Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

How Language Shows Leadership Differences Between Men and Women

There are significant differences between women CEOs’ leadership styles and those of their male peers, original research by S&P Global, in partnership with Paris 2 Panthéon-Assas University, shows. “Women CEOs: Leadership for a Diverse Future” analyzed words used by CEOs in earnings calls and found the largest differences in the use of words related to diversity, empathy, adaptability and transformation. It also revealed women CEOs demonstrated a more positive leadership style, as evidenced by their tendency to use words such as “growth,” “continue,” “good” and “customer” more than men CEOs. This study built on S&P Global’s 2021 study about the leadership differences between women CEOs and men CEOs during the COVID-19 pandemic, showing how leadership styles have changed over the past two years.

It is challenging to evaluate the leadership styles of women CEOs because there are relatively few of them. The “Women CEOs” study was confined to CEOs at the 5,801 global companies in the S&P Global Broad Market Index. While the percentage of women CEOs increased over the two years of the study, from 5% in 2021 to 5.4% in 2022, the sample size of women CEOs remains modest. A separate study, created by Arizent and sponsored by S&P Global and American Banker, looked at how to increase diversity in leadership roles.

Both the “Women CEOs” study and the 2021 study analyzed language used in earnings calls via natural language processing. Earnings call transcripts were selected because they are used by public market CEOs to signal vision and intent.

As in the 2021 study, the analysis of transcripts found that women were more likely to emphasize communication and culture, with a focus on adaptability and flexibility. Men CEOs were more likely to use terms such as “transaction,” “performance” and “growth.” However, in the second year of the study, women became more likely than men to emphasize performance, growth and accountability. This indicated a change in the leadership styles of women CEOs, perhaps driven by a shift from concerns over the pandemic to concerns over macroeconomic conditions.

Despite this change, women CEOs’ leadership styles remained distinct. Rather than reverting to a baseline shared by CEOs of any gender, the language of women CEOs became increasingly different over the course of the study, especially when it came to using words related to empathy.

Gabriel Morin, associate professor of leadership development for the Research Laboratory in Management Sciences at Paris 2 Pantheon-Assas University and co-author of the study, believes that the differences in leadership style are attributable to the management theory of “authentic leadership.” According to this theory, authentic leaders display a pattern of transparent and ethical behavior, encouraging the sharing of information while accepting employee input. It is hard to be certain why women are more likely to demonstrate authentic leadership as CEOs, although it may be that companies with a woman CEO are more likely to value diversity and be open to this type of leadership style.

Today is Monday, October 31, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

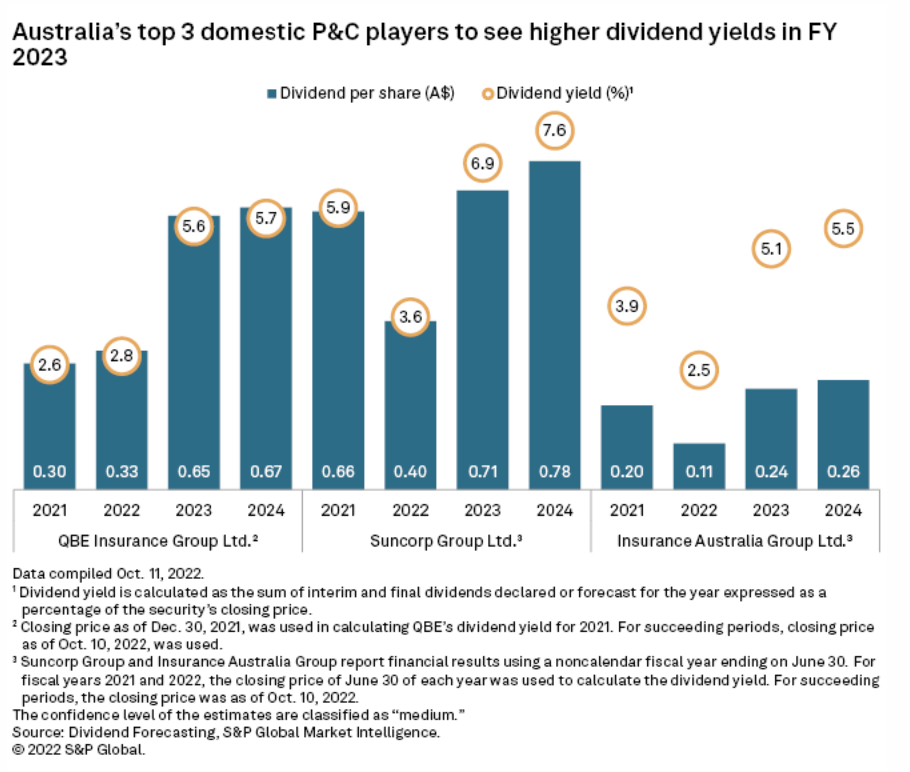

Australia P&C Dividends Resilient Despite Stormy Forecast

The top three property and casualty insurers in Australia are expected to nearly double their ordinary dividends for fiscal 2023, despite the projected negative impact of a wet spring and early summer on catastrophe budgets. QBE Insurance Group Ltd., Australia's largest P&C insurer based on market capitalization, is forecast to declare a total dividend of 65 Australian cents for its fiscal 2023, nearly double the 33 cents per share S&P Global analysts predicted for fiscal 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Watch: Capital Markets View - October 2022

In this episode of Capital Markets View Patrick Drury Byrne, head of credit markets research, joins Chris to talk about a wide range of European issues including current rating performance trends, the profile of speculative grade issuers, tightening financing conditions and key sectors and themes to watch.

—Watch the full video from S&P Global Ratings

Access more insights on capital markets >

Europe To The Fore, Elsewhere Through The Floor: How LNG Flows Were Turned On Their Head In 2022

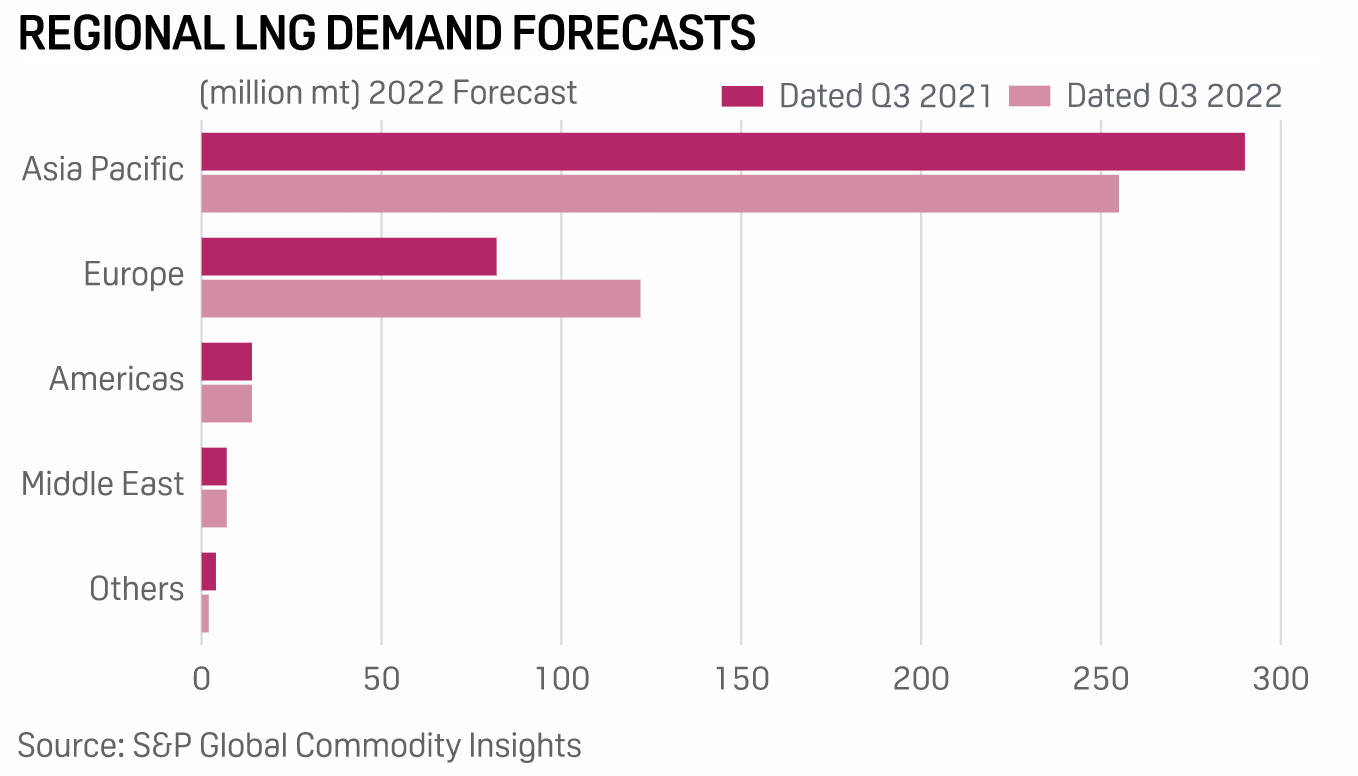

Europe's policy shift to LNG and away from Russian pipeline gas has sent cargo import volumes surging by 65% in the first nine months of 2022 versus the same period in 2021. Unsurprisingly, LNG imports to Europe from almost every supply source will increase, while a significant volume that was previously going to other markets, such as Asia or Latin America, is now being consumed by Europeans.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

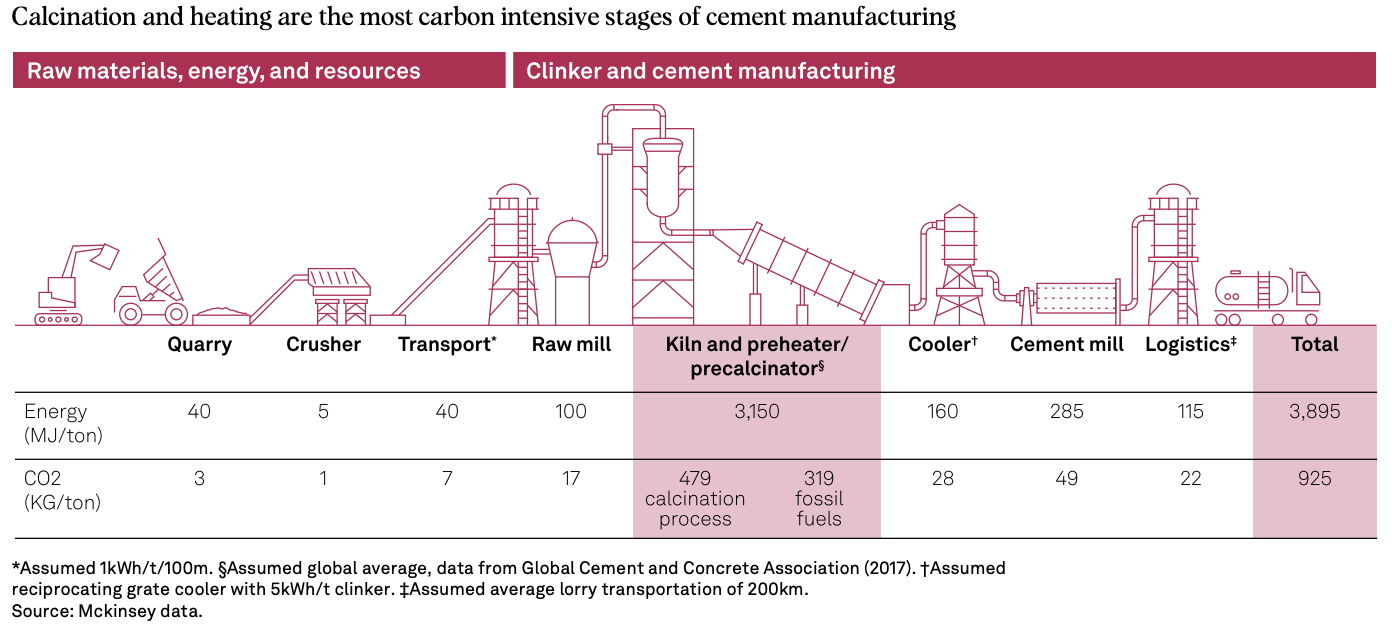

Decarbonizing Cement Part One: How EU Cement Makers Are Reducing Emissions While Building Business Resilience

The EU is leading the way on decarbonizing the cement industry, with larger players taking steps to reduce emissions by 2030. In this research, S&P Global Ratings analyzes the steps some European players are taking to decarbonize their operations and update their strategies to meet changing customer demands. It also looks at the financial and operational implications for companies in light of the EU's goal to hasten emissions reduction and the challenges the industry faces given the current nascent stage of decarbonizing technology.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Opinion: The Fashioning Of A New Global Gas World Order

The fashioning of a new global gas world order is underway. Specifically, we are witnessing the unravelling of a 50-year relationship built around gas between Europe and Russia. The repercussions extend way beyond that continent as the partial isolation of Russia — until recently the world's largest gas exporter — is being felt across the world. All gas importers are scrambling to secure supplies from a common LNG "pool".

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

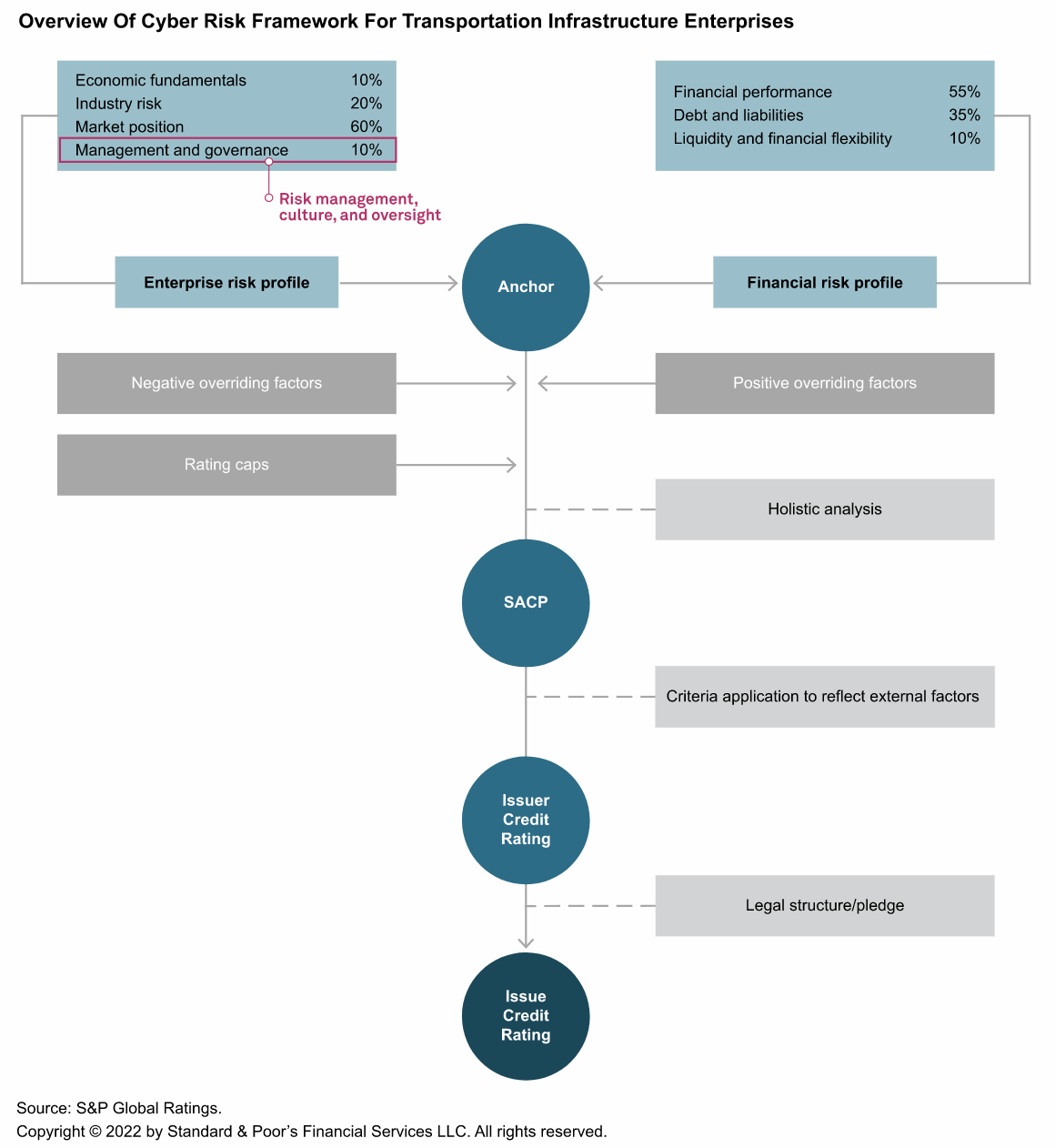

Cyber Risk In A New Era: U.S. Transportation Infrastructure Providers Remain Vigilant On The Road To Cyber Preparedness

S&P Global Ratings expects U.S. transportation infrastructure enterprises will be targeted more frequently for cyberattacks given their role as providers of critical infrastructure for the movement of people and goods. Overall, it views risks as moderate, although there are lower-probability, high-impact risks within the sector. Across the transportation subsectors, particularly for ports, mass transit operators and airports that have federal cyber oversight and regulation, management teams have implemented cyber security policies and procedures to mitigate long-term credit risk, supported by ample liquidity to buffer a disruption in operations.

—Read the report from S&P Global Ratings