S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

After the pandemic significantly impacted industrial activity, global steel markets, and downstream producers last year, 2021 is expected to bring forth a vastly improving outlook for most metals. The productive future of mining on a global scale will likely hinge on widespread adherence to ESG principles, including health and safety regulations, carbon emissions reduction, and clampdowns on illegal deforestation, across the industry.

Published: March 9, 2021

The Biden presidency in the U.S. was expected to bring about enthusiasm for the green revolution and the metals to fuel it. But faced with a decision to permit one of the most valuable mining projects in the country, the new administration sided with environmentalists and Indigenous rights activists.

The U.S. Agriculture Department's decision to withdraw approval for the proposed Resolution copper mine in Arizona was the Biden administration's first politically contentious action on mining. With other U.S. mines in development also expected to test the Biden administration, mining companies should anticipate new hurdles for their projects if the Resolution decision is any indicator of the administration's direction.

Adding Value to Iron Ore, at a Cost: Australia’s Magnetite Curse Strikes Again

Around nine years ago, your correspondent was part of a media tour that over consecutive days visited iron ore operations in Western Australia belonging to Atlas Iron and Karara Mining. The contrasts between the two mining operations were striking.

Read the Full ArticleAnglo American Suspends Operations at Moranbah North Coal Mine on Safety Concerns

Operations at Anglo American's Moranbah North coking coal mine in Queensland, Australia, is suspended on safety concerns following detection of a gas leakage.

Read the Full Article'Permanent State of Fear': 2 Years After Disaster, Mine Tailings Dams a Big Risk

On Jan. 25, 2019, a large dam full of mining waste from the Corrego do Feijao iron ore mine owned by Vale SA ruptured and sent a mudslide downstream toward Brumadinho, Brazil, killing at least 270. people.

Read the Full Article

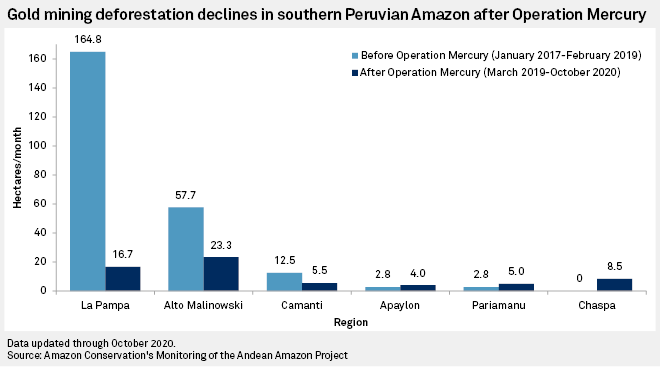

Nearly real-time satellite imagery analysis has been spotting and stymying illegal gold mining activity in the Amazon rainforeest.

The mining sector is a substantial contributor to forest ecosystem destruction, and a recent report suggests the world is behind on international goals to end global deforestation by 2030. The Amazon Conservation Association's Monitoring of the Andean Amazon Project, or MAAP, uses satellite imagery to flag potential deforestation sites and alert authorities to illegal activities across the Amazon rainforest in Peru, Bolivia, Ecuador, Brazil and Colombia.

Capstone's Ex-DRC Cobalt is 'Strategic' Source of Supply, Analyst Says

Capstone Mining Corp. is pushing ahead with a feasibility study of potential cobalt sulfate production at its Santo Domingo copper-iron-gold project in Chile.

Read the Full ArticleSatellites Flag Deforestation from Illegal Gold Mines in Amazon Rainforest

Nearly real-time satellite imagery analysis has been spotting and stymying illegal gold mining activity in the Amazon rainforest.

Read the Full Article

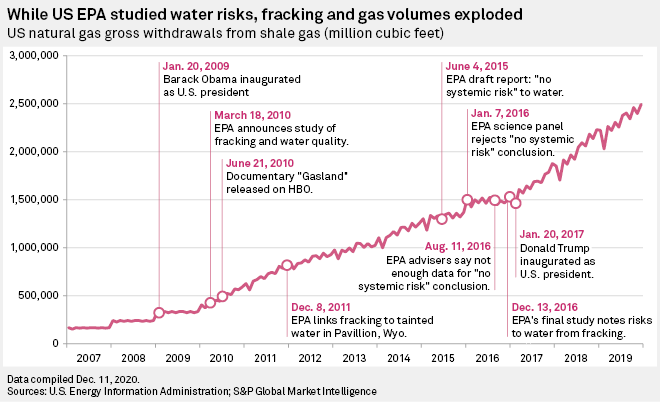

Much like the last time Democrats took control of the White House, President Joe Biden may find himself needing to support increased access to a controversial resource to achieve key policy goals.

For former President Barack Obama, that resource was natural gas — a pivotal part of shifting the U.S. power sector away from coal-fired generation and to curb the sector's greenhouse gas emissions. For Biden, mined battery metals will likely be needed to accomplish signature climate policies, such as mass deployment of electric vehicles.

Federal mineral mining financing has already been freed up by the outgoing Trump administration, the prospects of green stimulus appear poised to ratchet up demand for mined materials, and environmental permitting for mining looks unlikely to change.

With that setup, the Biden administration could take a leaf out of Obama's book, presiding over the blossoming of a policy-critical sector in part by simply not restricting it.

Biden already signaled Jan. 25 that mining will be key to his "Build Back Better" initiative when an executive order mandating government agencies to "buy American" included a call to maximize purchases of materials mined in the U.S.

Quota-Busting Canadians Present Biden with Aluminum Dilemma

Canadian aluminum producers breached their quota for exports to the U.S. in December 2020, S&P Global Platts reports, raising questions as to whether U.S. President Joe Biden will stick to the trade rules put in place by the Trump administration. There are signs that President Biden is happy to reverse earlier rulings, shown by the reversal of a tariff exemption from section 232 duties tied to a quota for imports from the United Arab Emirates.

Read the Full ArticleNew Congress Could Seek Compromise between Mining, Renewable Energy Interests

To ensure that the critical minerals needed to further develop renewable energy technologies are available, lawmakers should be willing to accommodate both renewable and mining interests, according to the leading Republican on the U.S. House Natural Resources Committee.

Read the Full ArticleU.S. Miners May Get New COVID-19 Protections in Early Days of Biden Administration

After calling on federal officials at the U.S. Mine Safety and Health Administration to issue an emergency temporary standard for workers in the early days of the pandemic, the United Mine Workers of American International Union, or UMWA, later joined with United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union to sue the agency.

Read the Full Article

Despite the challenges posed by COVID-19 in the first half of 2020, the mining sector managed to navigate through by capitalizing on the rebound of commodity prices and easing of restrictions.

According to S&P Global Market Intelligence's 31st annual Corporate Exploration Strategies study, the global exploration budget for nonferrous metals decreased only 11% to an estimated US$8.7 billion in 2020 from US$9.8 billion in 2019. In 2021, most commodity prices began much higher than they started 2020. This coupled with a persistent lack of pipeline investment—which is leading many base metals toward market deficits over the next several years—should stimulate additional exploration.

Chilean Mining Sector Expected to be Undeterred by 2nd Wave of COVID-19

The copper mining hub of Chile is grappling with a large second wave of coronavirus infections amid a national lockdown, yet the mining sector could be poised to push through the crisis largely unimpeded.

Read the Full ArticleSouth African Mine Closures Still a Last Resort in COVID-19 Battle

A shutdown of the mining industry in South Africa would be a last resort in the country's battle against COVID-19, analysts and industry players said, given the sector's economic importance.

Read the Full ArticleGemfields to Restart Zambian Emerald Mine Nearly a Year After COVID-19 Shutdown

Gemfields Group Ltd. will restart principal operations at its 75%-owned Kagem emerald mine in Zambia, which has been suspended since late March 2020 due to the coronavirus pandemic, Mining Weekly reported Feb. 25.

Read the Full Article

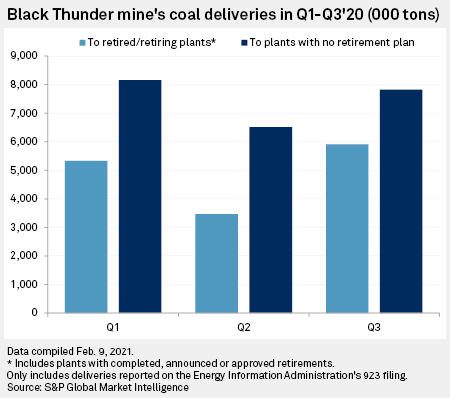

The owner of the second-largest coal mine in the U.S. by production volume is planning for the asset's closure as retirement dates approach for several plants that burn much of the mine's fuel.

Coal demand in the U.S. has been declining for years, and Arch Resources Inc. announced Feb. 9 that it would be winding down its thermal coal operations, including those at Black Thunder, a Wyoming mine that produced 12.7 million tons of coal in the fourth quarter of 2020. Black Thunder production represented about 9.7% of the coal mined in the country in that period, according to an S&P Global Market Intelligence analysis.

U.S. Thermal Coal Exports May Tighten Despite Recent Price Rises: Platts Analytics

Downside potential for US thermal coal exports remains for 2021 despite recent rises in prices, S&P Global Platts Analytics warned April 5.

The increase in US thermal coal prices, particularly those in the Central Appalachian basin, "is tied to the recovery of CIF Amsterdam-Rotterdam-Antwerp and other Atlantic coal basin prices," which have been pushed up by robust demand in Asia and widespread supply constraints, Platts Analytics said in its US Coal Market Forecast.

Indonesian Electricity Company PLN Tells Miners to Boost Domestic Thermal Coal Supply

Perusahaan Listrik Negara, Indonesia's state-owned electricity company, has told at least six miners to supply at least 1 million mt more thermal coal to the domestic coal market from January to February in accordance with the Domestic Market Obligation, market sources said.

Read the Full Article

After floating the idea of a megamerger between three South African gold producers in early March, Sibanye Stillwater Ltd. CEO Neal Froneman told S&P Global Market Intelligence that such a combination is just one approach to growth the company is considering as it seeks to throw more weight around the market.

GV Gold Aims to be Among Top Five Russian Gold Producers with Organic Growth

Gold mining company GV Gold believes its organic growth possibilities will help it to catapult into Russia's top five gold producers in the next four-five years, Vladislav Barshinov, the company's CEO, told S&P Global Platts in an interview.

Read the Full Article

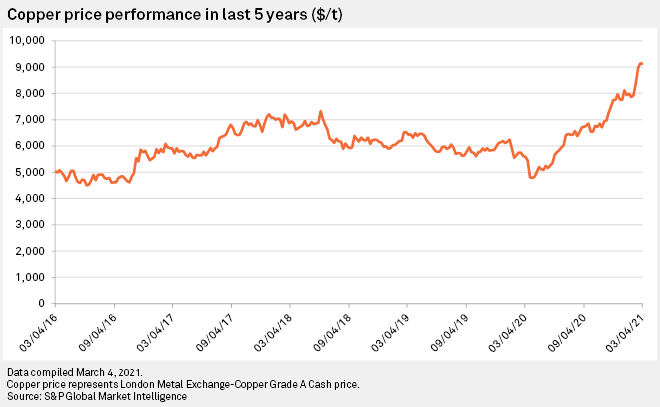

The impact of the COVID-19 pandemic could continue to weigh on copper production into 2023 after companies reduces activities to protect staff, a top analyst warned April 13.

Speaking at the World Copper Conference, CRU's director of copper research Vanessa Davidson said that government-imposed lockdown reduced copper production by around 500,000 mt last year, particularly at mines in the Americas. Worst affected was Peru, the world's second largest producer of the metal, where production fell by around 15%

However, a rapid recovery in mine production after the second quarter meant that the loss of production was much less than the 900,000 mt originally anticipated.

Although copper mine production is expected to increase 2.5% this year, the decision by many mining companies to delay key activities including stripping and maintenance to protect workers, could mean the impact of the pandemic will continue to be felt in the coming years, Davidson noted.

Meanwhile, the growing interest to reduce carbon emissions is likely to drive copper demand globally faster than producers can expand, said Erik Heimlich, CRU's senior copper analyst.

"Demand caused by the greening economy will lead to a significant supply gap opening up by the mid-2020s, providing strong price support," he said.

With production from existing mines set to peak in 2023, the gap between supply and demand is set to reach 5.9 million mt by 2031 if no new operations are developed.

There are plenty of mine projects in development, enough to increase production by almost 11 million mt.

But just building enough to fill the supply gap is expected to require more than $100 billion of investment, Heimlich noted.

In particular, the growing demands from stakeholders that the mining industry collaborate with local communities, reduce their carbon emissions, and limit their environment impact are pushing up costs.

State Company to Buy All DRC Artisanally Mined Cobalt, Partners with Trafigura

The Democratic Republic of Congo's state-owned cobalt company Entreprise Generale do Cobalt will become the sole buyer of the country's artisanally mined cobalt from April, in a move to put an end to the "quasi-mafia-like exploitation of cobalt" in the country.

Read the Full ArticleStrict Implementation of Environmental Controls in Tangshan Paralyzes Iron Ore Procurement

Spot iron ore procurement in Tangshan, China's top steel producing province, were slowed significantly by strict implementation of environmental controls on truck deliveries and sintering operations on March 9, following a renewed emergency response to heavy pollution weather on March 7.

Read the Full ArticleExpect Lithium Supply Crunch by 2025 as EV Market Booms: Piedmont CEO

Lithium supply will struggle to keep up with booming electric vehicle demand in the US and abroad over the next few years, and steps will need to be taken to incentivize additional production and exploration of the battery metal, according to Piedmont Lithium CEO Keith Phillips.

Read the Full Article