Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Apr, 2020

By S&P Global

More than 3 million coronavirus cases have been confirmed worldwide, according to Johns Hopkins University data. Testing is neither universal nor widely accessible. Studies to test antibodies of civilians in efforts to determine immunity rates show that the virus appears to be much more infectious than previously determined, and the accuracy of many antibody tests has been called into question. The World Health Organization warned that "there is currently no evidence that people who have recovered from COVID-19 and have antibodies are protected from a second infection."

Eager to support households and businesses but wary of moving too quickly, leaders in the U.S. and Europe are beginning to lift containment measures in phases. Texas, the U.S.’s second-largest economy, won’t renew its stay-at-home order to allow retail stores, restaurants, bars, and movie theaters to open with limited occupancy on Friday. Italy, whose sovereign credit rating S&P Global Ratings confirmed at 'BBB/A-2' with a negative outlook yesterday, announced it will gradually reopen starting on May 4, resuming manufacturing and construction first, and shops, museums, and other public venues two weeks later. Asian countries are struggling to contain sharply increasing infections as a second wave of COVID-19 emerged after preliminary lockdowns were lifted, prompting the measures to be reinstated in Singapore and Japan. Singapore, previously praised for its effectiveness in combating the coronavirus, now has more confirmed cases than Japan and today reported 799 new cases. Emerging markets have tumbled into recession as oil prices collapse, lockdowns in developed economies crush trade and tourism in their countries, and weaker healthcare systems struggle under the strain of infections.

Investors are responding with confidence to signs that the peak of COVID-19 has passed. Today, the S&P 500 rallied 1.5%. According to S&P Global Market Intelligence, the price of gold, which has shined as a safe haven asset during this crisis, climbed and closed in the first quarter of this year at $1,612.10 per ounce on March 31, up from $1,520.50/oz on Dec. 31. While gold prices dropped in mid-March, closing at $1,475.03/oz on March 19 amid a broader retreat in stock markets, gold recovered relatively quickly. Between Jan. 1 and March 31 of this year, when the S&P 500 fell more than 23%, the Liv-ex Fine Wine 1000, an index that measures the price performance of the 1,000 most traded wines, fell about 4%.

Market volatility remains, and industries are suffering. S&P Global Market Intelligence reported that U.S. insurance stocks retreated after companies across multiple industries discussed during first-quarter earnings calls the effects the pandemic has had on their businesses. Crude oil futures were lower in today’s mid-morning trade in Asia, according to S&P Global Platts, as the focus remained on oversupply, with recent supply cuts considered unlikely to balance the unprecedented demand destruction stemming from global lockdowns.

China saw a staggering 150% month-over-month increase in the dollar amount of private placement transactions in March, according to research conducted by S&P Global Market Intelligence. This bodes well for a quick recovery elsewhere once the catastrophic impact of the pandemic can be contained. But private funding to Chinese companies fell dramatically in January and February, meaning that activity in other large markets that were subsequently impacted by the virus, like the U.S. and the U.K., will likely decline before it recovers.

Extended containment measures are pushing the world into the deepest recession since the Great Depression, with corporate borrowers taking the biggest blow. Although S&P Global Ratings expects the drop in economic activity to be sharp but fairly short, the path to recovery remains very uncertain in its timing and trajectory until an effective treatment or vaccine are in place. S&P Global Ratings foresees the speculative-grade default rate to rise above 10%, given that the global community entered this crisis with a record level of credits rated ‘B’ and below.

While laying a strong and supportive foundation for recovery, the unprecedented fiscal and monetary support seen during this pandemic comes at the cost of higher government debt and puts the onus on policy choices in the handling of the overall response and ultimate exit path, according to S&P Global Ratings’ latest Credit Conditions report. The Bank of Japan announced that it will buy an unlimited amount of government bonds and at least double its amount of corporate debt to step up its stimulus response—a move that it acknowledged will push the economy into deflation after almost a decade of monetary easing. The U.S. Federal Reserve expanded the scope of its $500 billion Municipal Liquidity Facility to make eligible counties with at least 500,000 citizens and cities with at least 250,000. Launched on April 9, the MLF was available to counties with at least 2 million residents and cities with populations of 1 million or more prior to today’s announcement.

One week to the day after the price of oil in the U.S. plunged into negative territory, oil markets remain in flux. According to S&P Global Platts Analytics, oil consumption is expected to fall by almost 20 million barrels per day, about one-fifth of last year’s levels, by next month. Diamond Offshore, the Houston-based driller, initiated bankruptcy proceedings over the weekend. Trade unions in the U.K. called on the government to tackle the coronavirus crisis’ effects by directly investing in oil and gas projects and protecting thousands of jobs set to be displaced.

Today is Monday, April 27, 2020, and here’s an overview of today’s essential intelligence.

Global Credit Conditions, April 2020: Rising Credit Pressures Amid Deeper Recession, Uncertain Recovery Path

Government measures to stem the spread of coronavirus have escalated in the past three weeks amid a tripling of confirmed cases globally, to more than 2.5 million. These measures, together with business and consumer behavioral changes, are resulting in wider and deeper economic effects— and worse credit conditions—than we estimated in S&P Global Ratings' previous report published April 1. S&P Global Ratings also sees the post-pandemic recovery taking longer, based on the experience of China, the first major economy to emerge from the crisis.

—Read the full report from S&P Global Ratings

Credit Risk: Identifying Early Warning Signals In The Oil And Gas Industry

This article provides a deep-dive analysis on the credit risk impact of the European Oil and Gas industry which takes into account the consequences of the COVID-19 pandemic, causing oil prices to plummet on oversupply and weakened demand. The analysis covers European public companies in the Oil and Gas sector between January 2, 2020 and April 16, 2020 and utilises S&P Global Market Intelligence’s Probability of Default Model Market Signals (PDMS) which captures equity market sentiment, providing signs of potential default for 71,000+ public companies. The article also highlights where negative ratings actions were taken by S&P Global Ratings.

—Read the full article from S&P Global Market Intelligence

Oil industry faces historic change after prices turned negative

Headline oil prices in the US may have crashed briefly into negative territory last week, but even in the wreckage of the current economic crisis there is some hope. Eventually, demand for fossil fuels will return once coronavirus pandemic lockdowns begin to ease. When consumption does resurface, the global oil industry will look very different, however. At the heart of the current meltdown is Cushing, Oklahoma. The landlocked point on the map of America where a tangled web of pipelines comes together, bringing crude in from across the country to store in giant tanks. The problem is that Cushing’s capacity to hold 80 million barrels of oil is running out fast, squeezing a physical market where still too much crude is being produced to meet demand, which has plummeted catastrophically.

According to S&P Global Platts Analytics, consumption of oil is expected to fall by almost 20 million b/d, or about a fifth of last year’s levels, by next month. It could be more. This chronic imbalance between supply and demand means that Cushing’s acres of storage tanks, currently holding over 60 million barrels, could be completely full in three weeks. At this point, oil producers across the US may have no alternative other than to shut down their wells by literally turning off the spigots. Oil producers everywhere face the same problem to a certain degree, but in the US – where operating costs are high and the market depends on storage hubs like Cushing, which has been filling up at a rate of 6 million barrels per week as activity in refineries drops to a 17-year low – the situation is approaching a tipping point. Hundreds of debt-laden small producers across Texas and the Midwest, which have led the so-called US shale revolution, now face bankruptcy.

—Read the full article from S&P Global Platts

Feature: Governments need to agree to global carbon markets: IETA

Governments urgently need to agree policies to reduce greenhouse gas emissions to avoid adding to a build-up of atmospheric emissions that would push the world over dangerous temperature thresholds, according to Stefano De Clara, director of international policy at the International Emissions Trading Association. Failure to agree on a system of international emissions trading under the Paris Agreement would risk missing out on large-scale emissions reduction options that would slash the cost of seeing off the threat of climate change, he said. "It is a big challenge. Getting towards 2 degrees Celsius will already be challenging, and getting to 1.5 degrees will require a huge effort," De Clara said in an interview Monday. "It's also pretty clear from the [Intergovernmental Panel on Climate Change] reports, and from all the various scenarios, that we don't have much time to waste," he said.

—Read the full article from S&P Global Platts

Coronavirus challenges could prompt delays to money-laundering investigations

Banks that are subject to regulatory and criminal investigations could face delays due to remote working challenges and coronavirus-related changes in authorities' priorities. Banks across Europe are under growing regulatory scrutiny, particularly as money-laundering revelations have exposed significant failures in internal controls. Danske Bank A/S has been at the center of a €200 billion dirty money scandal in the Baltics, and is now under investigation by criminal prosecutors in Denmark and Estonia, along with the U.S. Department of Justice and Securities and Exchange Commission.

The DOJ is reportedly investigating Deutsche Bank AG for its role in the same scandal, as is Frankfurt's public prosecutor. Separately, the U.K.'s FCA is probing HSBC Holdings PLC's compliance with the country's money-laundering regulations. In the U.S., where authorities have historically handed out the heaviest fines to banks globally, some agencies seem to be adapting to the new working conditions, for example by conducting interviews using video applications, said Terence Grugan, an attorney at Ballard Spahr who represents entities subject to criminal and regulatory investigations by agencies such as the DOJ and the SEC.

—Read the full article from S&P Global Market Intelligence

Fine-wine investors toast despite stock market tumble

Fine wine is one of the few luxury goods that has withstood the severe hit to assets triggered by the coronavirus pandemic, an outcome that might increase its allure as an alternative investment for well-heeled buyers. Since the beginning of the year, the S&P Global Luxury Index, which tracks 80 of the largest publicly traded luxury goods companies, has fallen about 24% as the unfolding COVID-19 crisis has pummeled sales. Meanwhile, the trading prices of the world's most popular investment wines are holding their own. Between Jan. 1 and March 31, when the S&P 500 fell more than 23%, the Liv-ex Fine Wine 1000, an index that measures the price performance of the 1,000 most traded wines, fell about 4%.

A similar trend occurred during the previous financial crisis, when the S&P 500 crashed 38.5% in 2007-2008 while the Liv-ex Fine Wine 1000 index slipped a mere 0.6%. Over longer periods, fine-wine investments can deliver similar returns as equities, but usually with less volatility.

—Read the full article from S&P Global Market Intelligence

Analysts see strong Q1'20 gold prices boosting earnings despite coronavirus

Analysts expect strong gold prices to bolster gold mining earnings in the first quarter of 2020, with coronavirus-related mine suspensions mostly weighing on earnings in the second quarter. In the first quarter, the price of gold climbed and closed at US$1,612.10 per ounce on March 31, up from US$1,520.50/oz on Dec. 31, 2019. While gold prices dropped in mid-March, closing at US$1,475.03/oz on March 19 amid a broader rout in stock markets, the yellow metal recovered relatively quickly as investors sought safe-haven assets. The price of gold averaged US$1,582/oz for the three-month period, the highest quarterly average since the first quarter of 2013 and a 6.75% increase over the fourth quarter of 2019, TD Securities analyst Greg Barnes said in an April 23 note. Analysts expect higher gold prices to buoy free cash flow as companies continue to focus on containing mining costs. "The first quarter of 2020 should provide the first taste of the [free cash flow] to come," Barnes said.

—Read the full article from S&P Global Market Intelligence

Insurance stocks tumble as pandemic effects show up in earnings reports

U.S. insurance stocks retreated after companies across multiple industry segments discussed during first-quarter earnings calls the effects that the COVID-19 pandemic has had on their businesses. The S&P 500 declined 1.32% for the week ending April 24 to close at 2,836.74, while the SNL U.S. Insurance Index dipped 3.23% to 957.83. The hardest-hit property and casualty company was RLI Corp., which plunged 21.15%. Employers Holdings Inc., which focuses on workers compensation, dropped 15.59% for the week, while American Financial Group Inc. slid 13.61%.

—Read the full article from S&P Global Market Intelligence

Asian steel trade not out of the woods amid signs China's appetite is easing

Asian steel market participants have seen another week pass without signs of light at the end of the tunnel in containing the coronavirus pandemic as countries across the region extend lockdown measures, with the exception of Vietnam. China, which has provided some relief to the supply glut by importing steel recently, has started to show signs of its appetite easing as domestic prices soften. Singapore, Indonesia, the Philippines and Malaysia - the first three key buyers of billet and rebar - have the highest number of COVID-19 infections in Southeast Asia and last week announced extensions to lockdowns. This will mean even longer periods of standstill at construction sites including in Singapore, which has seen around 1,000 cases erupt daily at migrant worker dormitories, leading to the extension of its "circuit breaker" measures to June 1, the furthest date among Asian countries so far, in measures that would last 56 days.

—Read the full article from S&P Global Platts

India-ASEAN Infrastructure: Sovereign Strains Add To Lockdown Pain

COVID-19 containment measures have been hard on South and Southeast Asian transport infrastructure and utilities. Many piled on leverage in expectation of strong secular growth. Now firms are grappling with the double hit of stringent government restrictions, and rising sovereign rating risk. S&P Global Ratings has already taken ratings action on several transport infrastructure and utilities in this region and strains may linger well into 2021. One in four South and Southeast Asian infrastructure companies and utilities face downgrade pressure. Regulatory actions expose structural issues underlying infrastructure firms. The sharp fall in economic growth, ratings pressure on sovereigns, and a softening in state support for key counterparties pose further downside risks.

—Read the full report from S&P Global Ratings

Ratings, outlook downgrades may have limited impact on Asia banks' funding costs

Asia-Pacific banks may have needed to pay higher interest rates on new bonds following recent downgrades of their credit ratings and outlook, but the near-term impact on their funding costs is likely limited due to accommodating monetary conditions. As the effects of the novel coronavirus pandemic are felt across the world, S&P Global Ratings, Moody's and Fitch Ratings have cut credit ratings and outlooks on some banking institutions in Asia-Pacific to reflect the growing uncertainties they face.

—Read the full article from S&P Global Market Intelligence

VC Capital Flooding Into China, A Potential Harbinger For Other Countries

China saw a staggering 150% month-over-month increase in the dollar amount of private placement transactions in March. On the one hand, this bodes well for a quick recovery elsewhere once the catastrophic impact of the COVID-19 pandemic can be contained. But on the other hand, private funding to Chinese companies fell dramatically in January and February, meaning that activity in other large markets that were subsequently impacted by the virus, such as the U.S. and the U.K., will likely decline before it recovers.

Private company funding fell 15% worldwide in March, but the data tends to vary strongly from month to month in total dollar amount, since one large raise from a so-called unicorn could heavily skew the totals. Removing outliers using an interquartile range analysis showed a much more modest drop — about 5% — in March. However, it also showed a gradual decline in global venture capital funding since December 2019. April was also on track to be lower, based on data as of April 20 after removing outliers.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Europe, Apr 27-May 1: OPEC+ cuts to kick in as results season begins for European oil, gas majors

In this week's highlights: OPEC+ cuts are to start on Friday; oil and gas company results begin to stream in; the butadiene contract price's fall spells trouble for olefins; a Dutch wind auction closes; and a German hydrogen strategy emerges.

—Share this Market Movers video from S&P Global Platts

Europe residual fuel — Key market indicators this week

In the light of countrywide lockdown and reduced transport globally, the European fuel oil market has not felt the demand destruction on the scale of jet and gasoline, and with it, the rush for floating storage. Shipping operations are still continuing albeit at reduced rates, with many optimizing onshore storage while keeping a close eye on floating economics.

—Read the full article from S&P Global Platts

International Players Behind 91% Of OTT Video Subscriptions In Spain

Spain's highly competitive over-the-top market had another year of strong growth in 2019 as paid subscriptions reached 6.0 million, boosted mainly by the adoption of Netflix Inc. and the availability of high-speed fixed broadband. Three international players have managed to draw 91% of the total customer base, with the rest belonging to Rakuten TV Europe S.L.U.'s Rakuten TV, Telefónica SA's Movistar+ Lite, Access Industries Inc.'s DAZN, Mediaset España Comunicación SA's Mitele Plus and a few others.

Spain has one of the lowest multichannel penetration rates in Western Europe. Low multichannel uptake coupled with investments in fiber broadband have put it on the map for pay TV and OTT players looking to expand their operations. Global players like Netflix and WarnerMedia were initially targeting households that did not subscribe to a pay TV service by offering exclusive content not available in linear platforms. The slow but steady increase in multichannel penetration has led to streaming players seeking distribution partnerships with local operators to extend their footprint to pay TV homes.

—Read the full article from S&P Global Market Intelligence

LatAm digital lenders brace for make-or-break as funding dries up

The coronavirus pandemic has brought the first critical test to digital lenders in Latin America, as the crisis strains funding resources and raises serious concerns over asset quality deterioration. Some weaker players, experts say, won't survive. "It feels like a wartime effort rather than an economic crisis," Rafael Pereira, founder of Brazilian fintech Rebel, said in an interview. "Fintech lending is a very capital intensive business. I'd make sure I have enough cash."

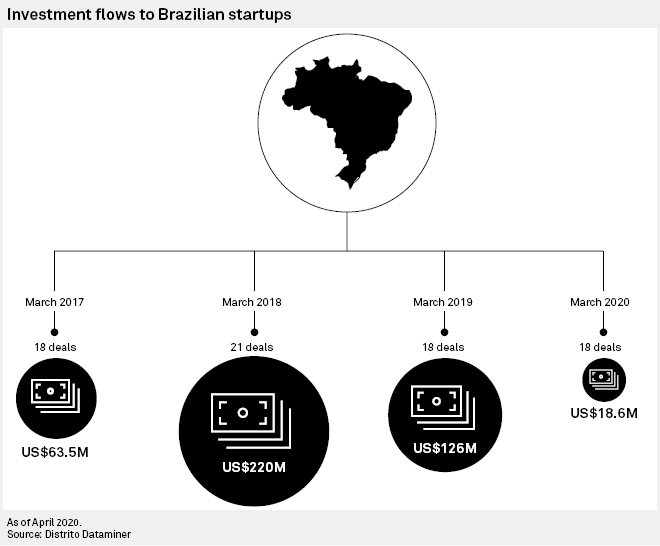

Unlike most traditional banks in Latin America, which rely primarily on deposits for funding, many fintech lenders depend upon the wholesale funding that has now all but dried up during the pandemic. In Brazil, for instance, investment in start-ups sank 85% year over year in March compared to a year ago to just $18.6 million, according to a Distrito Dataminer report. Venture capital investment flows overall also dropped markedly during the month, reversing stronger than average flows in both January and February.

—Read the full article from S&P Global Market Intelligence

Center-South Brazil sugarcane crush in H1 April expected to surge 39.6% on year: survey

Sugarcane crushed in the first half of April in Brazil's key Center-South region is expected to total 19.4 million mt, a surge of 39.6% year on year, an S&P Global Platts survey of analysts found Monday. Despite the coronavirus outbreak in Brazil, which initially raised concern about possible disruptions to the harvest pace, favorable weather conditions made up for any issues with low ethanol prices or sanitary constraints with sugarcane crushing.

In the 12 analysts surveyed, three trading houses estimated total cane crush to reach over 20 million mt, while the overall analysts' range encompassed 15 million to 23 million mt. Industry association UNICA is expected to release its official production figures this week. Analysts surveyed by S&P Global Platts expected an average of 1.7 days lost to rain over H1 April. The cane's total recoverable sugar (ATR) was expected to be higher year on year at 112.2 kg/mt, up from 109.34 kg/mt in H1 April 2019. From the analysts surveyed by Platts, the range was between 105 kg/mt and 116.5 kg/mt.

—Read the full article from S&P Global Platts

Listen: Street Talk, Episode 60: You Down With PPP? Consider The Risks

The U.S. government and bank regulators have responded swiftly to the economic fallout from the coronavirus with unprecedented stimulus packages, including $349 billion for small businesses through the Paycheck Protection Program, or PPP. The program has offered a lifeline to banks' small business borrowers and attractive fees to some lenders but a group of bankers and advisers cautioned during our community bankers conference webinar series that the program is just a short-term fix and does come with some risk.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Newspapers fighting for survival as COVID-19 ravages ad spending

As a centuries-old business with underlying advertising conditions, it is hardly surprising that the newspaper industry is acutely suffering amid the coronavirus pandemic. Newspapers are once again bleeding revenues and cutting workers as local businesses pull back on advertising. Interpublic Group of Cos. Inc.'s research unit MAGNA expects 2020 print ad revenue to be down more than 25% year over year, versus a pre-pandemic projection for a 17% decline. With many publishers already on shaky financial footing ahead of the outbreak, analysts warn that some papers, especially those focused on local news, will not survive an economic downturn. While the industry is looking to the U.S. Congress for relief, it remains unclear how soon or how much aid might be forthcoming.

"The newspaper companies are unfortunately in very, very tough shape from an advertising standpoint with revenues falling apart," said Craig Huber, CEO and founder of Huber Research Partners, an independent equity research firm specializing in media, internet and information services stocks. He estimated that publishers are currently facing 35%-plus declines in advertising revenues. "I long have said that during the next economic recession, there's going to be a big shakeout in the newspaper industry. A lot of them could very well go belly up," Huber said in an interview.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language