S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

In our previous blog (part II), S&P Global introduced SPACs’ lifecycles, as well as the potential benefits and risks of investing in SPACs.

In this blog, we will focus on SPACs’ liquidity. In general SPACs’ liquidity is poor when seeking the target, surges on the deal announcement date, and remains low relative to the S&P SmallCap 600® after de-SPAC.

Special Purpose Acquisition Companies (SPACs) – Part II

In the previous blog, S&P Global introduced SPACs and discussed market trends that emerged given SPACs’ popularity. In this blog, we will discuss SPACs’ lifecycle, as well as the benefits and risks of investing in SPACs.

Read the Full ArticleSpecial Purpose Acquisition Companies (SPACs) – Part I

SPACs have been raising funds faster than ever before. In 2020, SPACs raised close to USD 100 billion in public offerings, which is more than in the prior 10 years combined.

Read the Full Article

An unprecedented flood of blank-check companies hitting Wall Street is amplifying concerns of an IPO bubble.

Special purpose acquisition companies have drawn widespread interest over the last year, drawing endorsements from celebrities like Colin Kaepernick and investment giants like Bill Ackman. SPACs have launched with names like Just Another Acquisition Corp. and Do It Again Corp. And now, in one of the starkest signs of the market's overexuberance, it has taken only 70 days in 2021 for the number of new SPAC listings to topple the annual record of 227 set in 2020, according to S&P Global Market Intelligence data.

While SPACs have long faced critics, the sudden acceleration of new listings, coupled with a broader sell-off in certain U.S. equities, has forced many on Wall Street to question whether the market has gotten ahead of itself. Others have targeted the structure itself. Staffers in the U.S. Securities and Exchange Commission's Office of Investor Education and Advocacy have worried about the potential for SPAC sponsors to pursue a deal that is not favorable to regular investors.

Credit FAQ: SPACs And Credit Quality: S&P Global Ratings' Recent Ratings Experience

S&P Global Ratings looks at how these increasingly popular structures are considered from a credit perspective, as well as examples of how SPAC transactions have been favorable for existing, rated entities that reduced debt through a SPAC transaction.

Read the Full ArticleNew SPACs Head Into 2021 with Deal Markets in Sight

Once viewed as last resorts to take a company public, special purpose acquisition companies have entered a renaissance with private market investors and executives looking for more alternatives beyond the traditional initial public offering.

Wall Street is readying itself for a barrage of SPAC-led deals in the coming years that could bring scores of private companies public and cement the vehicle’s place as a credible alternative to the IPO.

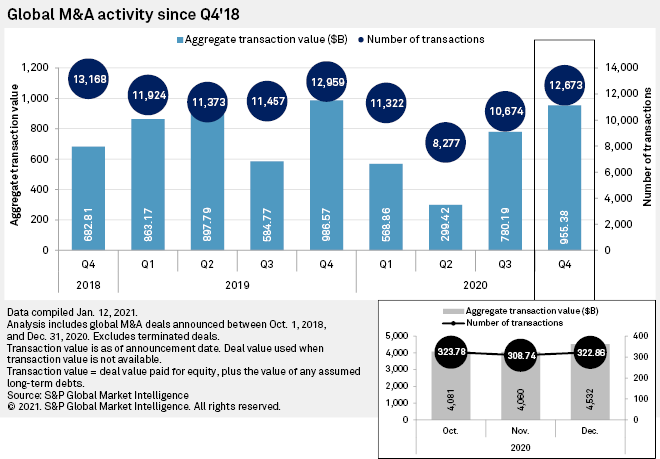

The total announced value of global M&A deals just about doubled in the second half of 2020 to $1.736 trillion compared to the first half of the year, according to S&P Global Market Intelligence's latest M&A and equity offering report.

The rebound came after M&A activity slowed considerably during the height of the COVID-19 pandemic when economic uncertainty spiked along with market volatility. But companies are ready to transact again, Evercore Inc. co-Chairman and co-CEO John Weinberg said during a February conference call.

PE Firms Line Up to Launch Blank-Check Companies amid 2020 Spike

Once considered an eleventh hour way to raise and invest capital, blank-check companies have grown in popularity among private equity firms wanting to differentiate their product offerings and make the most of their deal pipelines.

Read the Full ArticleMore SPACs May Consider Deals in 'Exciting' Insurance Industry

Traditional insurance carriers might not make for the primary targets many special-purpose acquisition companies seek to identify for their initial business combinations, but that could be changing as business dynamics evolve.

Read the Full Article2020 was the year of the Special Purpose Acquisition Company, or SPAC, with more than 200 going public last year alone. What accounts for the recent SPAC boom and what can we expect in 2021? Watch a replay of S&P Global Market Intelligence’s recent complimentary webinar featuring a panel of top investment banking and legal experts with deep experience in the SPAC process.

Watch the Replay(opens in a new tab)Singapore plans to have more stringent rules with a stronger emphasis on governance than in the U.S. for blank-check companies that seek a listing on the Asian financial center's exchange.

Singapore Exchange Ltd. started a public consultation on March 31 for a regulatory framework for listing special purpose acquisition companies, which are skeleton organizations that launch with the intention of buying and reverse merging with a private company. Under the proposed rules, investors in these companies won't be allowed to cash out as soon as the SPAC merges with a private entity, and sponsors won't be allowed to vote on a business combination, two key departures from the regulation in the U.S.

Hong Kong, Singapore Adopt Divergent Approaches to SPACs as Deals Heat Up

Hong Kong and Singapore, Asia's most established financial centers, are taking very different approaches to blank-check companies, alternatives to traditional IPOs that are gathering steam in the region where takeover targets are plentiful.

Singapore Exchange Ltd. is reportedly working toward listing special purpose acquisition companies, which are skeleton organizations that launch with the intention of buying and reverse merging with a private company, as early as 2021.

Read the Full Article

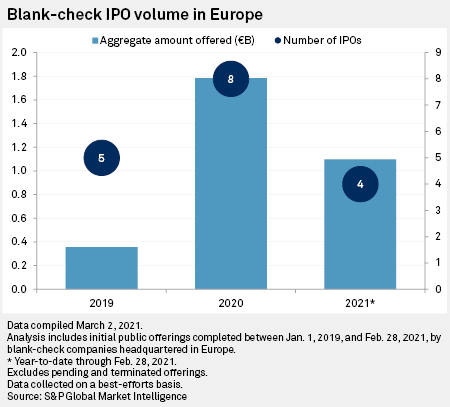

More Europe-based special purpose acquisition companies were listed on U.S. exchanges than on European ones during the so-called blank-check boom of 2020, but this could change in 2021.

A total of eight Europe-based SPACs completed an IPO in 2020, only three of which chose to list on European stock exchanges, S&P Global Market Intelligence data shows. U.K.-based Marwyn Acquisition Company II Ltd. listed on the London Stock Exchange, France-based 2MX Organic SA on Euronext Paris and Dutch Star Companies TWO BV on Euronext Amsterdam, raising roughly €410.8 million in aggregate, compared to the roughly €1.37 billion in aggregate raised by European SPACs that were listed on the U.S. stock exchanges in 2020.

Amsterdam Exchanges Storm Ahead After Brexit, but London Plots Renewal

Amsterdam has shoved London aside to become Europe's biggest share trading venue post-Brexit, but the British capital is already fighting back with a series of financial reforms. British Chancellor Rishi Sunak is aiming to ensure London does not fall behind. On March 3 he published a review of the U.K. listing regime by Jonathan Hill, a former EU finance commissioner.

The British review aims in part to liberalize the rules surrounding special purpose acquisition companies. These are companies with no commercial operations formed purely to raise capital through an IPO to acquire an existing company. In the U.S., billions of dollars have been raised through SPACs in 2021 so far alone.

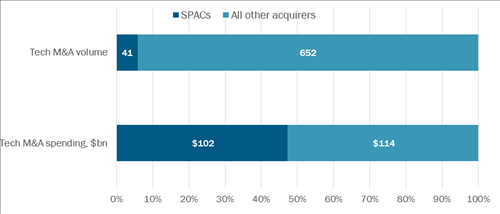

Coming out of nowhere, a new player has disrupted the tech M&A landscape. Flush with billions of dollars and driven by the need to spend right away, special purpose acquisition companies (SPACs) have created a third option for startups that, historically, have had to choose either to sell or go public when they want to exit.

Tech and SPACs: A Dance of Wall Street Darlings

Wall Street has fallen in love with blank-check companies, which, in turn, love the technology, media and telecom markets.

Read the Full ArticleTech and SPACs: Too Much of Two Good Things

Certain qualities of the SPAC model and the tech sector make the two well suited for each other, and according to an analysis of S&P Global Market Intelligence data, a third of SPACs listed in 2020 and another third of those listed in 2021 targeted the technology, media and telecom, or TMT, industry.

Read the Full Articles

A surge in the popularity of blank-check companies in the U.S. as a means to raise money and list on a stock exchange has carried over into the mining sector, with one mining investment expert lauding the capital-raising method as an overall positive for metals and mining.

SPACs, which allow a company to raise cash, list and then pursue transactions, have attracted high-profile mining entrepreneurs including Robert Friedland, executive co-chairman of Ivanhoe Mines Ltd. Earlier this year Ivanhoe Capital Acquisition Corp., with Friedland as CEO and chairman, completed a $240 million IPO in a blank-check company. While the company's plans are not set in stone, it has listed battery-related metals as a key focus.

"We intend to seek a target in industries related to the paradigm shift away from fossil fuels towards the electrification of industry and society," Ivanhoe Capital Acquisition said in a Jan. 6 prospectus.

A Solution to Battery Metals Crunch Awaits in Ocean – DeepGreen, SPAC CEOs

DeepGreen Metals Inc. announced March 4 that it will combine with Sustainable Opportunities Acquisition Corp., a special purpose acquisition company, to create a combined entity called The Metals Co. with an estimated equity value of about $2.9 billion. The deal with the SPAC offers DeepGreen the speed and certainty needed to move operations forward, DeepGreen Chairman and CEO Gerard Barron said in an interview with S&P Global Market Intelligence.

Read the Full Article

In 2020 a wave of special purpose acquisition companies, or SPACs, raised money for shell organizations focused on investing in the energy transition as fundraising for oil and gas declined. The deluge of renewable fuels-oriented SPACs has continued into 2021, but there are also indications that those companies may now be open to upstream targets.

There is precedent for SPACs taking advantage of troubled drillers. Riverstone Holdings LLC-backed shell companies merged with Centennial Resource Development Inc. and Alta Mesa Resources Inc. in 2016 and 2017, respectively. Alta Mesa has since filed for Chapter 11 protections and divested its assets. The most recent upstream reverse merger was Pure Acquisition Corp.'s combination with HighPeak Energy Inc. in 2020.