Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 16 Sep, 2020

In the wake of a historic dive into negative figures on April 20, the oil industry called for an alternative to pricing at the hub of Cushing, Oklahoma.

S&P Global Platts responded by putting to work its expertise in cargo markets to design a methodology that would simultaneously provide clarity into what is being valued and a broad, regional representation of price.

Platts AGS, the US’ new waterborne crude benchmark, clearly demonstrates the value of a defined grade within a specific trading framework, bringing structure to a regional market previously characterized by one-off deals.

The tension between liquidity and precision is an important consideration in the development of a new US crude benchmark. Higher transaction volume does not improve the usefulness of an assessment if it undermines clarity and precision. On the other hand, an overly specific assessment may not reflect a broad enough segment of the market to provide a trustworthy representation of price.

To take an extreme example, consider a US Gulf Coast crude assessment that calculates a volume-weighted average based on information from a basket of pipeline and cargo trading locations in the Gulf Coast, normalized based on historical spreads to a single terminal. This assessment could advertise significant liquidity, but would that liquidity come at the expense of clarity and precision?

The proportion of market information from different locations and from pipeline versus cargo trades would fundamentally change the kind of market the assessment represents each day. And that’s not a problem you can solve through a normalization process based on historical price differences.

The other extreme would be a futures contract with physical deliverability at one or a few close-proximity assets. This pricing mechanism would be clearer and more precise, but would not provide a regional representation of value.

Limiting deliverability to a small group of assets, while positive for clarity and precision, excludes liquidity. And because of the financial-to-physical convergence inherent in these types of contracts, there is no flexibility for an assessment process to determine value from nuanced market information.

Following in the footsteps of other waterborne benchmark ecosystems – Dated Brent and Platts Dubai – Platts AGS strikes the balance between the “anything goes”, volume-weighted average approach and the overly restrictive physically deliverable futures contract examples.

The assessment provides total clarity into what is being valued and under what trading circumstances. In addition, it captures a large swath of transaction volume and the entirety of the US’ main crude exporting region without distorting value.

To get there, Platts worked with the market to develop solutions for two key methodology challenges.

The impediments to fungibility in the USGC crude market boil down to two questions at the point of delivery: what is the crude and how deep is the water where it’s loading?

The former presents an interesting challenge in setting the guideposts for a functional market based on Permian crude. Unlike, for instance, the North Sea, where a certain grade will be fed by a relatively small geographic area, the Permian Basin covers a huge area of the southwestern US with big gathering systems feeding nine key pipelines.

With over 4 million b/d of production spread across two distinct basins, a crude buyer for a refinery might make the argument that the Permian should be carved up into different grades like Brent, Forties, Oseberg, Ekofisk, and more recently Troll, a few thousand miles to the northeast.

Platts decided it would be most useful to draw up the specifications for one grade that captured the majority of unblended, direct-from-Permian supply while meeting the technical needs of refiners across the US, Europe and Asia.

“Crude oil specifications need to consider the market liquidity of the streams involved… commingling/ blending that may occur in production and transportation… [and] the requirements of refiners who will ultimately transform the crude oil into finished products,” said Dennis Sutton, executive director of the Crude Oil Quality Association.

With that in mind, Platts proposed and – following some revisions – implemented a set of specifications for Platts WTI Midland that accommodated feedback from producers, traders, refiners and other stakeholders. The specifications cover the basics like gravity and sulfur content in addition to addressing iron and mercaptans, which are left out of many specifications.

In its determination of suitable gravity parameters, Platts considered data reported by Houston-area terminals as well as Certificates of Analysis for US Gulf Coast cargoes. The data showed that direct-fromPermian supply is consistently pushing (or exceeding) the upper bounds of the NYMEX WTI API specification range of 37-42.

In addition, the reported quality statistics demonstrate the variability in crude from this vast production area with reported API at Magellan East Houston and Enterprise Crude Houston terminals diverging by as much as 1.5 API in a given month.

Quality data from the Houston terminals also showed that the direct-from-Permian stream is significantly sweeter than the NYMEX WTI sulfur limit of 0.42% and most of the Permian-to-USGC pipeline limits of 0.4%. Industry feedback suggested 0.2% has emerged as an export market litmus test for unblended, direct-fromPermian barrels often sought by global refiners.

Platts’ specifications including 40-44 API and 0.2% or less sulfur are a first step in finding the balance between maintaining liquidity and providing a clear representation of value that is technically practical for buyers.

“Quality consistency is the hallmark of concerns for any refinery and in particular for the Asian refiner due to issues related to crudes being offered that were not Midland grade but rather blends of Midland and Canadian grades. By setting standards that ensure that the quality of the barrel in the AGS assessment falls within defined parameters that reflect Midland-grade WTI, such concerns are assuaged,” said Robert Sanz, president of RLS Consultants.

As the Permian crude stream and crude export market evolve, so too may the Platts WTI Midland specifications. However, it will remain consistent that further changes are based on industry feedback and implemented with transparency and appropriate lead time.

In the US Gulf Coast crude export market another impediment to a uniform regional market is different water depth at different docks. The Americas Aframax market long ago ceded control to freight buyers on the issue of overage charges.

Crude shippers have the incentive to load as many barrels as possible to get the most out of their fixed freight cost. The maximum number of barrels is determined by the draft at berth and on the way out to sea.

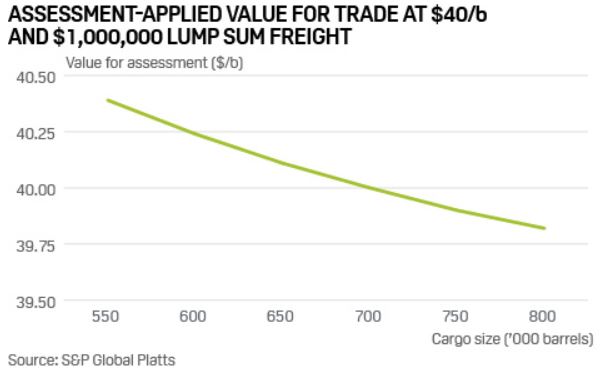

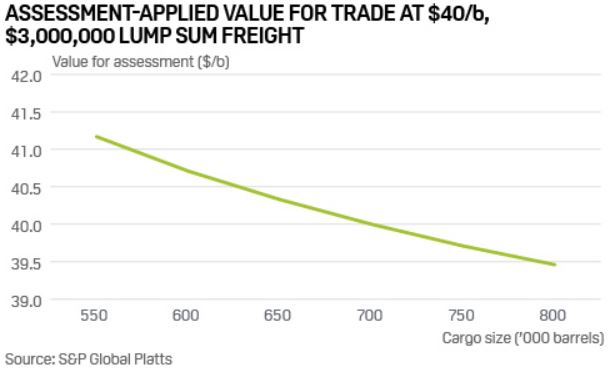

In the case of Corpus Christi, depth in excess of 45 feet may allow over 700,000 barrels to safely load onto an Aframax. On the other end of the spectrum, depth of about 40 feet in Nederland may limit Aframax loadings to about 600,000 barrels. A buyer would only pay for the volumes they load, so why would the 100,000 barrel difference matter?

Assuming a USGC to UK lump sum freight cost of $1,000,000, a 725,000 barrel Corpus Christi loaded Aframax would incur $1.38/b of freight cost to reach western Europe. Meanwhile, the 600,000 barrel Nederland vessel would clock in at $1.67/b for the same route. So on an FOB basis, all else equal, a trader would be willing to pay 29 cents/b more for the same molecules loading in Corpus Christi.

Given this dynamic of variable volume and fixed freight, FOB cargoes will understandably trade at different values depending on achievable loaded volume. Platts viewed this distortion as important to address – not in the Market on Close process itself – but in how that market information is interpreted. So, the Platts AGS methodology calls for bids, offers and trades used in the assessment to be normalized to reflect the freight economics of a 700,000 barrel typical cargo size.

One important point of this adjustment is that, unlike a backward-looking location normalization, as may be present in other new Gulf Coast crude assessments, Platts’ cargo-size normalization is not a circular reference with historical trade information. Rather, this normalization changes daily based on the value of Platts’ assessed freight rates.

When Aframax rates are on the lower end of about $14/mt, the normalization would be about 25 cents per 100,000 barrels. However, when freight rates are at elevated levels, as seen in early 2020, that same normalization could reach $1/b or more. This normalization of market information puts docks across the US Gulf Coast on a level playing field, a crucial step in assuring the daily Platts AGS assessment reflects the value of oil, not logistics.

Now in just its fifth year, the US Gulf Coast export market has so far had few pillars of consistency.

Crude quality was mainly handled on a one-off basis with no defined specifications to pinpoint true directfrom-Permian supply. Value was difficult to ascertain in the absence of a price assessment that isolated the value of Midland-quality WTI from the impact of dockto-dock logistics.

Platts AGS changes that, answering the call of the industry for an alternative to Cushing, by addressing the complexities of the US Gulf Coast export market and balancing assessment liquidity and precision.

Content Type

Theme

Location

Segment

Language