Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 27 May, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In early March 2020, S&P Dow Jones Indices released the SPIVA Australia Year-End 2019 Scorecard. With the market gyrations in late February and March due to the COVID-19 pandemic spreading across the globe, we decided to provide a “mid-term” SPIVA update to include data up to March 31, 2020, and to share the timely results through the webinar, Harnessing Active Vs. Passive Findings During Times of Market Turbulence. So, what did we find?

Q1 2020 Market Performance

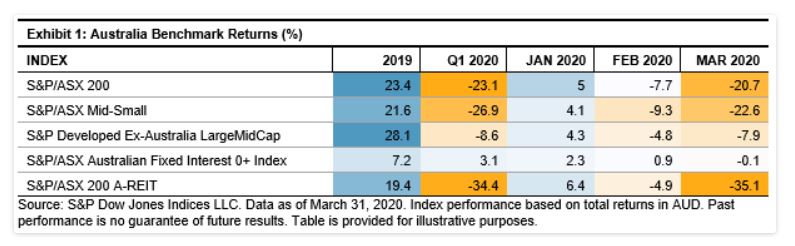

With the exception of Australian bonds, all asset classes suffered drawdowns, with the S&P/ASX 200 seeing a drawdown of 23%. The S&P/ASX 200 A-REIT experienced a drawdown of 34.4%.

Q1 2020 Fund Performance

As Exhibit 2 shows, for the three-month period ending March 31, 2020, 61.2% of funds in the Australian Equity General category were outperformed by the S&P/ASX 200. This was more or less in line with the results as of Dec. 31, 2019. What becomes more interesting is when we look at the results on a month-by-month basis, we saw a steady improvement in the performance of funds in that category across the three-month period, with the number of funds outperformed by the benchmark decreasing from 78.4% to 50.8%. To put this another way, in January 2020, 21.6% of funds outperformed the benchmark, in February 2020, this increased to 41.5%, and in March 2020, it increased to 49.2%. The volatile market appears to have provided active fund managers opportunities to outperform the benchmark, although the benchmark still outperformed greater than 50% of funds.

Other fund categories were also not able to beat the benchmark in Q1 2020, with the exception of A-REITs. For the three-month period, 39.3% of A-REIT funds were outperformed by the benchmark.

While opportunities for outperformance by active fund managers may have increased in Q1 2020, most continued to underperform their relevant benchmarks. The challenge remains. How can investors, or financial advisors, select outperforming funds in advance? 2020 hindsight continues to prevail in 2020.

How Does SPIVA Assist Financial Advisors?

David Haintz of Global Adviser Alpha joined our mid-term SPIVA results webinar and provided a wealth of advice for financial advisors. David’s advice can be heard starting at minute 23:45. A couple of key takeaways from his advice include the following.

Content Type

Theme

Location

Language