Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Apr, 2020

By S&P Global

Today is Earth Day, and here’s an overview of today’s essential intelligence.

CLO Spotlight: Redesigning The CLO Blueprint After COVID-19

Few parts of the global economy have remained unscathed by the coronavirus pandemic. From a corporate credit standpoint, the greatest deterioration has been most noticeable in those sectors and industries vulnerable to falling demand, supply chains disruptions, and tighter financing conditions. As S&P Global Ratings' corporate analysts continue to reassess the creditworthiness of speculative-grade companies, an increasing volume of the collateral backing European broadly syndicated loan (BSL) collateralized loan obligations (CLOs) have seen pressure build on tranche ratings.

As of April 21, 2020, almost 88 obligors (non-financial corporations) included in Europe, Middle East, and Africa (EMEA) CLO portfolios that S&P Global Ratings rates have had their ratings lowered and/or placed on CreditWatch with negative implications. With market sentiment fluctuating as the COVID-19 effects evolve, CLO structures and their associated documents are being reassessed to adapt to the current market landscape. Whether it may be perceived as CLOs being reactive or just simply prepared, in this publication S&P Global Ratings highlights some of the most commonly observed developments in CLO documentation, structures, and the underlying loans that they are exposed to. At the same time, S&P Global Ratings also offers insights into how certain loan or CLO features appear to be developing in the market place.

—Read the full report from S&P Global Ratings

Signature Bank says 14% of loans have asked for payment deferrals

Signature Bank reported that about 5,100 clients representing $5.6 billion of loans, or 14% of its portfolio, have asked for payment relief so far. Most of the loans are backed by commercial properties, including multifamily residential buildings, although borrowers representing about 25%, or $1.2 billion, of the bank's $4.6 billion portfolio in its business financing and equipment leasing unit have also asked for deferrals. The $53.07 billion-in-assets bank is based in New York, which has been an epicenter of COVID-19 infections and subject to strict quarantine measures. Signature said it is protected by strong collateral positions, with a loan-to-value ratio of 61% in its $14.88 billion multifamily portfolio, and 56% in its $10.53 billion portfolio of other commercial property. During a conference call on first-quarter results, executives said many of its clients are multi-generational property-owning families and "neighborhood retail" landlords in New York's outer boroughs, and Long Island and Westchester County.

Signature's clients "recognize that this could be a temporary situation," Executive Vice President Eric Howell said about the retail property portfolio. "They're not looking to hand over their building and give up their 30% to 50% equity in the property." President and CEO Joseph DePaolo said many multifamily borrowers had not asked for deferrals, and are sitting on cash and looking for opportunities to buy.

—Read the full article from S&P Global Market Intelligence

Europe's innovation to keep drawing venture capital interest despite pandemic

Innovative European businesses will once again amass large amounts of venture capital once the short-term investment hiatus caused by the coronavirus pandemic passes, according to market sources. Over the past five years, Europe has become a thriving innovation hub with tech and healthcare startups attracting increasing interest from venture capital investors. European startups racked up roughly $122 billion of venture capital over the period, with investment hitting a record $36.05 billion in 2019, more than double the $17.68 billion raised in 2015, data from investment intelligence platform Crunchbase shows.

International investors have also poured into the sector. U.S. and Asian funds accounted for 21% of all startup funding rounds in the region in 2019, double the proportion seen in 2015, according to a tech sector report by U.K.-based venture capital firm Atomico. Most venture capital invested in 2019 went to financial technology, enterprise software and healthcare companies, sectors in which investors projected continued growth over the coming five years, the report found.

—Read the full article from S&P Global Market Intelligence

COVID-19 compounds challenges for Amazon, Walmart in India

E-commerce companies in India are struggling to step up during the COVID-19 pandemic as the country's chaotic lockdown poses further challenges on their ability to operate, with market leaders Amazon.com Inc. and Walmart Inc.'s Flipkart India Private Ltd. expected to suffer significant losses in 2020.

Online retailers operating in India were forced to suspend operations hours after a 21-day nationwide stay-at-home order was announced March 24 due to a lack of clear guidelines and a mass exodus of employees in anticipation of lockdowns. Most of Amazon's more than 60 fulfillment centers across the country were reportedly shut for the first few days. In some states, delivery workers were not provided passes to make deliveries and some reportedly were even beaten by the local police for flouting the lockdown. By the time the confusion eased toward the end of March, e-commerce companies were staring at a huge backlog of deliveries, particularly for the essential items most sought after by consumers during the present crisis.

—Read the full article from S&P Global Market Intelligence

Eurozone bad bank could help deal with toxic debt, but will be a hard sell

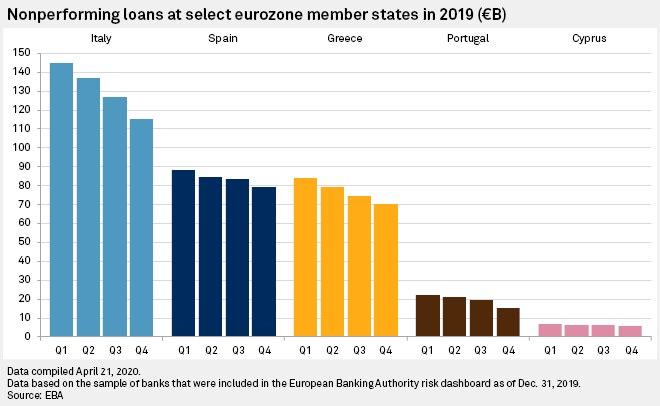

A eurozone bad bank could help Europe manage an uptick in soured loans amid the coronavirus crisis, but getting consensus will be tough because such a project raises questions about risk-sharing, pricing and the role of the government in the region's banking systems, according to analysts. As the COVID-19 pandemic is expected to trigger a deep recession in the eurozone and a new wave of nonperforming loans, the European Central Bank has resurrected the idea of putting legacy toxic debt on banks' balance sheets in a bad bank as a way to help lenders cope with new NPLs. According to an April 19 report in the Financial Times, senior EU officials rebuffed the idea, saying there are more suitable ways of handling bad loans.

—Read the full article from S&P Global Market Intelligence

Mexico announces emergency $25.5 billion package to fight pandemic

Mexico announced a Peso 622.56 billion ($25.5 billion) package on Wednesday that will help the nation face the economic consequences of the coronavirus pandemic, with the focus on Pemex, the state-controlled oil firm. The emergency budget will be aimed at 38 priority projects of the government which include crude production, the rehabilitation of the six existing refineries, the construction of a new refinery and power generation using the country's hydroelectric plants, President Andrés Manuel López Obrador said during his daily press conference.

The move comes a day after the central bank of Mexico announced a series of measures worth Peso 750 billion to improve liquidity in the financial system that included cutting the benchmark interest rate by 50 basis points to 6% and providing a Peso 250 billion financing facility for commercial and development banks to increase lending. Some analysts, however, think the capital injection, even if it were correctly implemented, will be insufficient, and does not solve the fundamental issue in the country, which is the political mismanagement.

—Read the full article from S&P Global Platts

Fed pressured to expand access to Main Street loan program ahead of launch

The Federal Reserve may have to lower the price for businesses to access its Main Street Lending Program and tweak other details so that more firms can tap into the $600 billion emergency loan pool. That is the assessment that the Fed received from several key trade groups and lawmakers of both parties, who suggested ways the Fed can improve on its Main Street facility to ensure it helps more businesses affected by the coronavirus pandemic. The lending facility marks a major step for the U.S. central bank, taking it further from its conventional role of setting interest rates into developing a loan program aimed at more directly helping small and medium-sized businesses.

The Fed is relying on banks to operate the program. Banks will make four-year loans to businesses that have at most 10,000 employees or $2.5 billion in revenues in 2019. The Fed will then buy 95% of each loan, with banks keeping the remaining 5%. Unlike the Small Business Administration's Paycheck Protection Program, the Main Street loans are not forgivable and will need to be paid back, although any payments are deferred for a year. The Main Street program is not up and running yet, and the Fed is reviewing roughly 2,000 comments it received suggesting potential changes. Below are five key issues to watch as the Fed prepares to launch the program.

—Read the full article from S&P Global Market Intelligence

VIDEO OF THE DAY

Exploring VIX® in Volatile Markets

How can VIX data help us understand the current market environment? S&P Dow Jones Indices' Tim Edwards explores what recent historical highs for VIX could mean for equity and commodity markets moving forward.

—Share this video from S&P Dow Jones Indices

How Factors in the China A Share Market Behaved Differently during the Coronavirus Outbreak

In the first quarter of this year, the China A shares market was on a roller coaster in response to the domestic coronavirus outbreak followed by the spread of coronavirus in other parts of the world. S&P Dow Jones Indices' previous blog, “How the Chinese Equity Market Responded to the Domestic and Global Coronavirus Outbreak,” looked into how industries reacted differently during recent market declines and rallies. In this blog, S&P Dow Jones Indices extends their analysis to the performance of the S&P China A Factor Indices in the first quarter of 2020.

—Read the full article from S&P Dow Jones Indices

Liquid, Long/Short Alternative Strategies Performed Strongly in Q1 2020

With the stock market in the midst of a historic slump, many investors may be looking to alternatives to protect against a prolonged downturn. The S&P Strategic Futures Indices are designed to measure the performance of passively constructed, liquid, and transparent solutions by spreading risk evenly across global futures markets utilizing a long/short trend-following strategy to deliver results with little correlation to traditional markets. The recent performance of these indices has reflected their usefulness in providing liquidity and capital preservation during broad market downturns.

The S&P Systematic Global Macro Index (SGMI) has had a relatively modest correlation to the S&P 500®, while the S&P Dynamic Futures Index (DFI) and the S&P Strategic Futures Index (SFI) have been negatively correlated to equities. Low and negative correlations can make these strategies attractive to investors looking to diversify their portfolios and preserve capital during periods of broad equity market stress.

—Read the full article from S&P Dow Jones Indices

Geopolitical uncertainty in wake of COVID-19 may give gold time to shine

The world is entering a period of deep geopolitical uncertainty, but that could be good for gold prices, industry observers said in presentations to the World Gold Forum. Presenters and attendees logged on to the virtual conference starting April 20 to discuss the gold industry and the COVID-19 outbreak that has roiled global markets and drove the event online. While gold has largely proved its ability to store value through the turbulent market conditions created by the coronavirus, there remain a lot of unknown risks to the sector.

"There's a potential scenario that the COVID crisis ... brings countries together and there's more collaboration. We think that, unfortunately, the more likely scenario is that the crisis accentuates this trend of division given the temptation, particularly of populist and nationalist leaders, to blame the foreigner, to blame others, and particularly if the economic crisis deepens in different countries," said Daniel Litvin, founder and managing director of Critical Resource, a consulting firm specializing in political, stakeholder and sustainability challenges for the mining sector. There could be a temptation for global economies to erect more trade barriers to international business in the wake of the pandemic, a factor that may depend heavily on the U.S. presidential election, Litvin said during his presentation to the forum.

—Read the full article from S&P Global Market Intelligence

PODCAST OF THE DAY

Listen: A difficult road ahead for diesel

The European diesel markets are in turmoil: demand has crashed – taking prices with it – and storage is filling up fast. Could we see a repeat of negative oil prices as we have seen in the US crude markets? In this episode, S&P Global Platts editor Virginie Malicier tells Joel Hanley how diesel markets are coping in the Covid-19 pandemic. We also hear from freight reporter Charlotte Bucchioni, who gives an update on soaring shipping rates, as charterers scramble for spare tonnage.

—Listen and subscribe to the Global Oil Markets podcast from S&P Global Platts

Analysis: US braces for deluge of Saudi crude as storage faces breaking point

When the OPEC+ alliance failed to reach an agreement on new output cuts at its meeting in early March, Saudi Arabia immediately pledged to shock and awe the market by pumping crude oil at its maximum capacity. Saudi Arabia also slashed its crude prices for April delivery, sparking a wave of fixtures by US refiners. Six weeks later, even with a new deal forged this month that goes into effect in May, the Saudis' strategy is playing out with a tsunami of the kingdom's crude headed for US shores – all while the market endures its worst shock in modern history. Some 44 million barrels of Saudi crude – about 1.41 million b/d – is expected to reach the US over the next four weeks, according to data from S&P Global Platts trade flow service cFlow. That is about quadruple the most recent four-week average, based on the US Energy Information Administration's records of US imports of Saudi crude.

—Read the full article from S&P Global Platts

US energy firms mull building new crude storage, conversions, more as stocks rise

The North American energy sector is weighing options from building new tanks farms to more extreme alternatives such as temporarily storing crude in rail cars as US commercial crude storage threatens to fill to capacity as soon as May.

Oil producers, midstream firms, traders and others are considering all types of storage possibilities to capture contango profits with NYMEX WTI at about $16/b on Thursday after falling into negative territory for the first time ever on Monday. But energy analysts warn the negative-pricing potential threatens to return in the days and weeks ahead as the Cushing storage hub quickly fills to capacity, followed by other regions throughout North America. Some of the options include converting tanks and storage wells into crude storage, utilizing all offshore floating storage, and more. The larger midstream players are deciding whether to build new storage that may not hold long-term value, while other export and refining hubs, such as Corpus Christi, Texas, are better positioned at least in the near term because they already had a wave of storage construction underway.

—Read the full article from S&P Global Platts

US mulls options to help struggling oil sector

Lawmakers, regulators and the president have floated an array of possible tactics to aid the U.S. oil industry, but which proposals stick and whether they will staunch the sector's bleeding remains in question. Issues around lending and oil storage capacity have come to the fore of the conversation in recent weeks, as the oil industry struggles to cope with the precipitous drop in demand the coronavirus pandemic has brought coupled with the fall-off in prices brought on by the Saudi-Russia price war. President Donald Trump tweeted April 21 that he had directed the secretaries of Energy and Treasury to "formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!"

—Read the full article from S&P Global Market Intelligence

Closure of US meat plants raises more concerns over long-term corn feed demand

A slew of temporary shutdowns at meat-producing plants in the US to control the spread of COVID-19 is raising more concerns on long-term corn feed demand, analysts said. In the 2019-20 marketing year (September-August), feed and residual use is likely to account for nearly 46% of the domestic corn demand in the US, according to the US Department of Agriculture's latest World Agricultural Supply and Demand Estimates report. Some of the major meat production units that have suspended operations include JBS USA's pork processing plant in Minnesota, Smithfield Foods' plant in Sioux Falls and Tyson Foods' Iowa plant.

—Read the full article from S&P Global Platts

Against power sector's advice, FCC opens utilities' wireless airwaves to unlicensed use

The Federal Communications Commission Thursday voted to open a wireless communications band heavily used by utilities to unlicensed use, despite concerns voiced by power and gas companies that such action would threaten grid reliability and heighten outage risks. US airwaves known as spectrum are the invisible infrastructure needed for wireless services. New rules adopted by the FCC make 1,200 megahertz of spectrum on the 6 GHz band available for unlicensed operations. That band currently houses private communications networks operated by oil and gas operations and electric companies, and has long been relied on for utilities' mission-critical operations. FCC commissioners unanimously voted to approve the rules seen as critical to the next generation of Wi-Fi and proliferation of connected, wireless devices during the agency's monthly meeting, held virtually due to the coronavirus pandemic. They pointed to the outbreak, which has prompted teleworking and distance learning at an unprecedented scale across the country, to support their decision, which effectively increases the amount of spectrum available for Wi-Fi by almost a factor of five.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language