Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 17 Apr, 2020

By John Welling

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

Amid Losses, Shariah-Compliant Benchmarks Beat Conventional Counterparts by Substantial Margins

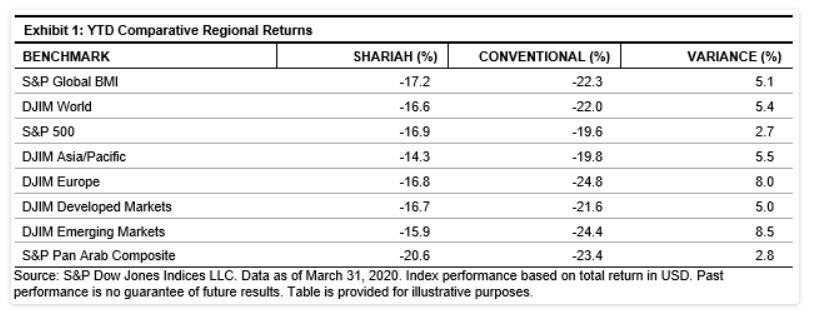

Global equities fell 22.3% during Q1 2020, as measured by the S&P Global BMI, with COVID-19 taking center stage and cases growing worldwide. The S&P Global BMI Shariah—which fell 17.2%—markedly outperformed its conventional benchmark by more than 500 bps, marking its greatest quarterly outperformance since inception. The trend played out across all major regions as the S&P 500® Shariah outperformed its conventional counterpart by 2.7%, while the Dow Jones Islamic Market (DJIM) Europe and DJIM Emerging Markets each outperformed their conventional benchmarks by more than 8.0%.

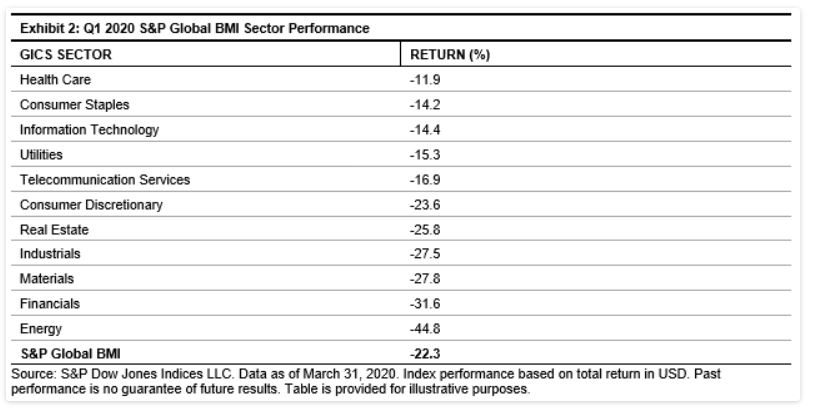

Sector Performance Acts as a Key Driver

Amid the tough backdrop, broad-based Islamic indices outperformed their conventional counterparts by a substantial margin, as Information Technology and Health Care—which tend to be overweight in Islamic indices—outperformed among sectors, while Financials—which is underrepresented in Islamic indices—heavily underperformed the broader market.

MENA Equity Returns Varied

Following the MENA equities underperformance in 2019, the S&P Pan Arab Composite mimicked steep emerging market declines during Q1 2020, with a loss of 23.4%. The S&P Oman led the way in the region, holding losses at 8.7%, followed by the S&P Qatar, which declined 18.0%. The S&P UAE suffered the steepest losses, falling 30.3%, followed by the S&P Egypt BMI which declined 29.4%.

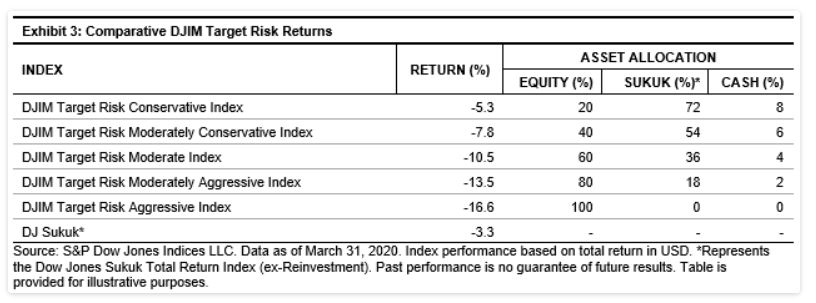

Shariah-Compliant Multi-Asset Indices Outperform

The DJIM Target Risk Indices—which combine Shariah-compliant global core equity, sukuk, and cash components—outperformed the S&P Global BMI Shariah and DJIM World Index in Q1 2020 across all allocations as diversification away from equities stabilized returns. The comparably more risk averse DJIM Target Risk Conservative Index was the best performer, due to its 80% combined allocation to sukuk and cash during the declining equity environment, ultimately contracting 5.3% during the quarter. Meanwhile, the DJIM Target Risk Aggressive Index suffered the greatest losses—down 16.6%—due to its 100% allocation to a mix of Shariah-compliant global equities, in alignment with the broader S&P Global BMI Shariah and DJIM World Index.

For more information on how Shariah-compliant benchmarks performed in Q1 2020, read our latest Shariah Scorecard.

A version of this article was first published in Islamic Finance news Volume 17 Issue 15 dated the 15th April 2020.