S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSRussia's invasion of Ukraine has triggered a shift in European power production sources and forced the governments to rethink their long-term energy policies.

The European Union is now on track to reduce reliance on Russian gas sharply before eliminating it entirely. Yet, with coal and nuclear phaseouts taking place across Europe – Germany will close its remaining reactors in December and will get rid of all coal by 2030 – natural gas was expected to play a key role in energy transition.

Russian gas flows account for about 40% of all European imports. And there are doubts on whether gas has a future as bridge generation fuel between high-carbon intensity fuels and green energy.

In recent months, coal – the most carbon-intensive fuel – has been having a so-called "renaissance" period to address reduced gas availability. The European Commission said coal burn could rise some 5% above previous expectations over the next five to 10 years. Yet this could only be a short-term solution.

European Refiners Acting Fast to Replace Russian Crude

European refiners looking to replace Russian crude have turned to countries and grades that have seen limited flows to the continent in recent years, as well as buying more oil from sources used regularly prior to the invasion of Ukraine.

READ THE ARTICLEEU's Proposed Ban on Russian Crude Likely to Reshape Global Oil Market

EU plans announced May 4 to halt Russian oil imports by year-end is expected to reshape global energy flows and add to price pressure as buyers race to secure new supplies.

READ THE ARTICLEHopes Rise for West of Shetland Drilling Rig Activity

Optimism is making a comeback among North Sea drilling contractors, according to the April edition of S&P Global's North Sea Rig Report. There is finally some recognition by UK Government of the need to support domestic hydrocarbons production as part of the energy transition, given added importance by the aim of reducing imports from Russia.

READ THE ARTICLE

India emerged as the largest buyer of Russian Urals crude in April enticed by hefty discounts, as several of the grade's regular European customers have boycotted this oil following Russia's invasion of Ukraine.

India Ponders Brazilian Term Crude Deals Amid Supply Squeeze

India is eyeing term crude deals with Brazil but analysts said high shipment costs, long sailing period and limited bandwidth with the South American producer to commit plentiful volumes beyond its traditional Asian customers will keep the size of any new term deals relatively small.

As India looks to diversify its crude buying, expectations of signing term deals with the Latin American supplier has grown after a visit of Brazilian Energy minister Bento Albuquerque to India in April.

Albuquerque held discussions with Indian petroleum minister Hardeep Singh Puri to explore the possibility of long-term crude oil contracts among other energy cooperation opportunities.

The Platts Market Data - Shipping dataset provides access to the full breadth and depth of our shipping market data, including benchmarks and contract price assessments.

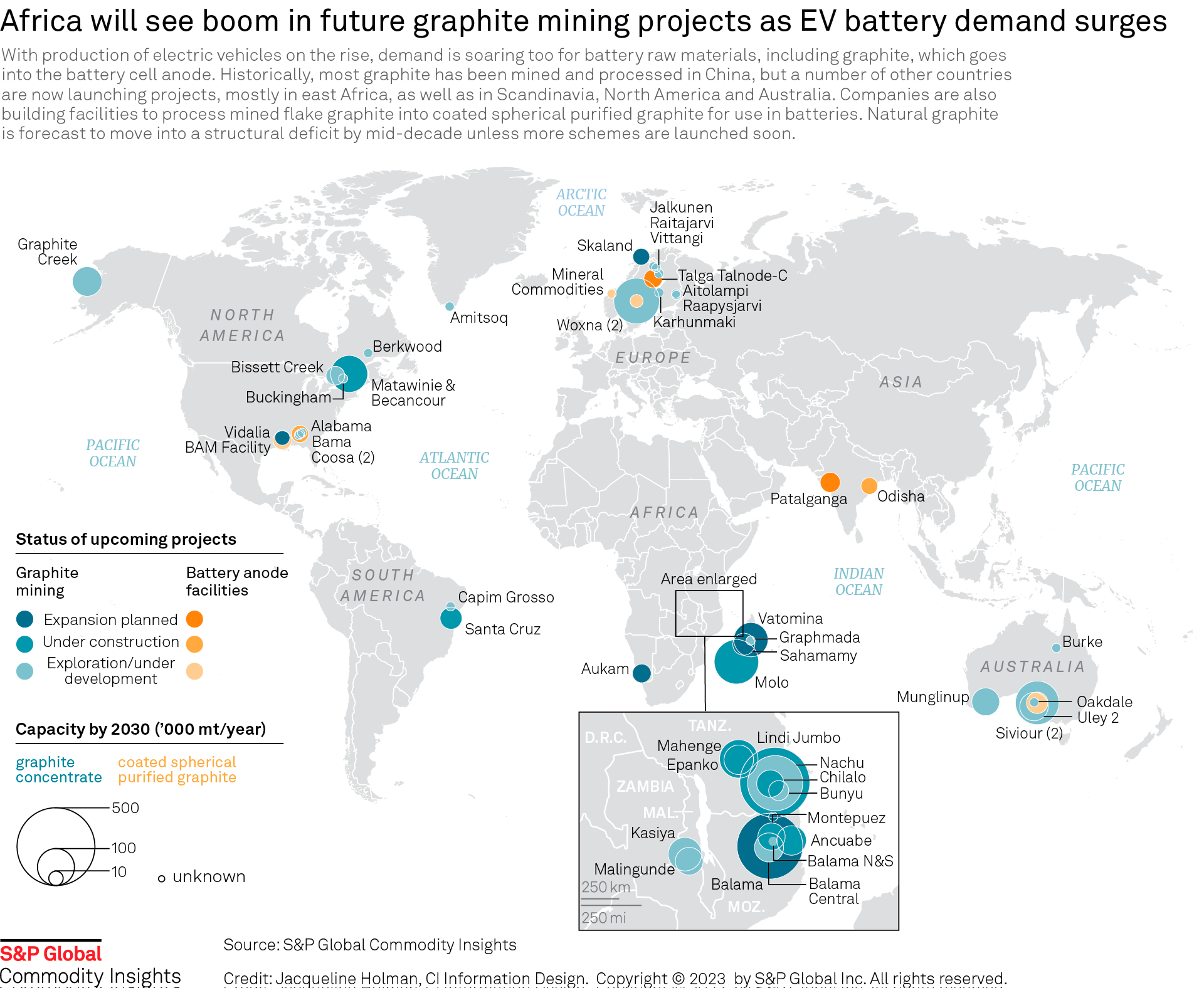

ACCESS MORE(opens in a new tab)The market for battery anode raw material graphite is set to move into deficit by mid-decade on rising electric vehicle demand, with a number of companies looking to establish graphite mines and processing facilities outside traditional supplier China in a bid to diversify the supply chain.

Natural graphite is forecast to move into a structural deficit as soon as 2023-24, as global demand growth for processed graphite, also known as spherical graphite, begins to outstrip supply, EIT InnoEnergy and European Battery Alliance Policy Manager Ilka von Dalwigk told S&P Global Commodity Insights.

She highlighted forecasts from UBS, which estimates a natural graphite deficit of 3.7 million mt in 2030, representing some 37% of the market.

Trade Cases Have Boosted U.S. Aluminum Investment, Lowered Imports: Association

The successful implementation of targeted trade enforcement on common alloy aluminum sheet since 2021 has reduced unfairly traded imports in the US and has encouraged the domestic aluminum industry to invest in capacity expansion, the Aluminum Association said May 3.

READ THE ARTICLEJapan Companies Accelerate Move to Replace Russia Coal with Australian Supply, Others

Japanese utilities and manufacturers are stepping up efforts to seek alternative supplies to Russian coal from Australia, Indonesia and Vietnam, among others, the Ministry of Economy, Trade and Industry said May 17, following the country's decision to phase out Russian coal imports.

READ THE ARTICLEHigh Prices Lure Uranium Explorers to the U.S. — Thor Mining CEO

Rising uranium prices and growing interest in nuclear energy have spurred U.K.-headquartered Thor Mining PLC to advance drilling at a project in Colorado

READ THE ARTICLE

Asia may gain an edge in negotiating bigger discounts for spot Russian cargoes, seal some long-term contracts, as well as witness the emergence of new buyers in the region, as the EU's move to distance itself from those cargoes may create a problem of plenty for the leading non-OPEC supplier.

The latest pledge by the EU this week to ban Russian oil imports by sea, which amounts to more than two-thirds of Russian crude deliveries to the bloc, will sharply narrow the sale window for Russia, as the exporter will now have to largely be dependent on Asian buyers.

"The US has already banned imports of Russian crudes, and with the European Union in the process of doing so, that has left Asia as the only major outlet for those crudes. As a result, Asian buyers should have the upper hand in terms of pricing," said Lim Jit Yang, adviser for oil markets at Platts Analytics of S&P Global Commodity Insights.

According to Platts Analytics, Asia is expected to account for about 40% of global incremental crude runs in 2022, with the US and Europe accounting for about 30% and 18%, respectively.

China's Independent Refineries Set to Receive First Russian Urals Crude Since Nov

China's independent refineries in Shandong are set to resume taking Russian Urals, with the first cargo arriving in early June and at least eight more cargoes later in the month, according to S&P Global Commodity Insights' shipping fixtures and market sources.

READ THE ARTICLEJapan Mulls Using Public Finance for U.S. LNG Expansion: Minister

Japan is considering providing public finance to help expand US LNG projects, Minister of Economy, Trade and Industry Koichi Haguida said May 10, as the country moves to phase out its dependency on Russian energy.

READ THE ARTICLEAsia's Appetite for U.S. Crude Intact Despite Lucrative Russian Offers

Asia's appetite for US crude posted positive growth in the first quarter despite lucrative Russian offers, but North American supplies could face more competition in the second quarter as refiners will continue picking up barrels from the non-OPEC supplier until they remain outside sanctions and are available at substantial discounts.

READ THE ARTICLE

Europe and the G-7’s pledge to sanction imports of Russian oil is raising questions over how a future global economy may operate.

Read and SubscribeJohn Anton, Peter Tirschwell, and Nathalie Wlodarczyk join the Essential Podcast to talk about supply chains, what's gone wrong, and what—if anything—can be done to get them back on track.

The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets—macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more—in interviews with subject matter experts from around the world.

Container Freight Rates to Remain Elevated in Medium Term: C.H. Robinson

US-based logistics provider C.H. Robinson expects global ocean freight rates for container ships to remain elevated through 2022 as the holiday peak season begins, the company said during its first quarter earnings call April 27.

The company indicated that, while volumes had waned amid hampered production capacity in China, there was a strong likelihood for an increase in booking activity as Chinese production facilities come online, which would serve to keep freight rates elevated.

"Covid lockdowns in China have reduced [production]," C.H Robinson CEO Robert Biesterfeld said April 27. "We expect some pent-up demand when China fully reopens."

The Ships dataset, originated from IHS Markit, provides indispensable information and insight to companies around the world enabling them to address challenges while developing new opportunities and staying competitive.

ACCESS MOREEven less than a year ago, few people could have imagined that the largest export market for Thai rice in 2022 would be Iraq.

Brazil, China Conclude Key Negotiations on Starting Corn Trade

Brazil and China have completed some key negotiations on starting Brazilian corn exports to China, according to a statement released May 23 by Brazil's Ministry of Agriculture, Livestock and Supply.

Read the ArticleUkraine Farmers Switching to Beans from Corn on Export Headwinds: Agribusiness Club

Farmers in Ukraine currently engaged in spring crop planting amid the ongoing conflict may have switched some of their corn acres to soybeans in the current season, general director of Ukrainian Agribusiness Club, Roman Slaston told S&P Global Commodity Insights in an interview.

Read the Article