Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Apr, 2020

By S&P Global

Deepening inequalities, disproportionately infecting minority communities, and disadvantaging women at home and work, the coronavirus crisis may not be the “great equalizer” some have suggested it to be. Instead, the pandemic may be the ultimate disruptor—accelerating economic, technological, and energy transformations. As consensus about the longevity of this crisis grows, with many experts saying that COVID-19 will continue in waves instead of being eradicated entirely, the likelihood that the changes implemented during this crisis will outlast the acute phase is increasing.

While some U.S. states are beginning to loosen lockdowns and coronavirus-containment measures, S&P Global Ratings expects that an extended aversion to leisure activities, non-essential gatherings, and traveling while the risk of infection remains is likely to result in a much slower recovery for tourism than for the rest of the world’s biggest economy. States most dependent on tourism are likely to see credit pressures due to loss of revenue, spikes in unemployment, and reduced economic activity—and may ultimately face a significant lag during the recovery from the crisis.

Wheat-flour sales in Southeast Asia suffered severely amid the pandemic in April, and flour-mill sources expect the weakness to extend into May and potentially June, S&P Global Platts reported. Although demand for necessities is unlikely to diminish, a decline in household incomes has led to lower spending by consumers, even on the basic necessities—visible in how the decline in wheat-flour sales has dented demand for imported wheat in the region.

Cable networks historically have survived recessions with very little damage, but a survey conducted by Kagan, a media research group within S&P Global Market Intelligence, found that an unemployed individual looking to reduce household expenses is most likely to cut a streaming subscription and a traditional TV service. Alongside an advertising-market meltdown, possible additional COVID-19 outbreaks, and increasing joblessness rates, this could damage cable network economics.

Capital goods companies’ revenues and EBITDA will almost certainly decline this year. S&P Global Ratings’ outlook for the sector was already weak due to trade tensions and slowing economic growth, and COVID-19’s rapid spread added significant stress. This decline will raise pressure on credit quality in the sector. Already, S&P Global Ratings has taken more than 40 negative rating actions and expects the negative rating bias to grow. The proportion of ratings with negative outlooks has risen to approximately 31%, from 19% at end-2019.

According to S&P Global Market Intelligence, the crisis has altered the retail environment for the automotive industry, tossing longstanding assumptions about what cars consumers want and how they will pay for them into the air amid economic uncertainties and lifestyle changes. While popularity for larger SUVs has been high in recent years, the crisis may bring about a repeat of behavioral shifts seen during the 1970s oil crises, when automakers rushed low-cost, fuel-efficient models to the market. Coronavirus has hit as the industry shifts toward electric vehicles and as consumers move toward leasing and shared mobility services rather than car ownership. This adds complexity to plotting a route back to business-as-usual. Investors will likely pay extra attention to auto companies’ liquidity, balance sheets, and recovery plans in upcoming earnings reports to gauge their resilience in addition to the top-line and bottom-line results, experts said.

"There remains an exceptional level of uncertainty regarding the near-term outlook for [oil] prices and product demand. There is the risk of more sustained consequences depending on the efforts of governments and the public and private sectors to manage the health, economic, and financial stability effects of the pandemic,” BP Plc CEO Bernard Looney said while announcing the company’s first-quarter earnings. The London-based oil supermajor reported $3.7 billion in oil inventory losses but foresees cost reductions from technological changes as beneficial to the business. Reiterating his commitment to BP having net-zero carbon emissions by 2050, Mr. Looney said the coronavirus crisis “only adds to the challenge for oil in the future. We're all living and working very differently—no travel, I'm connecting with people, the company is running, and I think there's a real possibility that some of that will stick... and therefore the question has to be will consumers consume less, and I think there's a real possibility that that may happen."

An S&P Global Market Intelligence analysis shows that the pandemic has disrupted 247 mine sites in 33 countries. At-risk gold production continues to climb, this week reaching approximately 1% of the 2020 global estimated production, with mine closures continuing for longer than initially anticipated. At-risk production for both silver and copper rose 0.3% this week. Uranium's at-risk production rose to 11.8%, from 11.7%. At-risk nickel has risen from 0.5% last week to 0.9% this week. Platinum's at-risk production has marginally decreased, from 2.85% to 2.78%. Additionally, S&P Global Market Intelligence expects global exploration budgets to fall 29% this year to a total of $6.9 billion.

According to S&P Global Ratings, companies around the world are confronting this unprecedented health threat while also reeling from the dual shock of the breakdown in OPEC negotiations and accompanying collapse in global oil prices. In addition, looming systemic threats posed by climate change require deftness, adaptability, and resilience for entities to remain relevant now and in the future. Immediate consequences aside, this pandemic calls into question how companies prepare for black swan risks, which are, by definition, harder to predict, measure, and prioritize.

More than 3.1 million cases of coronavirus have been reported worldwide, with 217,000 deaths, according to Johns Hopkins University data. More people are infected and dying in the U.S. than anywhere in the world. Confirmed cases in the U.S. topped 1 million today and more Americans have died due to the coronavirus than died during the Vietnam War.

Today is Tuesday, April 28, 2020, and here’s an overview of today’s essential intelligence.

Capital Goods Companies Face Shocks From COVID-19 And Economic Recession

The impact of COVID 19 and the sharp economic contraction will result in significant declines in revenue and EBITDA for capital goods companies in 2020, raising the pressure on credit quality in the sector. S&P Global Ratings has taken over 40 ratings actions in recent weeks and expect the negative rating bias to grow. The extent of the impact depends on end market exposures, with those facing weaker end market more vulnerable to downgrades. Speculative-grade issuers are more vulnerable to downgrades given their limited diversity of end markets and resulting cash flow and liquidity pressures. Investment-grade issuers, while not immune to downgrades, should face less ratings pressure given their more diversified business models, greater cushion in credit metrics, and enhanced liquidity positions.

—Read the full report from S&P Global Ratings

Tourism-Dependent U.S. States Could Face Credit Pressure From COVID-19's Outsized Effects On The Industry

The abrupt halt of the U.S. economy due to the COVID-19-induced recession is uniquely configured to stress the tourism sector (including leisure, hospitality, and travel-related activities), more so than in past recessions. The measures states have implemented to contain the pandemic (including social distancing, closing of nonessential businesses, limiting gatherings, and restricting hotel use), while prudent, have shut down the tourism sector in the U.S. for now. It is not just in the U.S; the international response to the pandemic has also curtailed travel and tourism globally, reducing it to historically low levels. For states with significant portions of the economy dependent on tourism, S&P Global Ratings expects COVID-19 and containment measures to translate into pressure on their creditworthiness.

—Read the full report from S&P Global Ratings

The ESG Lens On COVID-19, Part 2: How Companies Deal With Disruption

The strategic threat posed by the spread of infectious diseases is by no means a new risk, but the COVID-19 pandemic has made this risk a reality. It has already illustrated how one microscopic virus can rapidly spread around the world and bring the global economy to a grinding halt, leaving significant and lasting disruption in its wake. While the pandemic has displayed the immediate and striking social consequences to business and society alike, as described in the accompanying commentary, "The ESG Lens On COVID-19, Part 1," published April 20, 2020, this catastrophe also may give us some insight as to how the companies S&P Global evaluates prepare for disruption amid a rapidly evolving risk landscape. Indeed, disruption rarely occurs in isolation. Today, companies around the world are confronting this unprecedented health threat, while reeling from the dual shock posed by the breakdown in OPEC negotiations and accompanying collapse in global oil prices, along with the looming systemic threats posed by climate change. The growing complexity posed by these emerging and intersecting risks and megatrends are conspiring in ways that require deftness, adaptability, and resilience for entities to remain relevant, both now and for the long run.

—Read the full report from S&P Global Ratings

The S&P BSE 100 ESG Index: A Socially Responsible Investment Strategy

In recent years, socially responsible investing has gained importance worldwide. There has been a paradigm shift in investment strategy globally, whereby the number of market participants who have become socially conscious and want to hold investments in companies that acknowledge the relevance of environmental, social, and governance (ESG) factors in doing business has significantly increased. ESG investments have matured globally, and many fund managers are tracking ESG indices like the S&P 500® ESG Index and S&P Europe 350® ESG Index, among others. Passive fund managers use exchange-traded funds or structured products that track an ESG index to make investments for market participants, while active fund managers depend on ESG scores to make active investment bets.

—Read the full article from S&P Dow Jones Indices

Automakers brace for new post-pandemic retail landscape

As automakers reopen factories and dealerships that were hurriedly closed amid the rapid spread of the novel coronavirus, they must now consider how to chart a course through what could prove a radically altered retail environment. Long-standing assumptions about what cars consumers want and how they will pay for them could now be up in the air amid huge economic uncertainty and lifestyle changes brought about by the pandemic. Larger, less economical SUVs have been among the most popular models in recent years and have commanded greater profit margins for carmakers. But companies will note motorists' lurch toward cheaper-to-run cars in the wake of the global financial crisis in 2007-2008, a repeat of behavioral shifts seen during the 1970s oil crises when automakers rushed "econobox" products to market.

—Read the full article from S&P Global Market Intelligence

Investors focused on liquidity, balance sheets ahead of automakers' Q1 earnings

Investors will likely pay extra attention to automakers' liquidity, balance sheets and coronavirus recovery plans in upcoming earnings reports to gauge companies' resilience during the pandemic in addition to the top-line and bottom-line results, experts said. Major automakers including Ford Motor Co., General Motors Co., Fiat Chrysler Automobiles NV and Tesla Inc. are set to release results for the first quarter of 2020, the period when the companies started to shutter their production plants and saw crushed vehicle demand as consumers limited movement and spending. Several automakers have cut forecasts and issued warnings for their future financial positions.

—Read the full article from S&P Global Market Intelligence

Amazon's grocery play likely to capitalize on retail sites distressed by virus

Amazon.com Inc. will have its pick of the nation's distressed retail real estate as it pushes deep into the brick-and-mortar market with a new grocery concept , experts said. The Seattle-based e-commerce company will have supreme negotiating and pricing power — even more than traditional grocers, given its brand and the havoc the coronavirus outbreak has wreaked on the commercial real estate market, particularly retail.

—Read the full article from S&P Global Market Intelligence

Kagan Survey – Cable Networks Could Be In For Rough Ride

Cable networks historically have survived recessions with very little damage, but this time could be much different. A recent survey conducted by Kagan, a media research group within S&P Global Market Intelligence, found that if a person lost their job and was looking to reduce household expenses, they were most likely to cut a streaming subscription (37%), followed by a traditional TV service (28%). That, in tandem with an advertising-market meltdown and another possible COVID-19 outbreak in the fall, could wreak havoc with cable network economics. With unemployment claims coming in record numbers — 22 million people have filed claims in just the last four weeks — it is clear the months ahead will see significant cord cutting as consumers try to scrape together money for food, rent and utilities.

—Read the full article from S&P Global Market Intelligence

Small bank loan growth jumps as PPP funding ramps up

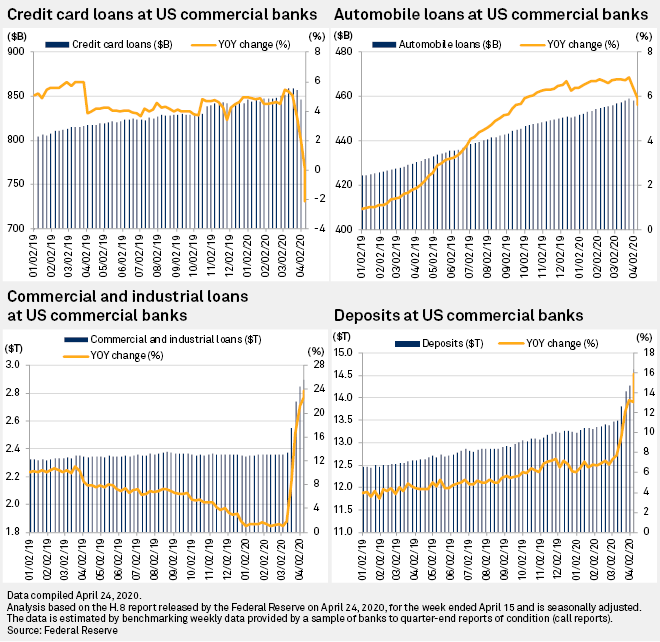

Commercial loan growth reaccelerated across much of the U.S. banking industry as lenders began to fund federally backed small business loans and prepared to start processing a second round of applications under the coronavirus relief program. Excluding the 25 largest institutions by assets, commercial and industrial loans increased 6.3% during the week ended April 15, according to seasonally adjusted data in the Federal Reserve's most recent H.8 report on commercial banks. That represents a huge jump from growth rates of 0.6% to 0.8% in the preceding two weeks, and leapfrogs growth of 2.1% to 2.3% during two weeks in March when corporate draws against bank credit lines were particularly heavy. Since large corporations tend to do business with large banks, C&I growth had been stronger at the 25 biggest institutions, peaking at week-over-week growth of 8.3% in March. But smaller banks appear to have started funding Paycheck Protection Program loans faster than their biggest peers.

—Read the full article from S&P Global Market Intelligence

Market welcomes Deutsche Bank's Q1 earnings preview, but risks remain

Deutsche Bank AG's share price soared when it released a first-quarter earnings preview saying it expected profits and revenue above market expectations, but analysts see more risks for the bank later in 2020 as it absorbs the full impact of the COVID-19 pandemic. The group's profitability and capital position were already under pressure due to its multiyear restructuring, and the economic downturn triggered by the coronavirus crisis will likely heighten the pressure this year. Germany's largest bank said it will post a first-quarter pretax profit of €206 million on revenues of €6.4 billion, beating the average analyst consensus forecast for a pretax loss of €269 million and revenues of €5.67 billion. The market welcomed the news, with Deutsche Bank's share price closing nearly 13% higher at €6.14 on the Xetra electronic platform of the Frankfurt Stock Exchange April 27.

—Read the full article from S&P Global Market Intelligence

Japan Q1 crude steel production volumes lowest in over 10 years, worse to come

Japanese crude steel production in the past three quarters fell back to levels not seen since 2009 as the industry grapples with downstream manufacturing and construction worksite closures brought about by the coronavirus pandemic, compounding issues faced through existing tepid domestic demand and export opportunities. Production in the first quarter totaled 24.4 million mt, up 2.9% from the fourth quarter but down 2.4% year on year, according to the Worldsteel Association. The prospects for the second quarter are no better, as the nation's steel industry continues to reel from the effects of the coronavirus pandemic. "We're seeing contracting markets at home and overseas," a Japanese trader said. "It's only going to get worse in the second quarter as we will see the planned production cuts from major blast furnaces take place."

—Read the full article from S&P Global Platts

COVID-19 Mining Impacts - Many Mines Extending Closures

As the novel coronavirus pandemic continues to spread worldwide, quarantines and lockdowns are preventing employees from going to work, with mining operations experiencing adverse effects since early March. The hardest-hit areas are Africa, Latin America and North America, due to national and provincial quarantines. While all commodities are potentially at risk, production of gold, copper and platinum group metals has been particularly affected. Since the outbreak in China was elevated to a public health emergency in January, S&P Global Market Intelligence has been monitoring and documenting worldwide mine closures. This was completed on a best-efforts basis, and may not include all assets impacted by the pandemic. Although Chinese mines were significantly impacted beginning in January, limited reporting has been available on individual mines. In the third of a weekly series of articles, we have identified, at time of compilation, disruptions to 247 mine sites in 33 countries.

—Read the full article from S&P Global Market Intelligence

Pandemic Expected To Push Exploration Budgets 29% Lower In 2020

As the coronavirus crisis continues to weigh on markets and propels many countries into full or partial lockdowns, planned exploration spending for 2020 will likely be pushed downwards. With junior explorers unlikely to see much support over the next several months, this sector will be the hardest hit, with allocations forecast to decrease 42%. Producers will not be spared, as they face lower metals prices and country-wide closures in areas in which they operate, sending their budgets an estimated 23% lower. As a result, we now expect global exploration budgets to fall 29% in 2020 to a total of US$6.9 billion. We arrived at this projection by taking the results of our 2019 survey and applying trends documented in previous market downturns, while adjusting for country-specific shutdowns. This methodology resulted in a smaller aggregate 2020 budget total of $6.6 billion; adding our estimate for budgets of companies spending less than $100,000, and budgets by private companies for which we did not obtain data in 2019, resulted in an estimated total of $6.9 billion, or $2.9 billion less than in 2019.

—Read the full article from S&P Global Market Intelligence

FEATURE: Southeast Asia's flour sales takes a beating from COVID-19; dents wheat imports

Sales of wheat flour in Southeast Asia was severely impacted by the coronavirus pandemic in April and there may be little respite soon as flour mill sources expect the weakness to extend into May and possibly June. The decline in wheat flour sales has in turn dented demand for imported wheat in the region. Indonesia, the world's second largest wheat importer, is expected to import 10.8 million mt of wheat in 2019/2020, down 200,000 mt from the US Department of Agriculture's previous estimate released earlier this year. Governments' stringent social distancing measures across the region had put a strain on economic activity which were directly dependent on social interaction. This generally slowed hotel, restaurant and catering businesses, but in certain markets, these activities came to a grounding halt as governments pushed hard for consumers to stay and cook at home -- all in the name of eradicating COVID-19.

—Read the full article from S&P Global Platts

Listen: Out of the frying pan: Global veg oils markets wrestle with COVID-19 disruptions

Supply and demand in the global vegetable oils markets have both shifted in response to the coronavirus crisis, resulting in increasingly complex and unpredictable price trends. Robert Beaman talks to George Duke and Piero Carello about how production and consumption have changed in Asia, while Rowan Staden-Coats looks at how this has combined with trends in the European biofuels sector to influence the market for used cooking oil.

—Listen and subscribe to this episode of Commodities Focus, a podcast from S&P Global Platts

NYMEX crude settles lower after dip to $10/b level

NYMEX June crude futures settled slightly lower Tuesday after flirting with the $10/b level on an imminent oil storage crunch. June crude sunk as low as $10.07/b early Tuesday, but settled at $12.34/b, down 44 cents on the day. ICE June Brent futures settled up 47 cents at $20.46/b. The NYMEX June contract has been battered well ahead of expiration as growing inventories are met with a lack of storage capacity, especially Cushing, Oklahoma delivery hub that's close to 80% full and rapidly rising.

—Read the full article from S&P Global Platts

BP sees 'exceptional' uncertainty on prices and demand, says cost-cutting will protect business

BP warned Tuesday of "exceptional" uncertainty over prices and oil demand, and said coronavirus could prompt a long-term reduction in oil consumption, but that cost reductions arising in part from technological change would protect the business. Unveiling first-quarter results, including a $3.7 billion write-down in the value of BP's oil inventories, new CEO Bernard Looney said he did not expect the company to curtail its oil production due to the filling up of storage capacity worldwide, but he did expect output to be crimped by production cuts implemented by the OPEC+ group of countries, highlighting Iraq, where BP operates the Rumaila field, as an example.

—Read the full article from S&P Global Platts

Brazil's Petrobras sees Q1 refined product sales slide 4.9% on year

Brazilian state-led oil producer and refiner Petrobras registered a 4.9% year-on-year slide in refined product sales in the first quarter of 2019 amid a sharp slide in domestic demand caused by coronavirus-related shutdowns at home and abroad, although indications that social distancing measures will ease in May brightened the second-quarter outlook. "The negative effects of the global recession provoked by the public health crisis didn't impact the performance of sales and production in a substantial way during the first quarter," Petrobras said in a production report released late Monday.

—Read the full article from S&P Global Platts

Analysis: Low oil prices a consolation prize for container, dry bulk shipping

The coronavirus has crushed global supply chains and destroyed demand for consumer goods, holidays and a raft of key commodities. With over 90% of global trade carried by sea, the outlook for containers, cruises and dry bulk over the coming months looks bleak. Low oil prices may provide some salvation but they are also symptomatic of the problem. While the tanker market enjoys a bonanza with freight rates driven by a demand to store crude and its products at sea, its shipping cousins in containers and dry bulk are suffering. They have no need to come to the rescue as steel, copper and laptops are that much easier to store on land. Freight rates for clean tankers have spiked to record levels in the past week on all vessel classes, while container shipping rates have been under pressure amid much volatility.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language