Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Apr, 2020

By S&P Global

At the conclusion of a difficult week, the world surpassed 1 million confirmed cases of coronavirus and the total global death toll neared 60,000. A new wave of infections prompted China and Singapore to reinstate lockdowns over parts of both nations. As a result, half of the world is under orders to stay home.

The combination of the coronavirus, oil price war, and market volatility has troubling implications for the global economy, according to S&P Global Ratings. Leaders from the International Monetary Fund (IMF) and World Health Organization (WHO) spoke together at a rare joint news conference today in Geneva, Switzerland, warning of the crisis’ risks.

“This is a crisis like no other,” Kristalina Georgieva, IMF managing director, said. “Never in the history of the IMF have we witnessed the world economy coming to a standstill. We are now in a recession. It is way worse than the global financial crisis.”

“We are all aware of the profound social and economic consequences of the pandemic,” WHO Director-General Tedros Adhanom Ghebreyesus said. “Ultimately, the best way for countries to end restrictions and ease their economic effects is to attack the virus.”

“We don’t want to end up in a cycle of lockdown followed by release, followed by another lockdown, followed by release,” said Mike Ryan, the WHO’s head of health emergencies, while encouraging countries to keep their prevention methods in place.

Ecuador’s President Lenin Moreno said yesterday that the country has “tens of thousands of infected people and hundreds of lives cut short” from the coronavirus. Brazil has reported more than 8,000 cases. The spread has reached sub-Saharan Africa.

As investors grapple with the economic fallout of COVID-19 and seek to understand its impact, China has become an unexpected stabilizing force in emerging markets. Despite being the initial center of the outbreak, Chinese equities have experienced lower volatility, minimal currency fluctuation, and less exposure to falling oil prices in the recent market environment in comparison with emerging market peers, according to S&P Dow Jones Indices.

The U.K., France, and New York today reported their highest death counts of the outbreak. Italy and Spain’s outbreaks appear to be slowing. The E.U. waved the bloc’s import tariffs for medical supplies. In New York and New Jersey, state officials are seizing ventilators that are being unused in facilities to redistribute at hospitals on the front lines of the crisis.

“We’re not at all at the crest of this wave yet, and we’re even less at the beginning of a decline,” French Prime Minister Edouard Philippe said yesterday. U.K. Prime Minister Boris Johnson, who has tested positive for coronavirus, shared a video on Twitter today stating he is still in isolation with a fever. German Chancellor Angela Merkel returned to work today after a 12-day quarantine and several tests showing her to be free from the virus, having previously interacted with a doctor who tested positive. Spain’s top health official Fernando Simon tested positive for coronavirus on Monday. U.S. President Donald Trump said today that while the U.S. Centers for Disease Control and Prevention recommended Americans to wear non-medical masks when leaving their homes, “I’m choosing not to do it. It’s only a recommendation.” President Trump reinforced his previous position that lockdown measures across the country are within the authority of states’ governors.

Restaurants and retailers were among the industries that led U.S. job losses in March stemming from the coronavirus pandemic, though experts believe the full impact of the crisis across the consumer sector and broader economy is yet to be seen. "We are seeing only the tip of a very nasty iceberg that we are heading towards," Erica Groshen, senior extension faculty member at the Cornell University School of Industrial and Labor Relations and ex-commissioner of the Bureau of Labor Statistics, told S&P Global Market Intelligence.

An extraordinary OPEC+ meeting—consisting of OPEC, Russia, Mexico, Kazakhstan, Oman, Azerbaijan, Malaysia, Bahrain, Sudan, South Sudan, and Brunei—is planned for Monday to try and broker a deal on production cuts. Negotiations and trading were already underway today, delegates told S&P Global Platts. Since the alliance was nearly terminated on March 6, when Russia rejected a Saudi-led OPEC proposal for deeper cuts to combat the coronavirus' impact on the oil market, the price war has roiled oil markets and hampered already low demand. Values for cash Dubai and Oman crude contracts rose from record lows today amid calls for an OPEC+ meeting. President Trump met with the CEOs of several American producers today. While some U.S. shale companies have been pressuring the Trump administration to forge a deal that would boost prices and stave off layoffs and bankruptcies, not all are on board. OPEC sources declined to say what the bloc would do if the U.S. doesn’t buy off on an agreement to cut production.

Today is Friday, April 3, 2020, and here is essential insight on COVID-19 and the markets.

Global flight numbers appear to stabilize in April: radar data

The number of global daily flights appears to have stabilized in April, radar data suggests, following large falls in March as airlines slashed flying capacity amid the coronavirus epidemic. Flightradar24 data showed tracked daily flights at 80,431 Wednesday, above the seven-day moving average for the first time since March 12. A total of 76,024 flights were recorded on Thursday, also above the moving average.

Although the daily total of purely commercial flights was still below the moving average Thursday, the fall in flight numbers appeared to have decelerated. The total number of flights peaked at 188,587 in March and at 109,212 for commercial flights, Flightradar24 data showed.

—Read the full article from S&P Global Platts

Private capital more diversified now than in global financial crisis

Private equity as an asset class has grown substantially since the global financial crisis, and firms have much broader strategies and tools available to them. Just over a decade on from the downturn, the industry faces another significant challenge. In the second of a two-part series, S&P Global Market Intelligence looks at how strategy diversification and the evolution of the debt market will affect how the private equity industry is impacted by the coronavirus outbreak.

—Read the full article from S&P Global Market Intelligence

OPEC+ seeks US buy-in on oil cuts with webinar summit scheduled for Monday

The OPEC+ alliance plans an extraordinary meeting Monday to try and broker a deal on production cuts, but negotiations and horse-trading were already underway Friday, as members held a flurry of calls to exchange proposals and trade intelligence, according to delegates. Ministers appear to be coalescing around collective supply curbs of 10 million b/d, but details on how they would be divvied up - and indeed which countries would participate - are still in flux.

By comparison, OPEC's largest ever production cut was 4.8 million b/d in 2008, noted Giovanni Staunovo, an analyst with investment bank UBS. "Agreeing on a date for a meeting is one thing; splitting up those large cuts and making them credible is another," he said.

Monday's summit will be held via webinar, but no time has yet been set. Russia confirmed Friday that Energy Minister Alexander Novak would take part, after being noncommittal for much of the day, but the involvement of the US remains uncertain, despite President Donald Trump's proclamation in Twitter Thursday that he had successfully intervened in the Saudi-Russia price war that has inflamed the oil market's coronavirus-induced meltdown.

—Read the full article from S&P Global Platts

CRUDE MOC: OPEC+ call for meeting lifts Middle East crude from deep lows

Values for cash Dubai and Oman crude contracts rose from record lows Friday, amid calls for an extraordinary meeting by OPEC+ members to address multi-year low oil prices and excess global oil production. June cash Dubai's discount to June futures was up 92 cents/b day on day to be assessed at minus $7.76/b.

Thursday's cash/futures spread was assessed at minus $8.68/b, the lowest on record for the contract, with crude market sentiment nosediving in tandem with the end of the latest OPEC+ production cut agreement on March 31. June cash Oman rose in step with Dubai Friday, up to minus $7.76/b against June Dubai futures after rising 88 cents/b on the day. Saudi Aramco, initially expected to issue official selling prices around April 5 for its crude oil loading over May, could delay the OSPs until after the OPEC+ meeting is concluded, market participants said.

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

Listen: 'Cheap oil' takes VLCC freight for a bull ride on floating storage play

The tsunami of IMO 2020 turned into a tidal wave of cheap oil as producers flood the crude oil market and refiners cut runs amid the COVID-19 demand destruction. In the meantime crude is heading toward containment in tankers floating offshore. Catherine Wood and Barbara Troner of the S&P Global Platts shipping team put their heads together with Platts crude editor Kristian Tialios to explore the dynamics of current floating storage plays.

—Listen and subscribe to the Commodities Focus podcast from S&P Global Platts

CHART OF THE DAY

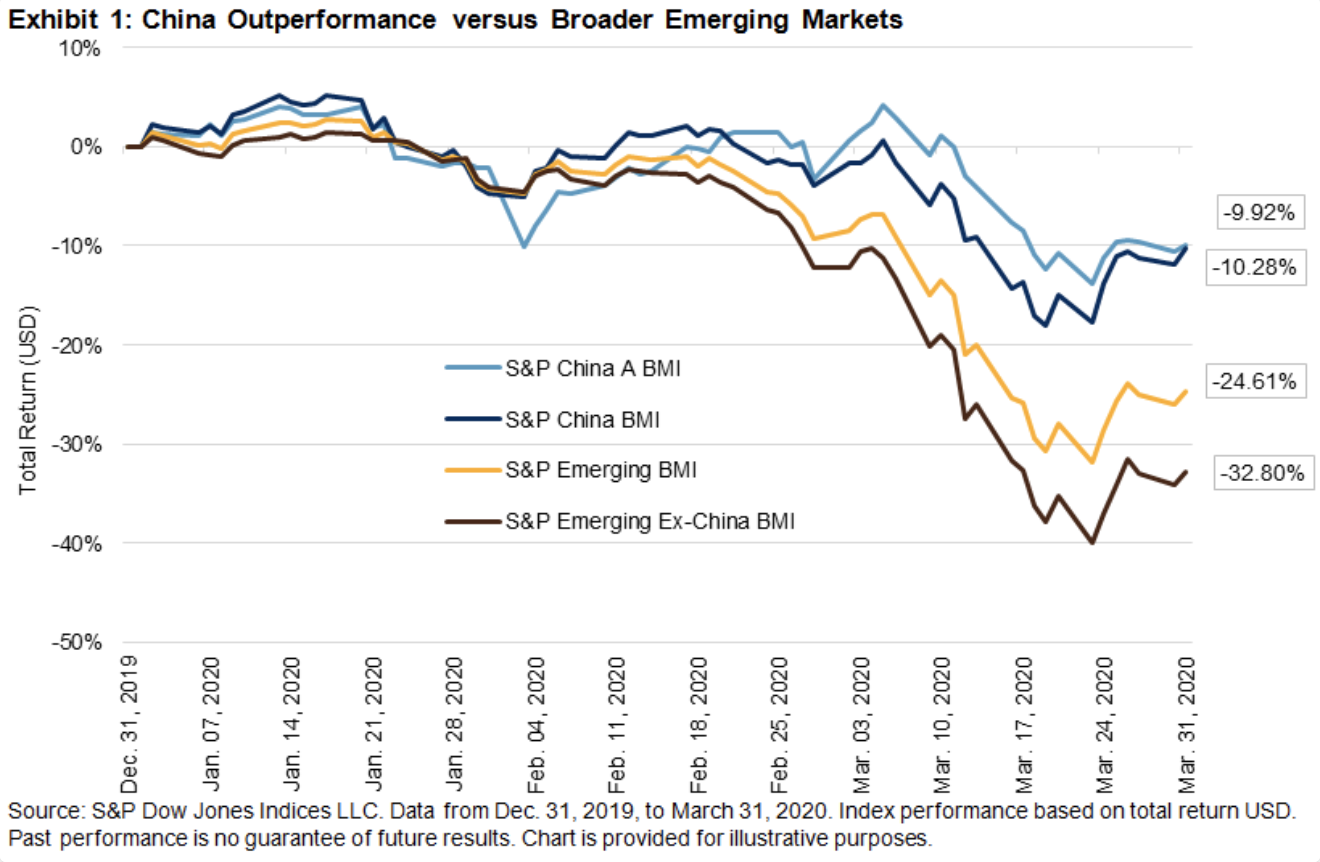

China: An Unlikely Stabilizer in Emerging Markets

As investors grapple with the economic fallout of COVID-19 and seek to understand its impact, China has become an unexpected stabilizing force in emerging markets. Despite being the epicenter of the outbreak, Chinese equities have experienced lower volatility, minimal currency fluctuation, and less exposure to falling oil prices in the recent market environment in comparison with emerging market peers.

On Feb. 19, 2020, U.S. markets closed at their all-time high. The following days and weeks would see a precipitous drop in global markets, as the pandemic became the primary concern. By March 23, 2020, the S&P Emerging BMI had declined 31.9% to its recent low, in a matter of just over four weeks since signs of slowing started in the U.S. However, not all emerging regions fared equally, and China—the epicenter of the virus and the first to suffer the most drastic economic consequences—outperformed broader emerging markets by more than 20 percentage points in the first quarter.

—Read the full article from S&P Dow Jones Indices

Middle East oil producers brace for painful times as 'war' prices kick in

The multi-year oil price crash that began in March is poised to dig a deeper hole into the Middle East producers' pockets in April, as sharp discounts in contractual prices by top suppliers led by Saudi Arabia came into effect this month. ICE Brent futures sank to the lowest since 2002 last month, but prices realized by the Middle East producers for key grades in March were lowest only since 2016, thanks in part to the whole-month average pricing mechanism used by most of the region's oil suppliers and the contract prices set prior to a full blown "price war" that started in early March.

Saudi Arabia supplied March barrels of key Arab Light grade to Asian customers at $37.17/b, down 36% from February. The previous low for the grade was $34.69/b seen in March 2016. But the story of April-loading barrels could be a harbinger of bad news for the Middle Eastern producers. Besides the sharpest global demand contraction caused by the coronavirus pandemic and a slump in crude oil, the steep price cuts announced by the Middle East producers became effective April 1. The April-loading barrels of Saudi's Arab Light crude are now being supplied to Asian buyers at a discount of $3.10/b to the monthly average of Platts Dubai/DME Oman this month, representing a fall of $6/b in differentials from March. Based on prices so far this month, the OSP differential is worth a discount of almost 14% to oil benchmarks that are already lowest in nearly two decades, versus a premium of 8.4% in March.

—Read the full article from S&P Global Platts

Dubai crude futures edge higher on questions over the US-Saudi-Russia alliance

Benchmark Dubai crude futures rose in mid-morning trading in Asia on Friday after comments from US President Donald Trump overnight suggested a new production cut alliance may be on the cards with heavyweight producers Saudi Arabia and Russia. However, the upward momentum was limited after Russia denied speaking with Saudi Arabia on increasing supply cuts. By Friday morning in Asia, Dubai futures had traced the overnight climb in oil markets, but in a somewhat muted manner, pricing in Russia's official statement after initial optimism had worn off.

At 11 am Singapore time (0300 GMT), the front-month June Dubai futures contract was pegged at $32.11/b, up $1.93/b from its assessment at $30.18/b at 4:30 pm (0830 GMT) Thursday. Still, traders mulled over other considerations related to the execution of such a deal in the near future, such as the quantity of crude oil that could realistically be taken off the market. Going forward, any deal to cut production is unlikely to be successful without the mutual cooperation of the US, Russia and Saudi Arabia, the world's top three oil producers, traders in Asia said. But the absence of a precedent where the US has joined production cut accords remain a major detractor to the realistic execution of such a deal.

—Read the full article from S&P Global Platts

Egyptian refiners offer rare gasoline cargoes as African demand slumps

In a rare move this week, Egyptian refiners Middle East Oil Refinery and Egyptian General Petroleum Corporation emerged to offer gasoline cargoes for prompt April-loading dates as domestic demand continues to spiral lower amid the COVID-19 pandemic. EGPC Thursday offered 27,000-33,000 mt of 95 RON gasoline for loading over April 16-18 from Alexandria, according to open tenders seen by S&P Global Platts.

The company, a typical importer of gasoline, has taken at least three to five MR-sized gasoline cargoes per month on a spot basis since the beginning of 2020. In 2019, EGPC's monthly gasoline intake stood at around five to six MR-sized cargoes on a spot basis, Platts calculations showed. Earlier this week, Midor offered 30,000 mt of 95 RON gasoline for April 10-12 loading from Alexandria. The last time Midor offered a gasoline cargo was in June 2019. "The tenders just show you how much demand has been hit," a Singapore-based market source said. "When typical importers sell you know things are bad."

—Read the full article from S&P Global Platts

African airlines urgently need financial help amid coronavirus pandemic: IATA

The International Air Transport Association warned this week that governments in Africa needed to provide financial relief amid the coronavirus pandemic, estimating that revenue lost by carriers could reach $4 billion, a 32% fall. IATA is calling for a mixture of direct financial support to provide relief from the effect of Covid-19 such as, loans, loan guarantees, support for the corporate bond market and tax relief.

"The air transport industry is an economic engine, supporting up to 8.6 million jobs across Africa and the Middle East and $186 billion in GDP. Every job created in the aviation industry supports another 24 jobs in the wider economy. Governments must recognize the vital importance of the air transport industry, and that support is urgently needed...Failure by governments to act now will make this crisis longer and more painful. Airlines have demonstrated their value in economic and social development in Africa and the Middle East and governments need to prioritize them in rescue packages," said Muhammad Al Bakri, IATA's Regional Vice President for Africa and the Middle East.

—Read the full article from S&P Global Platts

COVID-19: Coronavirus-Related Public Rating Actions On Nonfinancial Corporations And Affected European CLOs

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies and European collateralized loan obligations (CLOs), S&P Global Ratings is publishing a regularly updated list of rating actions we have taken globally on nonfinancial corporations, which have had an effect on European CLOs, and a summary table. These are public ratings where S&P Global Ratings mentions the COVID-19 coronavirus as one factor or in combination with others.

—Read the full report from S&P Global Ratings

Santander chairman sees 'very marginal' coronavirus impact on Q1 earnings

anco Santander SA is expecting the coronavirus to have a "very marginal impact" on its first-quarter results and will review its medium-term targets once the economy stabilizes, Executive Chairman Ana Botín said April 3.

Speaking at the bank's annual shareholder meeting, Botín said results for the quarter were in line with that of the first quarter of 2019, when earnings totaled €1.84 billion in 2019. However, current economic conditions make it impossible to forecast how much the virus might affect earnings in the future because of the uncertainty over the length of the health crisis, she said.

—Read the full article from S&P Global Market Intelligence

Consumer sector drives US job losses in March but worse days ahead – experts

Restaurants and retailers were among the industries that led U.S. job losses in March stemming from the coronavirus pandemic, but experts believe the full impact of the crisis across the consumer sector and broader economy is yet to be seen. The U.S. economy shed 701,000 jobs in March as consumer-focused industries contributed to more than half of the losses.

The leisure and hospitality industry led the decline with the loss of 459,000 jobs, a decrease of 2.72% from February, data from the U.S. Bureau of Labor Statistics showed. Food services and drinking places, a sector within leisure and hospitality, lost 417,000 jobs during the month. The retail sector shed 46,000 jobs, with furniture and home furnishings accounting for 10,400 jobs lost. Clothing and clothing accessories stores lost 16,300 jobs, a month-over-month decrease of 1.27%.

—Read the full article from S&P Global Market Intelligence

Hard-hit industries vie for a piece of massive Fed lending program

More than a week after Congress approved the largest fiscal stimulus in U.S. history, many companies still don't know if it will provide the financial lifeline they need to stay afloat. Since the legislation passed on March 27, industry groups have been pressing policymakers to ensure a large chunk of their firms can actually benefit from a major lending program at the heart of the new law. Under the CARES Act, the Treasury is getting $454 billion in funds to provide credit protection for the Fed's emergency lending operations, a backstop expected to lead to about $4.5 trillion in Fed lending.

Real estate groups, retailers and other sectors under pressure are closely watching for any guidance the Treasury and Fed will put out in the coming days, as the details will determine what kinds of businesses can get Fed loans to help them through the coronavirus pandemic. State and local governments, whose revenues are falling sharply and whose expenses are set to spike due to the pandemic, are also expected to get some chunk of the roughly $4.5 trillion in Fed loans.

—Read the full article from S&P Global Market Intelligence

US banks at lowest price-to-adjusted tangible book values in March

U.S. financials continued to underperform the broader market in March as stocks exhibited extreme daily swings. Within the S&P 500, financials trailed only energy as the worst-performing sector. The market capitalization-weighted SNL U.S. Bank and Thrift index plunged 26.9%, far worse than the negative 12.5% total return for the S&P 500.

The median return of the 320 banks in the S&P Global Market Intelligence analysis was negative 25.0%. Only five of those banks had a positive total return last month: Ontario, Calif.-based CVB Financial Corp. at 8.1%; Gallipolis, Ohio-based Ohio Valley Banc Corp. at 7.8%; Dunmore, Pa.-based FNCB Bancorp Inc. at 4.5%; Dunmore, Pa.-based Fidelity D & D Bancorp Inc. at 3.5%; and San Rafael, Calif.-based Westamerica Bancorp. at 1.7%.

—Read the full article from S&P Global Market Intelligence

BofA among first movers in $350B small-business rescue program

Bank of America Corp. became the first giant bank to start accepting applications under a key federal program to support small businesses, saying it had received about 10,000 applications by 10:00 a.m. ET on the day of the program's launch. Chairman, President and CEO Brian Moynihan said employees worked all night to add a new component to the company's core banking app in time for the launch of the Paycheck Protection Program on April 3. In an interview on CNBC, he said branches were open for small-business customers to apply, but that the process could be done entirely digitally.

BofA is currently accepting applications from existing small-business customers, starting with those that already have loans with the bank. Moynihan encouraged potential borrowers to go to banks where they already have relationships, in line with guidance from Treasury Secretary Steven Mnuchin. "We want everyone to go back to their borrowing bank to get the application because that will be easier to process," and faster, Moynihan said.

—Read the full article from S&P Global Market Intelligence

From crisis to crisis – March 2020 US leveraged loan market rivals 2008

As the longest economic expansion in U.S. history came to an abrupt end in March, the record credit cycle, during which the U.S. leveraged loan asset class doubled in size and became a dominant player in the capital markets, likewise collapsed. Putting it mildly, last month's loan market upheaval and resulting volatility were devastating. The U.S. leveraged loan asset class plunged 12.37% in March, the second-steepest monthly decline in the 23-year history of the S&P/LSTA Leveraged Loan Index. Before COVID-19 swept the globe, the top three biggest losses for loans were during the global financial crisis following the Lehman Brothers bankruptcy in September 2008.

Prices in the usually staid loan market gyrated wildly last month. On March 18, the Index declined by 3.74%, the biggest daily loss on record. In fact, in the history of the Index, there are only four instances of daily losses exceeding 3% — all of them last month. Likewise, there are only nine days on record when loans lost more than 2% per day. Six of these days were last month — the other four were in October and November 2008. That said, the biggest daily gain for the Index also was last month — 3.33% on March 26, which followed a 2.05% gain on March 25, the third-biggest daily gain on record.

—Read the full article from S&P Global Market Intelligence

Servicer Evaluation Spotlight Report™: U.S. Commercial Mortgage Servicers Preparing For Impact From COVID-19

S&P Global Ratings recently surveyed its ranked U.S. commercial mortgage servicers, all of whom have indicated they have successfully deployed their disaster recovery and business continuity plans in response to the COVID-19 pandemic. We view this industrywide accomplishment positively, although we recognize that all commercial mortgage servicers are now drinking from the proverbial firehose. While we are not taking any coronavirus-related ranking actions at this time amongst the U.S. commercial mortgage servicers' we rank, we believe significant operating challenges and bottlenecks lie ahead that will place strains on servicers' resources, including: Massive requests for forbearance or other forms of borrower relief; an increase in servicer advancing requirements; and acceleration of delinquencies and defaults.

All S&P Global Ratings-ranked U.S. commercial mortgage servicers have successfully deployed their disaster recovery and business continuity plans in response to the COVID-19 pandemic. S&P Global Ratings is not taking any coronavirus-related ranking actions at this time amongst the U.S. commercial mortgage servicers' we rank. However, S&P Global Ratings believes significant operating challenges and bottlenecks lie ahead, including massive requests for forbearance or other forms of borrower relief; increase in servicer advancing requirements; and acceleration of delinquencies and defaults.

—Read the full report from S&P Global Ratings

COVID-19 begins to affect US insurance product, rate filing timelines

Logistical challenges stemming from state-specific responses to the COVID-19 outbreak have led some insurance regulators to ask carriers to limit the volume of the product filings they submit or to hold off on their submission altogether. A review of rate, rule and form filings collected by S&P Global Market Intelligence finds that the Pennsylvania Insurance Department asked numerous carriers in mid-March to limit submissions to only those that are "necessary and essential" to their operations. Other states have extended the amount of time required for standard filing review processes to take place.

Federated Mutual Insurance Co., Hanover Insurance Group Inc., State Farm Mutual Automobile Insurance Co., Selective Insurance Group Inc., Nationwide Mutual Insurance Co., Travelers Cos. Inc. and Amica Mutual Insurance Co. or their subsidiaries were among the property and casualty companies that received a form letter from the Pennsylvania Insurance Department. In one example, a commercial lines rule filing by Farmington Casualty Co. and various other Travelers companies, a department representative said it was important to maintain "essential regulatory operations and to address issues as they are presented," as employees had been directed by Pennsylvania's governor to begin working from home.

—Read the full article from S&P Global Market Intelligence

Analysis: Coronavirus response could limit gas demand upside from fuel-switching

As US natural gas prices continue to test new lows, rising power-sector demand for the fuel from coal-to-gas switching could be offset in the months ahead by anticipated demand destruction and a compressed nuclear refueling schedule – both factors linked to the growing coronavirus pandemic. On Thursday, cash prices at the Henry Hub lost another 11 cents, tumbling to a preliminary 21-year low settlement price at just $1.48/MMBtu. Since November, the benchmark US gas index has given up more than $1.35, or nearly 48%, S&P Global Platts data shows.

Over the same five-month period, coal-vs-gas $/MWh fuel cost ratios have moved aggressively in favor of gas in nearly all of the competitive independent system operator territories, including SPP South, Into Southern, PJM West and MISO Indiana. Tumbling prices and favorable cost ratios for gas haven't gone unnoticed by power generators. Last month, thermal load share for gas in the US power sector climbed to an estimated 66%, up from 55% as recently as November, data compiled by S&P Global Platts Analytics shows.

—Read the full article from S&P Global Platts

US auto industry yet to see extent of COVID-19 demand shock – trade group CEO

John Bozzella, president and CEO of the Alliance for Automotive Innovation, spoke with S&P Global Market Intelligence on April 2 about the impact of the coronavirus pandemic on the auto industry. The article features a transcript of the conversation that was edited for clarity.

The auto industry might not yet understand the extent of the demand shock in the U.S. from disruptions caused by the ongoing coronavirus pandemic, according to the head of the Alliance for Automotive Innovation, a leading trade group that represents domestic and international automakers operating in the U.S. U.S. auto sales will be "substantially lower" in 2020 than previously forecast. Liquidity for automakers is a main focus for the industry as vehicle demand drops and production is temporarily halted around the globe.

—Read the full interview from S&P Global Market Intelligence

COVID-19 to make broad impact on upfronts as production shutdowns linger

In response to the health threat posed by the coronavirus, programmers are pivoting from large-scale in-person upfront presentations to virtual events. Given the production shutdown in Hollywood, it is difficult to know what the major programmers, including NBCUniversal Media LLC, ViacomCBS Inc., AT&T Inc.'s WarnerMedia, The Walt Disney Co., Discovery Inc. and Fox Corp., will be able to digitally showcase in May and how much those offerings may generate in advertising sales.

During the upfront negotiating season, content providers look to sell linear and digital schedules to advertisers ahead of the upcoming TV season. Media Dynamics, which provides analyses and forecasts for the media and advertising industries, estimated combined upfront spending against content on broadcast and national cable networks for the 2019-20 season at just under $21.9 billion, up 5.4% from the prior cycle.But the upheaval caused by the coronavirus has left many industry observers wondering exactly how this year's upfront selling season will play out.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language