Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Oct, 2022

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Cyber Strategy is Table Stakes

The new S&P Global “Cyber Trends and Credit Risks” report argues that a company’s cyber defenses are a material aspect of risk management, given the changing nature of cyberthreats and the evolving threat to core business functions. This means that a lagging or below-average cyber strategy could affect a company’s credit rating, making it more expensive to raise capital. An effective cyber strategy, including robust cyber defense and mitigation plans, is table stakes for companies engaging with capital markets.

So far, cyberattacks have had a limited impact on credit ratings. In the last 10 months, there were 50 negative credit ratings actions from S&P Global Ratings related to risk management, culture and oversight. A small subset of those actions was related to cyberattacks. Weak cybersecurity seems to be correlated with weak overall risk management. Inadequate cybersecurity or mitigation measures can potentially result in lower credit ratings than those of peers with similar financial metrics.

Cyberattacks in movies and the popular imagination tend to involve “hackers” breaking into networks. But technical attacks have become more challenging due to superior threat detection in modern cloud computing environments. This has led attackers to focus on human nature. The “2022 Verizon Data Breach Investigations Report” indicated that 82% of breaches involve social engineering, including stolen credentials, phishing and misuse, as well as error. According to the “Voice of the Enterprise: Information Security, Budgets and Outlook 2022” study by S&P Global Market Intelligence’s 451 Research, user behavior is the top information security pain point.

Many companies have responded to cybersecurity concerns by hiring third-party vendors, but this can introduce risks. Strong vendor management policies are critical to limiting credit impacts. Many of the highest-impact attacks appear to be tied directly or indirectly to sovereign actors who have access to advanced tools and vast resources. Cyber warfare and espionage will increase cyber risks for issuers.

Cyber insurance has grown quickly in the past few years and continues to evolve. According to S&P Global Market Intelligence, cyber insurance provider Coalition saw its July 2022 valuation increase 40% from September 2021. Cyber insurance can be an effective way to transfer partial risk from a credit perspective. However, many cyber insurance providers also require robust cyber defenses to be put in place.

Some companies that have experienced a cyberattack have chosen to keep the attack and their response quiet. However, regulation in favor of disclosure about cybersecurity and cyber events is likely coming. This makes cybersecurity an increasingly vital part of a company’s risk management framework. Cyberthreats are inevitable, which makes cybersecurity financially material.

Today is Wednesday, October 26, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Flash PMI Data Signaled Heightened Recession Risks In The U.S. And Europe

October flash PMI data showed economic contractions gathering pace in the U.S., eurozone and U.K., leaving Japan as the only major developed world economy to muster any expansion at the start of the fourth quarter. However, even in the latter business confidence in the outlook has deteriorated to present a full house of downbeat sentiment for the year ahead across the largest advanced economies. This thereby hints strongly at the economic growth trend weakening further in the coming months.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Real-Time Payment Networks Grow, But Banks Still Search For Uses

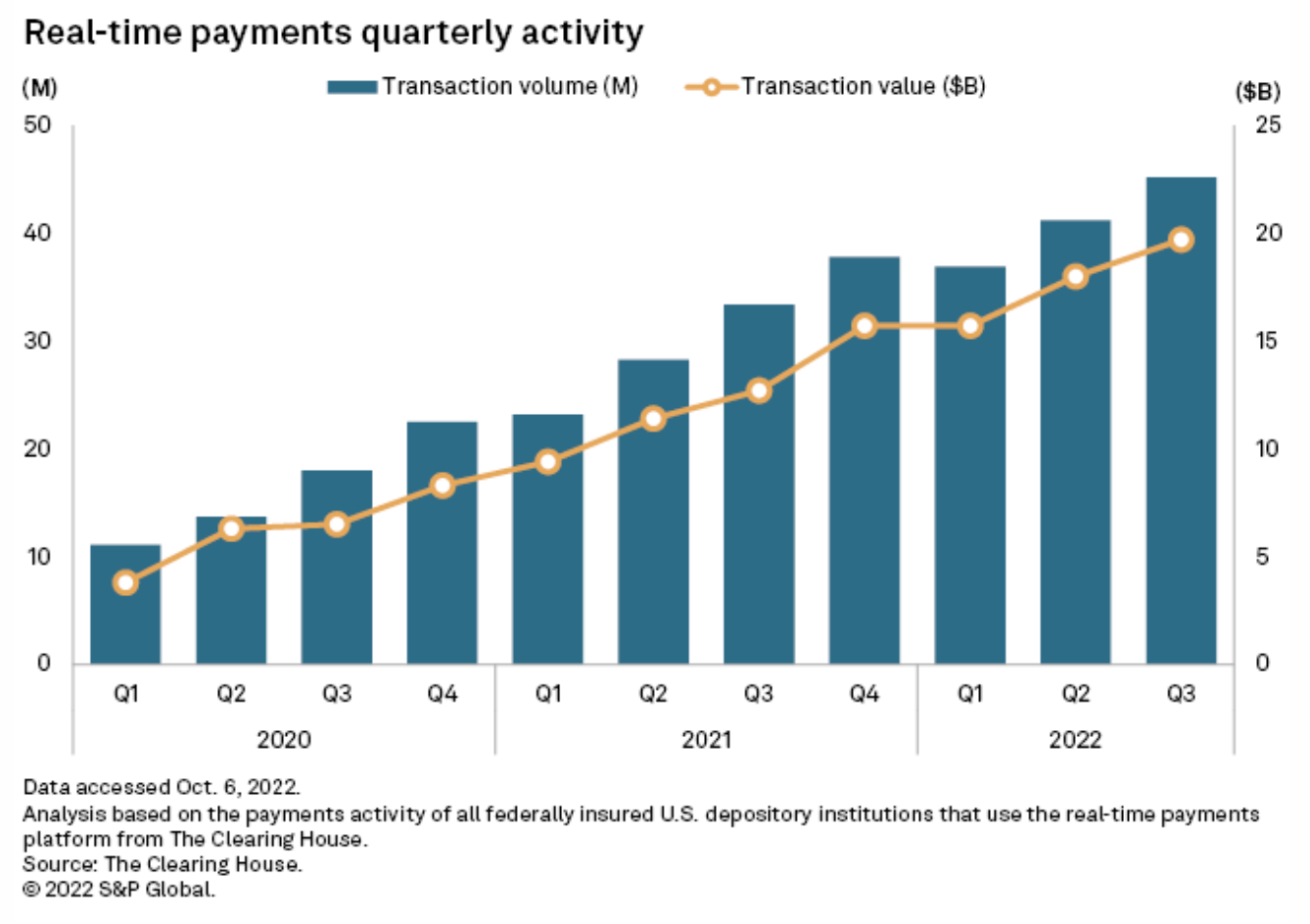

The future success of real-time payments platforms owned by the Federal Reserve and the largest U.S. banks hinges on whether financial institutions and fintechs can find real-world uses for the technology. Real-time payments are still in their infancy in the U.S.: The Clearing House, a company owned by Bank of America Corp.; JPMorgan Chase & Co.; Citigroup Inc.; Wells Fargo & Co.; and other large banks launched the nation's first real-time payment platform, or RTP, in 2017, while the Fed has scheduled a production rollout of its own planned platform, the FedNow Service, for May to July 2023.

—Read the article on S&P Global Market Intelligence

Access more insights on capital markets >

U.S. Refiners Head Into Earnings Season With Higher Margins, Export Ban Threat

U.S. refiners will likely show some optimism during upcoming third-quarter earnings calls, as margins remain elevated by tight diesel supplies heading into peak winter heating season. However, refiners may also touch on some oil demand headwinds as the global economy remains far from bullish and as the Biden administration dangles the possibility of an export ban in its attempt to lower prices.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

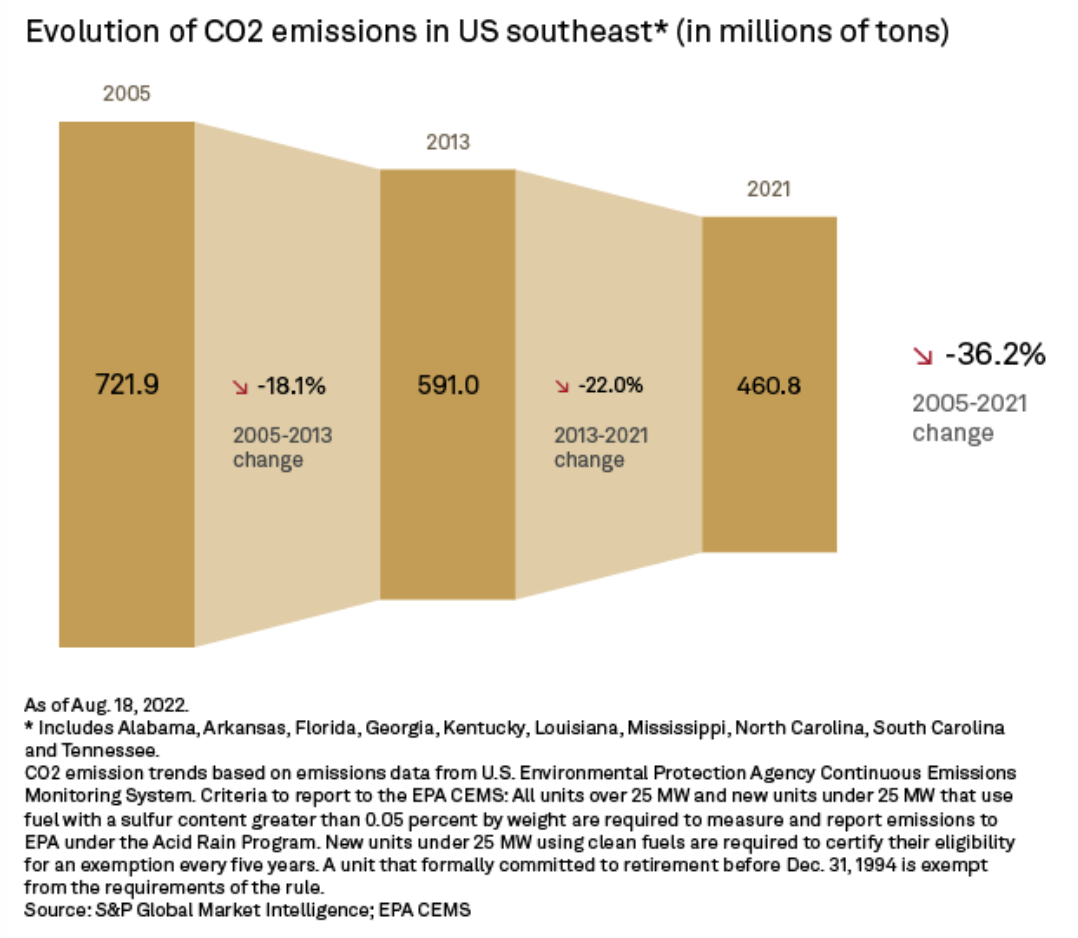

U.S. Southeast CO2 Trends Suggest Region Is Primed For Green Investment

Owing largely to clean air commitments by local utilities, the renewable-portfolio-standard-disinclined U.S. Southeast achieved a steeper reduction in CO2 emissions than the broader U.S. between 2005 and 2021, illustrating a path to successful decarbonization outside of broad mandates. Decarbonization, however, is not necessarily synonymous with green energy. Energy providers in the region largely leveraged natural gas substitution for coal generation and, to a lesser extent, the expansion of nuclear energy to curb carbon emissions, markedly falling behind on the renewables front compared to other parts of the U.S.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: COP27: A Critical Year For Global Climate Talks

With geopolitical and economic pressures altering the context dramatically since the last meeting in Glasgow, S&P Global Commodity Insights tackles the most pressing questions ahead of this global climate gathering. Vandana Sebastian speaks to Roman Kramarchuk and Dan Klein on what to expect at COP27, whether countries can reach a consensus on climate goals, the significance of decarbonization in a world of evolving energy priorities and the relevance of COP27 amid the global energy crisis.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Apple's Latest iPhone Pricing Structure Nudges Consumers Toward Pro Models

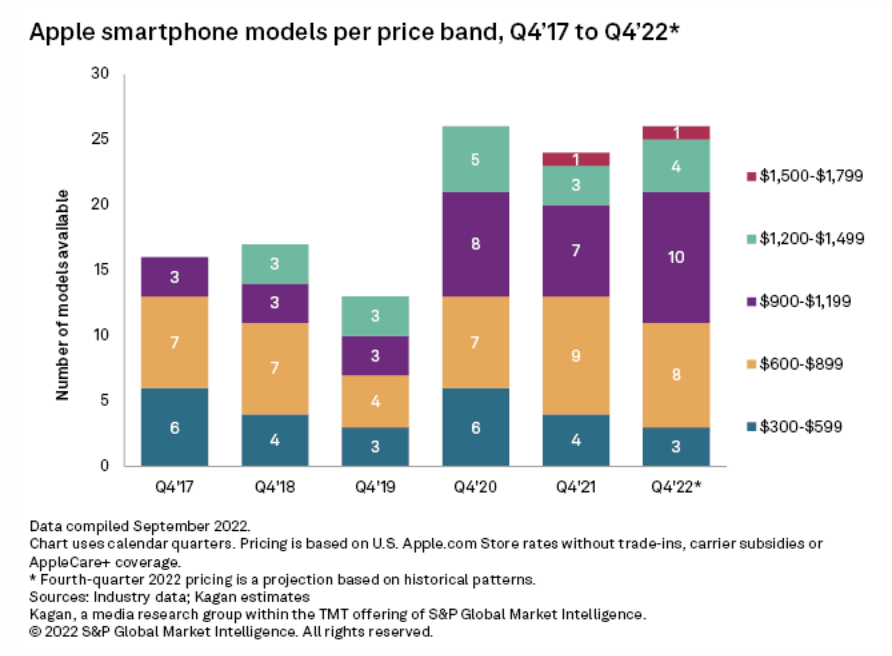

The iPhone 14 lineup was announced on Sept. 7, with four new models, three of which share the price points of their direct predecessors from the iPhone 13 lineup. While this might seem that the cost of buying an Apple smartphone would remain the same as it was prior to the 14 launch, the discontinuation of the budget-friendly iPhone 11 and iPhone 12 mini, along with the introduction of the iPhone 14 Plus, instead increased the median price for all iPhones by $100.

—Read the article from S&P Global Market Intelligence