Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Apr, 2020

By S&P Global

Never before has the price of oil fallen below zero. Today, just eight days after OPEC and its allies agreed to a record-setting production cut of 9.7 million barrels a day beginning next month, U.S. oil futures closed at -$37.63 per barrel, down 306% (or $55.90) from Friday’s close of $18.27. This marks an unprecedented turn in the coronavirus cocktail of complications, which have included a near wipe-out of global petroleum demand as economies enforce lockdowns—and means that sellers have to effectively pay their buyers to take oil off their hands.

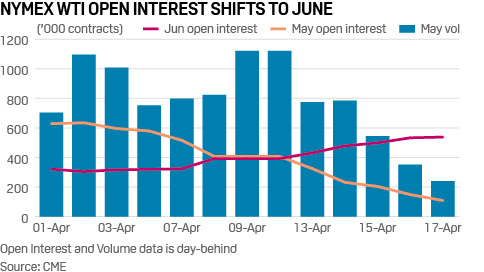

According to S&P Global Platts, a lack of storage capacity forced traders to exit positions ahead of Tuesday’s contract expiration, pushing the front-month New York Mercantile Exchange West Texas Intermediate crude benchmark index to settle in negative territory. The previous record low front-month settlement was $10.42/b on March 31, 1986. Oil under futures contracts on the NYMEX WTI is delivered to Cushing, Okla., where, according to S&P Global Platts Analytics, there is “no space” and “low open interest.”

S&P Global Platts Analytics now sees global oil demand contracting 7.8 million b/d this year, revised from a 4.5 million b/d decrease in its March outlook. Oil demand is now projected to contract in every month through December. Even in the immediate days following the historic OPEC+ agreement on April 12, analysts considered the deal to be insufficient against the dramatic drop of demand and projected an oversupply of oil and shortage of storage capacity.

“The evidences of what's going on [with market volatility] are very clear. The cause is also very clear,” S&P Dow Jones Indices Managing Director of Investment Strategy Craig Lazzara said on the latest episode of The Essential Podcast. “It's not like the financial crisis where… it was obscured at the beginning. There's nothing obscure about this. There's a virus and there's a public health response. The public health response is to deliberately to suppress the economy, and that’s what’s happened.” The plunge in oil futures today resulted in stocks in the S&P 500 Energy Sector falling 3%.

On its own and within the context of the broader implications of the pandemic, this latest development for oil markets makes clear the devastating depths, breadths, and interconnectedness of the global health crisis.

S&P Global Ratings today made another round of downward revisions to GDP, and now forecasts the economy in Latin American to contract more than 5% this year, then expand a bit more than 3% in 2021. Quarterly annualized contraction in the second quarter will be roughly three times as severe as the worst quarter during the global financial crisis, according to the forecast. Chile and Peru are projected to recover more strongly than Mexico.

As social distancing affects the service sector in Asia-Pacific, unemployment rates across the region could rise more than 3 percentage points, twice as much as during the average recession, according to S&P Ratings Chief APAC Economist Shaun Roache.

Almost 2.5 million coronavirus cases have been confirmed worldwide, with almost 170,000 deaths, according to Johns Hopkins University data.

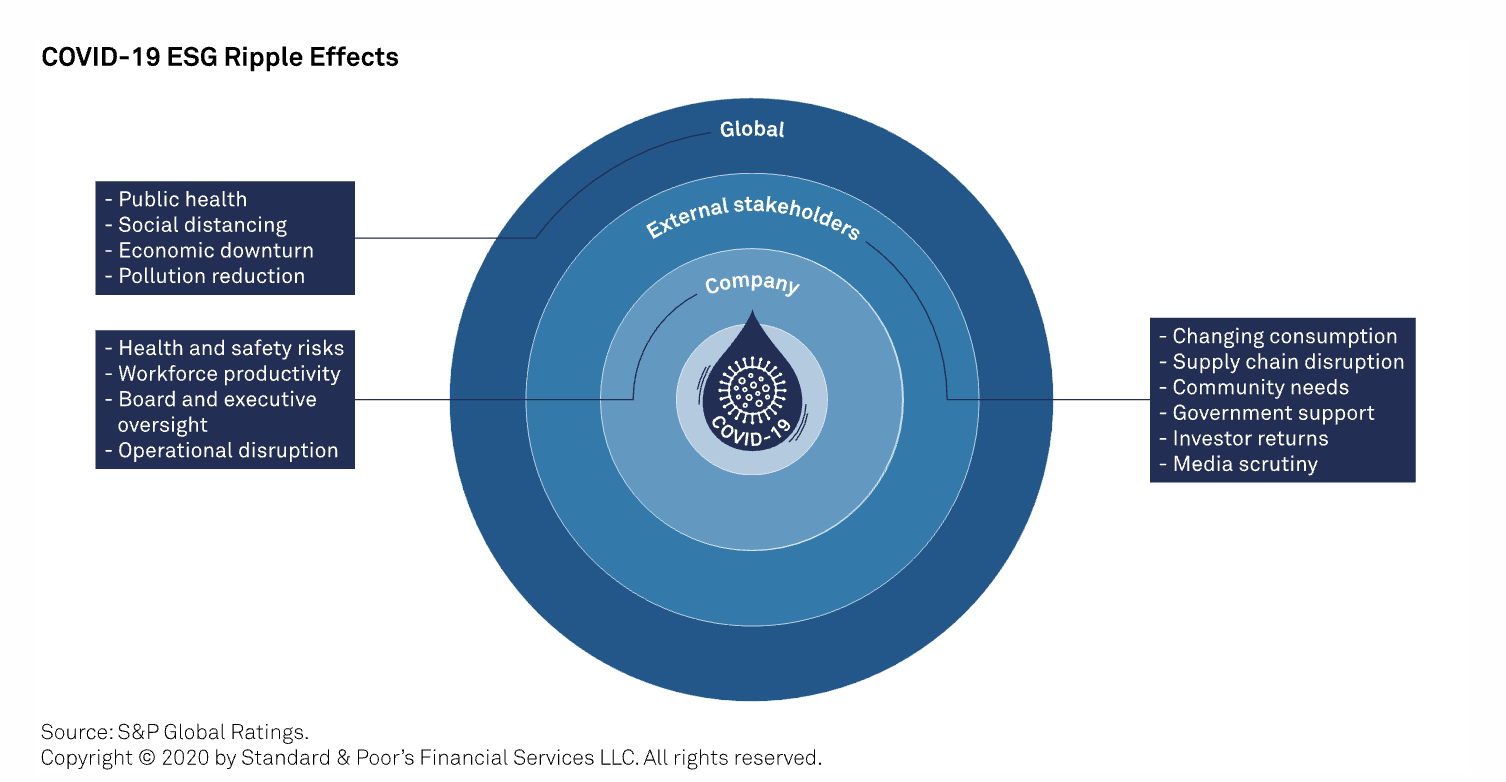

As the situation surrounding the outbreak and the global economy evolves each day, a spotlight continues to shine on environmental, social, and governance (ESG) factors. According to analysis by S&P Global Ratings, the crisis has brought to light the materiality of ESG-related risks and the deep linkages between businesses and their stakeholders across the value chains.

Environmental concerns are in focus against the backdrop of discombobulation in oil markets. For now, renewable energy’s supply chains are holding up against the pandemic’s pressures, and retailers across the U.S. and Europe aren’t abandoning their commitments to reduce plastic packaging. As the oil price collapse continues, the case for investors and governments to shift more capital to the clean energy sector grows stronger, the International Renewable Energy Agency said in a report today.

S&P Global Ratings believes social factors—namely health, safety, and workforce dynamics—are currently the most acute factors with risks of direct financial consequences and indirect reputational effects.

Good governance during the crisis remains critically important. Some CEOs and management teams are taking pay cuts as their companies lay off workers to cope with the pandemic’s hit to revenue. Seen largely as a symbolic gesture, doing so could help companies manage reputational damage and enhance their ability to attract and retain workers in the long term. Additionally, experts warn that financial institutions with gender-diverse boards and managements will be better-placed to navigate the coronavirus crisis, but unless banks put gender balance at the forefront of their crisis-management strategy, the pandemic could be detrimental to the progress made by the sector, according to S&P Global Market Intelligence.

Today is Monday, April 20, 2020, and here’s an overview of today’s essential intelligence.

NYMEX WTI settles in negative territory for first time ever amid lack of storage

Front-month NYMEX WTI settled in negative territory as a lack of storage capacity forced traders to exit positions ahead of Tuesday's contract expiration. NYMEX May WTI settled at minus $37.63/b, down $55.90 from Friday. The contract had never before traded in negative territory, and the previous record low front-month settlement was $10.42/b on March 31, 1986.

The selloff is "all related to the expiration," S&P Global Platts Analytics senior consultant Sergio Baron said. There is "no space in Cushing and low open interest," he added. "WTI is deliverable via exchange, so a long futures contract with no space doesn't have other alternative to sell." Traders have been shifting out of the May contract and into the outer months since the beginning of April. Open interest in the May contract stood at 108,593 lots Friday, down 520,000 lots since April 1, CME data shows.

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

The Essential Podcast, Episode 5: A Unique Unhappiness — Volatility in Markets

Less than two months ago, the S&P 500 and the Dow were riding to record highs after 11 years of unprecedented economic expansion. In the time since, the market has seen steep drops and slightly fewer steep rises. An oil price war and the global coronavirus pandemic have each contributed to historically high levels of volatility. Is a jittery market the new normal, or just a passing phase? In conversation with host Nathan Hunt, Craig Lazzara, Managing Director for Investment Strategy at S&P Dow Jones Indices, discusses record market volatility, the VIX, and Russian literature.

—Subscribe to The Essential Podcast from S&P Global

Despite recent market rally, pandemic will continue to hit insurers' investments

Financial pressures produced by the COVID-19 pandemic have evolved into a longer-term concern for insurers' investment portfolios in what remains a volatile market. After experiencing historic declines from late February through most of March, equity markets have since rebounded on the heels of multiple rescue packages passed by the federal government. Rich Sega, global chief investment strategist for Conning & Co., said the market has "clawed its way back," but he believes the stock market turmoil is not over because the crisis is medical, rather than financial, in nature.

"We're still seeing emerging cases, so it's not going to be over as quickly as we thought it might have been a month ago," Sega said in an interview. "We still have the same problems, the compression for insurance companies anyway, for their investments."

—Read the full article from S&P Global Market Intelligence

Low Volatility Response in Brazil

The COVID-19 pandemic hit the Brazilian equity market hard, causing the worst monthly performance since September 1999. As measured by the S&P Brazil BMI, the Brazilian equity market lost 29.80% in March 2020. The S&P/B3 Low Volatility Index exceeded its benchmark by 640 bps during the same period. Moreover, the low volatility strategy presented superior cumulative and risk-adjusted returns over the 20-, 10-, and 5-year periods.

To highlight the behavior of the S&P/B3 Low Volatility Index in different market circumstances, S&P Dow Jones Indices analyzed the monthly return data in up and down markets. The results are asymmetric, displaying some participation in the up markets and evident downside protection. The S&P/B3 Low Volatility Index outperformed the benchmark in down markets, providing an average monthly excess return of 2.12%; the strategy exceeded the average by more than 400 bps.

Over the long term, the S&P/B3 Low Volatility Index presented relatively attractive performance in comparison with its benchmark, providing more evidence for the existence of the Low Volatility anomaly, and suggesting that volatility reductions achieved during declining markets do in fact potentiate the benefit of the S&P/B3 Low Volatility Index in terms of risk-adjusted returns.

—Read the full article from S&P Global Dow Jones Indices

The ESG Lens On COVID-19, Part 1

The coronavirus pandemic has rapidly spread across the globe, creating a once-in-a-generation public health catastrophe. It has upended the global economy, plunging even the most prosperous countries into recession. It's exposing vulnerabilities in value chains, revealing the depth of corporate values, and prompting coordination and collaboration not seen since war-times. Financial markets have been roiled as investors seek to identify the companies that are best positioned to weather a crisis of this magnitude and as governments develop strategies to rescue beleaguered sectors. With a long recovery ahead, it's clear that few sectors and companies will be spared the consequences. The impacts are both direct and indirect, and most certainly enduring.

With the unprecedented disruption being wrought by this pandemic, companies across the economy will be forced to closely manage their social and human capital and scrutinize their strategies as well as their readiness for "black swan" type risks, which are rare, difficult to predict, and result in severe outcomes that typically exceed expectations. However, even if this pandemic is without precedent, the fallout from it could precipitate a more acute focus on environmental, social, and governance (ESG) factors and preparedness for attentive leadership teams. In S&P Global's view, strong ESG performers with stakeholder-focused and adaptive-governance structures are likely to remain resilient amid these rapidly changing dynamics. This commentary explores in detail the ways in which ESG issues are heightened by the pandemic.

S&P Global Ratings expect governments around the world will step in, to some degree, to buoy the most visibly affected industries, but the social ramifications are rippling across sectors and will likely carry with them consequences that aren't immediately apparent. S&P Global Ratings' ESG Evaluation considers near-term measurable risks such as changing consumer behavior like cancelling vacations or avoiding restaurants and sporting events due to social distancing. But it also considers less tangible, reputational impacts: for instance, the good will a utility might generate by extending favorable payment terms to its most vulnerable customers or the community benefits an industrial company might reap by repurposing its production facilities to develop personal protective equipment. By contrast, a company could face backlash from layoffs or exposing employees to the virus. Additionally, S&P Global Ratings considers the extent to which a company's fortunes are affected by the region in which it operates—obviously, demographics and geography can influence the spread of the virus, but companies will also be subjected to the various government actions and reactions. And while the social factors may appear more urgent, there are still environmental and governance implications emanating from this extraordinary upheaval.

—Read the full report from S&P Global Ratings

Oil rout shifts focus to renewables

As the oil price rout continues, the case for investors and governments to shift more capital to the clean energy sector grows stronger, the International Renewable Energy Agency said in an April 20 report. "With the need for energy decarbonization unchanged, such investments can safeguard against short-sighted decisions and greater accumulation of stranded assets," Francesco La Camera, director-general of the intergovernmental organization, wrote in a forward to the report. Meanwhile, price volatility is undermining the "viability of unconventional oil and gas resources, as well as long-term contracts," he said.

The International Renewable Energy Agency, or IRENA, issued the report the same day that futures prices for West Texas Intermediate crude plummeted into negative territory for the first time ever as markets sapped of demand by the coronavirus pandemic remain awash in oil.

—Read the full article from S&P Global Market Intelligence

Renewable supply chains holding up against coronavirus impacts for now

The coronavirus continues to threaten a disruption of supply chains for power generation assets, with a lag potentially coming with implications for renewable projects utilizing tax credits. The real delay, however, may be stalling projects in early-stage development. "Clearly, disruptions in global supply chains are giving investors and lenders concern," said Ram Sunkara, a partner at Eversheds Sutherland LLP who leads the firm's natural gas liquids, petrochemical and distributed generation and renewable corporate procurement teams. "For renewable projects specifically, a COVID-19 related delay to expected timelines for wind turbines or solar modules could potentially impact tax equity financings as the tax regulations require projects to be under continuous construction within a four-year period."

Many projects that entered construction in 2016 need to come online by the end of 2020, noted Sunkara. "However, industry participants are already discussing ways to mitigate this risk, whether it comes in the form of 'excusable delays' under the regulations or the potential extension of the four-year window for continuous construction." Most utility-scale projects due online in 2020 have largely sourced their components by now, said Mona Dajani, partner and co-head of the energy and infrastructure projects team at Pillsbury Winthrop Shaw Pittman LLP. She expects those projects to remain on track.

—Read the full article from S&P Global Market Intelligence

FEATURE: Why the next recession won't break the world's largest carbon market

A decade after the financial crisis sent carbon prices under Europe's cap-and-trade emissions scheme cratering, reforms made in the interim will ensure the mechanism is not neutered by the coronavirus pandemic and its economic aftermath. Set up in 2005, the EU's Emissions Trading System is the world's largest carbon market and covers around 45% of the EU's CO2 emissions from more than 11,000 installations, including power stations and heavy industrial plants, as well as flights between EU countries. Companies receive a number of allowances for free and buy the rest in regular auctions, or from each other, to cover their needs for any given year.

Following the economic shock of the global financial crisis, prices under the scheme lingered at rock bottom for years, enabling heavy polluters to make less stringent emission cuts. Now COVID-19 has had a similar impact, sending prices for emission allowances, so-called EUAs, about 40% lower mid-March. Although they have regained some ground since then, analysts said more downside could be on the horizon. But carbon market watchers say the latest economic shock will not wreak havoc on the scheme as it did a decade ago, even though the International Monetary Fund now expects the coronavirus recession to be far worse than in 2009.

—Read the full article from S&P Global Platts

Coronavirus pandemic accelerating need for coal production cutbacks amid declining demand

Declining US coal-fired power demand, hit further by the coronavirus pandemic pressuring electricity demand, has pushed major coal basins into oversupply and utility stockpiles to multi-year highs, requiring producers to consider permanent cutbacks, B Riley FBR analysts said Friday.

"While YTD US coal production is at its lowest level in decades, demand declines have been even sharper," B Riley analysts Lucas Pipes, Daniel Day and Matthew Key said in a report. The combined impact of elevated coal stockpiles and subdued US electricity demand from the economic shutdown "has led to little-to-no activity in the spot market" and led some producers to expect to sell less than their contracted 2020 volumes, they said.

"Even before the COVID-19 outbreak tipped the thermal coal market deep into oversupply, ESG concerns had been weighing on thermal coal producers' share prices for some time," adding that wind power generated a greater portion of US electricity generation than coal over three separate days. The analysts also noted that "since the COVID-19 outbreak and subsequent shutdown of much of the industrial production in the US, the power load on most weekdays more closely resembles a typical weekend, underscoring the dramatic decline in overall power demand during the lockdown."

—Read the full article from S&P Global Platts

Coronavirus crisis to test banks' gender balance efforts, could halt progress

Financial institutions with gender-diverse boards and management will be better placed to navigate the coronavirus crisis, according to experts. But they warn that, unless banks put gender balance front and center of their crisis management strategy, the pandemic could be detrimental to the progress made by the sector. "The real risk in the short term is that diversity and inclusion initiatives are seen as 'nice to have' and fall off everyone's radar," said Jessica Clempner, a principal at Oliver Wyman and lead author of the company's "Women in Financial Services 2020" report, which was released in November 2019.

That is despite research suggesting banks that embrace gender diversity at a board level are more likely to come out of a financial crisis in better shape. For example, a discussion note released by IMF researchers in 2018 found that banks with a higher share of women on their boards were more stable in 2008 when the global financial crisis hit. Banks with more female board members generally had higher capital buffers, a lower proportion of nonperforming loans and a greater resistance to stress, it found.

—Read the full article from S&P Global Market Intelligence

Why voluntary CEO pay cuts, while largely symbolic, matter in ESG context

CEOs and management teams at dozens of companies around the world are taking voluntary pay cuts as their companies lay off workers to cope with the revenue hit from the coronavirus pandemic. Experts say cutting executive pay, while largely a symbolic gesture, could help companies manage reputational damage and enhance their ability to attract and retain workers in the long term. "CEO pay this season has significant implications for a company's reputation," said Corey Klemmer, director of engagement at investment adviser Domini Impact Investments LLC. Klemmer said the optics of large CEO bonuses paid out based on a company's 2019 performance as thousands of employees lose their income "could do significant reputational harm."

"It risks making that company into a poster child for inequality and indifference in this moment when the world is searching for ethical and compassionate leaders," she said.

—Read the full article from S&P Global Market Intelligence

Coronavirus delivers long-awaited recession test for once-booming flex offices

The flexible office sector's moment of truth has arrived. The market's boom in recent years has long had its skeptics, who have argued that short-term office leases would be easy targets for businesses looking to cut costs in a recession. That downturn is finally here — and it is much more severe than anyone might have feared. The coronavirus pandemic has forced governments to instruct millions of workers across dozens of countries to stay at home as they struggle to decrease the virus' spread. The measures have slowed global economies to a crawl, costing millions of jobs. The worst economic crisis since the Great Depression is forecast as a result.

Like most other sectors, flex is being hit hard and some of its largest operators are beginning to show the strain. The We Co.'s WeWork operation, widely acknowledged as the driving force behind the flex boom of the past decade, has reportedly stopped rent payments at some of its locations and is requesting rent relief from landlords. IWG PLC, the world's largest flex provider, has suspended its full-year 2019 dividend, while its senior executives have taken a 50% pay cut to reduce the group's costs as the crisis shrinks revenues.

—Read the full article from S&P Global Market Intelligence

Economic Research: Jobs And The Climb Back From COVID-19

The human cost of the COVID-19 pandemic is incalculable. Most important is the loss felt by communities that experience the worst that the disease can bring. Many are feeling the stress and isolation resulting from long periods of social distancing. There is, of course, an economic cost as well and, at the individual level, the worst of these include losing one's livelihood. Job losses also impose broader costs on society. As household incomes fall, consumer spending and tax revenues suffer. Borrowers are less likely to repay their debts. Job seekers lose skills and become discouraged.

Jobs are at the core of the current economic crisis. Measures designed to limit viral spread are striking at the heart of the engine of job creation across Asia-Pacific--the service sector. The unfortunate truth about jobs in almost every economy in the world is that they are easily lost but hard to win back. The more jobs that are lost today, the slower will be the recovery. Surging unemployment would not only be terrible news for those out of work, it would have major credit implications across sectors. Policymakers know this, hence the remarkable efforts to encourage firms to keep workers on the payroll. Wage subsidy programs are being rolled out from Hong Kong to New Zealand and payroll taxes are being slashed elsewhere. These policies should help limit the damage to the labor market. They are large and well-targeted. However, their cost-benefits deteriorate over time, questioning how long they can help.

—Read the full report from S&P Global Ratings

Analysis: China's steel market unlikely to fully recover from virus impact until H2

China's domestic steel market will continue to face downward pressure in the second quarter due to high steel production, soaring steel inventories, depressed exports and lackluster demand in the manufacturing sector. Infrastructure construction has recovered quickly so far in Q2, but the property sector may see new starts drop significantly in 2020 and thus be unable to generate much incremental steel demand. Liquidity challenges at steel traders and mills have eased recently, partly due to end-user demand recovery and partly because of China's loosening monetary policies.

—Read the full article from S&P Global Platts

VIDEO OF THE DAY

Watch: Market Movers Europe, Apr 20-24: Surge in floating storage hits tankers amid oil demand destruction due to coronavirus

In this week's highlights: European energy major Eni's earnings will be closely watched; polyethylene producers are set to expand production margins; and how low can UK natural gas prices go?

—Share this Market Movers video from S&P Global Platts

Europe's media, entertainment firms see negative rating actions amid COVID-19

Media and entertainment firms received 5% of negative credit ratings actions from S&P Global Ratings in Europe, the Middle East and Africa in the wake of the coronavirus pandemic, making it the hardest-hit sector within the broader technology, media and telecoms landscape. As of April 16, of the 295 negative actions taken against companies in the region, 16 were issued to media and entertainment companies who depend on in-person attendance or advertising — including broadcasters, event organizers and movie theater chains. Technology and telecoms companies received seven and four negative actions respectively.

—Read the full article from S&P Global Market Intelligence

Latin America COVID-19 Weekly Update

The COVID-19 outbreak, and its associated economic and financial implications, will push LatAm into a deeper downturn this year, than during the 2008-2009 GFC. S&P Global Ratings forecasts Latin America’s GDP to contract just over 5% in 2020. However, S&P Global Ratings expects growth to bounce to a bit over 3% in 2021.

—Read the full report from S&P Global Ratings

Economic Research: Economic Recovery From The COVID-19 Pandemic Will Be Uneven Across Latin America

S&P Global Ratings has made another round of global downward GDP growth revisions as social distancing policies have been extended and data emerges, showing the severity of the economic impact of the COVID-19 pandemic. S&P Global Ratings now forecasts Latin American GDP to contract by a little more than 5% for 2020, expanding by a bit more than 3% in 2021.S&P Global Ratings expects the second quarter to be the worst for Latin American economies as strict social distancing policies continue in place; quarter-over-quarter annualized contraction in the quarter will be roughly 3x as severe as the worst quarter during the global financial crisis.

S&P Global Ratings also expects an uneven recovery across Latin America, with stronger recoveries in Chile and Peru, where more-effective viral outbreak containment policies and robust economic responses will help more rapidly repair the damage to the labor market and investment dynamics. On the other hand, S&P Global Ratings sees weaker recoveries in Mexico, where pre-existing economic weakness, delays in virus containment measures that risk prolonging the health crisis, and limited economic policy responses will mean it will take longer to repair the damage done to labor market and investment dynamics.

—Read the full report from S&P Global Ratings

What The CARES Act Means For Credit In U.S. Public Finance

The Coronavirus Aid, Relief and Economic Security (CARES) Act is the third, and largest to date, stimulus bill to come out of Washington in an effort to slow the spread of the virus and offset the losses from the accompanying recession. The bill contains several provisions that S&P Global Ratings views as credit supportive for entities in U.S. public finance, including programs to address the needs of state, local government, transportation, health care, housing and higher education credits. All the provisions in the bill are designed to help provide liquidity and stabilize operations, but the credit risk remains that these measures may be exhausted too soon and more federal actions or more severe budget cuts could be needed. The monies in the CARES Act will start to flow to the sector in late April.

—Read the full report from S&P Global Ratings

Liquidity conditions improve as Fed actions take hold

Liquidity pressures in short-term funding markets have eased this month, with borrowing rates settling into more normal territory after drastic actions taken by the Federal Reserve. The central bank has injected massive amounts of cash into the financial system since mid-March, when the coronavirus pandemic led to a sharp downturn in financial markets and shook investor confidence. The shock made investors warier of lending money to others, making short-term borrowing much more expensive for many companies and municipal securities issuers. But short-term borrowing rates have come down since, an indication that the Fed's programs "seem to be working," analysts at Société Générale wrote in a note to clients.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language