Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 30 Apr, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

It is unnecessary to give an update on today’s economic situation since most already have a wealth of information over the repercussions of the COVID-19 pandemic. I will instead focus on another major concern: how have pension funds performed, and furthermore, are there similarities in how they have performed during other crises?

After the S&P/BMV IPC dropped 16.38% from its highest monthly return posted in the past 10 years, the S&P/BMV Sovereign MBONOS Bond Index fell 0.72% and the S&P/BMV Sovereign UDIBONOS Bond Index followed with a loss of 3.10%. In this environment, we would expect that pension funds would have their worst month, or even their worst quarter.

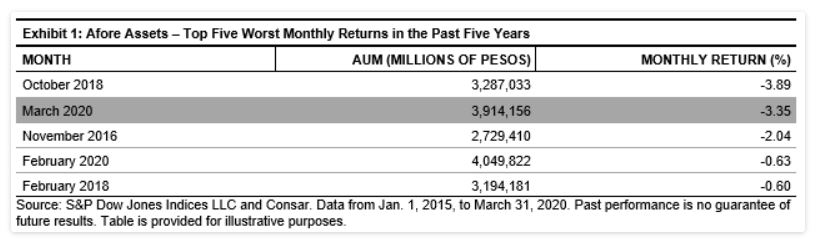

Using data provided by Consar (available since December 2015),[1] we can see that Afore assets dropped 3.35%, the second-worst month in the past five years, with October 2018 taking the lead with a loss of 3.89%, as shown in Exhibit 1.

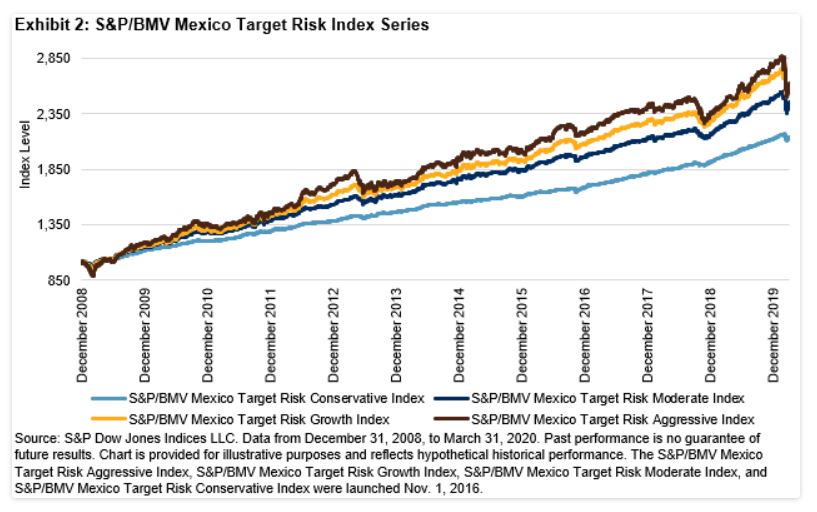

The pension fund system recently changed investment philosophy, moving from a target risk to a target date structure. Since the changes are so recent, we feel it is still appropriate to use the S&P/BMV Mexico Target Risk Index Series as a proxy to analyze performance before and during the COVID-19 crisis since instead of 4 strategies, now 10 different strategies are available with the same rules.

Exhibit 2 illustrates that despite performance losses, the indices had a positive slope and low volatility.

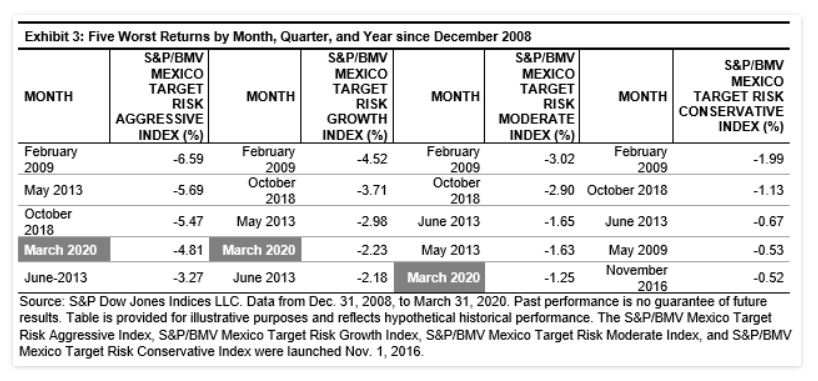

In Exhibit 3, we can see that March 2020 is the fourth-worst month since December 2008 for the S&P/BMV Mexico Target Risk Aggressive Index and S&P/BMV Mexico Target Risk Growth Index, while the S&P/BMV Mexico Target Risk Conservative Index held up well and did not rank among the lowest five months historically, driven by high exposure to fixed income indices and their performance relative to local and foreign equity. February 2009 was the worst-performing month for all the indices, which, interestingly was followed by the top monthly performance for all indices in March 2009, at 6.86%, 5.39%, 4.14%, and 3.53% for the S&P/BMV Mexico Target Risk Aggressive Index, S&P/BMV Mexico Target Risk Growth Index, S&P/BMV Mexico Target Risk Moderate Index, and S&P/BMV Mexico Target Risk Conservative Index, respectively.

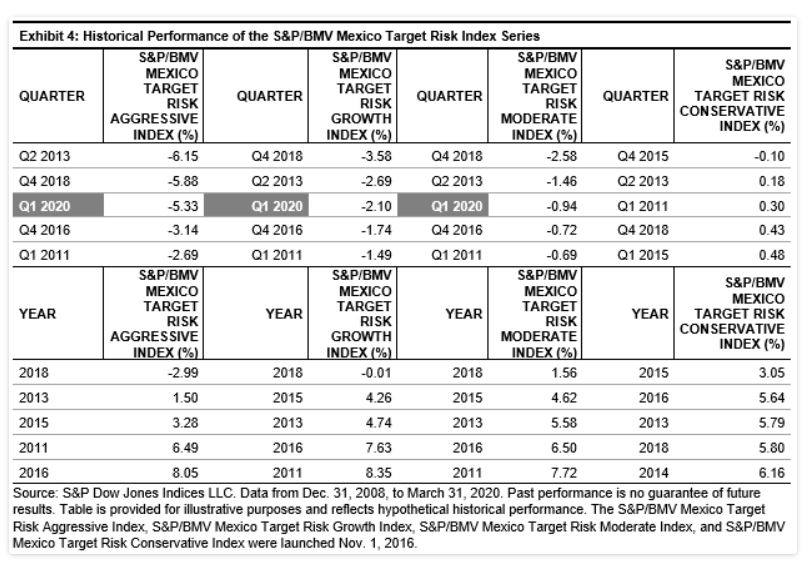

Looking at quarterly results, we can see that the first quarter of 2020 was the third-worst quarter for all indices except the S&P/BMV Mexico Target Risk Conservative Index, while Q2 2013 and Q4 2018 suffered greater losses.

Yearly results show that only the S&P/BMV Mexico Target Risk Aggressive Index recorded a loss in 2018 (we consider the 0.01% loss of the S&P/BMV Mexico Target Risk Growth Index flat), and in 2013 all other indices finished in the black.

Without minimizing the current COVID-19 crisis, there is a glimmer of hope. History shows that crisis months with heavy losses can be followed by positive months and, when using a disciplined approach of diversification and risk management, even result in a year ending on a positive note.

While the results of the S&P/BMV Mexico Target Risk Index Series may differ from those of any particular Afore, the indices were created taking into account the investment regime of Consar (read more here) and provide a benchmark we can use with our own Afore. In conclusion, do not be afraid of a month with losses and instead use a disciplined investment approach in line with your risk tolerance.

[1] http://www.consar.gob.mx/gobmx/Aplicativo/WebDashboard/WebDashboard.htm