Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

As the first country to emerge from the coronavirus-caused economic downturn, China is now facing a slowdown that could put its long-term energy transition and decarbonization ambitions at odds with current energy dependencies and needs.

China’s energy transition will likely be strategic for its long-term economic goals, according to S&P Global Platts. China is balancing policy risks with the need for reform—aiming to adopt a consumption-led economic model and decarbonization-oriented energy strategy rather than its existing investment-led growth structure—that S&P Global Ratings believes may result in more sustainable growth and improved credit conditions over the next decade.

Although leaders from China declined to attend COP26 in Glasgow, Beijing reaffirmed its climate targets of peaking carbon dioxide emissions before 2030 and achieving carbon neutrality before 2060 in its Nationally Determined Contribution to the Paris Agreement ahead of the conference. At an Oct. 27 State Council of China press briefing, government officials expressed concern over the lack of climate finance that advanced economies have deployed to emerging economies as well as support for finalizing Article 6 of the Agreement to develop an international carbon market, according to S&P Global Platts.

"By 2025, the share of non-fossil fuels in total energy consumption will reach around 20%, while energy consumption and carbon dioxide emissions per unit of GDP will drop by 13.5% and 18%, respectively, compared with 2020 levels, laying a solid foundation for carbon dioxide peaking,” China said in its action plan. “By 2030, the share of non-fossil energy consumption will reach around 25%, and carbon dioxide emissions per unit of GDP will have dropped by more than 65% compared with the 2005 level, successfully achieving carbon dioxide peaking before 2030.”

China said it will "strictly and rationally limit the increase in coal consumption over the 14th Five-Year Plan period and phase it down in the 15th Five-Year Plan period," alongside implementing strict restrictions on new coal-fired generation projects, the organized phasing-out of outdated coal-fired capacity, and limiting coal's transition into a power source for basic needs and system regulations, according to S&P Global Platts.

The net-zero push has sent China’s green bond issuance to record levels. However, the corporate credit landscape in the country is strained amid the troubles of property giant Evergrande. Banks’ loan growth has slowed as a result of the ripples sent through the country’s real estate and property sector, and their loan loss provisioning has increased as the country’s economy tightened, according to S&P Global Market Intelligence. Market participants are preparing for the risks associated with the continuing COVID-19 pandemic and China’s clampdown on key sectors.

The country’s economic conditions still rely on fossil fuels. Due to inflationary pressures and stretched supply chains sending global energy prices soaring, China decided to release oil products from its state reserves to ensure energy security, stabilize prices, and improve its domestic commodities supply. The country has maintained its crude import quotas from this year, at 243 million megatonnes, for 2022. Major Chinese companies see more opportunities than threats in China's emissions peak action plan, but the country’s upstream investments are unlikely to slow despite the energy transition, according to S&P Global Platts.

"China's state oil companies will keep a unique focus on upstream sector investments given the country's growing dependence on imported oil," Kang Wu, head of Asia Analytics and Global Demand at S&P Global Platts, said. "With energy transition underway and the energy sector set to witness big changes in coming decades, it appears that Beijing wants to ensure that sufficient investments keep flowing in to boost domestic oil production for its own energy security. Whether or not this strategy works to prevent China's oil production from eventually going down in the long run, remains to be seen.”

Today is Thursday, November 4, 2021, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Data: Supply Chain Disruptions Slow The Pace Of Economic Growth

Real GDP increased at an annual rate of 2.0% in the third quarter—a slowdown from 6.7% in the second quarter and lower than the 2.6% consensus expectation, highlighting the negative impact supply chain disruptions across the world are having on U.S. economic activity and prices.

—Read the full report from S&P Global Ratings

California Has Hit Brakes On Private Auto Rate Hikes Since Start Of Pandemic

Private passenger auto insurance rates have idled in California since the early stages of the COVID-19 outbreak, a sharp contrast to the rest of the U.S. California approved 29 filings for private auto rate increases between January 2019 and March 2020, but none since April 2020, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

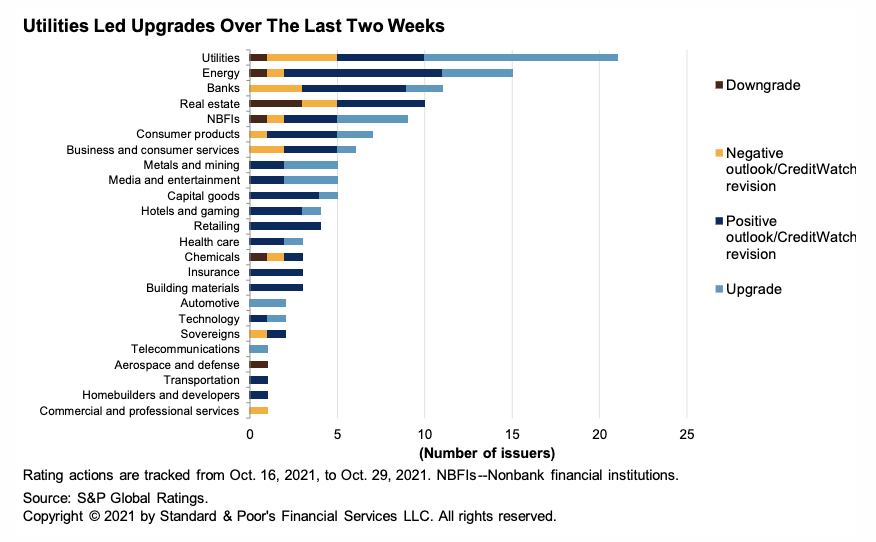

Global Actions On Corporations, Sovereigns, International Public Finance, And Project Finance To Date In 2021

The pace of global rating actions has decreased slightly from the previous months, led by a decrease in the number of negative rating actions. The number of upgrades continued to outpace downgrades at all rating levels, with 30 downgrades compared with 60 upgrades.

—Read the full report from S&P Global Ratings

SF Credit Brief: U.S. Structured Finance Issuance Reached A $91 Billion YTD High In October; Rising 59% Year Over Year To $640 Billion

U.S. structured finance new issuance totaled $91 billion in October 2021 across the industry's four major sectors: asset-backed securities, commercial mortgage-backed securities, collateralized loan obligation, and residential mortgage-backed securities.

—Read the full report from S&P Global Ratings

Danish Covered Bond Market Insights 2021

S&P Global Ratings expects the Danish economy to rebound in 2021. Strong mortgage market activity means higher issuance of DKK denominated covered bonds and Danish covered bond issuers continue to indirectly benefit from eurozone monetary stimulus.

—Read the full report from S&P Global Ratings

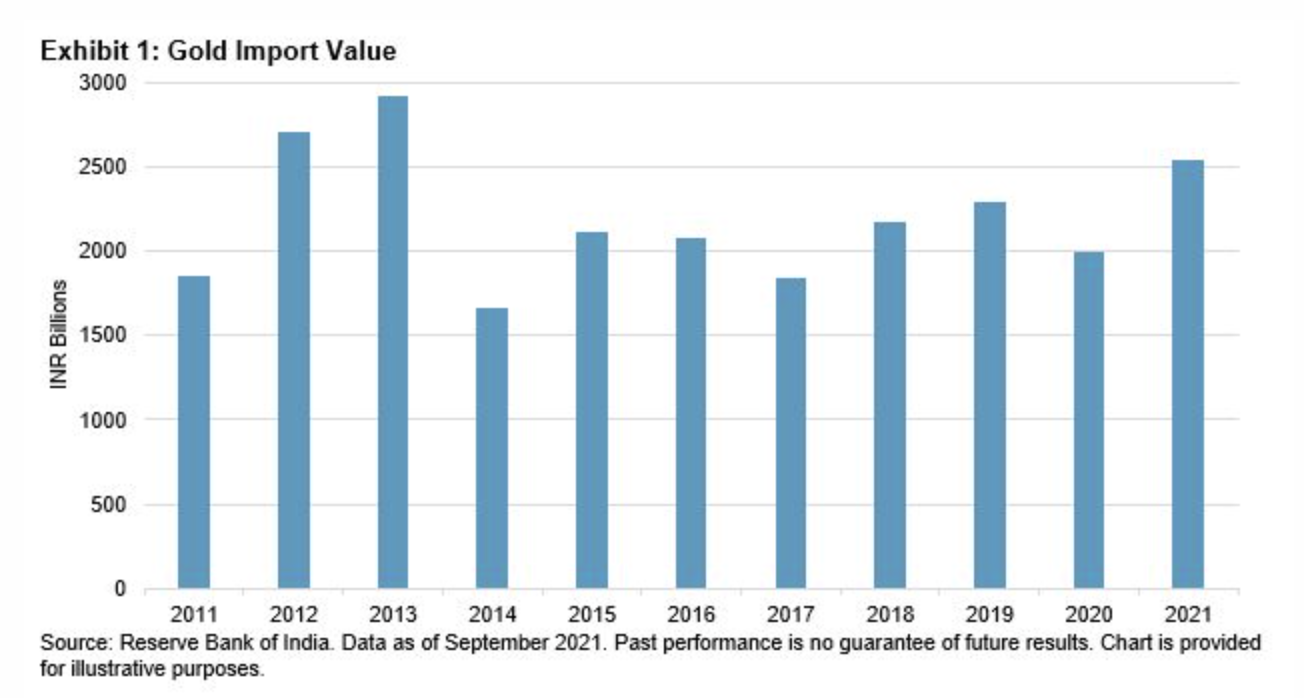

Gold Demand In India Bounced Back In 2021

China has been the primary destination for gold over the past few years and that continued this year, but a strong pickup in Indian demand coupled with lower growth in consumption from China is allowing India to gradually narrow the gap.

—Read the full article from S&P Dow Jones Indices

Stretched Supply Chains Spur Commodities Prices Higher

The S&P GSCI, the broad commodities benchmark, rallied 5.8% in October. Performance was solid across sectors, with energy-related commodities continuing to outperform and grains and metals regaining some of their recent weakness.

—Read the full article from S&P Dow Jones Indices

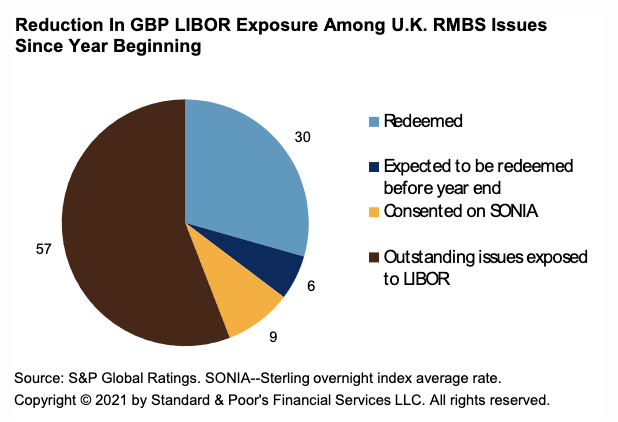

European And Japanese Structured Finance Markets Approach LIBOR Cessation While U.S. Markets Prepare For A Major Shift

Compared to corporate and bank debt markets, structured finance markets are more sensitive to the LIBOR transition because they generally contain both assets and liabilities tied to this benchmark, not just liabilities, and generally require high investor approval levels to amend bond documents.

—Read the full report from S&P Global Ratings

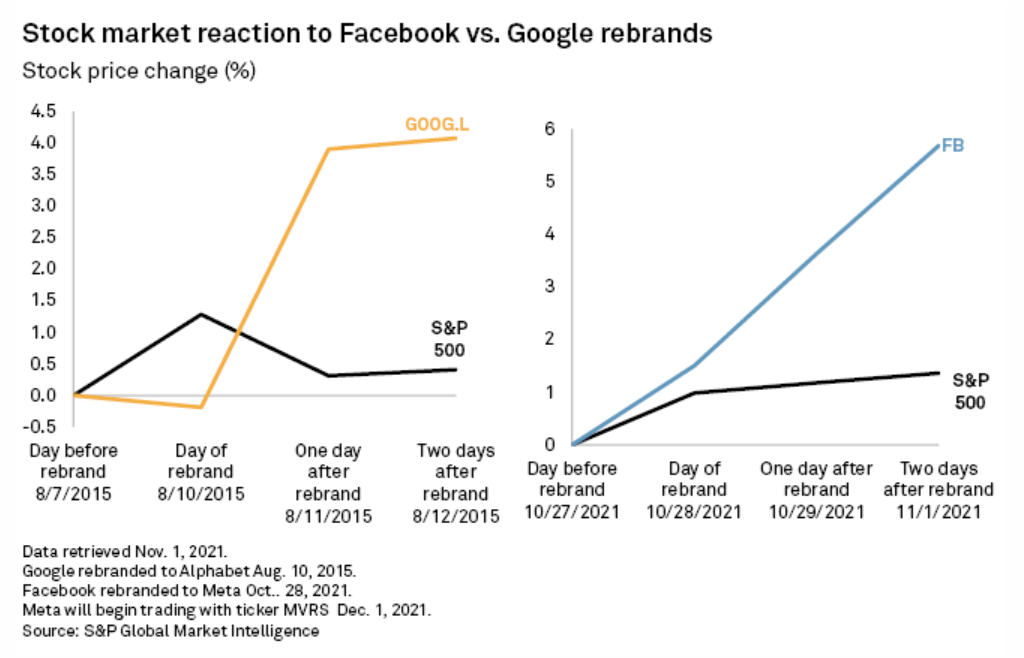

Facebook's Rebrand To Meta Vs. Google's Rebrand To Alphabet

Facebook's recent rebranding to Meta Platforms Inc. is similar in some ways to Google LLC's change to Alphabet Inc. in 2015. In other ways, though, the differences are quite pronounced. Differences in publicity, product offerings, and financials indicate that Meta plans to go in a different direction than Alphabet.

—Read the full article from S&P Global Market Intelligence

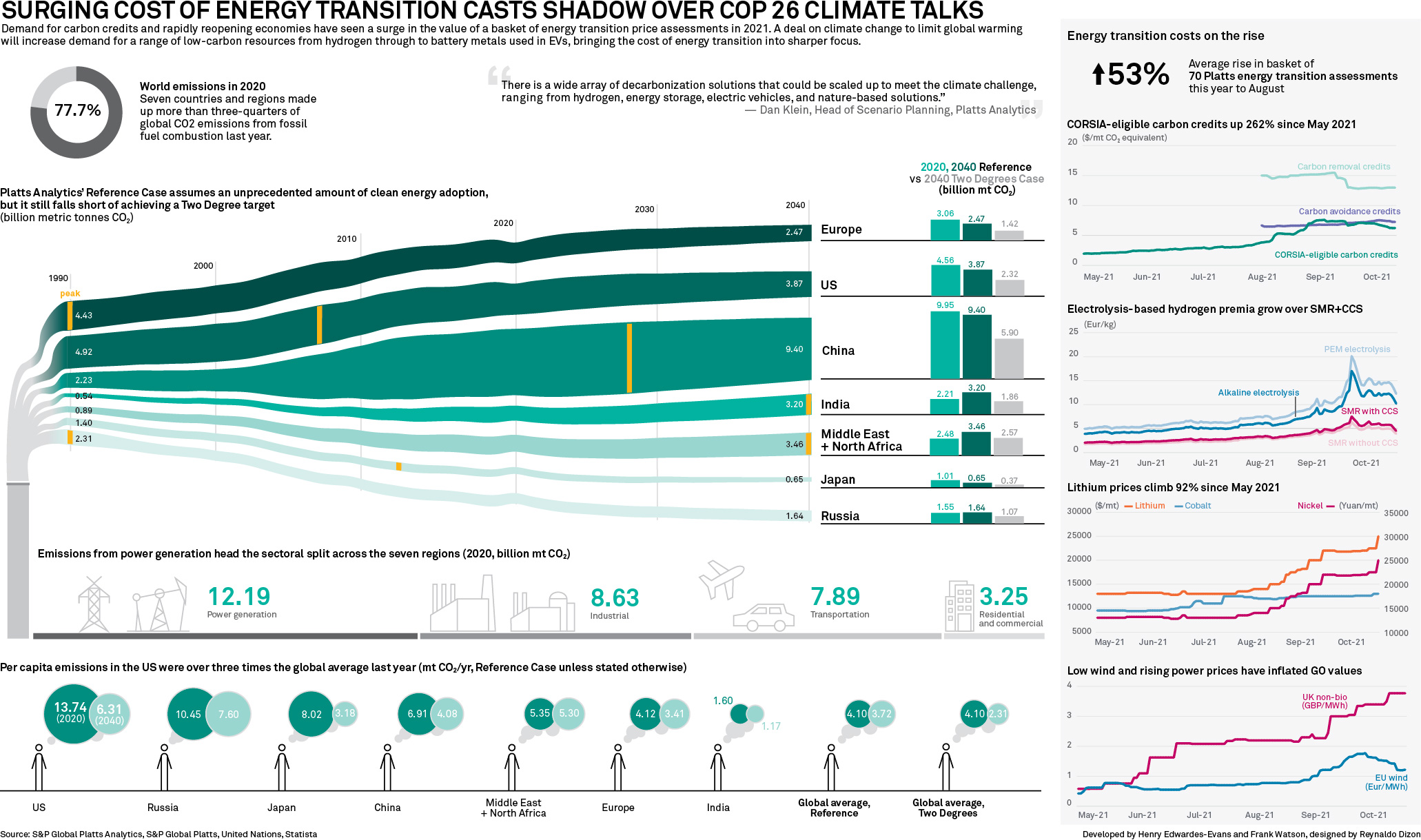

Infographic: Surging Cost Of Energy Transition Casts Shadow Over COP26 Climate Talks

Demand for carbon credits and rapidly reopening economies have seen a surge in the value of a basket of S&P Global Platts price assessments this year. A deal in line with the UN's ambition to keep 1.5 degrees Celsius global warming within reach will increase demand for a range of low-carbon resources from hydrogen to battery metals, bringing the cost of the energy transition into sharper focus.

—Read the full article from S&P Global Platts

Texas Winter Storm Brought Downgrades And Spurred Response Among Public Power And Electric Cooperative Utilities

Last February's storm disruptions of the Texas electricity and gas markets resulted in a significant number of negative rating actions for electric cooperatives and public power utilities. Credit deterioration largely stemmed from utilities' having to procure electricity or natural gas in significantly higher-than-usual quantities at extremely elevated prices for almost a week, which led to financial challenges.

—Read the full report from S&P Global Ratings

U.S. Needs Its Own Supply Chain Of Key Minerals – Perpetua Resources CEO

Perpetua Resources Corp. aims to satisfy about 35% of U.S. demand for the critical mineral antimony, a key ingredient in batteries, solar panels, and wind turbines, in the first six years of production at its Stibnite operation at a former mine site in Idaho.

—Read the full article from S&P Global Market Intelligence

Qualcomm Leads Other Major U.S. Chipmakers In Setting Net-Zero Goal

Chipmakers require tremendous amounts of energy and water, but U.S. chip producer QUALCOMM Inc. aims to reach net-zero emissions within the next 20 years. Qualcomm intends to achieve net-zero global emissions for Scopes 1, 2, and 3 by 2040.

—Read the full article from S&P Global Market Intelligence

Hydrogen Tax Credit Would Support Both Green, Blue Production

The hydrogen production tax credit proposed in the Democrats' latest federal budget reconciliation bill favors hydrogen produced from zero-carbon energy but is likely substantial enough to also support facilities that use natural gas as a feedstock.

—Read the full article from S&P Global Market Intelligence

Proposed U.S. Clean Energy Tax Breaks Could Be Transformational, But Risks Loom

Renewable energy developers are cheering the U.S. House of Representatives' proposal to expand and extend tax credits for clean power projects as part of a new budget reconciliation package. But to receive the full benefits of the credits, utilities and other project owners would need to meet domestic content and labor requirements that industry members say could be tough to satisfy.

—Read the full article from S&P Global Market Intelligence

Livestream: Former U.S. Energy Chief Moniz Talks COP26, Climate And Innovation

The threat of climate change and the potential of renewable energy are front and center this month as world leaders meet in Glasgow, Scotland, for the 2021 United Nations Climate Change Conference, or COP26. The challenge they face is daunting: Can they get the world's biggest economies to agree to dramatic reductions in greenhouse gas emissions to stave off the most severe impacts of climate change?

—Watch the full video from S&P Global Market Intelligence

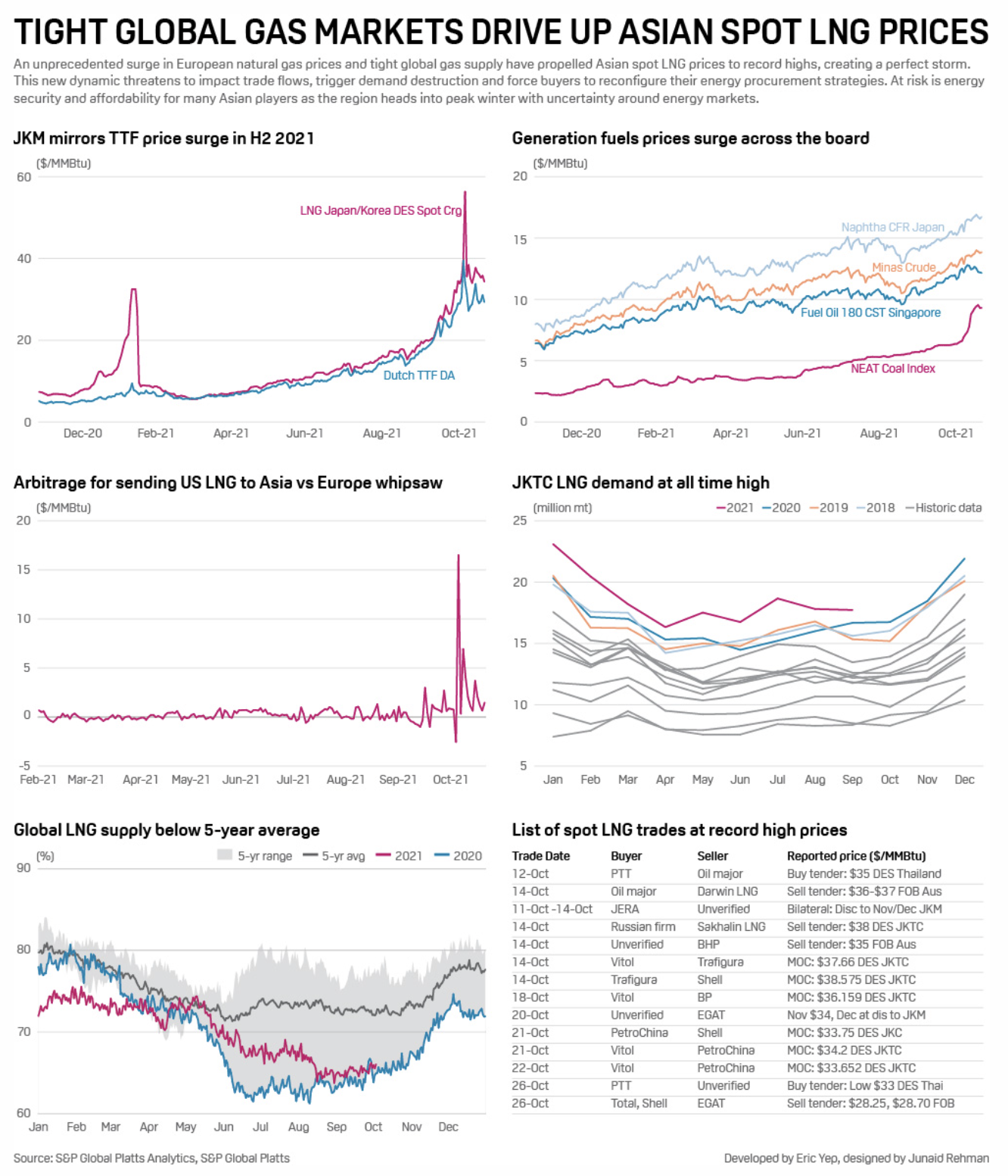

Infographic: Tight Global Gas Markets Drive Up Asian Spot LNG Prices

An unprecedented surge in European natural gas prices and tight global gas supply have propelled Asian spot LNG prices to record highs, creating a perfect storm. This new dynamic threatens to impact trade flows, trigger demand destruction, and force buyers to reconfigure their energy procurement strategies.

—Read the full article from S&P Global Platts

Feeling The Heat: 5 Key Features Of Iron Ore Markets In 2021

Iron ore prices have been on an uptrend since late 2018. Improving steel mill margins since China's steel sector supply-side reform—the attempts to eliminate excess steel capacity—have boosted iron ore demand and prices.

—Read the full article from S&P Global Platts

South Korean Refiners See U.S. As Reliable Crude Supplier Amid Tepid OPEC+ Output

South Korea is expected to purchase a minimum 10 million barrels/month of U.S. crude over the coming quarters as the country's reliance on North American supply increases amid tepid OPEC+ production levels, while competitive import costs for the U.S. barrels bode well for end-users in times of high oil prices.

—Read the full article from S&P Global Platts

Big Shale Drillers Enjoy Cash Flow, Earnings Boost From High Gas Prices

Four major shale oil and gas drillers reported hefty gains in free cash flows from high natural gas prices in the third quarter, and they vowed not to spend it to increase production.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language