IEA'S Global Energy Review. "We are not yet there but we seeing some [production cuts] already." Birol said that there have already been hefty production cuts from the US, Canada and Brazil, along with recent announcements from Norway. "I would expect reduction from countries whose oil markets are run by private companies to be at a level that one should not underestimate," he said.

—Read the full article from S&P Global Platts

As OPEC+ oil cuts go into force, Russia could make or break the deal

The OPEC+ supply accord goes into effect Friday, and Russia's performance could well determine whether it succeeds in speeding the oil market's recovery from the coronavirus crisis. The deal calls for the 23-country OPEC+ alliance to cut an unprecedented 9.7 million b/d of crude production over May and June, tapering down to 7.7 million b/d for the rest of 2020 and then 5.8 million b/d for all of 2021 through the first quarter of 2022. Given the precedent in previous OPEC+ agreements, compliance by Saudi Arabia and its Gulf allies with their production quotas does not appear in doubt, and indeed they have signalled in the past week that they have already begun ramping down their output. Russia, however, faces serious scepticism over its willingness to play ball, having consistently flouted its cuts in the past. Its quota is 8.5 million b/d, the same as Saudi Arabia's, which will require it to slash some 2 million b/d — or about one-fifth — of its recent crude production.

—Read the full article from S&P Global Platts

End in sight for Indian lockdown, but will the steel sector see a rapid rebound?

As May 3 approaches steel raw material suppliers are eagerly eyeing a demand boost from India, the world's second largest steel producer. The date marks the potential end to a 38-day lockdown in the country which has been a testing period for the steel industry, with India's raw material demand tanking and its steelmakers pushing product out onto the seaborne market. However, Indian market sources were circumspect about the prospects for any immediate strong recovery in trade amid concerns about a backlog of cargoes at ports causing bottlenecks, financing and cash flow issues, the pace of construction and automobile production restarts, and the strength of recovery in the wider economy.

—Read the full article from S&P Global Platts

Peabody Energy to take 'aggressive, decisive' action in face of COVID-19 impacts

Peabody Energy is looking to preserve cash amid the uncertainty created by the COVID-19 pandemic and is considering layoffs, divestitures and other measures to protect its business, the company said Wednesday. "It has been a challenging start to 2020 and among the most complex global backdrops in my more than three decades in the global resource industry," Peabody President and CEO Glenn Kellow said on the company's earnings call. "In just the first quarter, Australia was still facing the impacts of persistent and tragic bushfires, immediately followed by some of the heaviest rainfall to hit New South Wales since the 1990s. In the US, we saw natural gas prices hit 21-year lows, and now we and the rest of the world are managing through the devastating and complex COVID-19 pandemic." Kellow said Peabody is actively pursuing structural improvements across the entire enterprise. In April, the company eliminated approximately 250 positions from its Powder River Basin coal mines after trimming 215 jobs from its global mining portfolio in the first quarter. The company reported a first-quarter net loss of $129.7 million compared with a profit of $124.2 million in the year-ago quarter.

—Read the full article from S&P Global Platts

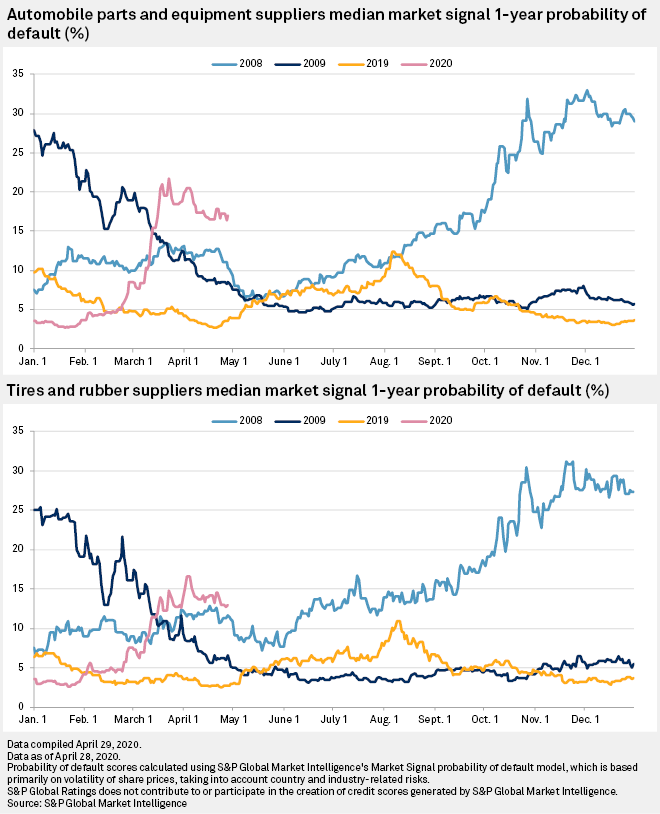

Auto suppliers see spike in probability of default during COVID-19 pandemic

The odds of default for auto parts suppliers jumped in April, and experts expect increased consolidation and bankruptcies within the industry as the coronavirus pandemic continues to hammer global new vehicle production. S&P Global Market Intelligence's median one-year market signal probability of default rose to above 20% for auto parts and equipment suppliers in April, up from below 5% at the beginning of 2020. For tire and rubber suppliers, the probability of default rose above 15% in April, up from below 5% in January. The figure represents the odds that a company will default on its debt within the next year based on fluctuations in the company's share price and other country and industry-related risks.

—Read the full article from S&P Global Market Intelligence

Crisis looms for motor finance industry as coronavirus threatens lease payments

In the now seemingly halcyon world of 2019, motor finance was a buoyant business. Lending for car purchases in the U.K. alone rose to £48 billion from £24 billion in 2012. With the COVID-19 crisis continuing to rock industries and cost jobs around the world, the repayment of much of that lending now looks much less certain, and authorities in the U.K. have intervened following calls from industry bodies to take action before the problem spiraled out of control. The Financial Conduct Authority confirmed April 24 the introduction of a package of measures to support consumer credit customers facing payment difficulties due to the impact of the coronavirus pandemic. The centerpiece is a three-month payment freeze for motor finance and other credit customers who are having temporary difficulties meeting finance or leasing payments due to the pandemic.

—Read the full article from S&P Global Market Intelligence

Consumer discretionary M&A activity falls 56.5% YOY by value in Q1'20

Consumer discretionary M&A activity in the first quarter of 2020 plummeted 56.5% year over year by value as the number of deals dropped 10.7% in the three months, according to data compiled by S&P Global Market Intelligence. Total M&A activity in value terms more than halved to $21.42 billion from $49.22 billion in the first quarter of 2019, while the number of deals decreased year over year to 1,045 from 1,170.

—Read the full article from S&P Global Market Intelligence

Leveraged loan downgrades continue threat to Europe's CLO investor base

A credit rating downgrade wave of historical proportions is following in the wake of economic disruption caused by COVID-19, swelling the ranks of riskier debt issues (those rated B-minus and triple-C), and potentially challenging Europe’s all-important CLO investor base in a way not seen since the global financial crisis more than a decade ago. European ratings had been under pressure even before the coronavirus, with downgrades outweighing upgrades every month (on a rolling three-month basis) since April 2017, according to LCD. This trend had also accelerated in the past year, as private equity took advantage of the then-hot markets — and relatively disappointing M&A supply — to lever-up holdings to fund dividends or opportunistic acquisitions. The erosion of lender protections, through weaker documentation, has only served to exacerbate these trends, and analysts predict lower recoveries from any uptick in defaults in the coming 12 months.

Already, the effect of COVID-19 on corporate credit quality has been severe. LCD’s data is based on facility, rather than corporate, ratings, and shows that in the three months to April 17, the S&P European Leveraged Loan Index (ELLI) recorded 51 downgrades and only one upgrade. This dominance of downgrades is of a magnitude not seen since January 2012, when Europe was feeling the effects of the sovereign debt crisis in countries such as Greece and Portugal.

—Read the full article from S&P Global Market Intelligence

Japan Corporate Creditworthiness Faces Mounting Pandemic Pressure

S&P Global Ratings said that downward pressure will mount further on creditworthiness across the Japanese corporate sector, with no end to the COVID-19 pandemic in sight. The automobile, auto-parts, transportation infrastructure, and retail sectors have all been affected directly by a substantial decline in demand, which is in turn hurting suppliers in the materials, electronics, and capital goods sectors. The fall in prices of crude oil and materials and the global economic downturn has hit general trading and investment companies (GTICs) and oil exploration companies. S&P Global Ratings believes that the performance of entities rated in various sectors will come under very strong downward pressure in the next one to two years. Even if companies implement short-term cost-cutting measures, a material decrease in revenue will inevitably cause profit levels to fall substantially.

—Read the full report from S&P Global Ratings

Effects Of COVID-19 On U.S. Student Loan ABS

S&P Global Ratings believes that student loan transactions will experience increased forbearance levels in the short term, and that they retain sufficient liquidity to pay note interest with cash reserve accounts and the availability of loan interest and principal collections. S&P Global Ratings does not believe that Federal Family Education Loan Program (FFELP) transaction ratings will be affected by a COVID-19 related increase in default rates because FFELP loans retain 97% federal government reinsurance. That said, some FFELP transaction tranche ratings may be affected by higher forbearance levels or income-driven repayment relief that persist beyond the next six months and impact pools' ability to pay principal by legal final maturity.

S&P Global Ratings generally expects to moderately increase the base case default rate and associated stressed level assumptions for private student loan pools to reflect the unprecedented macroeconomic environment obligors will experience. Speculative grade-rated legacy PSL transactions are at greater risk of downgrade than post-2010 and refi PSL transaction tranches, all of which are investment-grade rated, with most in the higher-rated categories.

—Read the full report from S&P Global Ratings

As Global IT Spending Falls, Tech Ratings Pressure Rises

S&P Global Ratings expect global information technology spending to decline 4% in 2020 versus our mid-March forecast of 3%, with slight outlook deterioration across all technology segments. Through April 24, S&P Global Ratings has taken 54 rating actions on U.S. tech issuers related to the COVID-19 pandemic and recessionary pressures. Some 52 were taken on speculative-grade issuers and only two on investment-grade issuers. S&P Global Ratings downgraded eight tech issuers globally to the 'CCC' category since the COVID-19 outbreak. Most downgrades in speculative-grade categories were related to liquidity concerns.

S&P Global Ratings has downgraded only six U.S. rated issuers to the 'CCC' category since the COVID-19 outbreak. Most downgrades in speculative-grade categories were related to liquidity concerns. S&P Global Ratings expects more negative rating actions on U.S. tech issuers, including investment-grade companies, should global business confidence drop significantly because the coronavirus becomes more resilient and delays the start of global economic recovery. A third-quarter rebound is assumed in the base-case scenario.

—Read the full report from S&P Global Ratings

COVID-19 targets cells; bats, coronavirus co-evolved; fighting cancer with math

The scientific community is scrambling to learn more about the novel coronavirus causing the COVID-19 pandemic, and preclinical trials have quickly revealed some of the virus's unique characteristics, potentially leading to treatments and vaccines. Scientists at the Ragon Institute and the Broad Institute — collectively run by the Massachusetts General Hospital, the Massachusetts Institute of Technology and Harvard University — have found that the virus targets particular cells in the body.

Investigating proteins coded by genetic material, the Boston-area researchers discovered that the virus can enter cells in the lungs, nasal passages and intestines. These cells express two proteins that are susceptible to the virus's own genetic makeup. The findings were published in the journal Cell. The researchers used RNA sequencing of mouse, primate and human cells to decipher what causes a particular cell type to act the way it does and compared the genes to the coronavirus infection mechanism. Specifically, cells that produce mucus and those that line the air sacs in the lung expressed the susceptible genes. In the intestine, the cells responsible for absorbing nutrients gave a similar signal.

—Read the full article from S&P Global Market Intelligence

US NIH using 'Shark Tank' contest model in $1.5B coronavirus tests initiative

The U.S. National Institutes of Health has put out the call for innovators — from the basement to the boardroom — to compete for a share of a $500 million prize in a contest to develop at-home and point-of-care diagnostic tests for COVID-19. The NIH is using a competitive model based on ABC's reality TV show "Shark Tank," where a panel of entrepreneurial investors — sharks — decide if they want to fund an innovator's product.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language