Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Published: July 6, 2020

Highlights

Panjiva Research will be taking part in a webinar on July 1 with our colleagues from S&P Global Market Intelligence’s Credit Analytics team to consider ways to augment credit analysis with supply chain data. You can register here.

This report considers the ways in which Panjiva’s global supply chain data may be useful for credit risk analysis before taking a look at evolution of supply chain risks from trade policy uncertainty through to the COVID-19 pandemic before taking a deep dive into three sectors.

More information regarding Panjiva’s data services are available here while S&P Global's Credit Analytics product can be found here.

Using supply chain data in credit risk analysis

Broadly speaking, credit analysis can be defined as the assessment of: the credit health of counterparties and investments; the probability of a firm’s default; and the creditworthiness of unrated companies.

Credit analysis tools can be useful for financial sector players including banks, insurance firms and portfolio managers as well as non-financial corporates in treasury, financial reporting and merchandise management. In prior research we’ve shown a similar set of applications for commercial finance.

Panjiva’s supply chain graph, a mathematical representation of a firm’s supplier and customer network, can be considered as the “physical twin” of the firm’s financial relationships. As a result the two very much feed into each other. There are at least four ways this can be applied:

Volumes flowing through a company’s supply chain provide a real-world guide to its activity in terms of production, inventory management and sales. More details can be found in S&P Global’s recent Quantamental Research on the topic. Weakening volumes can be an early sign of emerging financial weakness.

Characteristics of the supply chain can provide an extra layer of insights beyond reported company exposures by geography, product and counterparty shown in financial filings. Geographic exposure can be particularly important in the event of physical risk events such as heavy weather, natural disasters, labor disputes and of course the COVID-19 outbreak. Panjiva’s fundamental research regularly provides event-driven research on that basis.

A volatile supply chain, with a rapid turnover in suppliers and buyers or a sudden change in the number of counterparties, may be an early warning that the firm either has suppliers and buyers who are in trouble or that the firm itself is being viewed as a less desirable counterparty financially.

On a more positive tack, longer-term changes in the supply chain structure can also be used to identify the application of corporate strategies such as efficiency measures, reshoring strategies, entry to new markets or the sale of new products.

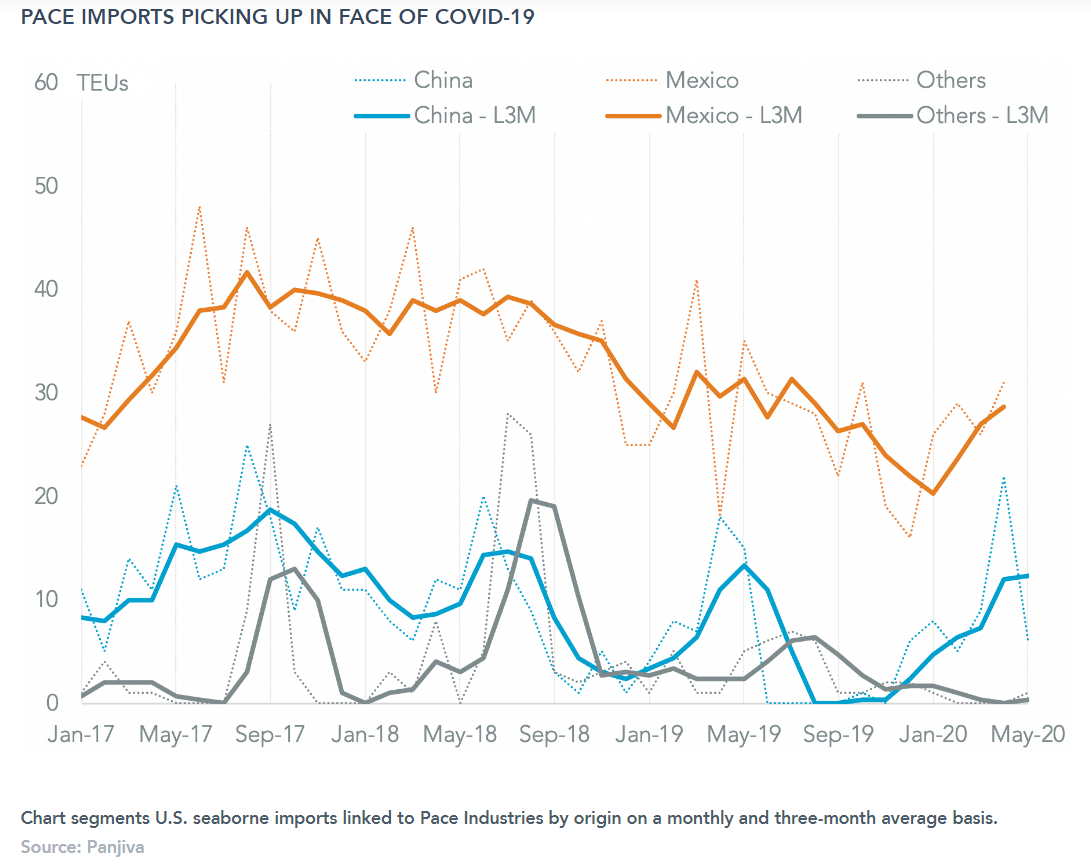

Chart segments U.S. seaborne imports linked to Pace Industries by origin on a monthly and three-month average basis.Source: Panjiva

It’s also worth noting that supply chain data, unlikely financial data, is ownership agnostic. In other words it can be particularly used for privately owned companies or those that are not bound by public company reporting disclosures. A recent example in the agricultural trading space is instructive in this regard with Cargill having withdrawn its quarterly reporting.

Global supply chain risks mount ahead of COVID-19

Risks to global supply chains are by no means a new phenomenon, but they have accelerated in the past four years, with two significant developments under the Trump administration. The U.S.-China trade war, as discussed in our extensive history of the topic, this reflects a wider geopolitical struggle that is mostly about technology supremacy rather than just the flow of manufacturing jobs.

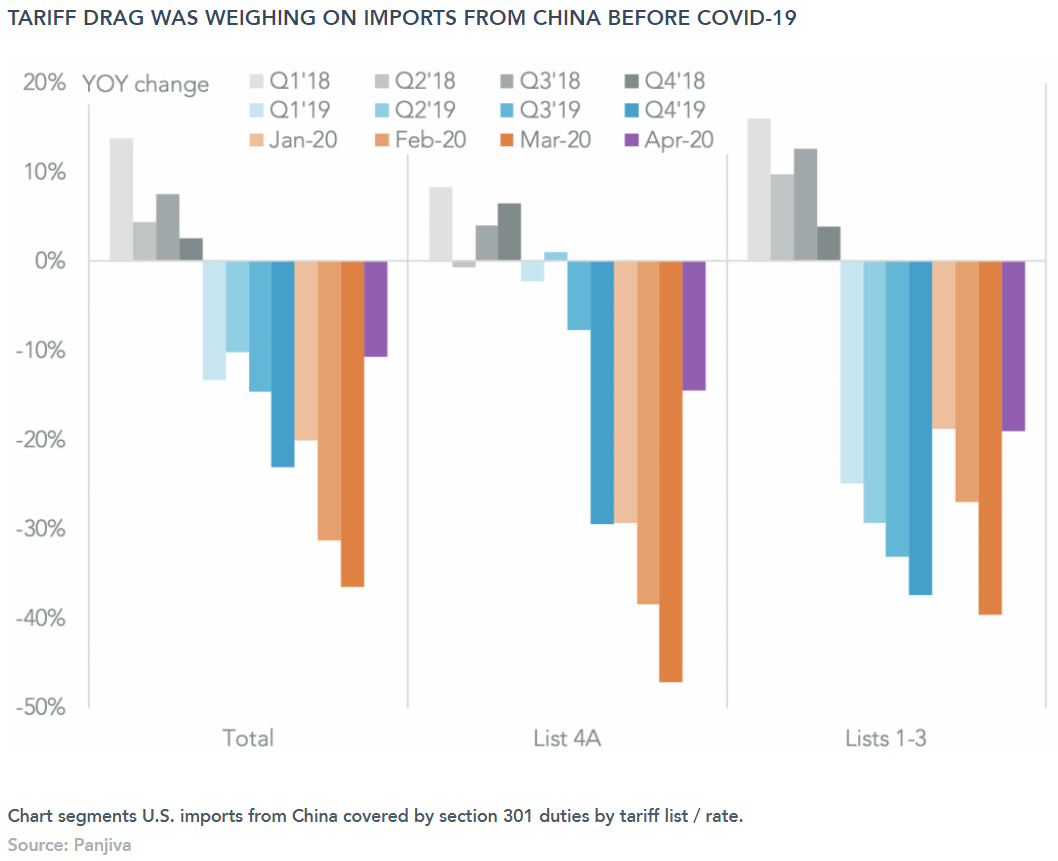

The main impact so far has been the implementation of tariffs on most U.S. imports from China. Imports of products that have faced 25% duties in a set of lists applied in July, August and September 2018 fell by 30.7% year over year in the 12 months to April 30, Panjiva’s analysis shows. Imports covered by 7.5% tariffs, which were initially applied at 15% in September 2019, have fallen by 16.0% over the same period.

The tariffs and associated trade war risks have led firms to face higher costs and to review whether “China+1” strategies are appropriate. From a risk perspective there are clear signs that relationships are worsening and that an extension of tariffs is possible.

Chart segments U.S. imports from China covered by section 301 duties by tariff list / rate.Source: Panjiva

The U.S.-Mexico-Canada Agreement (USMCA) represents a reformation of NAFTA to include sectors that didn’t exist in 1994 as well as update appeals procedures. Importantly though it also includes new rules-of-origin that may require a recasting of supply chains in manufacturing. This in turn may require firms to formulate a whole new set of relationships and may drive a degree of regionalization of supply chains. So far though there are few signs of that having occurred.

Those are by no means the only areas of trade policy volatility that have brought risks to supply chains with multilateral deals in Asia, the rise of tariffs such as “ Make in India“, the breakdown of the World Trade Organization appeals process and rising medical protectionism in the wake of COVID-19.

The effects of COVID-19 on global supply chains

Panjiva’s shipping data can provide a low-latency, high-frequency oversight of the performance of different industries during the pandemic, particularly for North American markets as well as those with substantial exposure to North America from a second-order perspective.

The impact of the COVID-19 pandemic can be split into four phases from a supply chain perspective.

The first has been the disruption of upstream supply chains due to factory closures. That initially occurred in China before spreading globally. Some of the most extreme examples have been the wholesale industrial closures seen in Mexico and India.

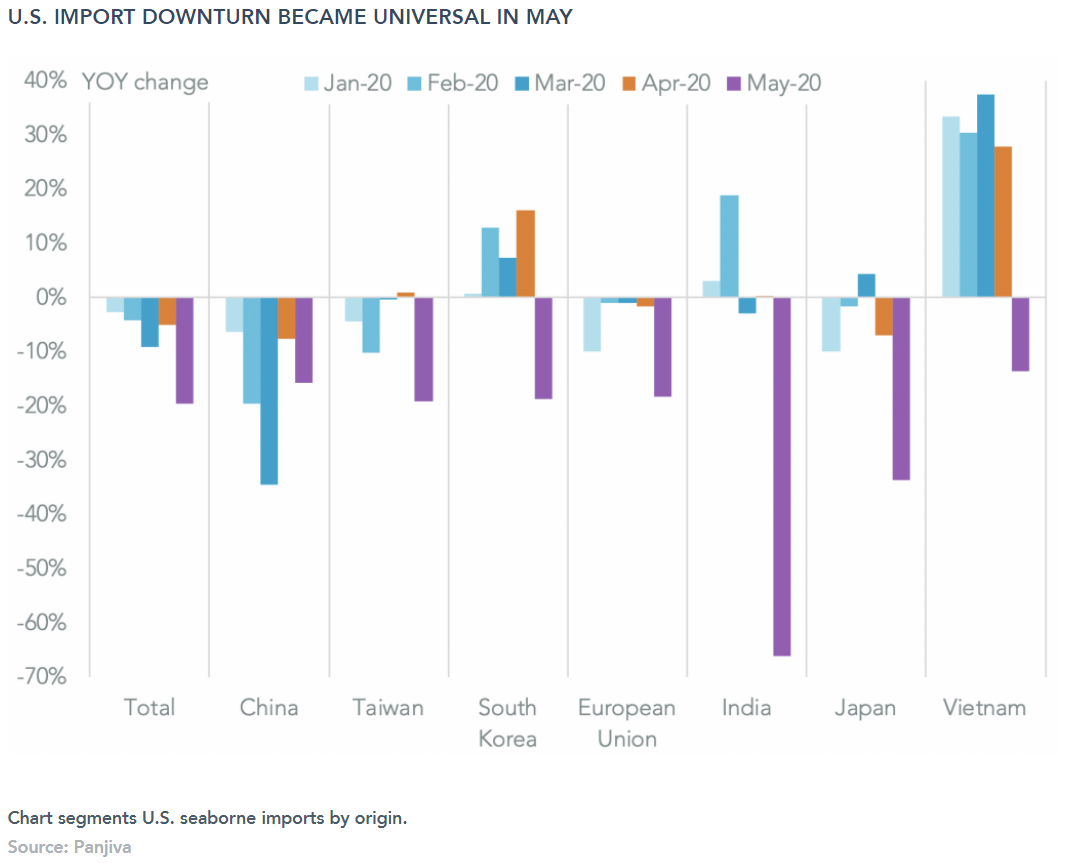

Panjiva’s U.S. seaborne import data shows that shipments from China slowed but didn’t collapse with a 34.5% decline in March being the trough performance, though shipments have continued to decline since. More extreme has been a 66.1% slump in shipments from India to the U.S. in May. Most other regions have seen a downturn of around 20% in shipments to the U.S. in May.

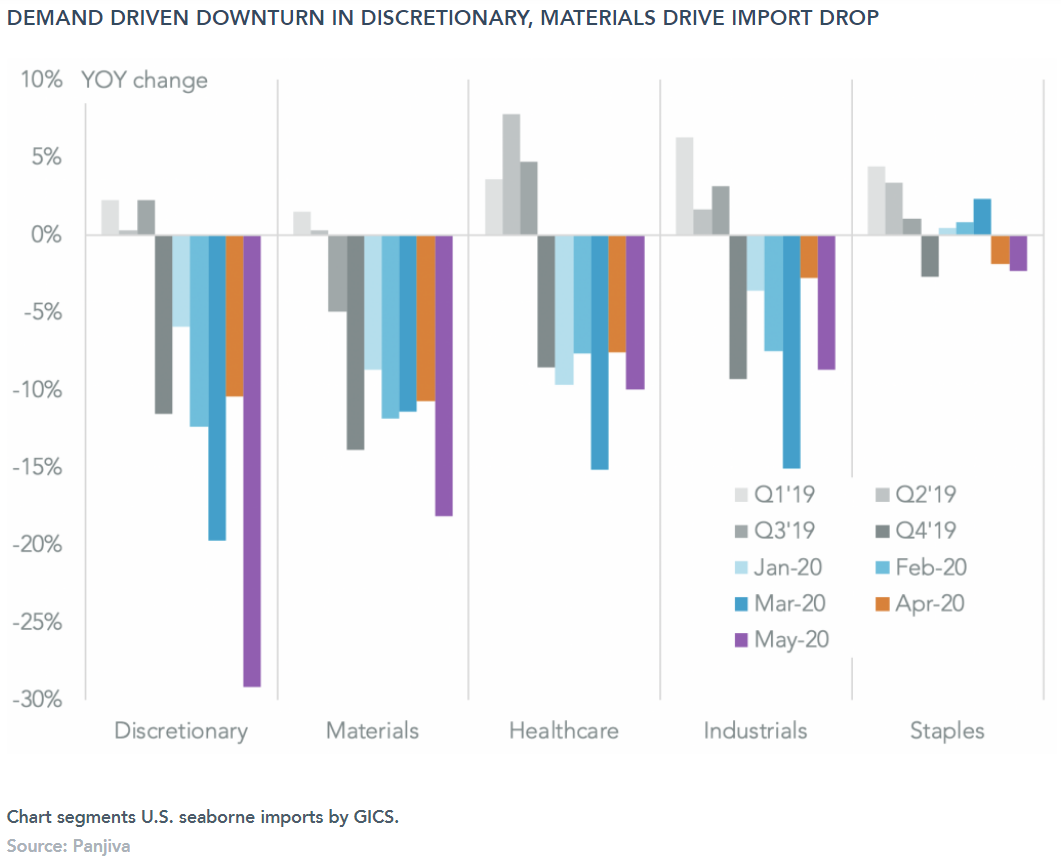

Chart segments U.S. seaborne imports by origin.Source: Panjiva

Second has been a collapse in demand. Panjiva’s data is structured primarily as products and companies rather than as industries. Nonetheless the product profile can be closely mapped to industrial sectors with five sectors*. Panjiva’s data shows that imports linked to the consumer discretionary industry have fallen fastest during the pandemic, counting the three months of imports to May 31 as a baseline on a year over year basis. Consumer discretionary imports fell by 20.2% year over year in the three months to May 31, including a 29.2% slump in May alone.

Imports of materials were the next biggest loser with a 13.6% drop reflecting slower industrial demand. Healthcare surprisingly fell by 10.7% despite government efforts to ensure a steady flow of medical supplies for COVID-19, though there’s clearly been a toll on demand for non-COVID-19 related procedures. The slower moving industrials imports have only fallen by 8.7% while consumer staples were more-or-less unchanged at 0.6%, which is unsurprising given the surge in panic buying.

Chart segments U.S. seaborne imports by GICS.Source: Panjiva

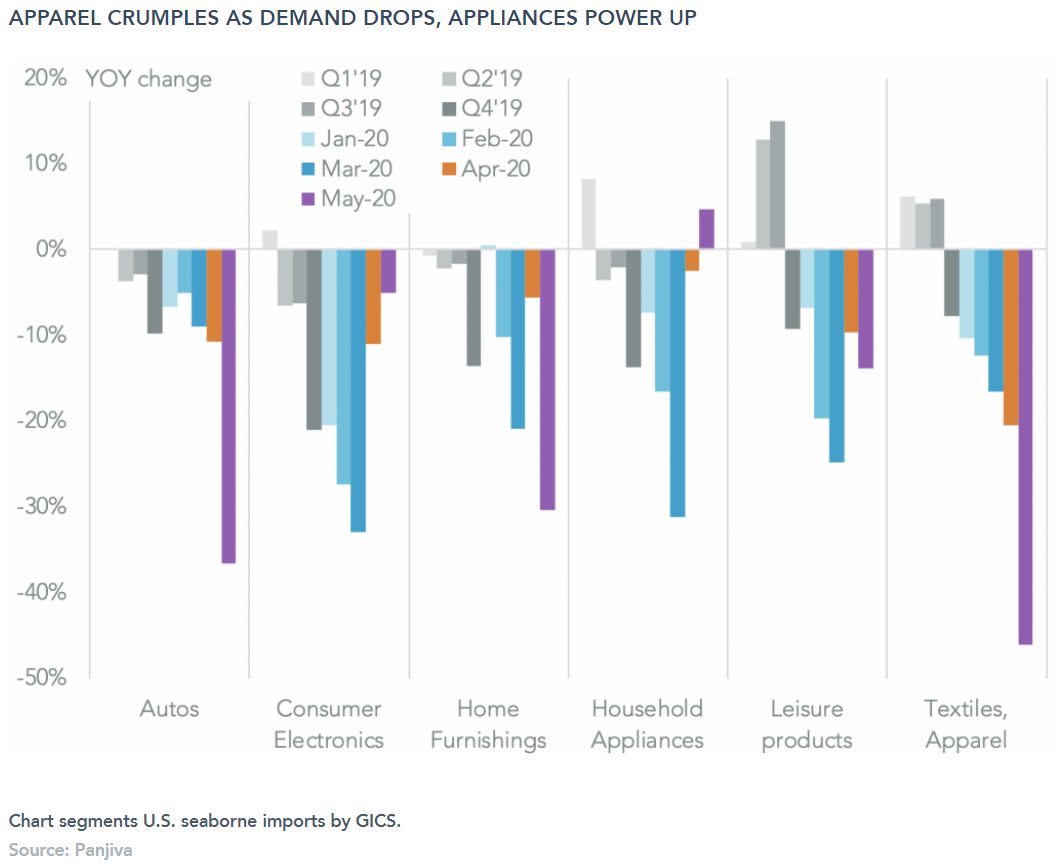

Within consumer discretionary all the big six sub-sectors tracked by Panjiva experienced a downturn. The slide in the automotive industry is notable in being around average at a 19.1% decline, but accelerating to a 36.6% slump in May alone.

Imports of household appliances and consumer electronics did better than average with declines of 9.0% and 15.5% respectively in the past three months including a 4.7% rise in household appliances in May alone. That’s not necessarily a good thing of course if retailers have over-ordered relative to outcome demand or if manufacturers are channel stuffing in order to maintain factory operations.

Chart segments U.S. seaborne imports by GICS.Source: Panjiva

In that context the third phase of impacts from COVID-19 resulting from the uneven reopening of manufacturing and retail operations could be the most significant from a risk perspective. That process is only just getting underway in late May / early June and could take several months to resolve. The relative unknowns of each company’s exposure to suppliers and customer dynamics requires a deeper analysis of each supply chain.

The sudden drop in shipments in the automotive industry and the recent recovery in consumer electronics and household appliances make them potentially fruitful sectors for further investigation.

As a side note the supply chains for other consumer items including furnishings, leisure products (toys) and apparel are relatively simple when compared to those of autos and electronics.

Screening sectors for companies that may face risk issues

In the analysis that follows for the three discretionary sectors we consider for the top 60 ultimate parent consignees the momentum between the year-over-year change in imports in April and May combined compared to Q1 as this shows:

1. Whether Q1 conditions continued or worsened in the past two months and is that performance positive or negative in absolute terms.

2. A negative momentum – ie the development in the last 2 months is worse than Q1 – may indicate a company with worsening conditions, either importing too much too early and having to revert, or indicative of a failing supply chain. More benignly it may also represent a moderation of earlier, rapid growth.

3. A positive momentum – ie the development in the last 2 months is better than Q1 – may indicate a company with improving conditions in terms of imports. That may include early recovery situations but also, potentially, firms that are taking a view that demand will rapidly recover.

Some of the more extreme cases have been discarded as they may represent data artifacts – see our Quantamental Research for more information – rather than genuine changes in activity. The analysis also excludes logistics companies and banks as they may be working on behalf of more than one ultimate consignee.

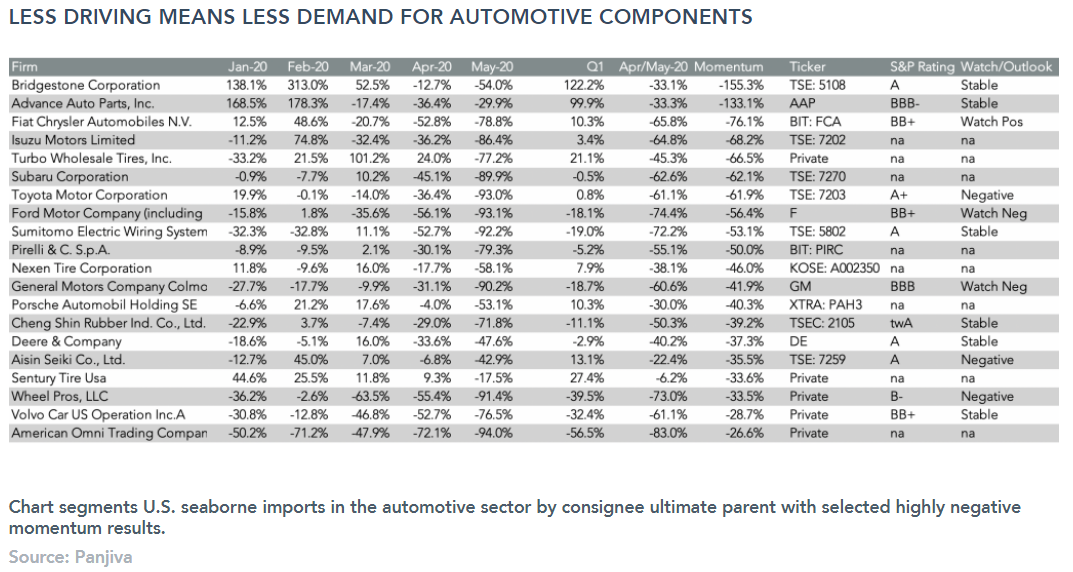

Autos

The automotive industry has been particularly hard hit by the pandemic. Out of the top 50 importers analyzed by Panjiva, 38 had a negative rate of momentum. A slump in demand in the U.S. resulting both from a lack of consumer confidence and dealer closures alongside the shuttering of major factories which have been deemed non-essential.

As a consequence the most impacted firms include a mixture of assemblers, including Fiat-Chrysler and Isuzu Motors with negative momentum rates of 76.1% and 68.2% respectively as well as component importers including Bridgestone and Advance Auto Parts at 155.3% and 133.1% respectively. The latter two are also exposed to a slump in miles driven and resulting need for replacement tires and service items respectively.

Chart segments U.S. seaborne imports in the automotive sector by consignee ultimate parent with selected highly negative momentum results.Source: Panjiva

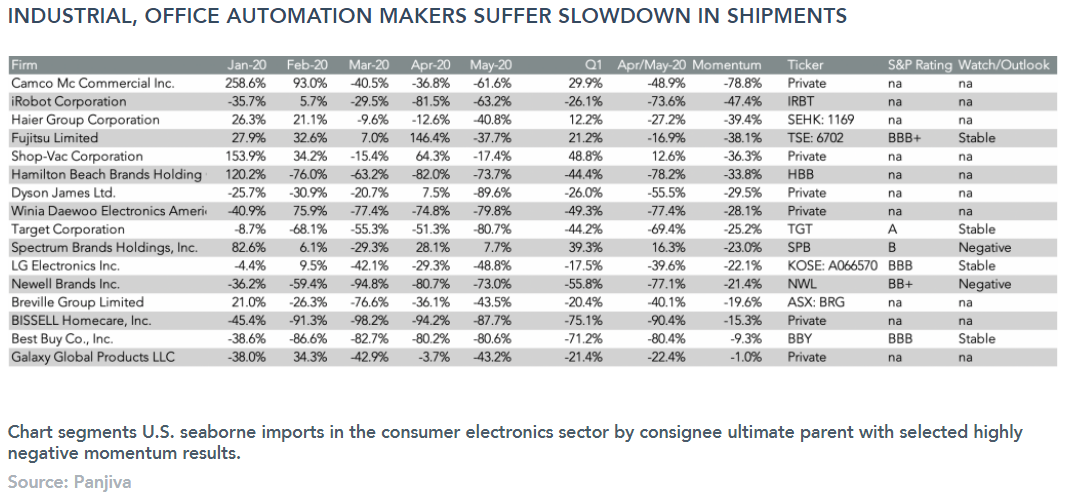

Consumer Electronics

The consumer electronics sector should not, in theory, have faced the demand destruction that autos have given the increased need for work-from-home equipment such as laptops and desire to improve home entertainment systems. Far fewer companies have therefore run into negative momentum as a result, with just 21 of the top 50 firms seeing a negative trend in April and May versus Q1.

Many of the firms that have negative momentum, including Hon Hai, Global Automation and Technicolor are still seeing positive (but less positive) growth in shipments. The swing to negative momentum for Foster Electric, with a 28.8% slide in shipments in the past two months from 34.9% growth before, follows a diversification of the firm’s supply chain towards Vietnam and away from China in response to the U.S.-China trade war.

Firms with a significant exposure to office automation technology have seen some of the most rapid reversals of momentum including printer makers Seiko Epson, Xerox, Lexmark and Oki. Similarly Commscope, a producer of network connectivity equipment, may also have lost out due to its exposure to office investments.

Chart segments U.S. seaborne imports in the consumer electronics sector by consignee ultimate parent with selected highly negative momentum results.Source: Panjiva

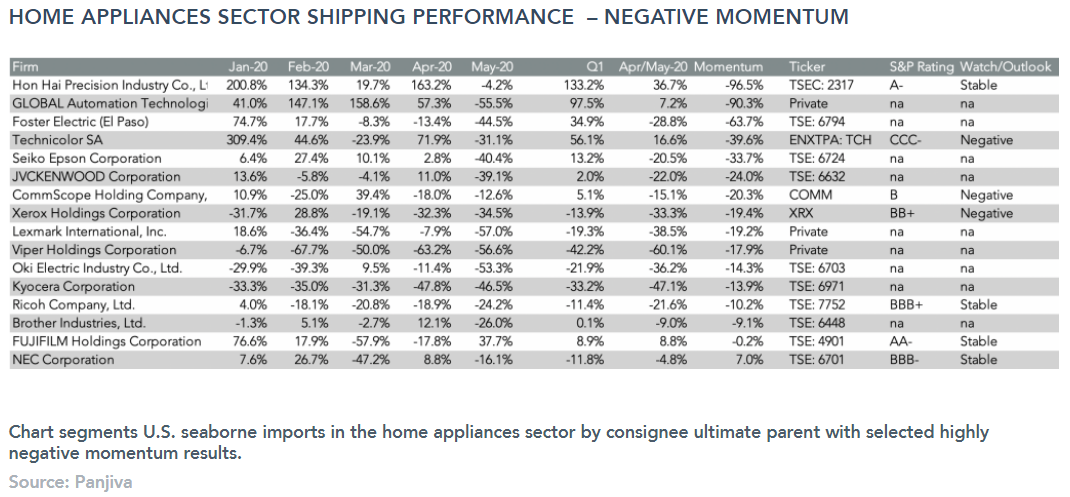

Home Appliances

The major home appliances manufacturers have entered COVID-19 after a period of turmoil for their supply chains caused by the U.S.-China trade war with tariffs charged on parts and completed devices. That’s led some to shift supply chains but most to lose profitability or unit sales.

The sector has faced challenges throughout the past five months. A high reliance on Chinese suppliers caused considerable disruptions when manufacturing their shutdown in February and March. A drop in demand in the U.S. came later in April and May. The prevalence of store sales for larger devices including vacuums and white goods has been a differentiating factor too.

The fastest drop in momentum has been seen by Camco, formerly GE’s appliances business, which saw a reversal to contraction from growth – its lower reliance on China may explain why it hadn’t lost out in Q1 before a demand crunch in April / May. The more extensive reversal suffered by iRobot is typical for the “loss of China then loss of demand” model. Not all firms are losing out though with Shop-Vac and Spectrum Brands both continuing to experience growth despite the slowdown.

Chart segments U.S. seaborne imports in the home appliances sector by consignee ultimate parent with selected highly negative momentum results.Source: Panjiva

* For this report, the five GICS industries covered deeply by Panjiva are:

The materials industry including chemicals, metals and paper / forestry.

Industrials are divided between electricals and machinery, though a high degree of product granularity is available for both.

Consumer discretionary includes autos, durables (split into consumer electronics, home furnishings and home appliances), leisure products and textiles, apparel and luxury goods.

Consumer staples is divided into food, beverages and tobacco as well as household and personal care.

Healthcare is divided between equipment / services and pharmaceuticals.

Content Type

Location

Language