Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 12 Aug, 2020

By Clement Choo

As the coronavirus crisis plays out, Clement Choo assesses the recovery in the world’s key auto production hubs, with China the exception to an otherwise weak environment.

Carmakers across the globe saw initial signs of improvement in the second quarter, but the auto industry remains concerned about the prospects for a long term recovery as COVID-19 cases have continued to flare up.

As a result, several countries could find themselves implementing another lockdown, which would delay any economic recovery and undermine consumer confidence. Buying cars will be the last thing on the minds of many consumers affected by the pandemic-induced downturn.

Japanese carmakers began to ease back on production cuts in August with several companies, such as Toyota Motor Corporation, planning to cut output this month by just 3%, compared with 10% in July and 40% in June.

The big news in Q2 was a plan by Japan’s Nissan to slash global vehicle production by 20% to 5.4 million units a year by the end of its 2023-24 fiscal year (April-March).

Forward gear: Carmakers ease or end production cuts over Q3

Reverse gear: Another round of lockdowns will delay any recovery

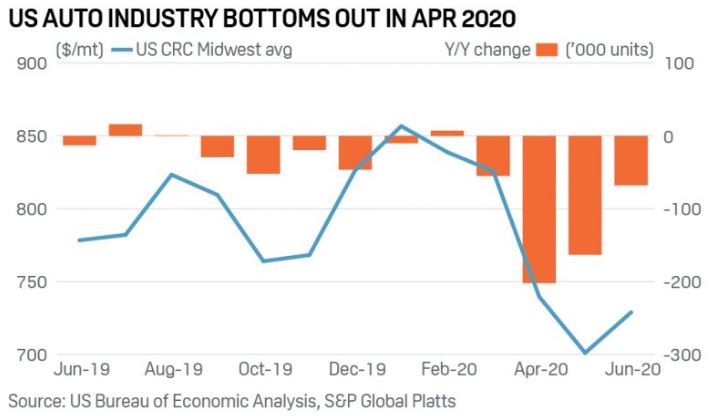

US manufacturing remained in contraction in June although the purchasing managers’ index (PMI) rose to 49.8 from 39.8 in May, data from IHS Markit showed.

The fractional deterioration in US manufacturing came as goods producers and their customers began to reopen amid looser restrictions following the coronavirus outbreak.

Automotive sales in the country fell over 25% year on year in June, with July buying activity still facing uncertainty due to market disruptions caused by the pandemic, according to industry consultants.

Analysts with Cox Automotive said total June new-vehicle sales were down 27% to a seasonally-adjusted annual rate, or SAAR, of 13 million units compared with June 2019 numbers. But June sales were slightly better compared with May, when sales dropped 30.2% on the year to an SAAR of 12.3 million units.

The Eurozone manufacturing sector has remained in contraction for the past 17 months, although its June PMI was revised higher to a four-month high of 47.4 from a preliminary estimate of 46.9 and compared to May’s final reading of 39.4.

In June, EU registrations of new passenger cars totaled 949,722 units, a drop of 22.3% compared to the same month last year but a slight improvement over May 2020, which saw a drop of 52.3%. Over the first half of 2020, EU demand for new passenger cars contracted 38.1%, the result of four consecutive months of unprecedented declines across the region.

China’s “official” measure of manufacturing activity improved for the third-consecutive month in July, helping to support domestic hot-rolled coil prices which rose 7% over the month. The manufacturing PMI, published by the National Bureau of Statistics, rose to 51.1 points in July from 50.9 in June.

India’s manufacturing remained in contraction for a fourth consecutive month in June even though the Nikkei manufacturing PMI jumped to 33.7 in June from May’s 12.6.

Vehicle output for April to June, which marked the first quarter of the Indian financial year, collapsed 79.4% year on year to 1.49 million vehicles, data from the Society of Indian Automobile Manufacturers, or SIAM, showed. The same data also put monthly production at 1.09 million vehicles in June, nearly halved from 2.25 million vehicles made a year earlier.

Although there were signs that most auto markets seemed to bottom out in Q2, full year projections were already lower before the initial surge of coronavirus infections. How global markets perform in Q3 could affect year-end holiday demand which could carry over into early 2021.

There are signs of recovery in Europe’s auto sector, which has been supporting hot-rolled coil prices. But in the US the rebound is less evident. Steelmakers have been lifting capacity utilization rates back to around 60% but downstream demand remains affected by the pandemic which is still severe in certain states. China’s manufacturing sector, including auto output, continued to improve in July.

While month-on-month increases are expected over Q3, year-on-year comparisons are likely to show declines amid market concerns about the prolonged impact of the coronavirus. Weak domestic demand has led Indian steelmakers to boost their exports, especially to China amid doubts about whether the latter can sustain its buying spree.

ASEAN’s leading carmaker, Thailand, revised its production forecast to 1 million-1.4 million units in 2020, figures from the Federation of Thai Industries, or FTI, showed. The range was widened from its previous forecast in May of a 33.8% fall to 1.33 million units. If Japan declares another emergency to fight the spread of COVID-19, local carmakers will once again take steps to cut production.

Content Type

Segment

Language