Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 7 May, 2020

By Tim Edwards

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

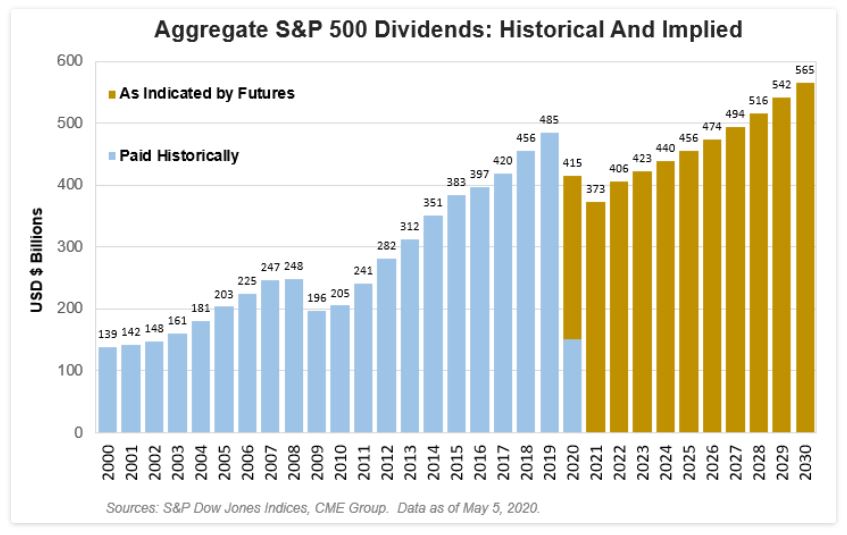

In 2019, the S&P 500® companies in aggregate paid a record $485 billion in dividends. This year, the figure could be closer to $415 billion, and it could be another seven years before they recover to 2019 levels, according to futures prices. Dividend futures, that is.

Index futures based on the level of the S&P 500 may be more familiar than those based on its dividends, but there is a simple connection between the two. An arbitrage mechanism connects index futures prices to current (“spot”) values of the S&P 500; the difference between spot and futures prices depends on the difference between interest rates and dividend yields until expiry of the future. Interest rates are knowable in advance; dividend payments are not. Dividend futures are designed to hedge this uncertainty.

In 2015, the CME launched a futures contract based on the annual dividends paid by a portfolio tracking the S&P 500. Today one can trade any of 11 contracts stretching out to the year 2030, with pricing based on “index points”; in 2019, for example, S&P 500 dividends amounted to 52.2 index points (versus an average S&P 500 index level of 2,913). Each year’s contract is settled at the total dividend points paid during that calendar year.

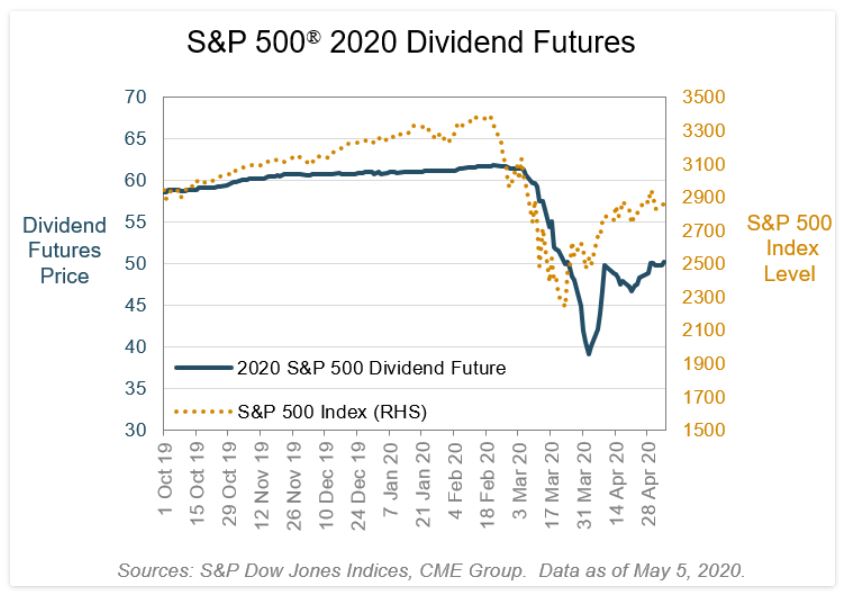

Stock prices usually move faster than fundamentals, and dividend futures are typically more stable than stock index futures. Not this year, however: the peak-to-trough decline in the 2020 S&P 500 dividend future in 2020 was 37%, compared to only 34% for the S&P 500. Having fallen further, the dividend future then lagged the recovery afterwards. The S&P 500 closed yesterday around the same level it began last October; the 2020 dividend future is still 15% lower.

The collapse in 2020 dividend expectations is more extreme considering that some dividends have already been paid this year: in the first quarter, aggregate S&P 500 dividends were still breaking payout records. Looking at the next contract out, the 2021 futures contract is currently priced at 44 – another 12% below this year’s future – and is perhaps a better guide as to what dividend run rate to expect in the medium term.

The existence of dividend futures ranging out several years allow us to make comparisons with total dividends paid historically and anticipated in coming years. To put the information expressed by futures prices in a tangible context, using the same mathematics that converts an index level to the aggregate capitalization of all the index constituents, we can express the prices of dividend futures in terms of the total dollar amounts of dividends paid out by the companies in the S&P 500. Exhibit 2 illustrates the conversion from annual futures prices into total aggregate dividends, in comparison to historical payments to shareholders.

Of course, futures prices are not perfect predictions. The dividend futures markets may be overly pessimistic – they have tended to underestimate payouts historically. But there are plenty of reasons to suppose that prices should recover faster than dividends. Declining U.S. Treasury yields offer a justification for valuations to increase faster than fundamentals (as discount rates fall), while dividends themselves may prove less popular with some shareholders and CEOs during a time of economic uncertainty. Time will tell, but if we take futures prices as imperfect guides, it seems fair to conclude that S&P 500 dividend payments could slow considerably in the short term and take quite a few years more to recover.