Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 14 Apr, 2021

By Ved Malla

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The S&P BSE SENSEX Index Series comprises three indices, namely the S&P BSE SENSEX, the S&P BSE SENSEX 50, and the S&P BSE SENSEX Next 50. The S&P BSE SENSEX is the oldest and most tracked index in India and comprises the 30 largest, most liquid, and financially sound companies in the S&P BSE 100. The S&P BSE SENSEX 50 is designed to measure the 50 largest and most liquid companies in the S&P BSE 100. Meanwhile, the S&P BSE SENSEX Next 50 is designed to measure the next 50 largest and most liquid companies in the S&P BSE 100 that are not members of the S&P BSE SENSEX 50.

In this blog, we will compare the returns of the S&P BSE SENSEX, the S&P BSE SENSEX 50, and the S&P BSE SENSEX Next 50 for the first quarter of 2021.

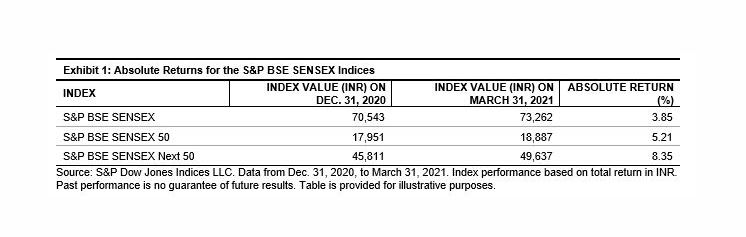

In Exhibit 1, we see that for the period ending March 31, 2021, the absolute returns of the S&P BSE SENSEX, S&P BSE SENSEX 50, and S&P BSE SENSEX Next 50 were 3.85%, 5.21%, and 8.35%, respectively.

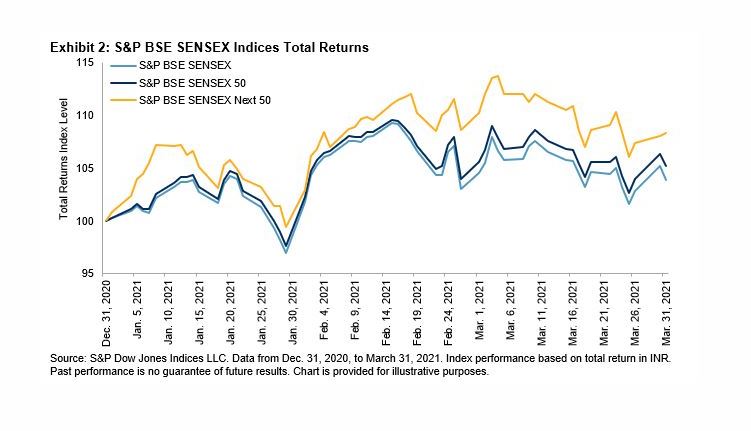

In Exhibit 2, we see the total return index levels of the S&P BSE SENSEX, the S&P BSE SENSEX 50, and the S&P BSE SENSEX Next 50. The S&P BSE SENSEX Next 50 consistently outperformed the S&P BSE SENSEX and S&P BSE SENSEX 50 during the first quarter of 2021, despite the high market volatility during this period.

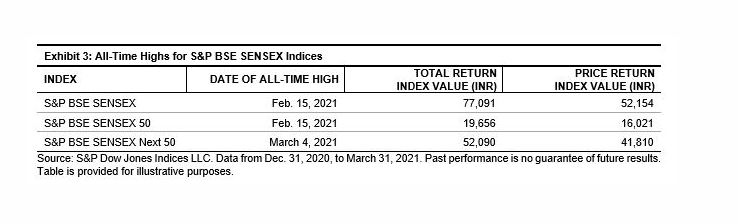

Furthermore, Exhibit 3 shows us that all three indices had their all-time highs in the first quarter of 2021.

To summarize, we can say that the S&P BSE SENSEX Index Series showed promising returns in Q1 2021; despite the increased volatility, all three indices reached all-time highs during this period.

The posts on this blog are opinions, not advice. Please read our Disclaimers.