Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Published: October 1, 2019

Highlights

As investors and companies increasingly weigh climate risk into their investment decisions and strategic direction, the question persists whether regulatory or market-based solutions offer a better path forward.

Scenario analysis based on scientific research indicates that climate risk will begin to impact global growth in the near future.

An uncoordinated regulatory response creates confusion and doubt in the markets. But market-based solutions are also plagued by inconsistent standards and terminology.

S&P Global believes effective and standardized ESG disclosure is needed to foster this growth. This presents an opportunity for governments and regulators to work with market leaders.

For a PDF of this report, please download.

As more and more companies and investors conclude that sustainable practices make for sustainable returns, the assessment of corporations’ environmental, social, and governance (ESG) footprints has moved from a simple measure of corporate responsibility to an investment proposition. While this general focus on ESG policies is undeniably beneficial, companies today are presented with the additional challenge of actively planning for climate risk. With a growing consensus around climate science, companies and investors must plan for a number of different scenarios, depending on the extent and impact of global climate change. However, an absence of shared terminology, benchmarks, and policies threaten to stymie investors and companies as they attempt to account for climate risk.

Concerns remain that corporations and sovereigns may not be acting quickly enough to structurally address the issue of climate risk. Despite efforts to incorporate climate risk into their decision-making, some investors and regulators fear that the market doesn't grasp the full scope of the costs and consequences of climate risk.

As laid out in its Agenda for Sustainable Development, the U.N.’s 17 Sustainable Development Goals offer a roadmap for enterprises to engage in sustainable finance while still pursuing their business objectives. Research indicates that companies that embed these goals in their growth strategies, suffer no statistically significant performance disadvantage at individual and portfolio levels, and may actually outperform their peers. As we embark on an era that has become popularly known as the fourth industrial revolution, defined by disruptive technologies, changes to climate threaten to further unsettle markets and create new winners and losers. Under these circumstances, sustainability becomes a strategic imperative for forward-looking firms.

Many investors and companies are seeking greater clarity and confidence in accounting for long-term climate risks and opportunities. Moreover, regulators and policymakers require a common framework to communicate the standards and practices of sustainable investing. Developing internationally accepted principles and performance indicators will help increase investment in initiatives like clean energy and sustainable infrastructure. In short, investors’ ability to speak a common tongue when evaluating opportunities would allow them to better assess the relative merits of one project or asset against another.

During Climate Week NYC in September, a number of companies and organizations announced new initiatives that seek to address long-term climate risk. The U.N. introduced the Asset Owners Net Zero Alliance, a group of asset managers overseeing a collective $2.4 trillion that have pledged to align their portfolios to meet net-zero greenhouse-gas emissions by 2050. Additionally, one-third of the world’s banking sector (that is, 130 banks holding $47 trillion in assets) signed on to the Principles for Responsible Banking, committing to plan for climate risks and environmental challenges in driving sustainable economies. At S&P Global’s 2019 Climate Week event, company representatives gathered with large institutional investors, industry leaders, and corporate ESG experts to share opinions about the best ways to quantify climate risk and for investors to act on their environmental concerns.

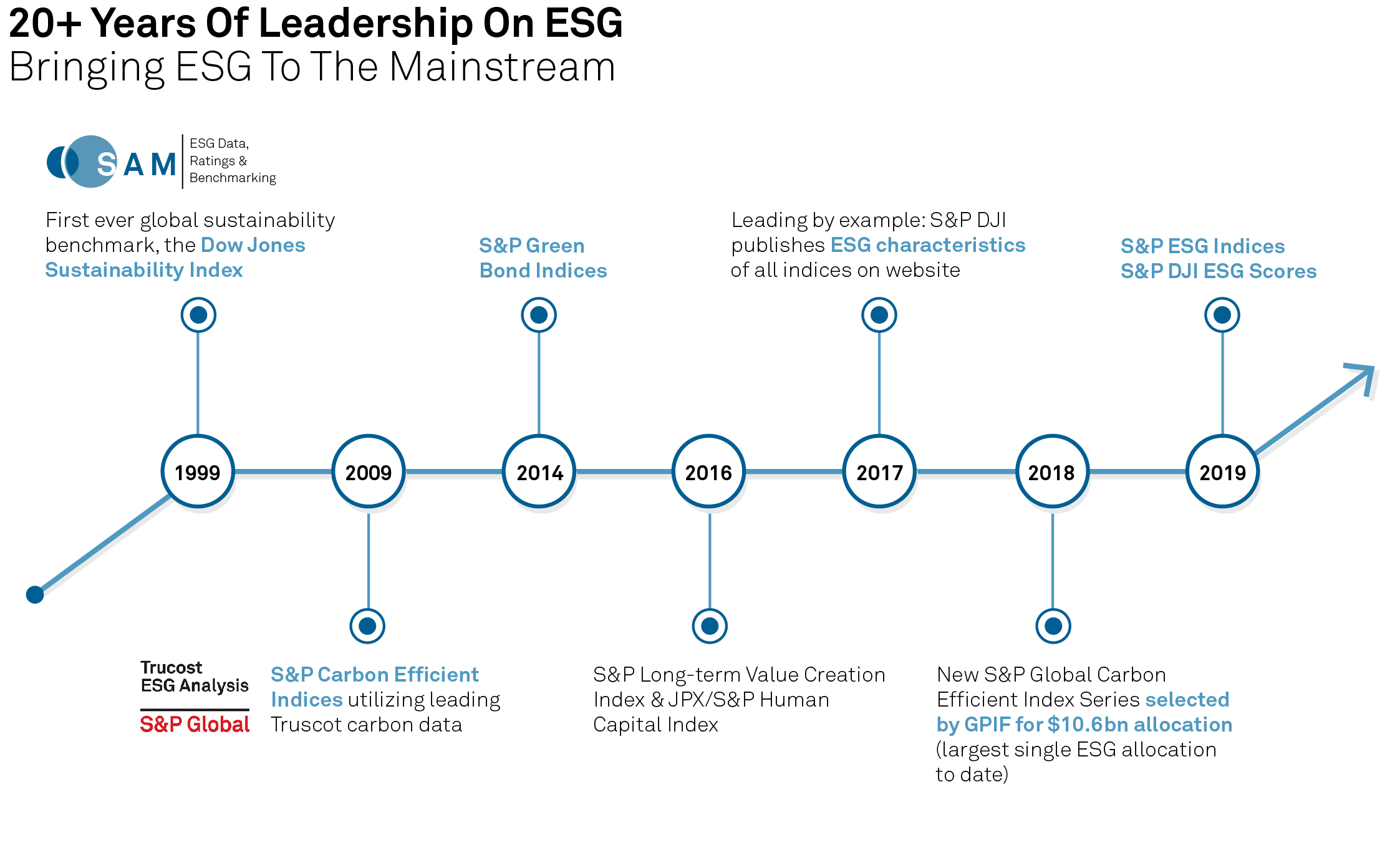

That session continues S&P Global’s longstanding commitment to finding sustainable-finance solutions, an effort that stretches back at least two decades with the introduction of the Dow Jones Sustainability Indices (DJSI). Developed in collaboration with ESG data firm RobecoSAM, S&P Dow Jones Indices launched the DJSI World in 1999—the first global index to track the sustainability efforts of public companies.

There are positive signs that we are entering a new phase in thinking about sustainability and climate risk. We are moving beyond merely featuring ESG in press releases and toward an era in which investors integrate ESG into their portfolios to their financial advantage. This is demonstrated by a comparison between the benchmark S&P 500 and the new S&P 500 ESG. The S&P 500 ESG is a broad-based index with similar industry group weighting as the S&P 500 but is designed to measure the performance of securities meeting sustainability criteria. In the most recent five-year period (Sept. 30, 2014-Sept. 30, 2019) the two indices posted nearly identical returns.

“Companies' awareness and engagement with climate and environmental issues also seems to be increasing rapidly,” according to Richard Mattison, CEO of Trucost, part of S&P Global Market Intelligence. “80 percent of the world’s largest companies are reporting exposure to physical or market transition risks associated with climate change, and a similar share are engaging in reducing corporate emissions.”

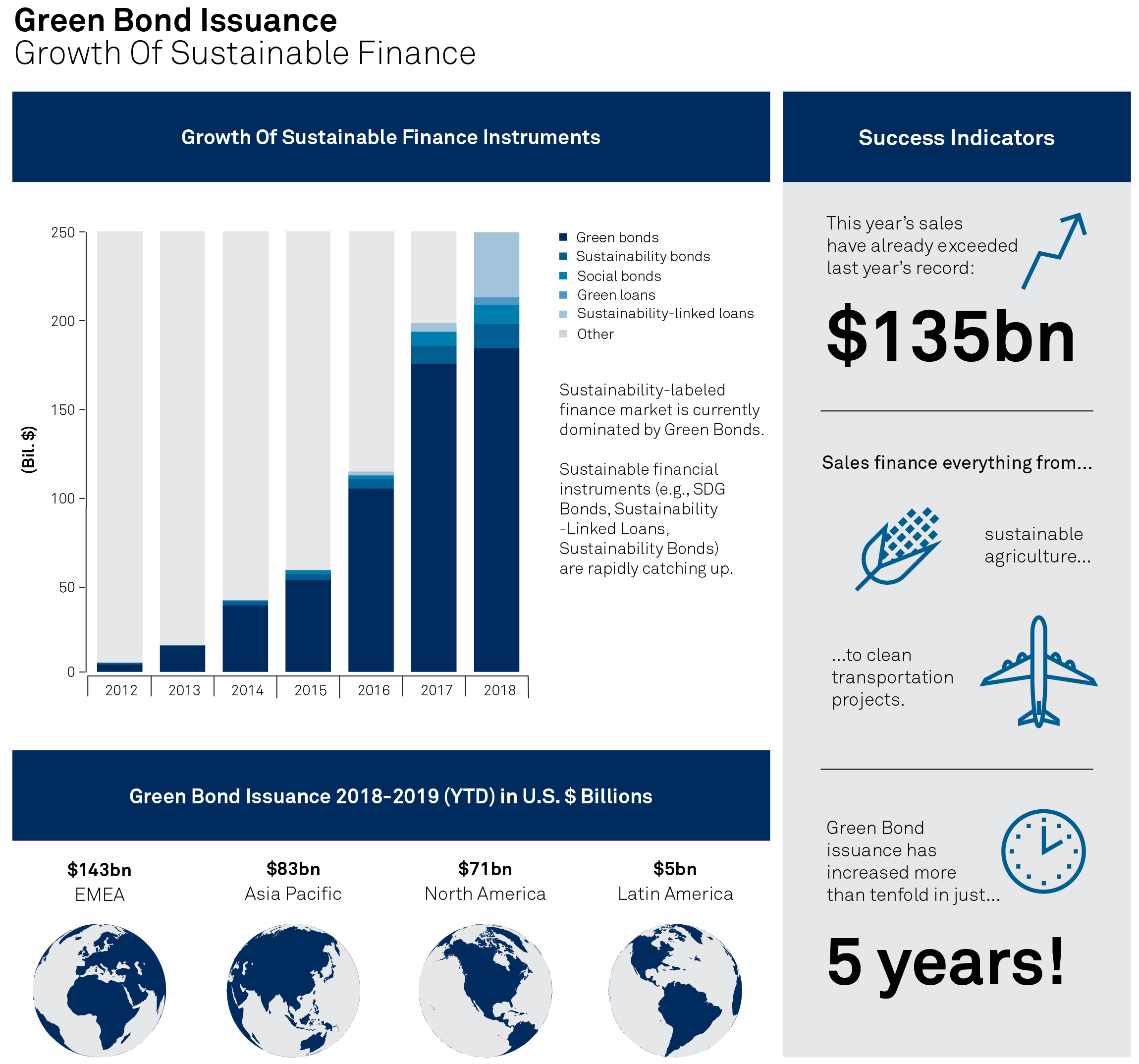

Investors have been quick to notice that there is a demand for sustainable, low carbon investments. Global sales of green bonds, used to finance everything from sustainable agriculture to clean transportation projects, have more than quadrupled in five years. And sales this year have already exceeded last year’s record $135 billion, with sovereigns, particularly European countries, driving the market. Other estimates put the market even higher, with data from the Climate Bonds Initiative showing green bond issuance skyrocketing to more than $167 billion last year, up from just $13 billion five years earlier.

Meanwhile, increasing pressure from shareholders and activists has led to divestment from some carbon-intensive industries like energy. Notably, a campaign spearheaded by environmental organization 350.org claims to have received commitments from institutions representing $11 trillion in assets to divest from fossil fuels.

There is now, and has been for some time, broad scientific consensus that climate change is happening and that anthropogenic factors play a significant role. Already, climate change has a part in determining the long-term credit worthiness of cities due to potential losses to infrastructure and property. If current models hold, climate change will begin to impede global economic growth in this century.

The 5th Assessment Report of the Intergovernmental Panel on Climate Change, estimates that the average global surface temperature has increased 0.85 degree Celsius (1.5 degrees Fahrenheit) since the first industrial revolution. Estimates of future warming by the end of this century range from 0.9-5.4 degrees C (1.6-9.7 F). Another U.N. report stated that the world has only 11 years left to prevent irreversible damage from climate change. Companies and investors have begun to ask themselves what the material effects of climate change will be on their assets and what the implications of moving energy transition away from carbon intensive industries can bring.

Royal Dutch Shell shocked the oil industry when it declined to renew its membership in the American Fuel & Petrochemical Manufacturers in April, leaving the century-old trade association over differences in climate policies. And asset-management giant AllianceBernstein, with more than half a trillion dollars under management, recently sent its investment staff to New York’s Columbia University to undertake an ESG-centric training course it developed on understanding the financial risks of climate change.

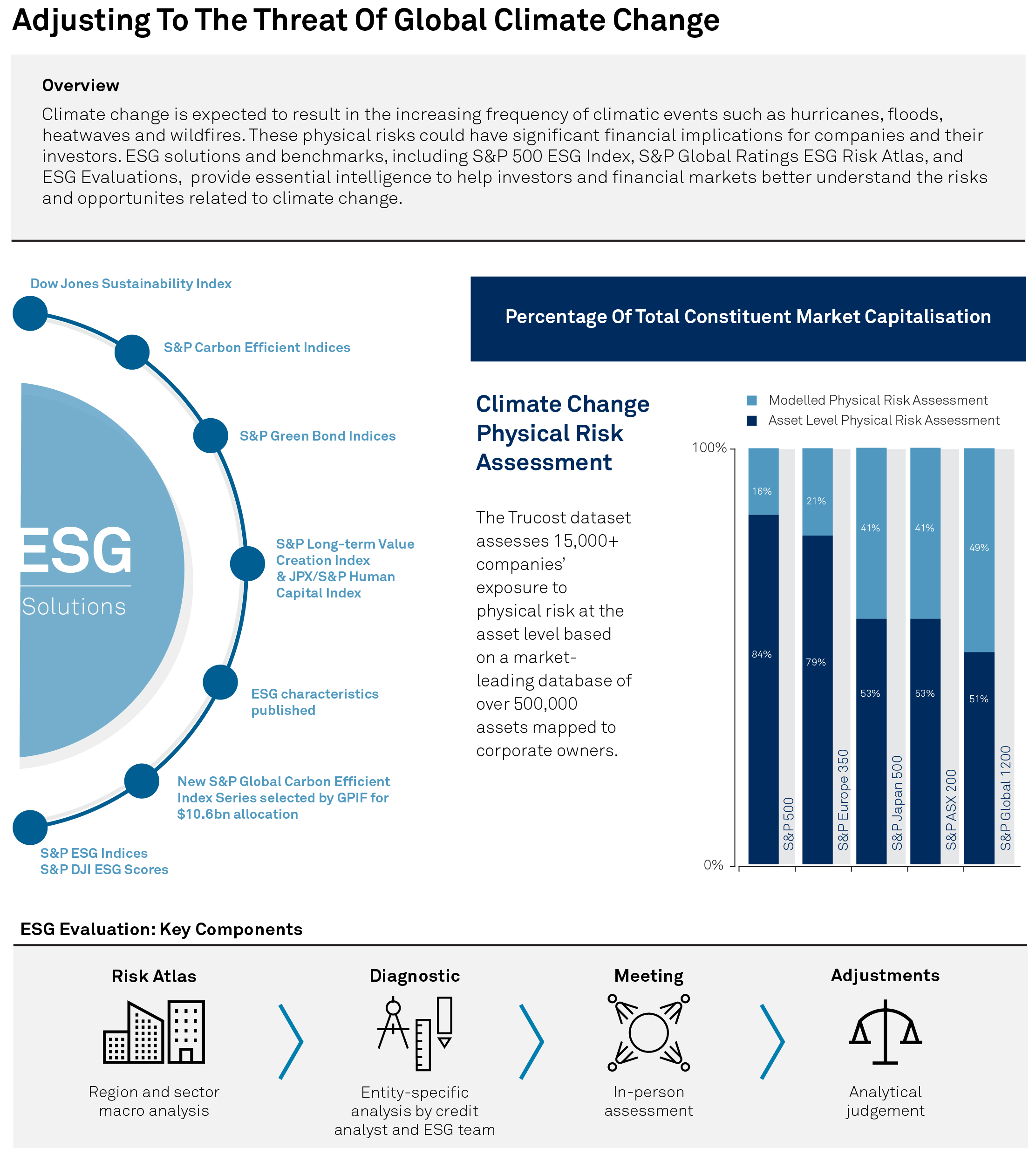

The potential economic consequences of global warming are still a matter of some debate. S&P ESG solutions and benchmarks, including the S&P 500 ESG Index, the S&P Global Ratings ESG Risk Atlas, and ESG Evaluations, among others, provide essential intelligence to help investors and financial markets better understand the risks and opportunities related to climate change.

Meanwhile, Trucost recently launched the Climate Related Physical Risk Assessment, looking at 15,000 companies and more than 500,000 assets in examining the impact of extreme temperatures, floods, droughts, wildfires, rising sea levels, and other types of physical climate risk—helping companies and investors report in line with the recommendations of the Financial Stability Board’s (FSB) Task Force on Climate-Related Financial Disclosures.

Extreme weather events have and will increasingly take a toll on the world’s infrastructure and economic productivity. Changing rainfall patterns can reduce crop yields through repeated and prolonged droughts, heat waves and wildfires, or floods.

In March, Trucost predicted that 2019 would be the year that companies transform the way they manage climate-related issues; that ESG is critically important to capturing mainstream investor attention; and that ESG issues overall are reshaping and reinventing business models. In April, S&P Global Ratings launched our ESG Evaluations, which are assessments that provide a forward-looking, qualitative, and data-driven opinion of an entity’s ESG performance and preparedness for future risks and opportunities.

The global regulatory response to the threat of climate change has been disjointed and politically volatile. In Europe, regulators are taking an increasing active role in mandating standards for climate reporting and pushing toward a carbon-neutral economy through energy transition. The response in the U.S. has been notably fractious, with a patchwork of regulation and deregulation that has yet to cohere into a federal policy. Emerging economies have tried to chart a middle course – encouraging economic development while attempting to prepare for a cleaner future.

While 197 nations have committed to curbing global warming by substantially reducing greenhouse-gas emissions, the fulfillment on those commitments has been uneven. Only Bhutan, Costa Rica, Ethiopia, India, and the Philippines are doing what they must to meet the 2- degree limit.

On a separate front, the U.N.-supported Principles for Responsible Investment—an international network of investors pledging to promote sustainability in their asset allocations—enjoyed its greatest growth last year, with an additional 453 signatories. In an interview with S&P Global Market Intelligence, the group’s CEO, Fiona Reynolds, suggested that the creation of an E.U. classification system for sustainable investments will reduce confusion in the rapidly growing sustainability industry and will likely be adopted on a global scale.

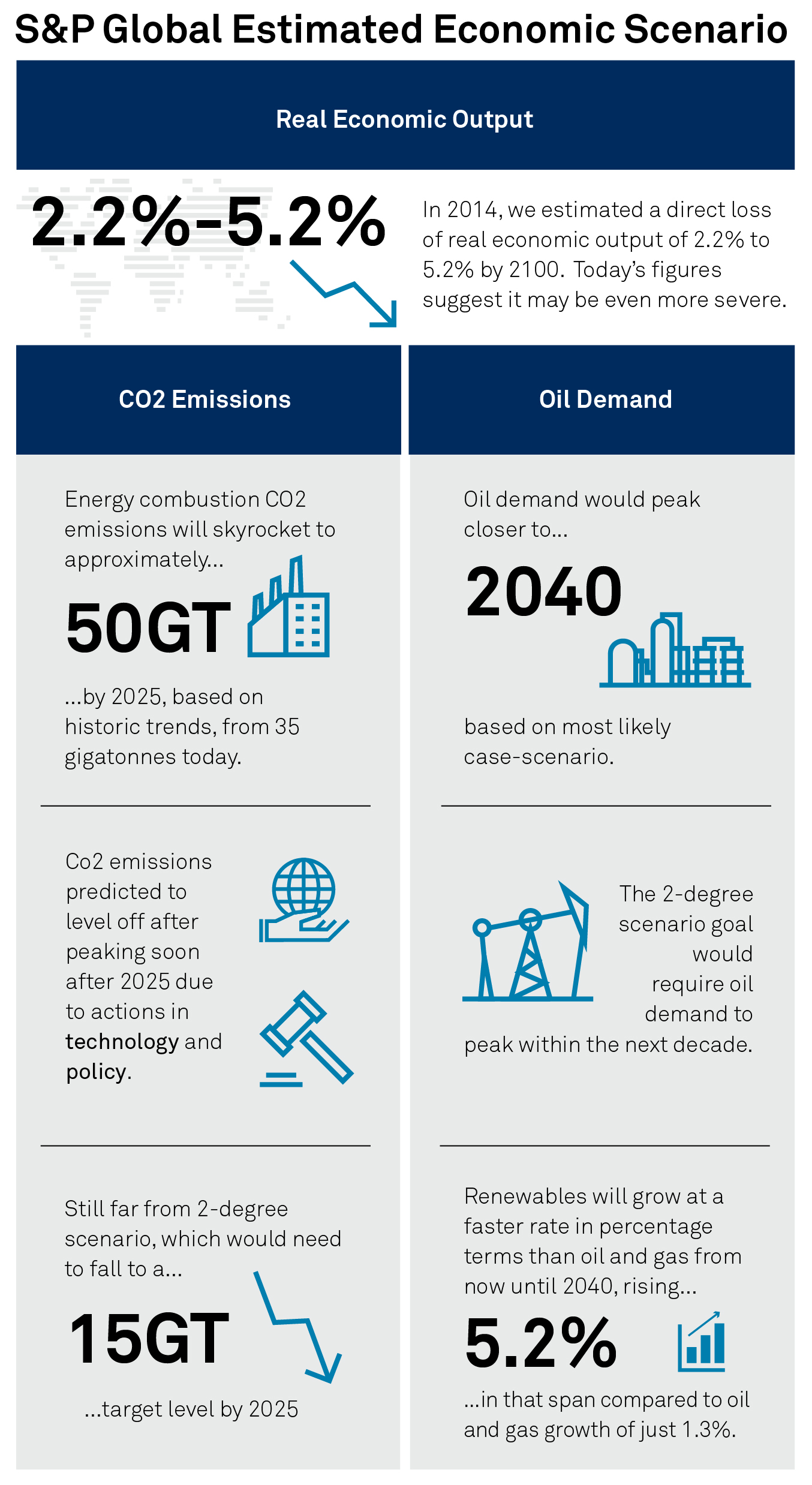

When S&P Global estimated the direct costs to the U.S. of addressing climate risk in a hypothetical business-as-usual path for the U.S. economy in 2014, we estimated a direct loss of real economic output of 2.2% to 5.2% by 2100. The most recent estimates suggest that these consequences could be far worse.

A recent study by S&P Global Platts analysts estimates that a scenario based on historic trends without further policy responses would send energy combustion CO2 emissions skyrocketing to approximately 50 gigatonnes by 2050, from 35 gigatonnes today. S&P Global Platts’s 2 Degrees scenario—taking into account expected actions on climate policy and technology developments required to limit global temperature increase to 2-degrees Celsius—requires fossil fuel demand to peak as soon as 2025 and global emissions to fall to about 15 gigatonnes by 2050. At the same time, oil demand would peak closer to 2040 in our most likely scenario (and not at all under business as usual).

Beyond energy transition and the replacement value of infrastructure, there are real costs of rerouting traffic, lost workdays and productivity, and potential relocation and retraining costs, among other variables. Likewise, climate change adds an extra layer of uncertainty. This imposes new costs on the insurance, banking, and investment industries and complicates business planning, particularly in the agricultural and manufacturing sectors, as well as public works projects—all of which are dependent on the energy sector. To be fair, many companies have made strides to reveal their exposure to transition, physical risks, and opportunities in line with the FSB’s recommendations. Some proposed policy interventions have attempted to build economic incentives to move away from high-carbon activities by putting a price on CO2 emissions.

Natural gas, while a fossil fuel, is less exposed to environmental risk because when burned for power generation, it is cleaner than other fossil fuels. Gas is seen by some as a bridge fuel in the energy transition, which should support demand in the next two decades even under a 2-degree scenario. However, there are environmental risks associated with the production, transportation, and distribution of natural gas from potential methane leakage, considering that methane is around 30 times more powerful a greenhouse gas than CO2.

Platts analysis has shown that the annual growth of oil and gas use for primary energy demand averaged 1.9% from 1995-2018, while demand for non-hydro renewables jumped to 6%. However, due to the massive size of oil and gas use relative to renewables, oil and gas energy consumption grew roughly five times that of renewables in absolute terms. Renewables will continue to grow at a much faster rate in percentage terms than oil and gas from now until 2040, rising 5.2% in that span compared to oil and gas growth of just 1.3%.

Investment in new sources of oil may still be needed even in a 2-degree world where demand peaks in the late 2020s. From an emissions perspective, a 2-degree transition would require involving passenger cars, commercial road transportation, aviation, marine, industry, personal usage, and other transportation providers. The power sector would need to grow to meet this demand from electrification and at the same will need to aggressively decarbonize to ensure that emissions are kept in check.

Electrification is not a panacea for the transportation sector. “Emissions impact depends on the electricity mix,” said Roman Kramarchuk, head of technology policy and energy analytics at S&P Global Platts. “If the electricity [for EVs] is being generated from coal, then we don’t have a story of reducing emissions. Until we get to a world where the story is one of renewables being pushed to replace fossil fuels, then we have a lot of uncertainty about the environmental benefit [of electric vehicles].”

During foundational transitions, policy can be a lagging indicator of public and market sentiment. Thus far, investors and companies have been far more aggressive in confronting the challenges of climate risk.

The fractious political climate in the U.S. has hampered a cohesive federal policy on energy transition or climate risk. While there is always the potential for a thaw in political tensions over climate change, the fact remains that the U.S. is unlikely to overtake the European Union on climate risk, energy transition, or decarbonization in the near future.

In this light, the most effective policies may be those that, rather than focusing on climate change itself, instead facilitate the growth of sustainable finance markets. This is already the case in some respects: tax incentives on green bonds make them more attractive to investors than vanilla taxable bonds may be. A policy push to foster growth in the market for green bonds could go a long way in the U.S., which has lagged Europe in issuance levels. This is despite studies showing that green bonds trade at lower yields (that is, higher prices) in the secondary market than comparable vanilla bonds, suggesting that investors will pay a premium to invest in a socially responsible way.

Mona Naqvi, director of product management for Environmental, Social, and Governance (ESG) at S&P Dow Jones Indices, asserts that “contrary to what mainstream investors might think, environmental, social, and governance (ESG) investing, on the other hand, is not some virtuous strategy relegated to those investors who are willing to put their beliefs before their returns. ESG can simply be a prudent approach to encompassing a broader information set that focuses on material issues with the potential to affect the long-term viability of company business models.”

As the market for green bonds grows, S&P Global believes we will see further diversification of issuers, financing types, and assets—with issuers seeking new forms of financing such as green loans, green funds, and green structured products. This is important given that issuance by development banks, which played a key role in the take-off of the green bond market, is on the decline, having represented just 11% of labeled green bond issuance in 2017, down from 60% in 2013.

Michael Wilkins, head of sustainable finance at S&P Global Ratings, believes that challenges remain in the green bond market. “The pricing of green bonds does not correlate with the environmental impact being provided by the green bond and that is something we think will change over time. You usually see a correlation between the credit spread and the credit rating so the higher the rating, the smaller the spread to reflect risk or lack of risk. At the moment that spread advantage is not correlated to the greenness of the bond.”

The sustainable-finance market is continuing to develop innovative products. Last year, leading lenders introduced the Green Loan Principles, and the bank-loan market has become an important area of sustainable finance. While it still makes up a relatively small part of the broader capital markets, the responsible-loans market is growing fast, reaching a combined $111.5 billion as of July, according to estimates by Environmental Finance.

S&P Global believes effective and standardized ESG disclosure is needed to foster this growth. This presents an opportunity for governments and regulators to work with market leaders. Yet the continuing absence of a universally accepted global framework means there is a lack of standardization in the green bond market, which poses risks to investors.

To help address this, the EU has, in the past three years, been working on an ambitious initiative to put ESG factors into the mainstream of capital markets and to redirect capital toward sustainable investment. European Commission President-elect Ursula Gertrud von der Leyen has pledged a new “Green Deal” as the centerpiece of the body’s next five-year mandate, elevating sustainable investment as a key policy objective. S&P Global views the Action Plan on Sustainable Finance and specifically the development of an EU “taxonomy” of green activities as one of the most significant developments in the sector in recent years.

ESG analysis has moved beyond charitable and community activities to encompass every aspect of a business, from greenhouse-gas emissions and environmental impact to the development of human capital and a company’s behavior as a global citizen. For investors, the assessment of companies’ ESG profiles has gone from being a “nice to have” to a driver of decision-making. For issuers and investors, climate risk plays a role in credit ratings and ESG frameworks provide a guide to further action. As such, establishing a standardized way to account for climate risk— and with it the potential to power a new market dynamic, rooted in responsibility and accountability—is a critical to create the foundation for a global, sustainable economy.

Written by Molly Mintz. Illustrations by Victoria Schumacher.

Content Type

Language