Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

EV Revolution, Batteries Not Included

Electric vehicles accounted for nearly 10% of global car sales in 2021, according to the International Energy Agency. S&P Global Mobility forecasts that over 75% of new vehicles sold will be electrified by 2030.

However, the International Energy Agency highlighted battery metals and their rising cost as a potential constraint on EV growth. Additionally, the agency said Russia's invasion of Ukraine "created further pressures, since Russia supplies 20% of global high-purity nickel."

Cobalt is one of the most expensive and problematic components found in today’s EV batteries and S&P Global Market Intelligence forecasts demand for the metal to increase 74.5% by 2026. Sourced primarily from mines in Congo, cobalt’s volatile price jumped to more than $80,000 per tonne in March, according to S&P Global Market Intelligence. Manufacturers are developing battery-cathode chemistries with less cobalt and even cobalt-free solid-state designs. But for now, “cobalt bearing [nickel-cobalt-manganese] chemistry will remain the dominant chemistry in the foreseeable future,” Andries Gerbens, a physical trader at Darton Commodities, told S&P Global Commodity Insights.

In discussing the raw materials needed to support batteries and EV growth, Tom De Vleesschauwer from S&P Global Mobility said, “We're going to come at a point where if everybody starts pushing so many EVs out there, we can't supply all of them. … For the next five to seven years, we will be in a very tight supply market.”

Kimberly Harrington from the U.S. State Department argued that "a typical EV requires six times the critical minerals than a conventional gasoline vehicle."

The CEO of EV startup Rivian Automotive, R.J. Scaringe, said the challenge represents a "staggering amount of work and investment that is needed to scale this industry quickly," and that "90% to 95% of the battery capacity supply chain the industry will need over the next 10 years has not been built yet."

Tesla Inc. CEO Elon Musk, speaking in August at the Offshore Northern Seas conference in Norway, identified a different EV battery constraint. “The main limitation is not that these metals are tremendously rare, but there's a tremendous amount of processing to take the ore and turn it into battery-grade materials,” Musk said.

Materials and battery supply limitations may dent EV growth overall, but will probably have a limited effect on Tesla’s market share and brand loyalty, which climbed to 67.5% in the first half of 2022, more than 12 percentage points higher than any preceding year.

Today is Wednesday, October 12, 2022, and here is today’s essential intelligence.

Written by Ken Fredman.

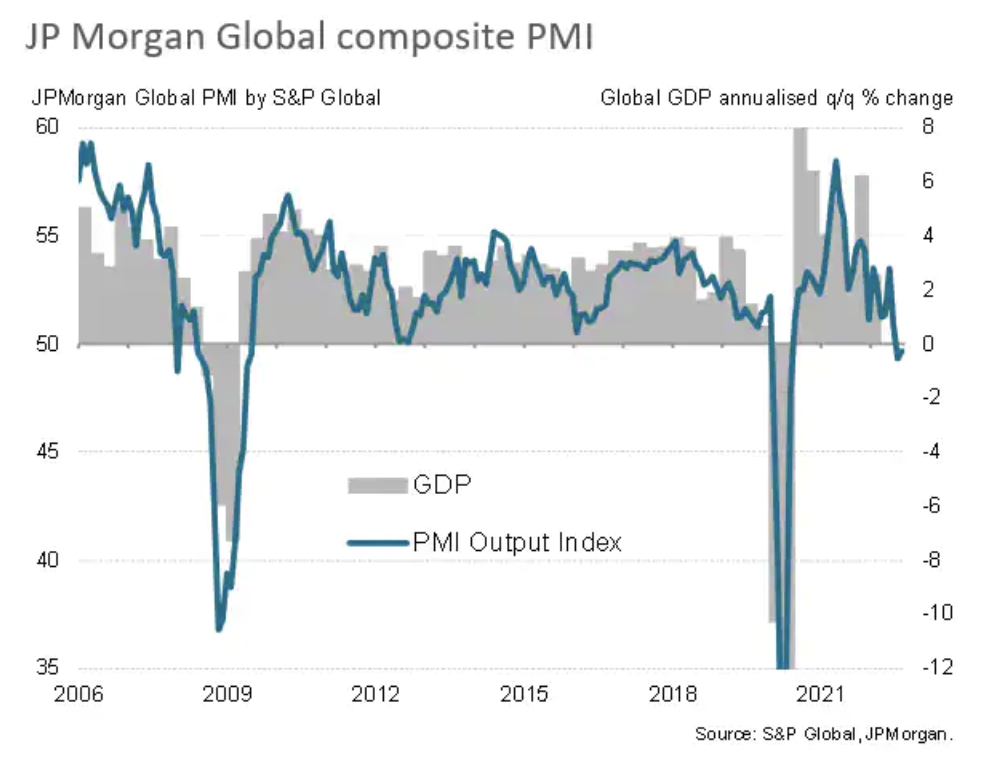

Global Economy Contracts For Second Month Running Amid Tightening Financial Conditions

Global economic output contracted for a second straight month in September, adding to signs that businesses around the world are reporting the toughest conditions outside of pandemic lockdowns since the global financial crisis. Manufacturing is being hit by rising prices, weakened demand and slumping trade, as well as a shift towards inventory reduction after the stock building seen at the height of the pandemic. In the service sector, consumer focused firms are likewise suffering falling demand due to the cost-of-living crisis. However, rising interest rates are also driving an increasingly severe downturn in financial services, led by a slump in real estate activity.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Listen: The Essential Podcast, Episode 68: Private Debt — Fit For Growth

Evan Gunther of S&P Global Ratings and Leon Sinclair of S&P Global Market Intelligence join the Essential Podcast to discuss the growth and evolution of private debt markets. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets — macroeconomic trends, the credit cycle, climate risk, sustainability, global trade and more — in interviews with subject matter experts from around the world.

—Listen and subscribe to the Essential Podcast from S&P Global

Access more insights on capital markets >

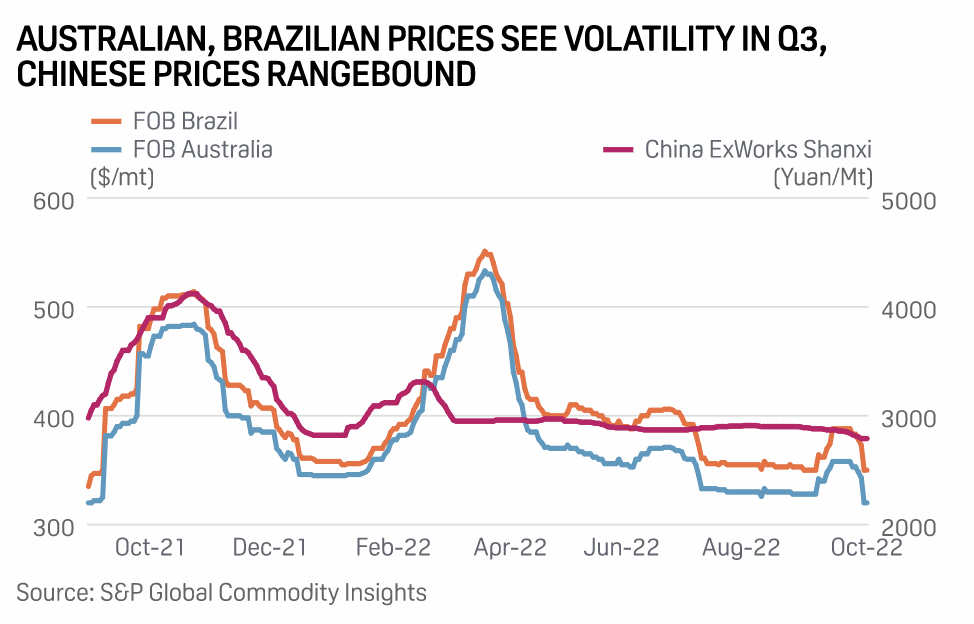

Trade Review: Alumina Markets Brace For Cost Pressures, Demand Uncertainties In Q4 Amid Energy Concerns

Alumina and primary aluminum markets globally could continue to see volatility and production challenges in the fourth quarter amid sustained concerns over energy prices and trade flow disruptions, while the indications for downstream demand are mixed. Market participants in China are anticipating potential policy updates for the aluminum industry on energy consumption and environmental guidelines at the National Congress of the Chinese Communist Party in mid-October.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: On The Ground At Climate Week NYC: The Delicate Balancing Act Of Addressing Climate Change

In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon bring you part two of our on-the-ground coverage from Climate Week NYC. Throughout the week, they heard experts talk about the delicate balancing act required to achieve net zero and energy transition goals while also accounting for the impacts on nature and society. They talk to the CEO of nonprofit Just Capital, Martin Whittaker, who explains why environmental and social issues cannot be considered in isolation. They hear from Dr. Jane Carter Ingram, executive director of climate change investment and advisory firm Pollination Group. And they talk to Matt Ellis, CEO of Measurabl, a company that tracks the physical and transition risks of climate change for the commercial real estate sector. (S&P Global has invested in the company.)

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

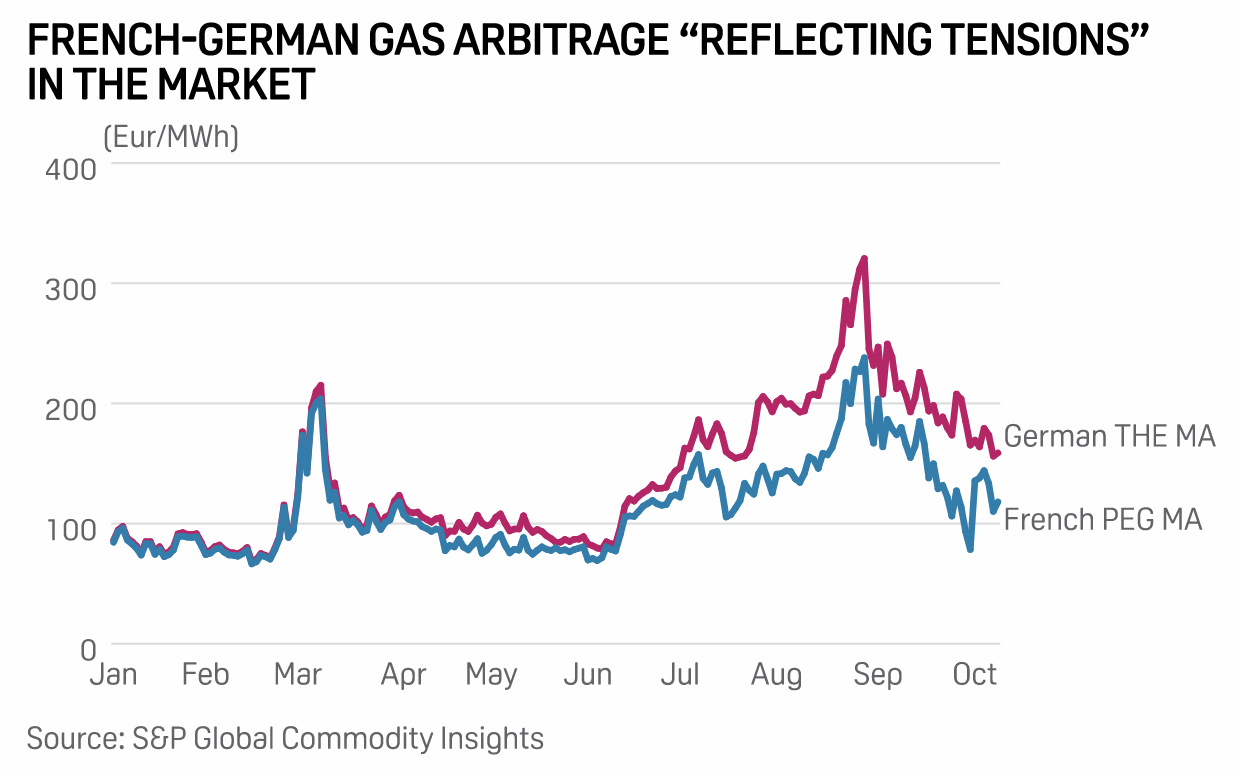

Implementation Of France-Germany Gas Flow Still Subject To Deadlines: GRTgaz

The start of gas flows from France to Germany via the Obergailbach interconnection point was still subject to a number of deadlines, French grid operator GRTgaz said Oct. 11. It was initially scheduled for some 100 GWh/d (9 million cu m/d) of capacity at Obergailbach to be available from the week starting Oct. 10 to enable flows in the France-Germany direction.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

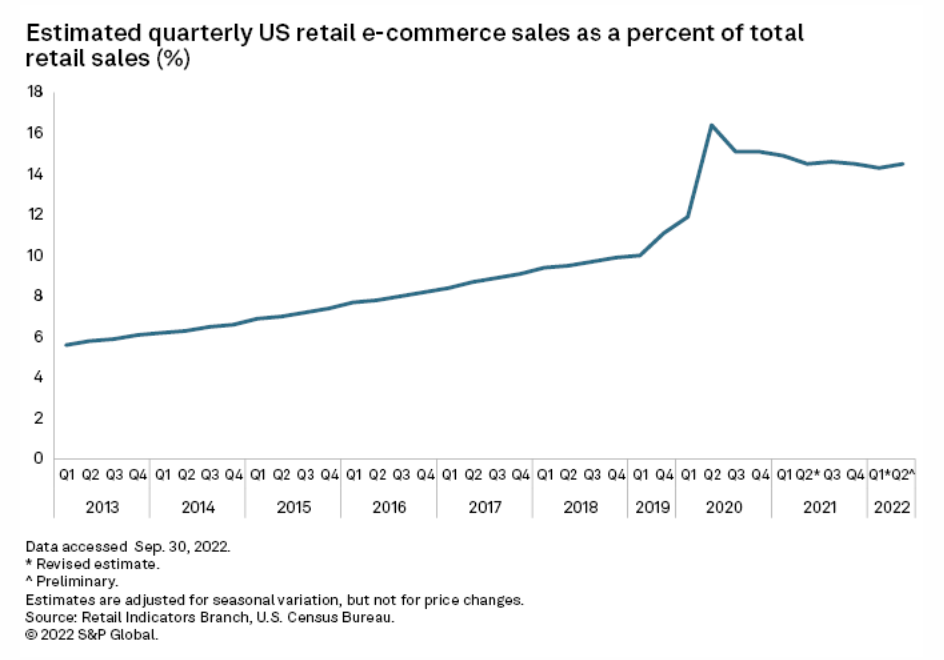

Christmas In October As Amazon, U.S. Rivals Fight For Bargain Shoppers' Attention

U.S. e-commerce leaders rolled out holiday deals early this month as excess inventory and inflation trends drove Amazon.com Inc., Walmart Inc. and Target Corp. to compete for bargain shoppers' approval. Amazon launched its second Prime Day event of the year on Oct. 11, with savings on a variety of discretionary goods including electronics, kitchen appliances and toys.

—Read the article from S&P Global Market Intelligence