Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Wheatstone/Gorgon Saga

Along the semi-arid Pilbara coast of Western Australia, two of the world’s largest natural gas projects extract natural gas from beneath the ocean floor and process this gas for export and domestic consumption. The Wheatstone Project, located 12 km west of the coastal town of Onslow, is among Australia's largest resource developments and the nation's first liquefied natural gas hub. The Gorgon Project, based nearby on Barrow Island, comprises a three-train, 15.6 million-metric-ton-per-year LNG facility and a domestic gas plant. Both facilities are owned and operated by Chevron Australia, a subsidiary of Houston-based Chevron Corp. Since mid-August, Australia's Offshore Alliance workers union has been warning of the possibility of strikes and other industrial actions at the Wheatstone and Gorgon facilities unless its bargaining claims are met. After talks between the union and Chevron Australia broke down this month, industrial actions began at both facilities. The resulting supply disruptions have the potential to raise LNG prices in a market already constrained by increased European demand.

A significant percentage of the natural gas consumed domestically in Western Australia comes from Wheatstone and Gorgon, but the facilities were actually constructed to meet the LNG demands of the Asian market. In 2022, the two projects exported 27.5 MMt of LNG, about 46% of which was sent to Japan, 15% each to China and South Korea, and about 14.4% to Taiwan. So far this year, they have exported about 17.4 MMt of LNG, according to S&P Global Commodity Insights.

On Aug. 24, the Offshore Alliance workers union encouraged members to reject enterprise agreements submitted to Wheatstone and Gorgon workers. The vote on the proposed agreement took place Aug. 30–31 and was overwhelmingly rejected. This vote precipitated a decision by the Australian Workers’ Union to begin a series of industrial actions at Chevron's Wheatstone platform, including a demobilization of workers. Further industrial actions are planned to last until Sept. 28 for the Wheatstone downstream and Gorgon facilities. Chevron Australia filed an application with the Fair Work Commission to seek mediation assistance. On Sept. 8, in the absence of an agreement, industrial actions began at both facilities, and on Sept. 11, Chevron sent three applications for an intractable bargaining declaration to the Fair Work Commission. The intractable bargaining declaration provision exists within Australian law to force resolution to contract disputes where there is no reasonable prospect of agreement.

Rhetoric on both sides of the conflict has grown increasingly forceful since negotiations broke down. "The unions continue to seek terms that are above and beyond equivalent terms with others in the industry, including in agreements recently reached," a spokesperson for Chevron Australia said Sept. 8.

In a separate statement, Offshore Alliance spokesperson Brad Gandy said, “Chevron are being unreasonable and downright unusual in their behavior. Offshore Alliance members call on them to change tack so this dispute can be settled and the company can get on with the business of making billions of dollars exporting Australian gas.”

Japanese buyers of LNG have been getting mixed messages about whether the industrial actions will affect shipments. Most market observers believe that Chevron Australia will focus on meeting the contracted needs of foundation customers in Japan but that spot market shipments may be negatively affected.

Today is Tuesday, September 19, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

This Week In Credit: Central Bank Action Stations

Markets expect the Fed to pause when it concludes on Wednesday. But a pause is far from a hard stop, so communication regarding the outlook for interest rates — already at a 22-year high — will be key. The Fed is far from the only central bank on deck this week, with Thursday a particularly busy day including the Bank of England, before the Bank of Japan wraps up monetary policy updates on Friday. A single corporate default last week was welcome relief, following the highest August tally since 2009, and this week a global suite of flash PMI numbers for September will provide a temperature check on global economic activity.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Balancing High Yield And Growing Dividends In A Sector-Neutral Framework With The S&P Sector-Neutral High Yield Dividend Aristocrats

In September 2022, S&P DJI was pleased to add the S&P Sector-Neutral High Yield Dividend Aristocrats® to the S&P Dividend Aristocrats Index Series. While most dividend indices have notable sector under- and overweights versus their underlying benchmark, this index is the first in the series to be sector neutral. As such, this index emphasizes dividend growth and high yield while keeping the same sector weights as its benchmark, the S&P Composite 1500®. This blog reviews the methodology of this index and explain how it may serve as a more balanced dividend growth strategy that is more closely aligned with its benchmark.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

West Of Suez VLCC Rates Near 16-Month Lows Amid Weak Fundamentals

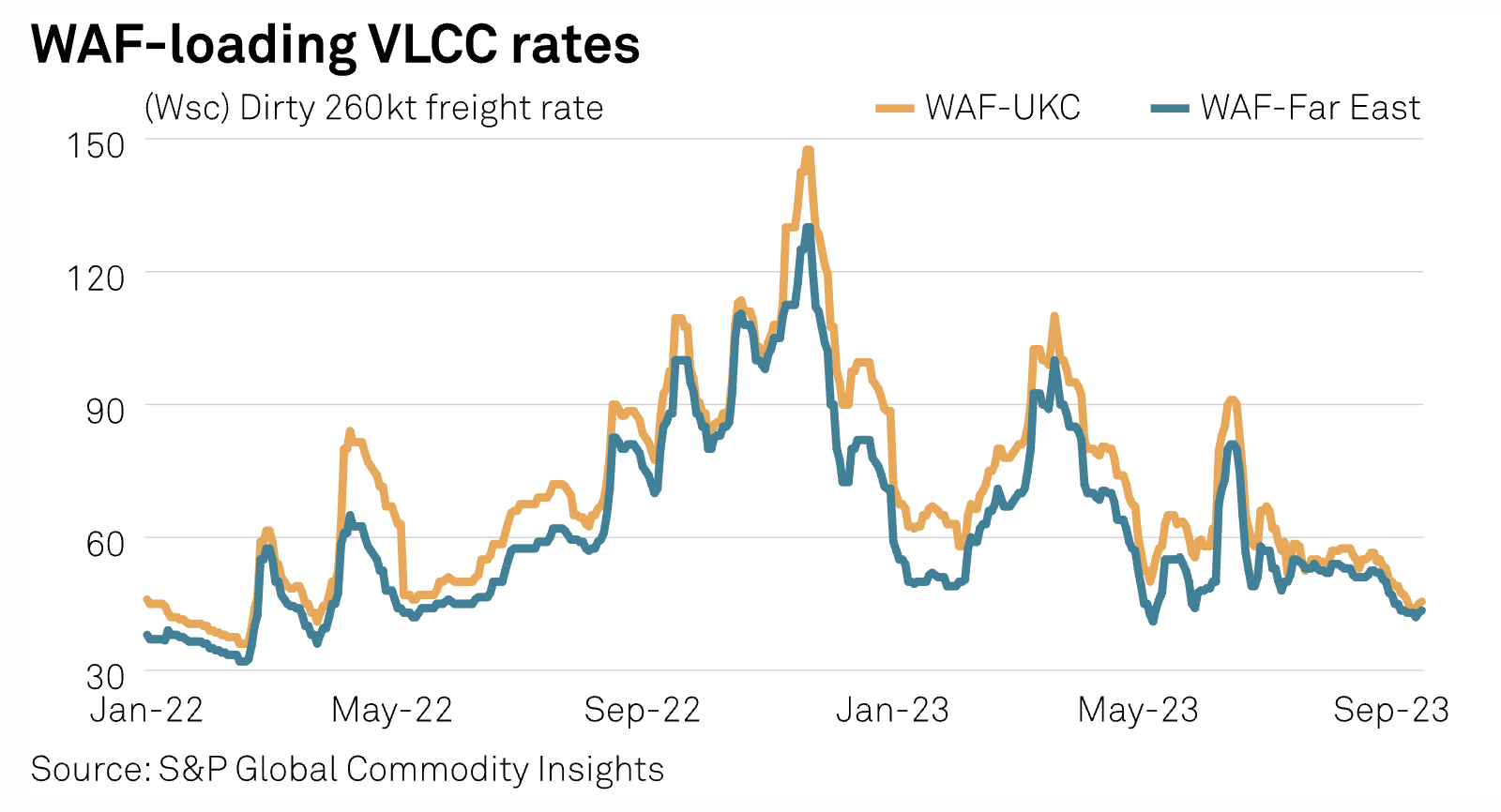

Freight rates for the West of Suez Very Large Crude Carrier market have fallen significantly since the end of August, with market sources pointing to low inquiry levels, OPEC+ oil production cuts until the end of 2023, uncertainty over China's economic prospects, weakness in adjacent markets and a lengthy tonnage list. Platts, part of S&P Global Commodity Insights, assessed freight on the 260,000 mt West Africa-Far East route at Worldscale 43.5 on Sept. 15, up from a low of w42 on Sept. 13 but below the July average of w53 and August average of w52.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Infographic: US Wind Power By The Numbers Q2 2023

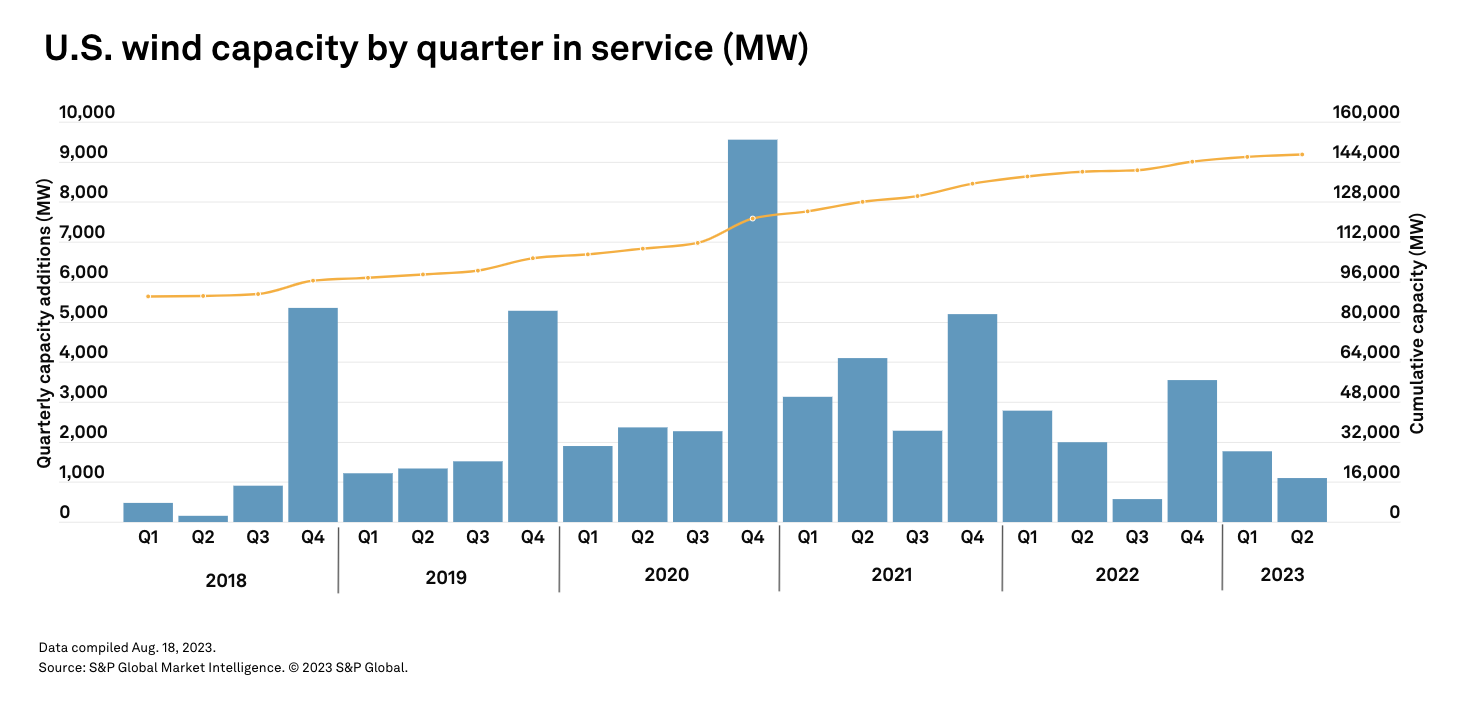

Renewable energy developers connected 1,099 MW of new wind power capacity to US electric grids in the second quarter, a 45% decline from the year-ago period. In the first two quarters of the year combined, developers installed 2,871 MW of new wind power capacity. Comparatively, in the first half of 2022, developers installed 4,784 MW of new wind power capacity. Wind power projects have faced the longest delays in 2023 of any renewable energy technology, with the average delay lasting 16 months, according to the American Clean Power Association.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Arctic Battle Not Over: AIDEA Comes Out Swinging In Fight To Drill Within ANWR

On Sept. 6, the Biden administration took steps to fulfill the president’s campaign promise to block oil and gas drilling in the Arctic National Wildlife Refuge, canceling the last remaining oil and gas leases within ANWR. But the holders of those leases — Alaska’s state-owned development finance corporation, the Alaska Industrial Development and Export Authority — is not taking this lightly. AIDEA Executive Director Randy Ruaro joined the podcast to talk about the lease cancellation, the organization’s planned lawsuit and why oil development and protecting the environment do not pose an either-or proposition as he sees room for both to coexist. He also touched on AIDEA’s views on rising oil prices and recent predictions about peak oil demand.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Tech Disruption In Retail Banking: Irish Banks Are Working With, Not Against, Fintechs

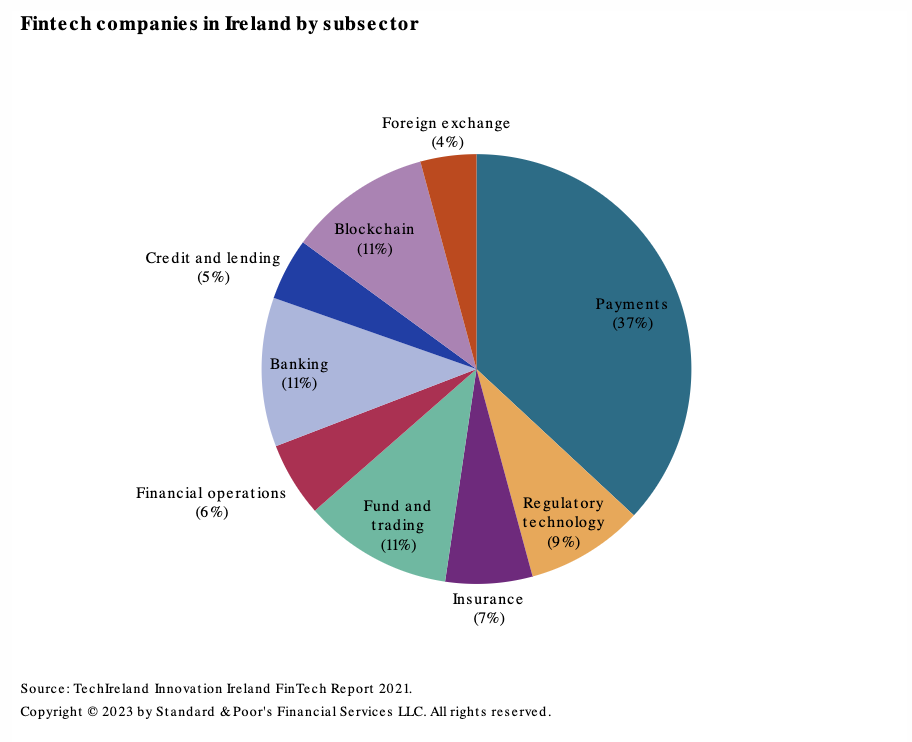

Irish banks do not face elevated risks from technological innovation in the short- to medium-term due to the relative stickiness of the customer base and its basic product expectations. The country has the technological and human infrastructure to be a European fintech leader, but banks' legacy issues, particularly the clean-up of nonperforming assets in recent years, has slowed new technology adoption. Fintech collaboration is providing most of the banking sector innovation, which has focused on efficiency improvements from data management and storage, cloud computing, cybersecurity and online/digital access to existing products, rather than new digital product offerings.

—Read the report from S&P Global Ratings