Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 15 Apr, 2020

By S&P Global

As confirmed coronavirus cases continue to rise, today topping 2 million worldwide, the stability of the global economy continues to waver.

In the U.S., the nationwide lockdown measures to combat the spread of COVID-19 have produced the greatest month-over-month decline in retail sales since the country’s Commerce Department began tracking such records in 1992. According to data released today by the U.S. Census Bureau, purchases online and in restaurants and bars, stores, and gas stations fell by 8.7% seasonally adjusted. More than 15 million initial jobless claims over three weeks beginning in the middle of March represent about 9% of the country's labor force. These job losses have raised the U.S. unemployment rate to levels that many economists believe already easily surpass the 2008-2009 recession.

Today was supposed to be Tax Day in the U.S. The postponement of state income tax filing deadlines to June due to the coronavirus crisis could cause liquidity issues. S&P Global Ratings reported that with 25 states receiving more than 50% of operating revenues from income taxes, any interruption could be meaningful. Every state that levies an income tax has adjusted the tax filing date; the full extent of lost revenues will not be known for months but will be felt in state budgets for years.

Marine gasoil on the U.S. Gulf Coast fell to record lows today amid dwindling demand. Even the U.S. cannabis market is taking a hit—the pandemic could shrink industry insurers’ premiums and the entire marketplace.

Across Europe, a re-opening of Europe’s leveraged finance segment may be coming closer, with the high-yield bond space likely to host new supply in the coming weeks, but loans are expected to lag. According to S&P Global Ratings, 31 European residential mortgage-backed securities transactions (of which 19 are U.K. transactions) have call options that could be exercised in the next 12 months. Market disruption caused by COVID-19 has made refinancing conditions more difficult. This raises the likelihood that some of these calls may not be exercised. Emergency monetary policy measures may support rated bank originators more than nonbanks.

Latin American financial institutions are at greater risk to cyberattacks during the coronavirus crisis. Global dislocation caused by the pandemic has led to a substantial uptick in attempted cyberattacks, and major banks in the region are already seeing a sharp increase in phishing and other related attacks.

Middle Eastern and North African oil exporters are likely to lose more than $230 billion in crude revenue this year if oil prices persist at current levels, according to the International Monetary Fund, with breakeven oil prices set to soar amid higher spending needs.

In Asia, China shows signs of rising defaults in mortgages, credit cards, and other household debt, but most analysts are not anticipating a systemic crisis on the immediate horizon.

Globally, privacy concerns are on the rise as Apple Inc. and Google LLC plan to launch a contact-tracing tool that alerts users who have come into contact with a person who has tested positive for COVID-19 and provide additional resources to those that have been exposed.

According to new research by S&P Global Market Intelligence, the private sector is discovering positive ways to support overwhelmed health and social care systems. Fashion houses are replenishing hospital clothing supplies; cosmetic companies are contributing disinfectants; aerospace, sporting, and academic institutions are manufacturing medical equipment; staffing agencies are adapting their benefits policies; and several corporations are pledging financial donations to support the response. Evidence is also emerging that investors are signaling a preference for products that favor companies with a positive societal impact. Environmental, social, and governance (ESG) funds are continuing to gain assets even during one of the most significant disruptions to markets, and as of April 6 the S&P 500 ESG Index was outperforming the S&P 500 by 2.47%.

Today is Wednesday, April 15, 2020, and here is essential insight on the markets.

The Positive Impact Scorecard

The private sector is discovering positive ways to support the response to Covid-19 and investors are signaling a preference for products that favor companies with a positive societal impact. The United Nations Sustainable Development Goals (SDGs) also provide a relevant and universal lens to track progress throughout the financial system.

Major public companies already have significant SDG-aligned revenue streams. By 2019, the world’s major global companies listed on the S&P Global 1200 had more than 42% of revenues aligned to SDGs. When also accounting for SDG Additionality, which takes into account how companies are delivering SDG-Aligned products, services and technologies in those geographies where they are most needed, the positive impact reaches 60-75% across the major benchmarks assessed with the S&P 500 achieving 75%.

—Read the full report from S&P Global Market Intelligence

A COVID-19 Systemic Risk Story in Seven Simple Charts

A recent article published by S&P Global Ratings indicates cash flow slumps and default rates spiking across multiple industries as a result from the economic slowdown caused by COVID-19. Unlike previous crises, such as the dotcom corrections in year 1999 to 2000, the global financial crisis of 2008 or even the energy price correction in year 2014, the COVID-19 virus has affected multiple geographies and sectors at the same time, creating multiple “epicenters” of industry shocks.

This S&P Global Market Intelligence blog provides a sample of data-driven charts that can answer questions on how this unprecedented slowdown could affect corporate credit risk. The blog focuses on the resilience of corporates, bank lenders and sovereigns going into this crisis.

—Read the full article from S&P Global Market Intelligence

COVID-19: Coronavirus- And Oil Price-Related Public Rating Actions On Corporations, Sovereigns, And Project Finance To Date

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies, S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on corporations and sovereigns as well as summary table and supporting charts. Also included is a summary of project finance rating actions. These are public ratings where S&P Global Ratings cites the COVID-19 coronavirus, oil prices, or both as a factor. This information is as of April 14, 2020.

—Read the full report from S&P Global Ratings

Insurers' Dividend Pause Amid COVID-19 Concerns Likely Indicates Caution, Not Credit Risks

Due to concerns about the financial impact of the COVID-19 pandemic, some insurance regulators are urging insurers to curb or suspend dividends, bonuses, and other discretionary capital distributions. While the response has been mixed, a number of insurers are heeding regulators' advice. S&P Global Ratings believes these capital management decisions will not have a material impact on insurers' credit quality as long as there are no underlying weaknesses in the companies' capital or liquidity positions.

In recent weeks, various regulators and supervisors in Europe, Australia, and Mexico have advised insurance companies to exercise prudence when establishing discretionary capital distributions, especially if those actions would materially affect their capital or liquidity positions. To date, Dutch insurers Achmea B.V., ASR Nederland N.V., AEGON N.V., and NN Group N.V., as well as U.K.-based RSA Insurance Group PLC, Aviva PLC, and Hiscox Insurance Co. Ltd., among others, have decided to suspend paying common dividends or share buybacks. Conversely, groups such as QBE Insurance Co. (U.K.) Ltd., Legal & General Group PLC, and Allianz Insurance PLC have decided to continue with the near-term distributions following careful consideration of supervisory guidance, while others have opted to delay annual shareholder meetings, in part to buy more time to weigh up considerations around dividend distributions.

S&P Global Ratings doesn't believe that insurers' decision to suspend dividends, as recommended by various regulators in response to the COVID-19 pandemic, will hurt their credit profiles. Such a decision doesn't necessarily indicate constrained capital or cash, but rather the uncertainty regarding the pandemic and the hefty costs that could materialize as a result. Although S&P Global Ratings sees no signs of systemic capital weakness across the global insurance industry, S&P Global Ratings' analysts acknowledge that, for some insurers, capital or liquidity deterioration, alongside suspended dividends, could have rating implications. S&P Global Ratings is actively engaging with insurers to understand the implications of COVID-19 on their capital positions.

—Read the full report from S&P Global Ratings

Privacy risks loom over Apple and Google's COVID-19 tracing tool

Industry experts have expressed mixed reactions to Apple Inc. and Google LLC's joint effort to combat the spread of the coronavirus, noting that the companies' immense size and reach are valuable but also raise privacy concerns. The tech players plan to launch a contact-tracing tool on their respective platforms that will alert users who have come into contact with a person that has tested positive for COVID-19 and provide additional resources to those that have been exposed.

While Apple and Google say that privacy and security are central to the project, analysts and industry observers question whether these companies — that collectively have access to data from a vast majority of the world's population and already face scrutiny for their privacy practices — are the best choice to lead the project.

—Read the full article from S&P Global Market Intelligence

CHART OF THE DAY

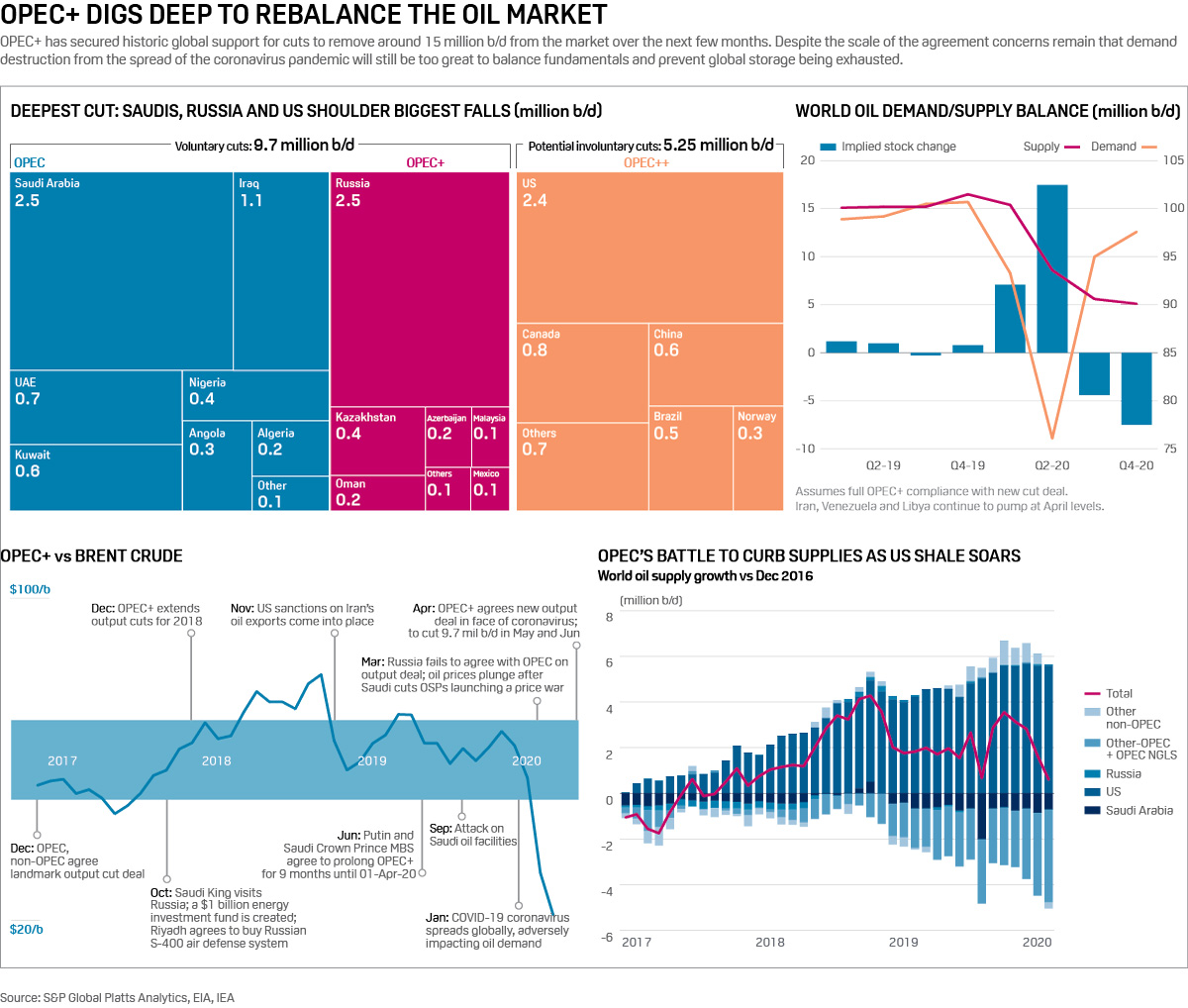

Infographic: OPEC+ digs deep to rebalance the oil market

OPEC+ has secured historic global support for cuts to remove around 15 million b/d from the market over the next few months. Despite the scale of the agreement concerns remain that demand destruction from the spread of the coronavirus pandemic will still be too great to balance fundamentals and prevent global storage being exhausted.

—Read the full article from S&P Global Platts

IEA expects 2020 global refining throughput decline on 'sharply' reduced demand

The International Energy Agency said Wednesday that it expects global refinery throughput to decline by 7.6 million b/d this year to 74.3 million b/d "on sharply reduced demand for fuels." This level, "last observed in 2010", has been attributed to the COVID-19 containment measures. Second-quarter throughput is likely to "plummet" by almost 17 million b /d, due to "widespread run cuts and shutdowns in all regions," the IEA said. Refinery runs need to drop below 60 million b/d "to avoid product inventory builds," the IEA said.

The IEA expects that, along with 250 million barrels of storage space available in the US, "it is possible that there could be as much storage capacity available in the rest of the world" to house the expected product stocks build-up in Q2. However, in the second half of 2020, the agency expects refining activity to recover "slowly" as the global market moves into deficit. It also expects runs to be lower than demand levels while there is destocking from the Q2 "product overhang."

—Read the full article from S&P Global Platts

Tracking global energy transition in turbulent times: solar stutters, coal keeps growing

As the extent of the impact of the coronavirus outbreak on economic activity and power demand emerges, newbuild activity in global power faces old and new sets of challenges. The short-term focus has been shifting due to coronavirus-related disruption of manufacturing activity and logistics, but delays will most likely be short-lived.

The global power capacity mix has already been shifting toward renewables. S&P Global Platts Analytics estimates that solar photovoltaic, wind and hydro made up almost 67% of total power capacity additions over the past year. The question is whether renewables investments will accelerate, but so far we do not see major signs that this could happen soon.

—Read the full article from S&P Global Platts

COVID-19 Impacts To Metals Prices: Volatility Is Here To Stay - Part 1

While S&P Global Market Intelligence expects that prices for the metals covered here will rebound in the second half of the year, we have significantly reduced our price forecasts since early March to reflect the considerably more severe impact of the COVID-19 pandemic than previously anticipated. We also now expect the rebound to be less robust, after S&P Global Ratings significantly reduced its 2020 global GDP growth forecast to just 0.4%. Furthermore, S&P Global Market Intelligence's price forecasts have been significantly reduced as S&P Global Ratings does not expect as significant a Chinese stimulus plan as that launched during the 2008-09 financial crisis. As a result, increased demand in the second half of 2020 will depend more on the pace with which national economies ease back toward normalcy.

—Read the full report from S&P Global Market Intelligence

COVID-19 Impacts To Metals Prices: Volatility Is Here To Stay - Part 2

In this part, we use S&P Global Market Intelligence data and insight to look at how the metal price environment for the precious metals and uranium has evolved during the COVID-19 pandemic. While the gold price dropped mid-March along with those for most other commodities and markets, it has since come back strongly on the back of higher financial investment demand. Meanwhile, silver, despite record retail investment, has sunk to its lowest price in 11 years due to lower industrial demand. Looking at the platinum group metals, or PGM, lockdowns in South Africa and plummeting global auto sales have severely shocked prices. This disruption has kept an uneasy balance, however, and has not yet fundamentally changed the price trajectories of upward for palladium and rhodium, and downward for platinum.

—Read the full report from S&P Global Market Intelligence

Fantasies from a Dividend Perspective

Q1 2020 ended with record dividend payments for S&P 500® issues, as shareholders reaped the benefits of a 10-year bull market. March 2020 (and the first six trading days of April 2020), however, gave a glimpse of what Q2 2020 may look like, as dividend cuts and suspensions started to be announced, with suspensions more prevalent. For 2020, liquidity and cost control are now the top priorities, with dividends lower and buybacks an endangered species.

The Good: Q1 2020 dividends set a new record, paying USD 127.0 billion, up from USD 117.0 billion for Q1 2019. The Bad: March 2020 announcements turned negative, as 13 issues announced cuts, with 10 of them being suspensions, making for a total forward impact of USD 13.9 billion, and more cuts are expected. For U.S. common issues, the net-indicated dividend change was USD -5.5 billion, with the last negative in Q2 2009 (USD -4.9 billion) and the previous record low in Q2 2009 (USD -43.8 billion). The Ugly: For Q2 2020 to date (the first six trading days), there were 57 actions (none of them S&P 500 issues), with 7 positive and 50 negative, and 40 of the 50 negatives being suspensions, amounting to net change of USD -4.8 billion. As for January’s predicted 2020 double-digit dividend gain for the year, just put a “-” in front of it.

The Full Reality Is Starting: Looking at the announcement dates (typically after the board of directors meetings), the next three weeks will be telling, with the first key test being when the big banks start off the earnings season. Last month, eight banks acted in unison to suspend their buybacks (to date, 27% of the S&P 500 has been cancelled, with 72% of the Financials sector).

—Read the full article from S&P Dow Jones Indices

Pandemic Accelerates Long-Term Shifts in Australian Equity Market: Health Care Reigns Supreme

While the COVID-19 pandemic wreaked havoc on global financial markets, it has affected Australian equity sectors quite unevenly. Energy, Financials, and Real Estate have experienced the heaviest losses, while Health Care has outperformed by a wide margin, sustaining a 10% YTD gain through April 9, 2020.

—Read the full article from S&P Dow Jones Indices

Crude rebounds after heavy selloff, outlook volatile

Crude oil futures rebounded in mid-morning trade in Asia Friday, after settling down 2.5% overnight due to a heavy selloff, with the near-term outlook appearing similarly volatile amid developments in the coronavirus outbreak, analysts said. At 10:56 am Singapore time (0256 GMT), March ICE Brent crude futures were up 90 cents/b (1.54%) from Thursday's settle at $59.19/b, while the NYMEX March light sweet crude contract was $1.06/b (2.03%) higher at $53.20/b.

Market participants continue to focus on trying to gauge the extent of demand impacted by the coronavirus. The World Health Organization declared the outbreak a "public health emergency of international concern." However, analysts said there was potential for prices to recover following recent aggressive selloffs.

—Read the full article from S&P Global Platts

April retail market: March US sales post record decline; 4 retailers go bankrupt

U.S. retail sales suffered a historic decline in March, and experts expect more dark days ahead as the coronavirus pandemic keeps American consumers at home. The U.S. Census Bureau reported that sales fell 8.7% from February as the coronavirus crisis continues to rattle businesses and forces retailers to close stores because of government-imposed lockdowns and social restrictions to curb the spread of the disease. As of April 15, more than 128,880 people have died worldwide from COVID-19, the disease caused by the coronavirus, according to data from Johns Hopkins University's Center for Systems Science and Engineering. Experts predict a deeper downturn in sales, partially since some businesses were still open in early March.

—Read the full article from S&P Global Market Intelligence

Dining out: Pandemic spoils March US restaurant sales; experts fear worse ahead

Experts say the U.S. restaurant industry's pain is likely to continue after sales dropped by nearly a quarter in March as the coronavirus keeps dining rooms across the country closed and companies look to scrounge sales from take-out and delivery. Nearly half a million restaurant workers lost their jobs in March in what experts say is the largest one-month employment decline on record for the industry and a sign of worse to come. Meanwhile, there are signs that federal relief measures to help businesses keep people on staff will not be enough.

Share prices for most of the largest publicly traded restaurant chains, however, rose in the last month, reflecting broader market gains despite the widespread economic pain from the virus and measures aimed at stopping it.

—Read the full article from S&P Global Market Intelligence

Rapid job losses strain US bank portfolios across country

More than 15 million initial jobless claims over three weeks beginning in the middle of March, representing about 9% of the country's labor force, have raised the U.S. unemployment rate to levels that many economists believe already easily surpass the 2007-2009 recession.

The job losses crystallize the devastating economic distress caused by the coronavirus pandemic that will weigh on bank loan portfolios as business borrowers shut down and struggle through an uncertain future, and as workers in formerly secure positions start to miss payments. The unemployment rate has historically had a clear, direct impact on credit performance, with credit card portfolios being particularly sensitive. Bank credit costs are widely expected to jump in the coming periods even as massive amounts of federal aid limit the damage and optimistic forecasts anticipate a quick recovery once measures to contain the spread of the virus are relaxed.

—Read the full article from S&P Global Market Intelligence

Bank of America 1st-quarter net income tumbles 48% YOY

Bank of America Corp.'s net income available to common shareholders tumbled 48% from the year prior to $3.54 billion in the first quarter. Its EPS fell 43% to 40 cents. The drop was driven by a $4.76 billion provision for credit losses. Over the preceding four quarters, BofA's provision ranged from about $800 million to about $1 billion.

The company joined large-bank peers including JPMorgan Chase & Co. and Wells Fargo & Co. in taking a large hit in anticipation of defaults driven by the economic downturn caused by the coronavirus pandemic. BofA said that it had granted payment deferrals to 3% of its consumer and small business accounts as of April 8, encompassing 7% of balances. That includes 16% of small business loan and line accounts that have been granted deferrals, representing 32% of balances.

—Read the full article from S&P Global Market Intelligence

Tax Filing Extensions Create Liquidity Issues For U.S. States

Postponement of state April 15 income tax filing deadlines, announced by every state that imposes an income tax, creates a temporary deferral of revenue that for at least some states is likely to be near in magnitude to the separate amount of potential permanent tax loss caused by the pandemic related economic slowdown. Unfortunately, this will create additional problems for state liquidity, creating uncertainty and challenges in revising fiscal 2020 and 2021 revenue forecasts, as separating out temporary income tax deferrals compared to the permanent loss due to economic activity will be difficult.

Every state that levies an income tax has adjusted the tax filing date. With 25 states receiving more than 50% of operating revenues from income taxes, any interruption could be meaningful. The full extent of lost revenues will not be known for months, but will be felt in state budgets for years.

—Read the full report from S&P Global Ratings

Credit FAQ: How S&P Global Ratings' Revised Criteria Look At U.S. Public Finance Rental Housing Bonds

S&P Global Ratings is monitoring the impact of COVID-19 on rental housing bonds and believe that the new criteria provides a better framework to capture any resulting developments in our ratings. In particular, relative to S&P Global Ratings' previous criteria, S&P Global Ratings believes that the revised criteria better captures emerging instability and the volatility in cash flows that rental properties may experience as a result of COVID-19 and future exogenous events.

—Read the full FAQ from S&P Global Ratings

Emerging COVID-19 effects pervasive in Progressive results

Progressive Corp.'s March earnings report provides an initial glimpse of the breadth and depth of the effects of the COVID-19 pandemic on the auto insurance business. In addition to the expected pressures on investment results and benefits from a decline in the frequency of claims, Progressive reported a sharp downturn in the volume of new personal auto insurance applications, a $103 million increase in reserves to reflect higher ultimate costs of claims incurred, and growth in its allowance for doubtful accounts. The pandemic also appeared to contribute to notable changes in the trajectories of growth in policies in force and premiums written at Progressive, the No. 3 U.S. private auto insurer and No. 1 commercial auto writer.

Progressive reported nearly 15.3 million personal auto policies in force in March, including nearly 7.2 million through its independent agency channel and 8.1 million in the direct channel. For the personal auto business overall and the agency channel, it was the first time since August 2017 that policies in force did not grow by double-digit percentages on a year-over-year basis.

—Read the full article from S&P Global Market Intelligence

UnitedHealth says impact of COVID-19 limited in Q1, likely to evolve

UnitedHealth Group Inc. executives said the COVID-19 pandemic had a limited impact on the company's first-quarter results, but they expect that to "play out differently" as the year goes on. CFO John Rex noted that reduction in elective care and the increase of incidence of infections caused by the novel coronavirus in the U.S. started in the middle of March, which was at the tail end of the reporting period. While the company maintains its EPS outlook for the full year, Rex anticipates "other key investor conference metrics likely will play out differently than we expected at that time and our quarterly progression will likely vary from historical patterns."

—Read the full article from S&P Global Market Intelligence

Pandemic could shrink cannabis insurers' premiums, market

Cannabis insurers may see premiums fall and their marketplace contract due to the pandemic caused by the novel coronavirus. The demand for coverage remains, said Erich Bublitz, vice president of cannabis underwriting for Admiral Insurance Group LLC, noting that March saw an uptick in cannabis insurance requests as people across many states rushed to buy products prior to government-ordered lockdowns. But COVID-19 is throwing up major barriers for sales as national travel slows dramatically and dispensaries struggle to stay on top of delivery requests. For example, Nevada is big market for cannabis, but that is predicated on tourist activity.

—Read the full article from S&P Global Market Intelligence

PODCAST OF THE DAY

Listen: Oversupply, coronavirus put US crude oil storage in the spotlight

US crude storage has quickly become an overwhelmingly important issue as the global market continues to grapple with an oversupply of crude and dramatically dwindling demand in light of the coronavirus pandemic. A steep contango in the oil market structure has created the huge incentive for traders and producers to store away their barrels instead of selling it on a prompt physical basis and this is quickly overwhelming storage availability. Joining the podcast is Richard Redoglia, the CEO of Matrix Global Holdings, which launched the world's first futures contract on crude oil storage capacity and holds monthly storage contract auctions.

—Share the Commodities Focus podcast from S&P Global Platts

Analysis: US crude stocks see largest-ever build amid record-low product demand

US crude inventories surged higher last week as refiner demand plummeted in the face of an historic slowdown in refined product demand, US Energy Information Administration data showed Wednesday. US commercial crude inventories surged 19.25 million barrels to 503.62 million barrels during the week ended April 10, EIA data showed. The build was the largest ever on record, eclipsing the previous record-build of 15.18 million barrels realized the week prior.

—Read the full article from S&P Global Platts

US corn CIF New Orleans outright price at lowest since August 2017

The US corn CIF New Orleans outright price for barges, for current-month shipment, was assessed at $3.6926/bu, $145.35/mt, on Wednesday, the lowest level since August 30, 2017, when the assessment was at $3.6550/bu. Corn paper values have been hammered in recent weeks by dramatic cuts in ethanol production. On Wednesday, the US Energy Information Administration showed the US ethanol production fell to 570,000 b/d, the lowest level in 12 years. Ethanol production has plummeted as demand for motor gasoline and blendstocks have dried up due to the coronavirus pandemic.

—Read the full article from S&P Global Platts

COVID-19: Coronavirus-Related Public Rating Actions On Nonfinancial Corporations And Affected European CLOs

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies and European collateralized loan obligations (CLOs), S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on nonfinancial corporations, which have had an effect on European CLOs, and a summary table. These are public ratings where S&P Global Ratings mentions the COVID-19 coronavirus as one factor or in combination with others. For more information, please see "COVID-19: Coronavirus-Related Public Rating Actions On Corporations And Sovereigns To Date".

—Read the full report from S&P Global Ratings

COVID-19 May Be A Litmus Test For European RMBS Calls

In the next 12 months, 31 European RMBS transactions have a call date on which the issuer may exercise their call options. Among these, there are 19 U.K. transactions that were issued between 2015 and 2018, which include legacy and recently originated loans from specialized/buy-to-let lenders. With these transactions' call dates approaching, S&P Global Ratings looks at call holders' ability and incentives to exercise the option. S&P Global Ratings also compares transactions' weighted-average margins at closing with their current weighted-average margins to show how the present economic conditions may reduce incentives to use the call option. Incentives have weakened considerably, in S&P Global Ratings' view, especially for nonbank lenders.

—Read the full report from S&P Global Ratings

European high-yield bond market set to re-open, but leveraged loans may lag

As market participants return from the Easter break there are reasons to believe a re-opening of Europe’s leveraged finance segment is drawing closer, with the high-yield bond space likely to host new supply in the coming weeks, though loans are expected to lag. Secondary markets have rallied — or at least stabilized — for the last two weeks, and accounts are willing to put money to work, albeit in strong, large, and defensive credits. Moreover the investment-grade primary is wide open and hosting record levels of issuance, while the first new issue with a sub-investment-grade rating since coronavirus shut down high-yield emerged last week.

Bankers, while reluctant to be precise on timings, emphasize demand for a new issue will not be the problem, but rather finding the right type of issuer willing to pay up is a more difficult prospect. “As for my pipeline, I agree there is demand, however we are struggling to find the correct issuer,” said one head of syndicate.

—Read the full article from S&P Global Market Intelligence

IMF predicts MENA oil exporters will lose $230 bil in revenue as fiscal breakevens soar

Middle East and North Africa oil exporters are likely to lose more than $230 billion in crude revenue this year if oil prices persist at current levels, while their breakeven oil prices are set to soar amid higher spending needs, the International Monetary Fund said in a report on Wednesday.

"Measured in real terms (adjusted for inflation), oil prices have not been this low since 2001," the IMF said in its regional economic outlook report for the Middle East and Central Asia. "Oil prices at these levels could result in more than $230 billion in lost annual revenue across MENAP [Middle East, North Africa, Afghanistan and Pakistan] oil exporters, compared with October projections, placing significant strains on fiscal and external balances."

Oil prices are down some 60% since the beginning of the year as the coronavirus pandemic decimated oil demand. OPEC and allies agreed over the weekend to curb crude output starting in May. The pact will see the coalition trimming production by a historic 9.7 million b/d in May and June and gradually reducing the cuts through April 2022.

—Read the full article from S&P Global Platts

UAE banks hit by NMC scandal after '1-2 punch' from oil price, coronavirus

Exposures that United Arab Emirates banks have to NMC Health PLC are set to exacerbate asset quality troubles as COVID-19 and low oil prices put pressure on corporate borrowers, analysts said. The recent spate of mergers has concentrated exposures to the London-listed healthcare provider among some lenders while the scandal also raises questions over corporate governance standards in the UAE. NMC Health is a holding company for NMC Healthcare LLC and other affiliates, the largest provider of private healthcare services in the UAE.

This comes as the "one-two punch" of COVID-19 and the low oil price will likely extend to credit markets, with potentially higher incidents of defaults, leading to worse asset quality among UAE banks, said Maria Elena Ponceca, a UAE-based portfolio manager.

—Read the full article from S&P Global Market Intelligence

INTERVIEW: Oman cost-cutting focused on non-producing projects: oil minister

Oman is embarking on a cost-cutting program to the sultanate's oil and gas sector, while also maintaining production levels amid the COVID-19 pandemic, minister of oil and gas Mohammed al-Rumhy has told S&P Platts.

"We're trying to find ways to cut expenditure. In the region, oil production still is the best business that will generate profit," Rumhy said. "The only earnings we can make right now is by producing oil and gas, even if the margins are $1/b or $2/b, it's better than nothing."

—Read the full article from S&P Global Platts

CRUDE MOC: Cash Dubai at over 18-year low as oil demand revised down sharply

Middle East sour crude benchmark cash Dubai fell to its lowest price in over 18 years due to a global fall back in oil prices on fresh downward revisions to oil demand for April. June cash Dubai was assessed at $19.64/b Wednesday at the end of the Platts Market on Close assessment process in Asia, touching lows last hit in 2002. Platts' front month cash Dubai assessment was previously assessed lower on February 27, 2002, at $19.57/b. The Middle East crude benchmark traced a global fall in oil markets, after the International Energy Agency forecast global oil demand in April would sink to 1995 levels.

—Read the full article from S&P Global Platts

China's household default risk to rise on pandemic woes

There are signs that point to rising defaults in mortgages, credit cards and other household debt in China, but most analysts are not anticipating a systemic crisis just yet. More individuals may not be able to service their loans on schedule amid rising unemployment and falling property prices, due to trade tensions with the U.S. in 2019 and the looming global recession brought about by the coronavirus pandemic in 2020. This means the country's rising household loans — a long-term strategy for China to shift the economic growth engine from exports to domestic consumption — could amplify the default risk even while it continues pumping liquidity into the slowing economy.

However, China's largest lenders, some of them so-called systemically important banks, are now more capitalized to withstand shock, analysts noted, compared to where they were during the global financial crisis in 2007 and 2008. Beijing also appears to have a mechanism in place to contain the growing financial risk in smaller banks and microlenders, which are likely being hit harder as they lend more to borrowers with weaker credit profiles.

—Read the full article from S&P Global Market Intelligence

China's steel import spree buying time amid global pandemic lockdowns

China has found itself in the rare position of being an active buyer of steel in the spot market since mid-March as the nation emerges from the worst of its coronavirus outbreak - just as the major buyers of its steel exports grapple with what has evolved into a global pandemic. In its cautious return to business as usual, China's recent binge in steel procurement - including cargoes diverted from original buyers who could no longer take delivery - may support the market in the second quarter, buying time that the rest of Asia needs to flatten the curve in the outbreak.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language