S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

The impact of COVID-19 on global insurance markets is largely felt through asset risks, notably capital markets volatility, and weaker premium growth prospects.

S&P Global Ratings expect most COVID-19-related losses (business interruption, event cancellation, etc.) to be picked up by reinsurers, so primary insurers' technical performance is unlikely to deteriorate materially. Strict lockdown measures helped maintain satisfactory performance, as motor and medical claims had a positive impact on loss ratios. Developed markets, particularly life ones, are likely to shrink in real terms as a result of the economic slowdown.

Developing markets, through their riskier asset allocation, will likely experience more declines in return on equity than developed markets. Ultralow interest rates mean that the most significant source of risk to insurers is the performance of investments, especially life insurers with guaranteed back books.

Down But Not Out: Insurers' Capital Buffers Are Proving Resilient In The Face Of COVID-19

S&P Global Ratings' surveillance of insurance companies has both increased and deepened since the COVID-19 pandemic began to spread around the globe.

Read the Full ArticleInsurance Industry And Country Risk Assessment Update: November 2020

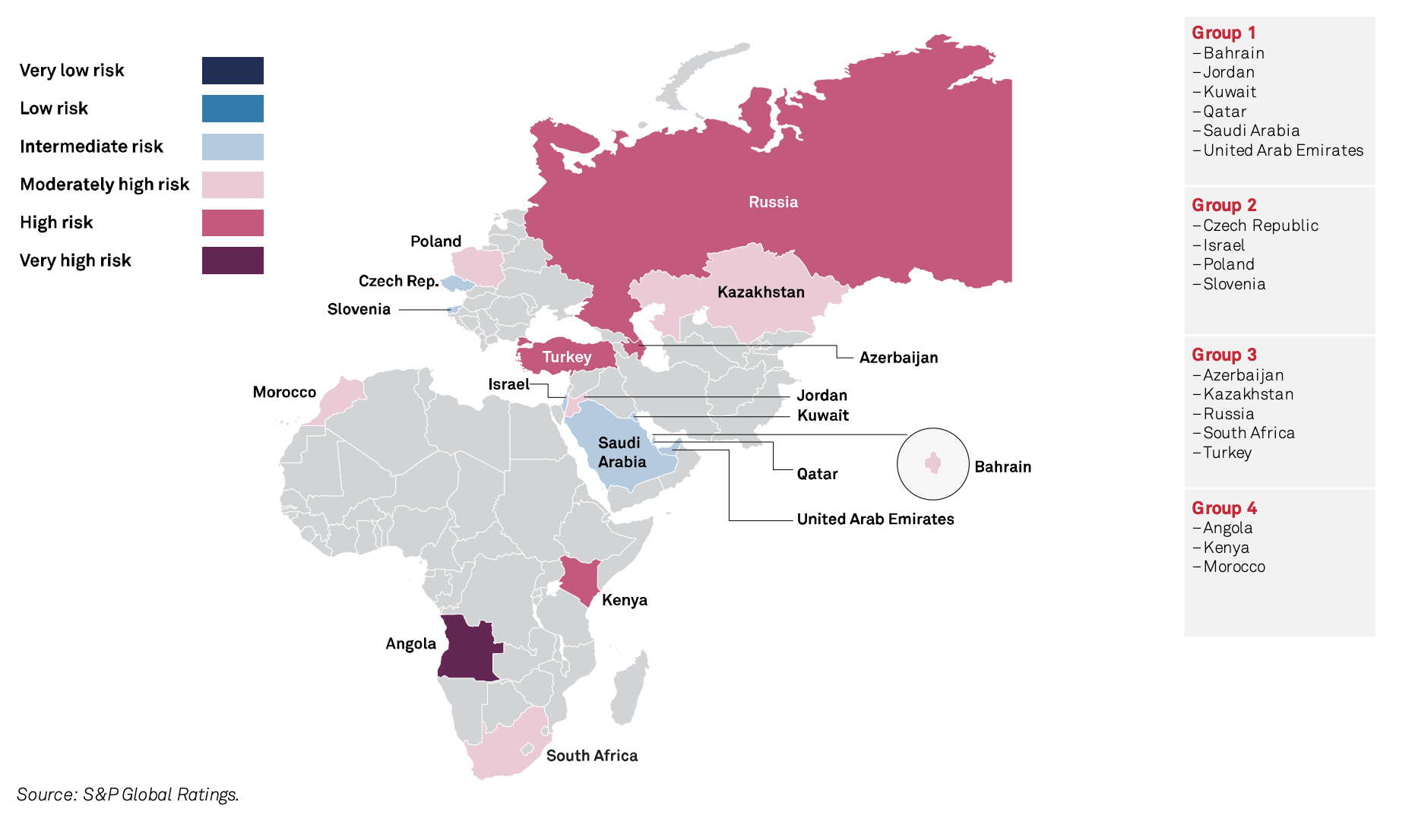

This article presents S&P Global Ratings' insurance industry and country risk assessments (IICRAs) for 103 insurance sectors covering 52 countries and four global sectors.

Read the Full ArticleDifficult Decisions Lie Ahead For Protection And Indemnity Mutuals At The 2021 Renewal

After the poor underwriting results of the past two years, protection and indemnity (P&I) mutuals were probably hoping for a better year in 2020-2021, but the early signs are not good.

Read the Full Article

Overall, S&P Global Ratings thinks this might be a tough year for the life insurance companies S&P Global Ratings rates, but S&P Global Ratings expects they'll be able to navigate through the difficulties without a significant negative impact on their credit quality. In S&P Global Ratings' view, life insurers will continue to deal with investment portfolio stress, muted earnings, challenges to distribution, and elevated mortality claims.

U.S. Property/Casualty Insurers Demonstrate Extraordinary Resilience During the Pandemic

2020 proved to be an extraordinary year as the U.S. property/casualty (P/C) insurance industry effectively navigated a pandemic affecting every aspect of its business.

Read the Full ArticleU.S. Insurance-focused Companies Generated $34B+ from Capital Issuances in H2'20

U.S.-based insurance and insurance technology companies raised about $34.31 billion from capital markets in the second half of 2020, according to an analysis by S&P Global Market Intelligence, down from $47.29 billion from the start of the year through June 11, 2020.

Read the Full Article

The COVID-19 pandemic is pressing insurance companies to urgently respond to megatrends--most importantly climate change and digitalization--that were already on the agenda, according to European insurance executives, experts, and analysts at S&P Global's conference.

The industry is starting to more precisely understand physical, transition, and liability risks linked to climate change and is revising underwriting and investments.

The U.K. Treasury's Review Of Solvency II Ahead Of Brexit: Still A Waiting Game For Insurers

As the U.K.'s transition period for exiting the EU comes to an end, the government has launched a review of Solvency II, a harmonized European Economic Area-wide insurance regulatory framework that came into force in 2016.

Read the Full ArticleEMEA Insurance Outlook 2021: Choppy Waters Ahead

While we estimate COVID-19-related market stresses could have initially wiped out up to 85% of the EMEA insurance industry's capital buffer, capital market recovery has subsequently helped restore it sufficiently to support ratings into 2021/2022.

Read the Full Article

As the COVID-19 pandemic spread from region to region, it has drawn attention to a hitherto unnoticed protection gap in insured and noninsured property/casualty (P/C) risks.

Key Takeaways

The COVID-19 pandemic is forcing almost all organizations to speed up their digital transformation priorities.

This rapid transformation will inevitably increase systemic vulnerabilities to cyber attacks, leading us to expect the next decade to be the most important period of growth for the cyber insurance market.

As Threats Grow, Cyber Insurance Seen as More of a Necessity

Businesses are treating cyber liability insurance as less of a luxury and more of a necessity as larger numbers of customers are drawn into the market and existing clients seek higher coverage limits, according to Advisen Ltd. surveys.

A global survey of risk managers and insurance buyers undertaken by Advisen and Zurich North America found that the take-up rate for cyber insurance continues to climb, with 78% of respondents having purchased such coverage.

More than half of respondents had purchased stand-alone policies, compared with 34% who had bought any kind of cyber coverage in 2011, the first year of the annual survey.

Read the Full Article

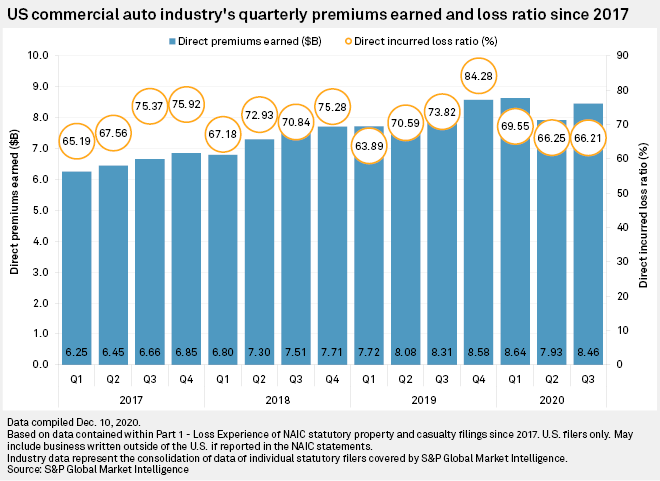

A majority of the biggest U.S. commercial auto liability insurers saw direct premiums written rise on a yearly basis in the third quarter, according to an S&P Global Market Intelligence analysis.

Progressive Corp. continues to lead the industry by a significant margin, with $1.44 billion in premiums written. It also recorded the largest year-over-year increase in premiums among the top 20 commercial auto liability insurers, at 30%.

State Farm Adjusts Some COVID-19 Rate Cuts Amid 'Diminishing Effect' on Driving

Changes in driving patterns have led State Farm Mutual Automobile Insurance Co. and its subsidiaries to dial back some of the temporary downward adjustments to premium rates they implemented during the summer.

The State Farm companies, over the last several weeks and in a number of states, filed to reduce the impact of COVID-19 premium adjustment factors, according to documents obtained by S&P Global Market Intelligence, as they cited a "diminishing effect" from the pandemic on driving exposure.

Read the Full Article

Higher mortality rates due to the coronavirus pandemic are affecting the bottom lines of many life insurers, but long-term care businesses are also seeing lower claims levels as individuals shy away from assisted living facilities.

Startup Insurance Broker's Carrier Deal Creates Path for Tech-Enabled Life Sales

Three-year-old Bestow sells term life policies issued by North American Co. for Life & Health Insurance and reinsured by Munich Re in every U.S. state, except New York, and is licensed as a carrier in its home state of Texas. The company recently announced a plan to purchase Centurion Life Insurance Co., which is licensed to sell in 47 states and the District of Columbia, to expand its national footprint as an insurer.

Startup Bestow Inc. is confident that its accessibility will overcome a lack of name recognition in the life insurance marketplace

Read the Full Article

Australia's private health system is unwell. Insurers are at risk of declining profitability as squeezed margins undermine their ability to pay claims in the long term, and consumers are being turned off by climbing premium costs.

Even with Public Option, Health Insurers May Benefit from Biden Plan

Former Vice President Joe Biden's healthcare plan, which has a public option, is not a step toward a single-payer system, and managed care companies may even find ways to profit if he wins the White House, according to some industry experts.

Industry observers believe Root Insurance Co.'s pending initial public offering is likely to benefit from equity markets starved for investment opportunities and momentum from the pop that Lemonade Inc. received when it debuted on the public market.

But the stock could face turbulence from subsequent public scrutiny as Root's leadership will be tasked with turning around operational trends that are troubling even for a unicorn whose flaws investors tend to forgive for the promise of stellar growth.

Insurtech Exec Says On-Demand Insurance Responds to Pandemic Needs

The chief growth officer of Slice said there has been interest throughout the pandemic in digital products that are more dynamic and can respond to events and signals as they happen.

Read the Full ArticleMore SPACs May Consider Deals in 'Exciting' Insurance Industry

Traditional insurance carriers might not make for the primary targets many special-purpose acquisition companies seek to identify for their initial business combinations, but that could be changing as business dynamics evolve.

Read the Full Article

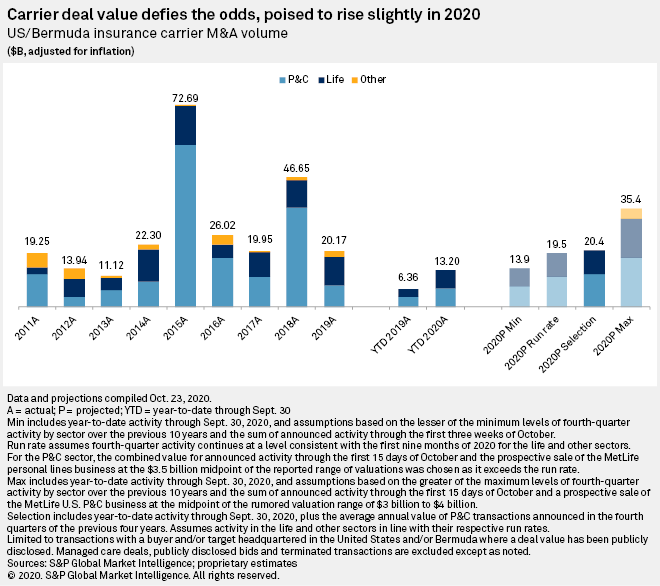

COVID-19 delayed deal-making across the insurance sector, but it did not derail activity.

Key Takeaways

Given that reinsurers exist to take on insurance risks, it is not surprising that they are more exposed to underwriting, reserving, and catastrophe risks than to investment risks. However, their investment risk has never been negligible, and a decade of low interest rates and tough underwriting conditions forced reinsurers to increase their appetite for investment risk.

To generate additional return, reinsurers invested, cautiously, in riskier and more illiquid assets. The gradual shift in strategy has been successful--reinsurers' capital adequacy has remained high, on average. Had their asset allocations remained unchanged, their investment returns would have shown an even more material decline.

The economic impact of the pandemic has somewhat eroded reinsurers' capital adequacy, but their caution has largely paid off. Despite unfavorable movements in the financial markets and in the economy, the stress test S&P Global Ratings performed on reinsurers' balance sheets as of the end of 2019 does not indicate change to our assessment of the sector's overall capital adequacy.

APAC's Costly Catastrophes: Reinsurance And More Required

The Asia-Pacific region's insurance and reinsurance sector saw its fair share of weather-induced woes over the past two years. And now, the pandemic is adding to this list.

Read the Full ArticleEurope's Top Reinsurers More Optimistic on COVID-19 Claims as Pace Slows in Q3

The top four European reinsurers are sounding more upbeat notes about their ultimate coronavirus exposures, though they do expect more claims, after making a smaller addition to their collective bill in the third quarter.

Read the Full ArticleGlobal Reinsurance Highlights 2020

The global outbreak of the COVID-19 pandemic, greater investor focus on environmental, social, and governance issues, the U.S. election, and a record number of natural catastrophes will all make their way into the history books.

Read the Full Article