Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 2 Mar, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

As we mark the first anniversary of the S&P/ASX All Technology Index, it seemed an opportune time to look back at what can only be described as a remarkable inaugural year.

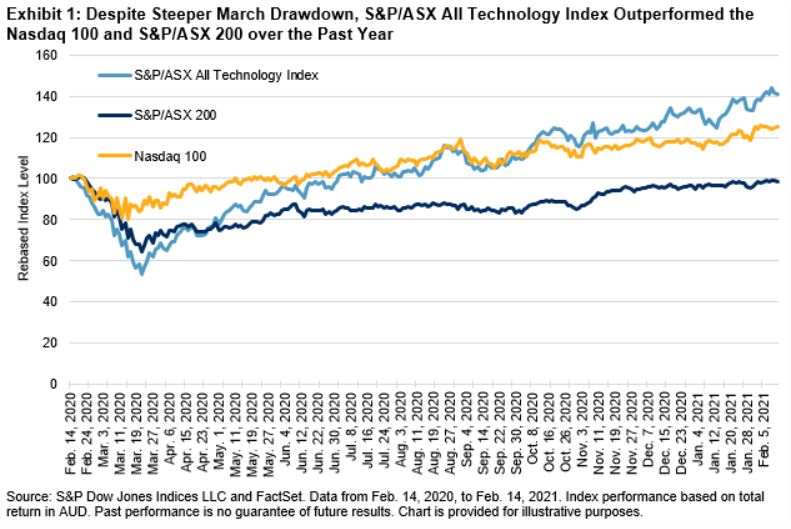

After peaking on Feb. 17, 2020—just one trading day post launch—the index plunged nearly 50% over the ensuing month, bottoming out on March 23 at the height of the pandemic-led selloff. Around this time, however, investors realized that Australia’s technology-driven companies were likely to be less affected by—and may even benefit from—the pandemic-related economic and social dislocations. By July 2, the index had fully retraced its losses, jumping 90% in just over three months. As of Feb. 14, 2021, the S&P/ASX All Technology Index gained 41% in the one-year period since its launch, powered by a 163% increase since the March low. In comparison, the tech-heavy U.S. Nasdaq 100 Index gained a comparatively small 25% in AUD terms and the S&P/ASX 200 had not yet returned to its pre-pandemic level.

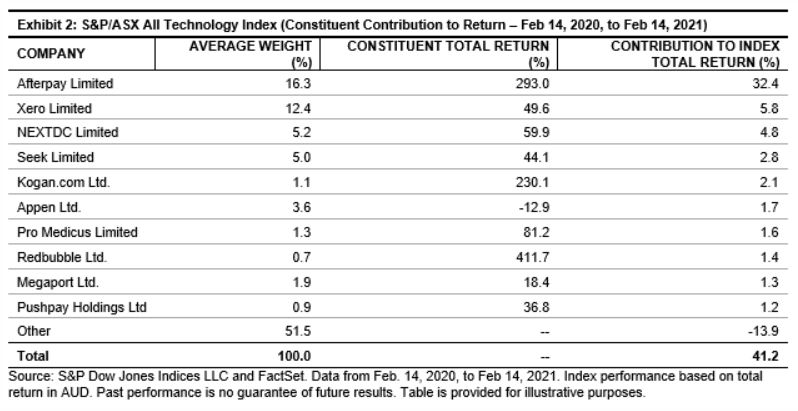

As depicted in Exhibit 2, Afterpay accounted for more than three-quarters of the S&P/ASX All Technology Index’s total return during its first year, as its nearly 300% price increase propelled the company to the top of the index. In fact, Afterpay is now the 12th-largest Australian company by market cap, up from number 52 a year ago. However, the strength of Australia’s technology industry extended well beyond this single high-flyer. Fellow top index holdings, Xero, NEXTDC, and Seek, each returned more than 40% over the past year. Meanwhile, online marketplace Redbubble was the index’s top performer, gaining nearly 412%.

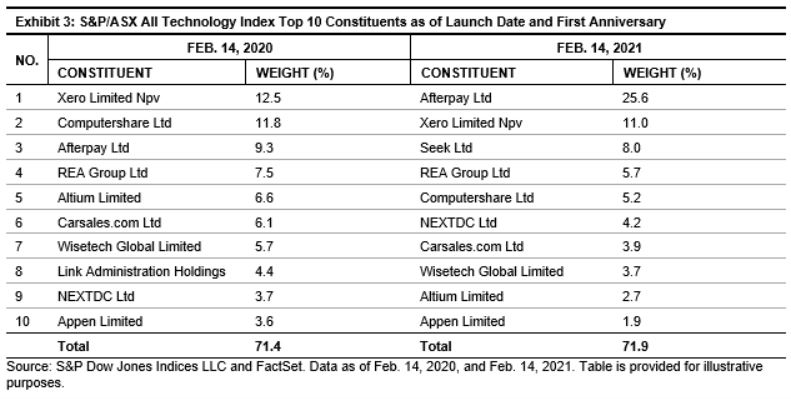

As illustrated in Exhibit 3, the composition of the index has shifted considerably since its launch. Most notably, Afterpay’s outsized performance has pushed its weight up to 25%, well above any other company. Importantly, the S&P/ASX All Technology Index methodology includes a 25% single stock cap in order to limit the influence of any single name and improve diversification. This cap is applied at each quarterly rebalance.

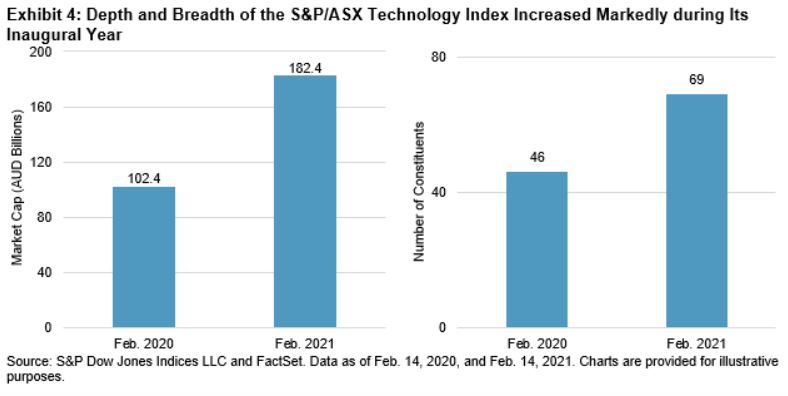

Despite the extreme market volatility experienced following the introduction of the index, the Australian technology industry has thrived of late. During the past year, the S&P/ASX All Technology Index expanded from 46 to 69 constituents, while its total market cap increased by AUD 80 billion (up 78%) to AUD 182.4 billion. In total, 26 companies were added to the index over the past year, while just 3 were removed.

While the S&P/ASX Technology Index will likely have a tough time surpassing the excitement experienced during its first year, it will no doubt continue to provide meaningful insights into this dynamic segment of Australia’s equity market for years to come.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language