Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 20 May, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

International opportunities to diversify equity allocations are increasing, along with globalization, and as a result, political risk matters now more than ever. More so, the interplay of macroeconomic policymaking and government instability continues to have far-reaching effects in political risk, augmenting the uncertainty that goes hand in hand with allocating to emerging markets.

Mindful of this, S&P Dow Jones Indices collaborated with GeoQuant, an AI-driven political risk data firm, to devise the Emerging Markets Political Risk-Tilted Concept Index (hereafter the “Concept Index”).

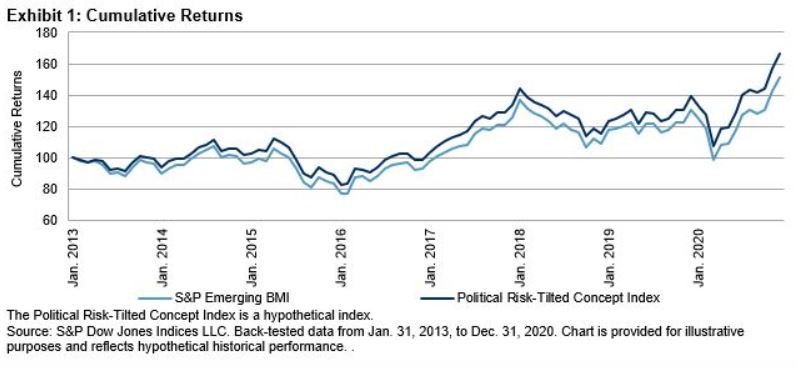

Offering a reduced-political-risk alternative to the exposure of the S&P Emerging BMI, the Risk-Tilted Concept Index overweights (underweights) countries with relatively low (high) political risk, leading to higher cumulative returns during the back-tested period (see Exhibit 1).1 Allocation decisions are made in accordance with GeoQuant’s custom “Macro-Government Risk Indicator,” which assesses both the riskiness of policies derived from macroeconomic management and the uncertainty around the capacity of incumbent governments.

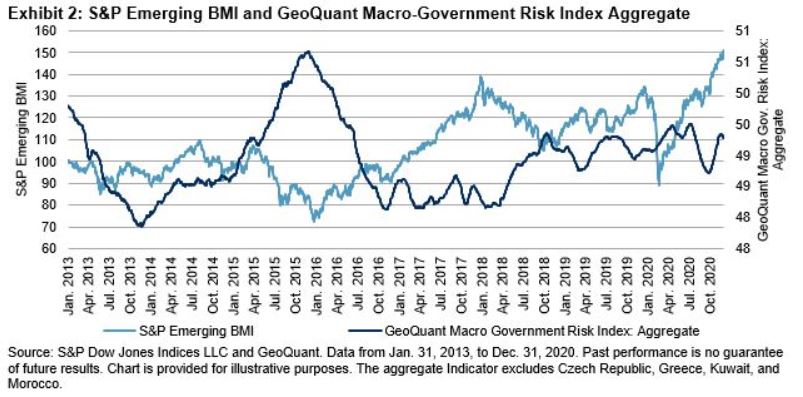

GeoQuant’s “Macro-Government Risk Indicator” is a weighted combination of macro-economic policy risk and government risk. In Exhibit 2 we can note the inverse correlation between a weighted cross-country aggregate of the indicator (r = -0.27) and the S&P Emerging BMI. This shows the inverse relationship between rising political risk and declining index performance. In fact, a sharp increase in macro-government risk from 2014 to 2015 among several high-weight countries (Taiwan, Brazil, and Russia) in the S&P Emerging BMI coincides with the largest drawdown from the benchmark index.

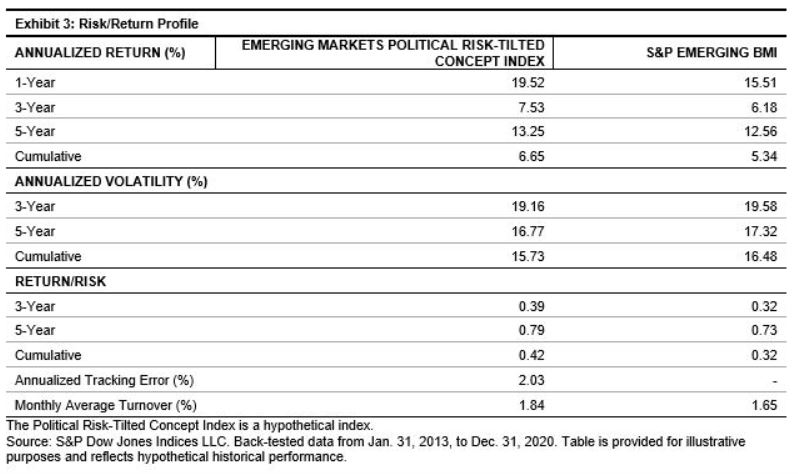

By incorporating political risk as a factor in emerging market allocation decisions, the Concept Index outperformed the S&P Emerging BMI while exhibiting lower volatility. The outperformance was mainly driven by mitigating losses in down markets. The Concept Index maintained a low annualized tracking error of 2.03% and a monthly average turnover of 1.84%, similar to the 1.65% of the benchmark. In fact, the risk/return characteristics presented in Exhibit 3 confirm that tilting the Concept Index according to countries’ relative political risk levels helped it to outperform the benchmark across the short and long term.

The ability of the Concept Index to decrease drawdown severity is noteworthy. Furthermore, it has the potential to hedge returns against unfavorable market conditions faster than with traditional methods, accomplished by controlling the downside.

Between 2013 and 2020, whenever the benchmark exhibited negative monthly returns, the Concept Index outperformed its benchmark 70% of the time. Moreover, the largest drawdown of the S&P Emerging BMI was -28.27%, compared to -26.13% for the Concept Index.

Incorporating political risk in allocation decisions can yield outperformance through lower volatility and higher returns. The Concept Index provides market participants with new tools to measure and assess the impact of political risk and to adapt equity allocation decisions accordingly.

To learn more about how political risk affects emerging market equities, see our paper Political Risk and Emerging Market Equities: Applications in an Index Framework.

1 The “Macro-Government Risk Indicator” covers 22 of the 26 total countries included in the S&P Emerging BMI between 2013 and 2020. The four countries not covered by the indicator are Czech Republic, Greece, Kuwait, and Morocco. The first three countries have a combined weight of 0.99% in the S&P Emerging BMI as of December 2020; Morocco has not been included the benchmark index since Q4 2015. The countries not covered are kept neutral to their weights in the S&P Emerging BMI.

The posts on this blog are opinions, not advice. Please read our Disclaimers.