Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 20 Mar, 2020

By Anu Ganti

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The rapid spread of coronavirus and oil price concerns have whipsawed U.S. equities since the S&P 500® reached its all-time high on Feb. 19, 2020. On March 16, 2020, the index plummeted by 12%, its worst decline since October 1987; as of the close of trading on March 18, 2020, losses for the S&P 500 amounted to 29%. Market commentators have argued that in this environment, active management has an advantage over index funds.

At one level, this argument is correct. We are in precisely the environment in which active portfolio managers have the most potential to add value, since relative returns are easier to achieve when absolute returns are poor.

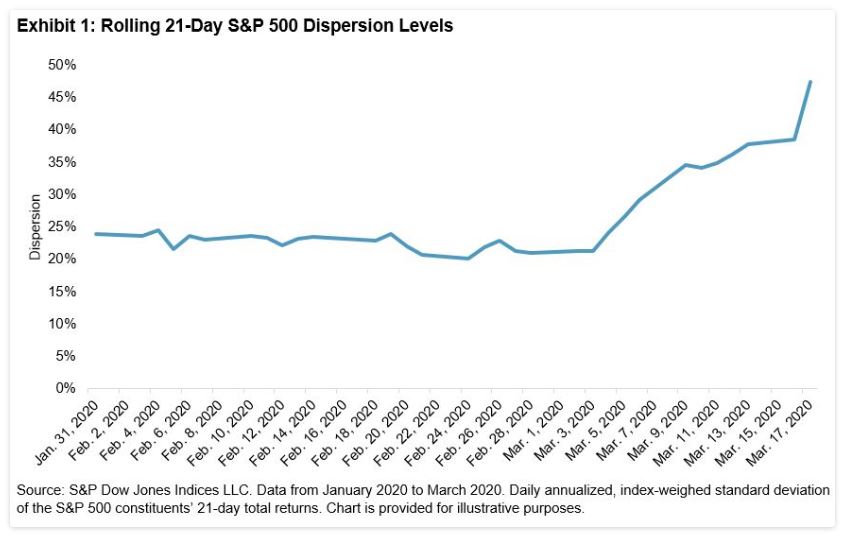

To understand this, we examine the rise in volatility that has accompanied the stock market’s decline. Higher volatility manifests itself as both higher dispersion and higher correlation; dispersion is a measure of magnitude, while correlation is a measure of timing. We have argued repeatedly that the value of stock-selection skill rises when dispersion is high: a larger gap between winners and losers means that active managers have a better chance of displaying their stock-selection abilities. Exhibit 1 illustrates that dispersion levels in the S&P 500 have jumped since early March 2020.

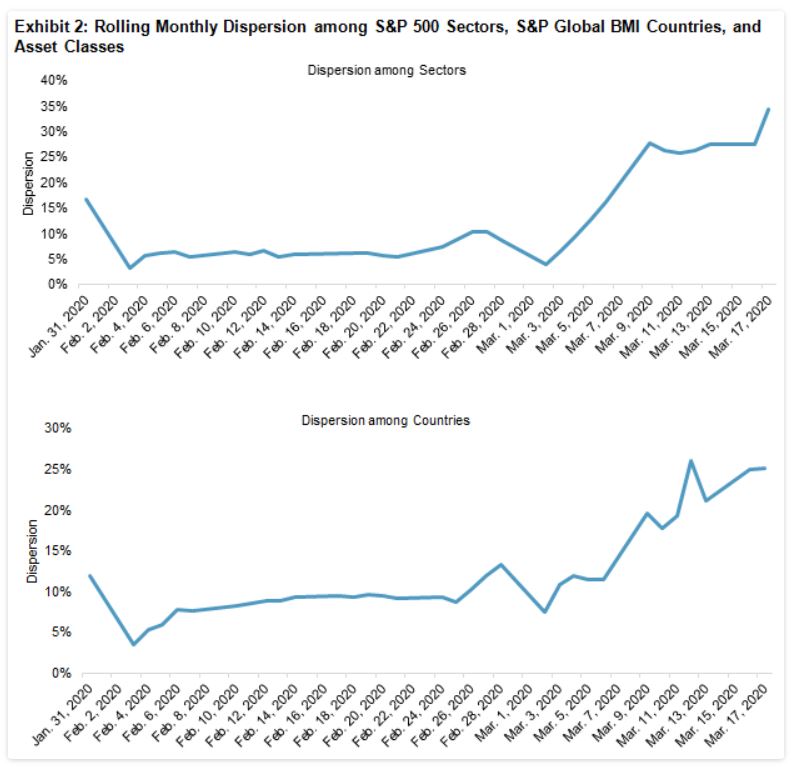

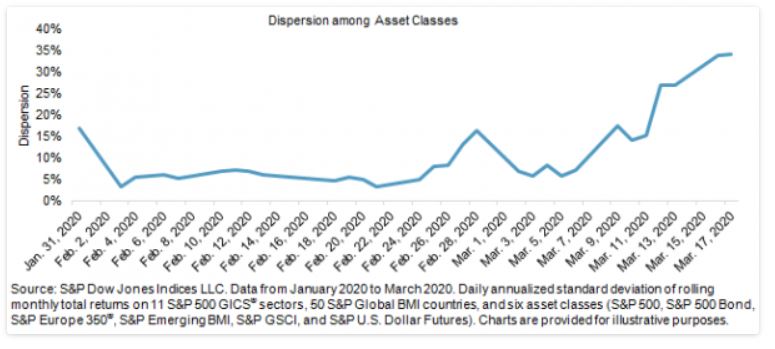

Higher dispersion also offers greater opportunities for skillful active managers to add value from selecting among sectors, countries, and asset classes. Exhibit 2 shows that dispersion among S&P 500 sectors almost doubled recently, with similar results across countries and asset classes.

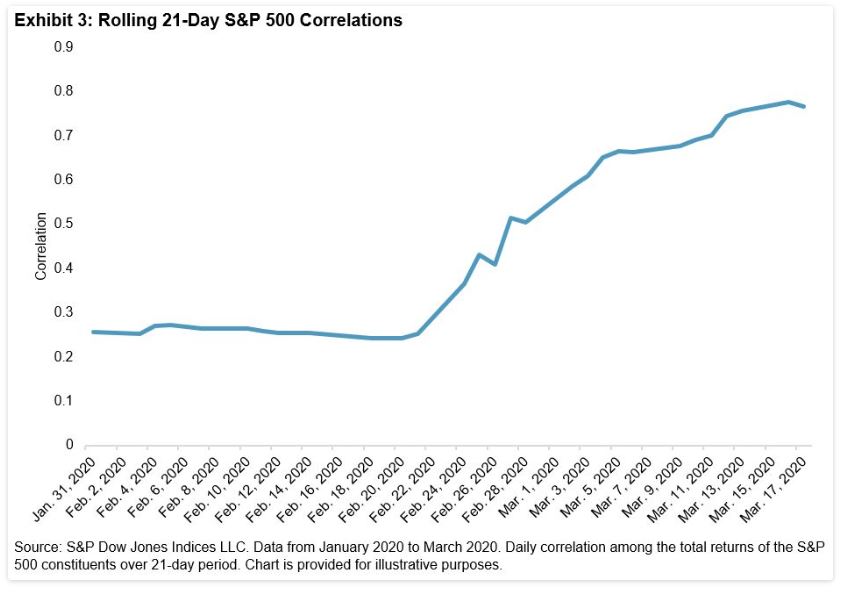

Although more nuanced than the obvious advantage of high dispersion, active managers should also prefer high correlations to low correlations. This is because active portfolios are typically more volatile than their index benchmarks; active managers forgo a diversification benefit. When correlations are high, the benefit of diversification falls, as does the benefit forgone, making active management easier to justify.

Exhibit 3 shows that as macroeconomic risk has escalated, correlations have risen; in fact, the reading of 0.8 on March 16, 2020, is an all-time record.

Both high dispersion and high correlations are now working in active managers’ favor. Higher dispersion means that the value of selection skill rises, while higher correlation means that the volatility gap between active portfolios and index funds declines. However, high potential for active value added does not automatically translate into actual value added. Time will tell how active managers will perform in this environment, but at this time next year, when SPIVA® results for 2020 become available—it would not be shocking if active management performance has improved.