Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 4 Sep, 2020

In early June, coverage of the environmental damage caused by a major gasoil leak at a facility owned by Nornickel in Russia’s Arctic region shocked both domestic and international audiences.

Russian President Vladimir Putin declared a state of emergency, and ordered lawmakers to strengthen environmental legislation.

There is little sign that the incident is causing Russian oil and gas companies to rethink their development plans in the region, however. The Arctic remains a strategic development priority for the Russian government, despite high costs, Western sanctions and logistical issues compounding the growing environmental concerns.

The Russian energy ministry estimates that Arctic oil production will account for 26% of overall output by 2035, up from 11.8% in 2007.

Many in Moscow even point to warming temperatures and retreating sea ice as a boost to plans to launch new oil and gas field development and increase shipments via the Northern Sea Route, which links Asia to Europe via Arctic seas.

In the months following the gasoil spill, several Russian companies moved ahead with plans in Northern Russia.

Russia’s largest producer, Rosneft, announced discovery of a new oil and gas field, Novoogennoye, at its major Vostok Oil project – a cluster of resources in Northern Russia that will ship resources via the NSR. CEO Igor Sechin also said in mid-August that the company resumed drilling in the Arctic Kara Sea, its first reported activity in the area since Western sanctions forced suspension of a joint venture with ExxonMobil in 2016.

Gazprom Neft has announced launch of full-scale development of the Northern section of its Novoportovskoye field, and shipped the first cargo from the project to ChemChina via the NSR. It also announced plans to set up a new joint venture with Shell to explore and develop hydrocarbons on the Gydan peninsula.

Novatek also completed its first Arc 7 ice-class LNG tanker shipment to Japan from the Yamal LNG project via the NSR.

These moves added to announcements made earlier in 2020 including Gazprom Neft launching development of several new projects at its largest gas condensate deposits in the Arctic, including Kharasavey, Bovanenkovo and Urengoyskoye.

Furthermore in March, at the height of tensions with Saudi Arabia over failure to agree to new coordinated oil production cuts, Putin approved tax exemptions to stimulate Arctic upstream oil and gas development. These will go some way to easing concerns over high costs of development in the region.

Estimates of breakevens on projects there vary widely. Onshore projects close to existing infrastructure have breakevens of close to the Russian average of $20/b, but for more complex projects in more remote areas this could reach over $100/b, if government assistance is not taken into account.

Permafrost risks

The Nornickel spill has had an impact on sentiment in Russia however, with concerns growing over how rising temperatures could impact thawing permafrost, which Nornickel blamed for the incident. As the company and local officials tackled the cleanup operation, a heatwave hit Siberia. The Russian meteorological center reported a record-high temperature above the Arctic Circle of 38 degrees Celsius in the town of Verkhoyansk.

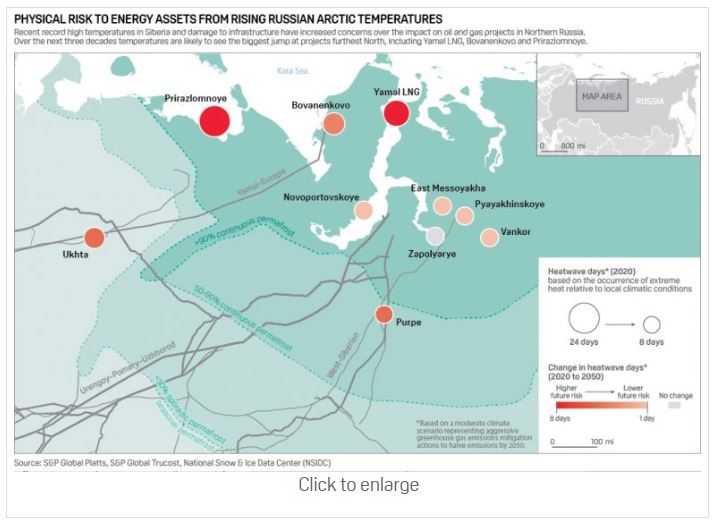

An analysis by S&P Global’s Trucost showed that projects furthest North, including the Bovanenkovo gas field, Prirazlomnoye oil field, and Yamal LNG are likely to see the biggest increase in heatwave days up to 2050.

Rising temperatures pose a number of risks for oil and gas companies operating in the region. They reduce the period during which winter roads can be used to transport essential heavy equipment to projects in the Far North. This could increase costs, and lead to months-long delays in moving equipment, if the window is missed.

Thawing permafrost also leads to the release of greenhouse gases into the atmosphere, and threatens the structural integrity of infrastructure. Russia’s major production projects and pipelines in the Arctic were launched over the last decade, and include some consideration for the risk of thawing permafrost.

Some companies have provided details of how they are mitigating the risks. Gazprom Neft said its own precautions include geotechnical monitoring, choosing optimal locations for buildings and equipment, and equipping them with active and passive thermal stabilization systems. Novatek has also said that it is using technology to keep the ground frozen, and developing infrastructure with a load-bearing capacity that takes 30-40-year warming into account.

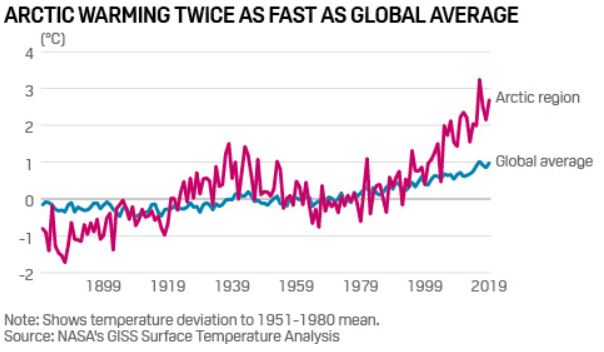

With Arctic temperatures warming at twice the rate of the global average, companies may need to increase these measures if they are to meet their ambitions in the region over the coming decades.

Content Type

Language