Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 9 Jul, 2020

By Fiona Boal

This blog reflects on the actions taken by S&P Dow Jones Indices (S&P DJI) to ensure that our commodity indices remain replicable and investable in light of the recent extraordinary market conditions experienced in the oil market.

Perhaps no other investable asset has been as severely affected by the COVID-19 pandemic as oil—not equities, not bonds, not currencies, and not even other commodities. While other asset classes have felt the pain of the once-in-a-lifetime decline in global economic activity, their prices have been held up in part by unprecedented levels of fiscal and monetary support. In contrast, we witnessed a dramatic collapse of prices in the oil market during March and April 2020, reminding investors once again that commodities are not anticipatory assets; they reflect current, real-world, “spot supply and demand” conditions.

Extreme volatility and a brief period of negative prices in the WTI crude oil market over recent months have highlighted that modern-day benchmarks are more than market barometers. As the asset management industry evolves and the demand for index-linked passive investment products grows across asset classes, indices also take on the role of rules-based, systematic, and transparent strategies.

As such, index providers must ensure that index methodologies continue to meet their stated objectives. Indices must reflect and adapt to market conditions, including periods of unprecedented market stress. The role of the S&P DJI Index Committee is to serve an oversight function to protect the integrity and quality of S&P DJI indices.

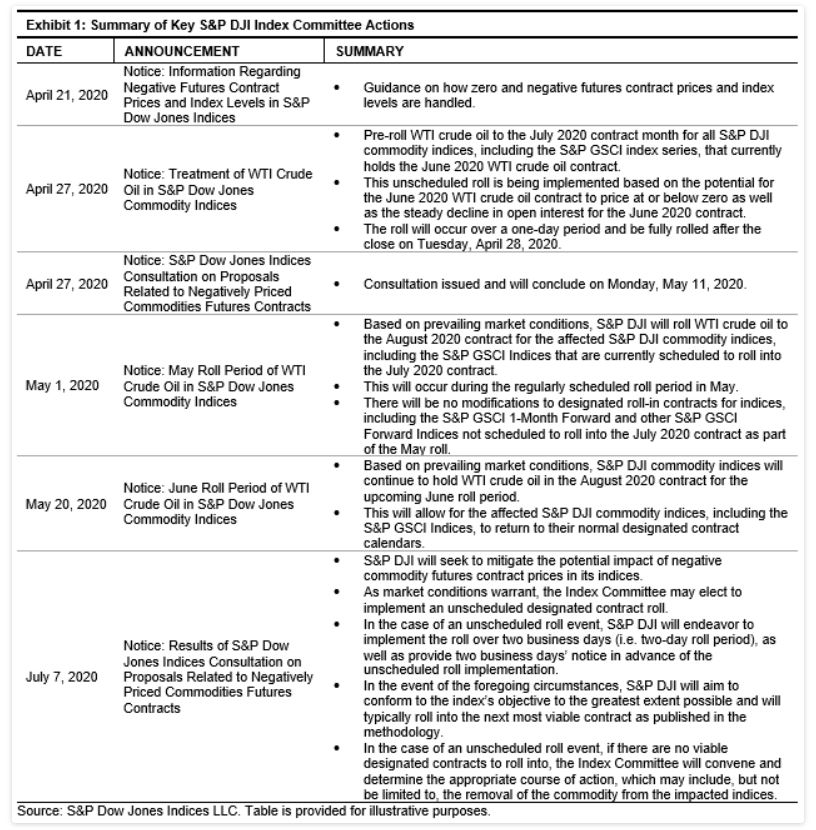

Exhibit 1 summarizes the actions of the S&P DJI Index Committee in response to the risks of negative commodities futures prices.

Indices should be replicable and investable. Indices play a vital role in reflecting the performance of rules-based, transparent investment strategies and form the backbone of financial products such as mutual funds, exchange-traded products, and over-the-counter swaps.

This blog does not provide any indication of the likely course of action by the S&P DJI Index Committee, with the exception of the confirmed and announced changes.

Content Type

Location

Segment

Language