Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 16 Sep, 2020

By Paul Hickin

China may have given oil markets false hope. A rapidly rebounding economy in the Asian powerhouse had initially revived demand, but bloated inventories and stockpiling by domestic refineries have exposed the fragility of prices.

A look at Chinese ports tells the full story. Shandong – home to a host of independent refineries – is completely congested. The volume of crude stored on tankers idled in Chinese waters near the port city for more than a week has quintupled from normal levels.

Chinese refineries – which had taken advantage of relatively cheap prices over the past quarter – are now struggling to find buyers for products, dampening the appetite for crude further.

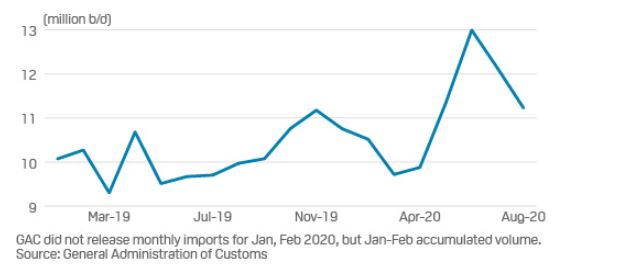

Oil imports have extended losses as expected – dropping 7.4% to a four-month low of 11.23 million b/d in August from July, data from China’s General Administration of Customs, showed recently.

The volumes have been in decline since July, when they peaked at close to 13 million b/d amid rising stocks in crude and oil products. Crude imports in September are set to decline further, with lower new arrivals than in the previous months.

New arrivals into Qingdao port, China’s top crude port on turnover, were estimated to have dropped by about 25% to 2 million-3 million mt in September from June-August, a port official said.

“The oil markets have been mistaking Chinese demand increases for consumption, when in reality it would appear much of it has been going into storage,” said independent oil expert Anas Al-Hajji.

With Chinese demand stalling, the market is looking to India to buy more marginal barrels.

State-owned refineries, which tend to focus on domestic demand, have seen runs increasing as consumption starts to slowly recover. However, export refineries – predominantly owned by the private sector – have seen runs decreasing due to a lack of demand and negative margins.

Although Indian domestic oil demand is limping back, it remains depressed due to high COVID-19 infection rates in the world’s most populous country. The country’s plight is increasingly a shared one, as fears of a second wave to the pandemic in Europe begin to spread and the US continues to grapple with the virus.

Seasonal demand factors will also begin to play into the market, should lockdowns be reintroduced during the Northern Hemisphere winter, which is quickly approaching.

S&P Global Platts Analytics predicts oil demand will contract 8.1 million b/d in 2020 before rebounding 6.3 million b/d next year.

Global gasoline demand has shown strong signs of bouncing back across Europe, the US and much of Asia, with the exception of India and Indonesia. However, this recovery is now running out of road.

European consumption, which has also been on a recovery trend, is hitting a wall, with mobility data across key countries starting to move sideways. Road congestion in Europe’s biggest capital cities rebounded by almost 10 percentage points in the week to Aug. 30, but congestion ended the month little changed from end-July levels, according to TomTom data.

This also poses a problem for a full recovery in oil demand into 2021. Consumption cannot fully recover until air transport returns to normal. Jet fuel accounted for about 8% of pre-coronavirus oil demand.

These depressed market conditions have left prices struggling. Dated Brent – the physical benchmark used to price two-thirds of the world’s oil – has been stuck in a narrow range around $45/b, or lower.

“Demand growth remains vulnerable and is unlikely to reach 2020 levels before 2022,” Platts Analytics said in a research note.

OPEC+, which controls around 45% of the world’s production, has taken its foot off the brakes by releasing 2 million b/d of crude back onto the market since August. The oil producers’ alliance had cut almost 10 million b/d from the market earlier this year in response to the COVID-19-induced collapse in demand and has now started to reduce country quotas in the hope of a continued improvement in consumption.

Consequently, Platts Analytics sees oil prices struggling to go beyond the mid-$40s/b mark by the end of the year before creeping up to $50/b by end-2021.

Oil markets can probably absorb a few more months of uncertainty in regional markets such as the US, India and Europe, but it is China that really worries traders the most.

Content Type

Location

Segment

Language