Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Battery metals are a big business. Will the market be able to match demand?

As global decarbonization efforts shake up energy markets, calls for greater renewable energy capacity and electric-vehicle fleets have sent demand soaring for battery and rare earth metals. This trend is only expected to continue and intensify. Used in everything from to EV batteries to solar panels, these elements will be critical to the energy transition from carbon-intensive sources.

This year has seen battery metals prices explode, with prices for cobalt, lithium, and nickel having increased by 55%, 45%, and 7%, respectively, from January to August, according to S&P Global Market Intelligence. Higher metals prices might equate to more expensive electric vehicles and battery storage systems, which in turn could create affordability concerns for the energy transition.

"In the short term, the elevated metal prices are going to really hamper battery manufacturers' ability to continue to get cost reductions to their end-users and to their [original equipment manufacturers]," Stuart Burns, founder and editor-at-large of metals-procurement platform Metal Mine, told S&P Global Market Intelligence. "That could slow the uptake of EVs in the short to medium term."

"It's not a given that we are going to achieve these really low [battery] cell costs that people have targeted," Caspar Rawles, head of price and data assessments at research firm Benchmark Mineral Intelligence, told S&P Global Market Intelligence. "It's extremely challenging to bring the cell costs down further when you've got raw material costs increasing rapidly."

Geopolitics—reflecting the need for strategic battery and rare earth metals reserves—will also play a powerful role in the new international order as some regions have more abundant resources than others.

“A lot of the essential minerals, critical strategic metals [that are] vital to energy transition, vital to battery production, vital to a whole range of different technologies that are going to be required to be scaled up are very much pegged on stability in these regions,” particularly Sub-Saharan, central, and the west coast of Africa, Andy Critchlow, Head of EMEA News at S&P Global Platts, told S&P Global’s Essential Podcast. As higher prices make the energy transition itself more volatile and the pace of the transition difficult to predict, “we've started to see that in Africa, we've started to see it in South America with some of the major stakeholders there, where countries are realizing how valuable these minerals are” and are engaging in resource nationalism, he added.

Without access to critical and necessary minerals due to supply chain disruptions, some companies have turned to technology for alternative solutions for electric vehicle production. But new strategies aren’t likely to diminish battery metals’ buoyancy. Market participants are eyeing investment in battery gigafactories to expand regionalization and strengthen supply chains in order to develop mining assets efficiently.

Today is Thursday, October 14, 2021, and here is today’s essential intelligence.

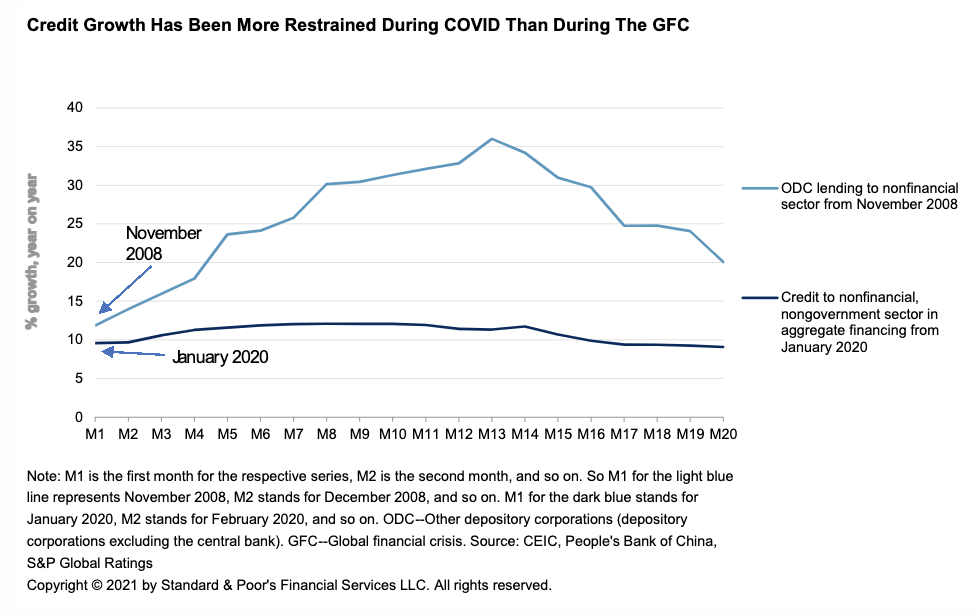

China Balances Policy Risk With A Need For Reform

Amid continuing external pressures, China has launched or intensified reforms to counter domestic risks ahead of an important party congress next year. These changes represent the most serious policy effort to head off threats to the government's credit fundamentals over the next five to 10 years.

—Read the full report from S&P Global Ratings

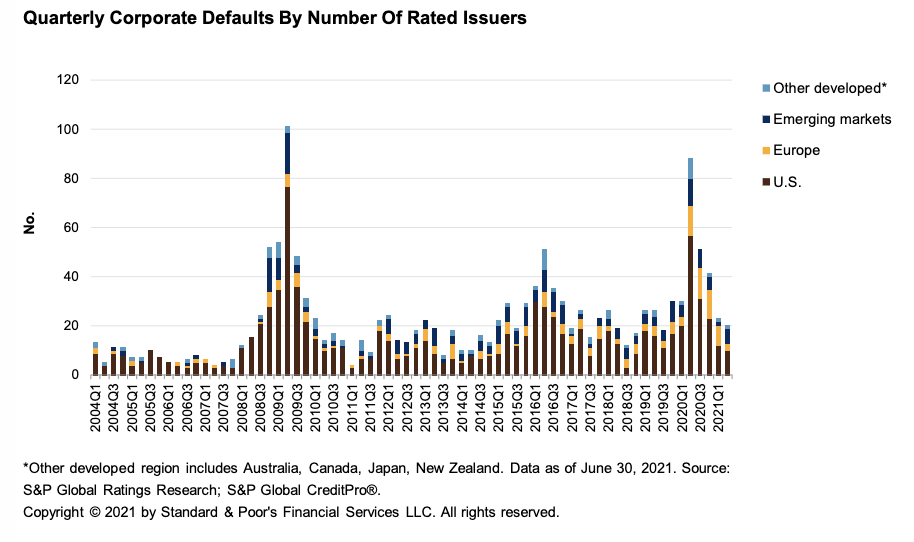

Default, Transition, and Recovery: Quarterly Default Update Q2 2021: Upgrades Outpace Downgrades For Second Consecutive Quarter

There were 20 rated corporate defaults globally in second-quarter 2021 (accounting for $12.9 billion in outstanding debt), down from 23 defaults ($25.9 billion) in first-quarter 2021 and 88 defaults ($151.4 billion) in second-quarter 2020.

—Read the full report from S&P Global Ratings

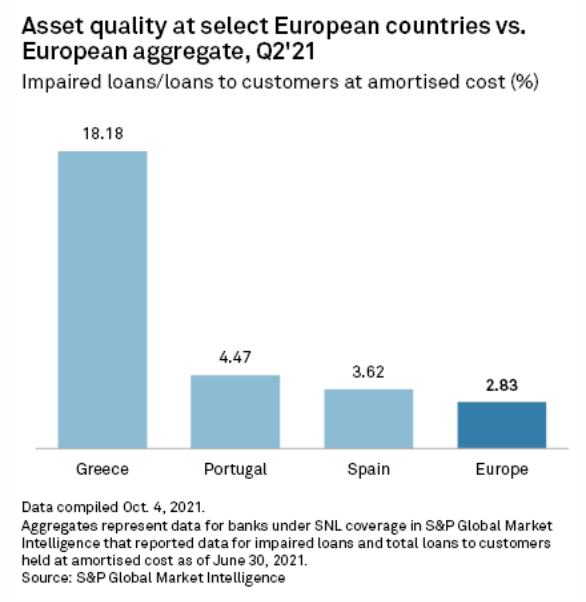

Southern European Banks Face Asset Quality Hit Due To Climate Change

The European Central Bank's climate stress tests showed that more than 60% of bank loans in Greece, Portugal, and Spain are exposed to high physical risk, which is defined as more than 1% probability of a firm suffering from the effects of a wildfire or a river or coastal flood in a year. Greece topped the list with more than 90% of bank loans exposed to high physical risk compared to the European average of above 20%.

—Read the full article from S&P Global Market Intelligence

JPMorgan Chase Says More M&A Could Be On The Horizon

JPMorgan Chase & Co. says it is interested in further acquisitions after executing a string of deals designed to add to its wealth management offerings, enhance the customer experience and position itself for a future marked by intensifying fintech competition.

—Read the full article from S&P Global Market Intelligence

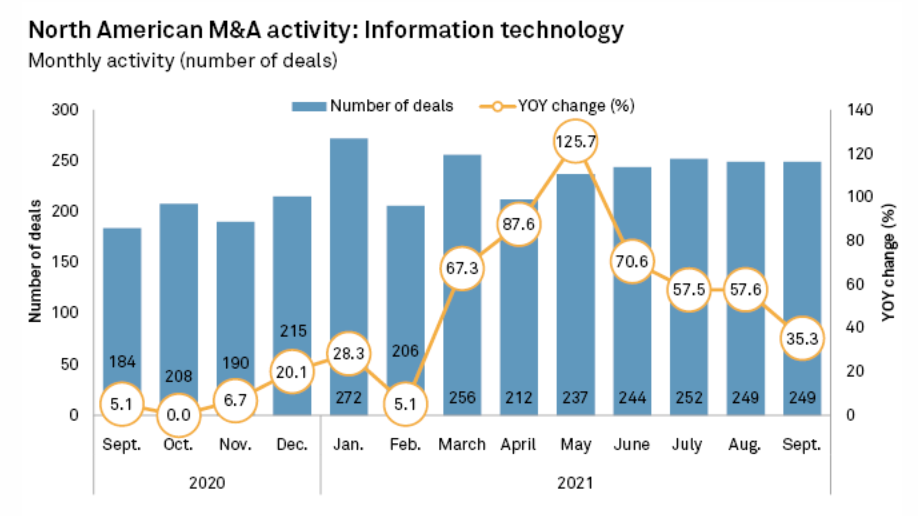

Qatalyst Cashes In On Infotech M&A In September As Valuations Start To Settle

Deal activity in the information technology sector remained brisk in September, but valuations dipped, signaling tech M&A may be settling somewhat after a historic run.

—Read the full article from S&P Global Market Intelligence

Financing, Engineering Setbacks Plague North Dakota's $1B Carbon Capture Project

The U.S. has seen lawmakers from both parties agree that carbon capture is one important way to rein in greenhouse gas emissions and rural communities are rallying around plans to retrofit large American coal power plants with the technology to save jobs.

—Read the full article from S&P Global Market Intelligence

RenewableUK Calls On Government To Double Onshore Wind Capacity By 2030

Industry group RenewableUK has called on the U.K. government to double the country's onshore wind capacity to 30 GW by 2030 to help decarbonize the power sector and drive down energy costs.

—Read the full article from S&P Global Platts

Global Fossil Fuel Demand Set For 2025 Peak Under Net-Zero Pledges: IEA

Global demand for fossil fuels could peak by 2025 if the world's current climate pledges are fully met, but oil demand would still remain at three-quarters of current levels by 2050, missing climate targets by a wide margin, the International Energy Agency said Oct. 13.

—Read the full article from S&P Global Platts

U.S. EIA Expects Surging Winter Fuel Spending As Gasoline Prices Top $3/Gal

U.S. household spending on all major home-heating fuels will surge this winter because of higher fuel costs and an expected colder weather, and gasoline prices will remain above $3/gal on a national average through the end of the year, the Energy Information Administration said Oct. 13.

—Read the full article from S&P Global Platts

OPEC Sees Greater Demand For Its Own Crude, As Hurricane Ida Keeps U.S. Oil Output Down

Barring a substantial increase in OPEC crude production in the coming months, the oil market will tighten considerably, the organization said Oct. 13, citing the lingering impacts of Hurricane Ida on U.S. oil production, along with field maintenance and outages in Kazakhstan and Canada.

—Read the full article from S&P Global Platts

EU Regulators' Body Questions Effectiveness Of 'Centralized' Gas Purchasing

ACER, the body representing EU energy regulators, said Oct. 13 it was unclear whether a proposal for a "centralized" EU approach to strategic gas purchasing would have any material effect on pricing.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language