Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 19 Aug, 2020

Highlights

Recovery in two metals markets – steel and cobalt – tops S&P Global Platts editors’ pick of themes to watch this week. Plus, Middle East oil products, European gas sector summer maintenance and coal-fired generation margins.

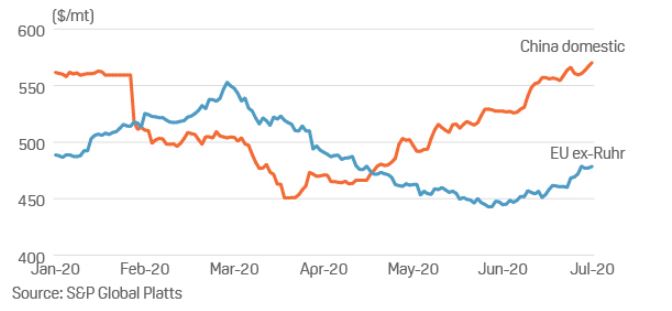

What’s happening? An upward trend in Chinese and German domestic hot rolled steel coil (HRC) prices indicates market recovery from COVID-19-related restrictions in both countries, but at quite different paces. China domestic HRC prices show a classic V-shaped recovery on a stimulus-fueled resumption of steel-consuming activities, which has brought Chinese steel prices up by around $100/mt since the start of May. German domestic HRC prices meanwhile show a more gradual U-shaped recovery.

What’s next?: Q3 sentiment in China is extremely bullish due to infrastructure stimulus and credit easing. So far Chinese mills have managed to pass on higher iron ore prices and margins are still very healthy, suggesting sentiment will continue to be positive despite inflationary fears. The outlook in Germany is more subdued, however, with major German steelmakers Thyssenkrupp and Salzgitter not expecting any meaningful market recovery before Q4.

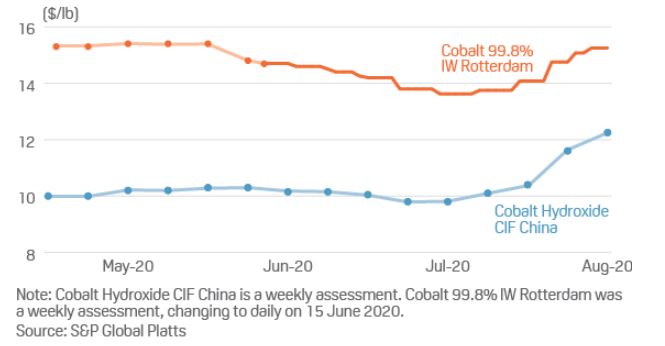

What’s happening? Cobalt prices have leapt sharply in recent weeks on a multitude of factors. Ongoing supply issues in the Democratic Republic of Congo and South Africa have restricted cobalt hydroxide flow into China, significantly boosting import prices. Refiners have turned to the metals market to secure cobalt briquettes as a precaution against further price climbs and shortness of material. The Wuxi exchange in China jumped on speculative buying in the second week of August, adding to the upward pressure on metals prices. Although exchange prices then cooled, the wider market is still feeling the boost.

Go deeper: Feature – East Africa, led by Rwanda, is ‘frontier’ for technology metals

What next? Many traders expect prices to continue to climb, with most bullish through to the end of 2020. With several producers shut, sold out or operating at reduced levels, and traders keen to hold onto their units, higher prices may prove a self-fulfilling prophecy. A large portion of the market is firmly bullish in the long term and many consider a supply deficit inevitable if demand from the EV sector rises as they expect.

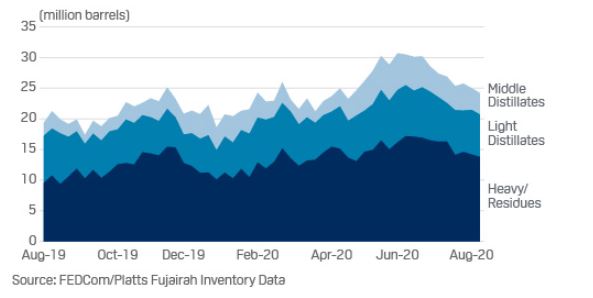

What’s happening? Oil product stockpiles at the UAE’s east coast port of Fujairah have retreated from the record high of 30.71 million barrels on June 1, but supplies are still well ahead of the end of last year. Total inventories stood at 24.23 million barrels as of August 10, down 21% from the record but still 31% above the end of 2019. Most recently, gasoline demand has seen a pickup as Pakistan issued tenders for the motor fuel and Saudi Arabia and Iraq imported fuel from Fujairah.

What’s next? Fujairah faces increased production as OPEC+ cuts ease and possibly increased demand as COVID-19 restrictions ease and Middle East refineries end maintenance. And with Middle Eastern refineries set to return from planned maintenance, exports of some products, such as naphtha, from the region are expected to improve in August, further crimping Fujairah stockpiles. Jet fuel demand may also improve. S&P Global Platts Analytics estimates that global commercial flights have recovered to around 50% of levels before COVID-19, but at much-reduced passenger levels and seat utilization.

Go deeper: Explore videos, podcasts, webinars and more on Platts LIVE

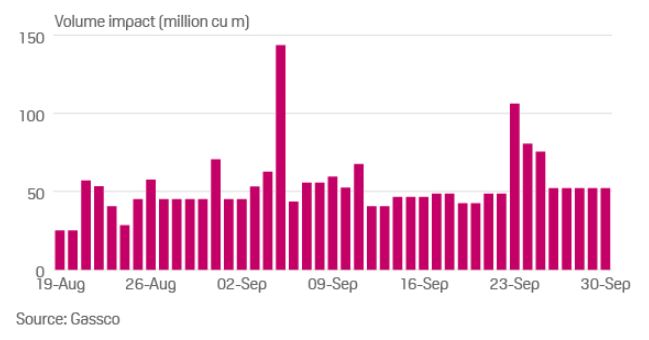

What’s happening? Norway is set to begin its heaviest period of planned 2020 maintenance at a number of offshore fields in the next week, with a significant impact on gas production capacity due to last until the end of September. An average of around 50 million cu m/d of gas output will be curtailed, or around one seventh of its 350 million cu m/d production capacity. At times, however, the impact is set to be much larger and is expected on some days to be as high as 140 million cu m/d.

What’s next? The traditional summer maintenance period on the Norwegian Continental Shelf comes as European gas prices remain historically low despite a small rally in recent weeks. The start of Norway’s summer maintenance, while expected, could give a boost to prices due to lower gas availability, though Russian gas supplies could increase to offset the Norwegian reduction.

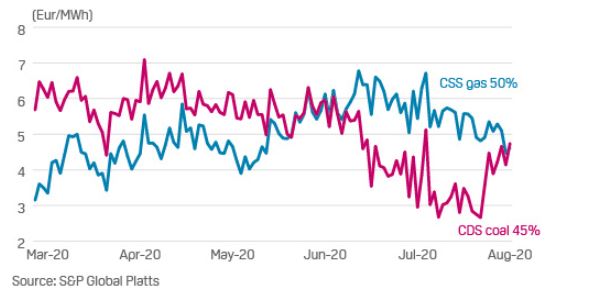

What’s happening? German coal-fired generation margins have recovered from record lows in July and moved again above comparable gas-fired margins for 2021, S&P Global Platts data showed. Behind the latest swing is EU CO2 prices falling sharply from a 14-year high and a rebound for TTF gas prices, while front-year coal into Europe fell with hardly any coal plants running in Western Europe this summer. However, the long-term trend of improved gas margins remains intact with RWE and Uniper to return mothballed gas plants to service in October.

What’s next? Germany’s older coal plants face closure with a first auction for closure compensation for 4 GW of hard coal capacity set for September 1, the process targeting older units no longer in the market. Further auctions in the coming years are to reduce capacity from the current 20 GW to a maximum of 8 GW by 2030. Germany’s coal exit become law August 14 and also sets a pathway to half lignite coal capacity to 9 GW by 2030. Nuclear closures and a gap in new wind additions are set to tighten supply further improving margins and utilization for both gas and remaining coal plants in Germany especially 2023.

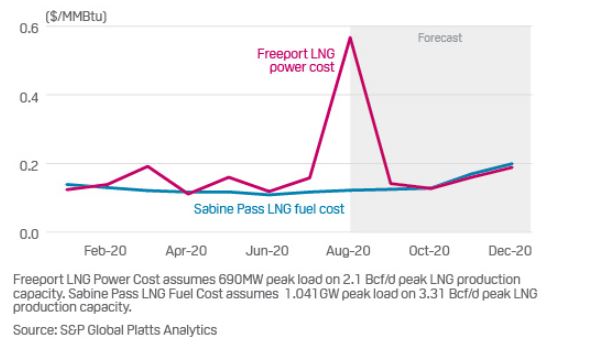

What’s happening? Freeport LNG terminal in the US has been ramping up recently, after 22 straight days of zero or near-zero observable feedgas deliveries in July. Fuel costs could impact how much of a near-term rebound in utilization the Texas facility sees compared with other US facilities that produce their power on site. Its power costs could exceed 50 cents/MMBtu in August, making for unfavorable production costs, according to S&P Global Platts Analytics data.

What’s next? US LNG exports are expected to recover in the late autumn and winter timeframe as Gulf Coast netbacks to Asia further improve and global demand picks up. The market is expected to learn this week about the number of cancellations of cargoes scheduled to be loaded at US liquefaction facilities in October.

Reporting by Stuart Elliott, Emmanuel Latham, Claudia Carpenter, Andreas Franke, Diana Kinch, Paul Bartholomew and Harry Weber

Content Type

Segment

Language